Global indices fall more than 2% on mounting scandal within the Trump administration, is now the time to buy?

Scandal At 1600 Pennsylvania Avenue

Scandal at 1600 Pennsylvania Avenue is not uncommon. Far from it in fact and newly elected President Donald Trump is not immune. His campaign and early presidency have been plagued with allegations of collusion with Russia that have grown to proportions seldom seen even in Washington. The latest twist in the story are accusations Trump asked then FBI Director Comey to curb investigations into Michael Flynn and Russian interference in general. If proven true these allegations could derail the Trump Agenda and spell doom for the economy and stock market, a fear that helped send US and global indices down by 2%.

While concerning the news is nothing but a headline, the market sell-off a knee-jerk reaction grounded in fear and a buying opportunity for savvy traders. The US market hit bottom the next day and has since bounced back to regain more than half the losses in a move confirming the bull market and Trump Trade. Underpinning the rally is economic and earnings growth, both of which point to long term gains in the equity market. Economic growth is expected to run in the range of 2% annually for the US this year with a growing chance of acceleration in the 2nd half. Earnings growth is expected to continue at a double digit pace into the end of this year and next year, also with a forecast for acceleration into the end of the year.

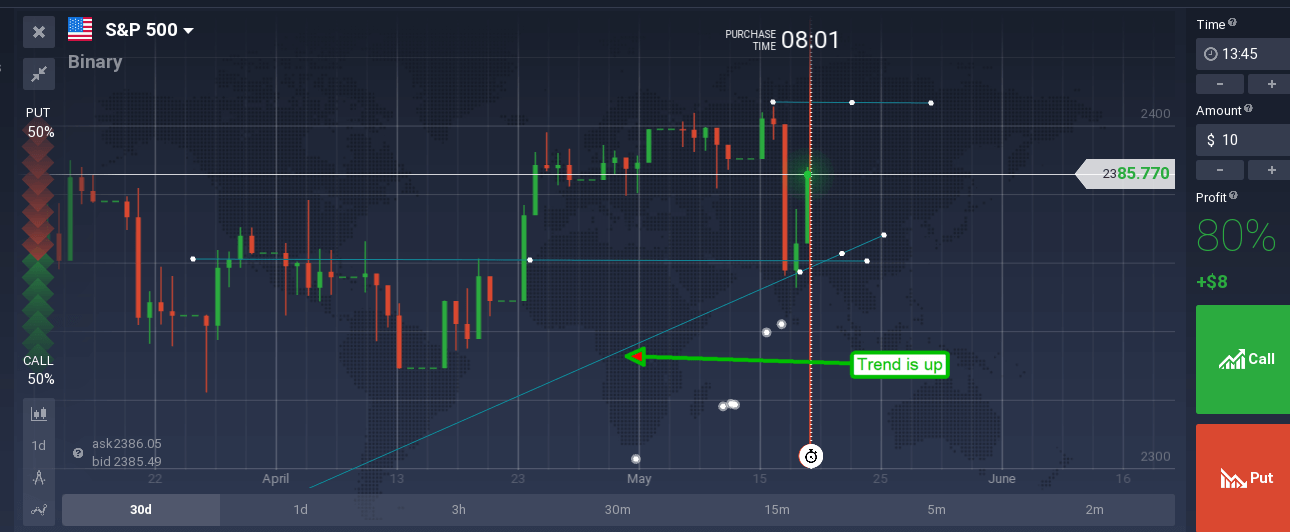

S&P 500 Dives 2%

The S&P 500 bounced from support at 2,350 and has since moved up by 1.5% in a move both bullish and trend-following. The index has regained the upper side of the short-term 30 day exponential moving average in confirmation of the bounce. The indicators, MACD and stochastic, remain bearish at this time but consistent with entry signals within a bull market. Upper target in the near-term is at the all-time high, just above 2,400, a break of which would be bullish and carry the index to all-time highs.

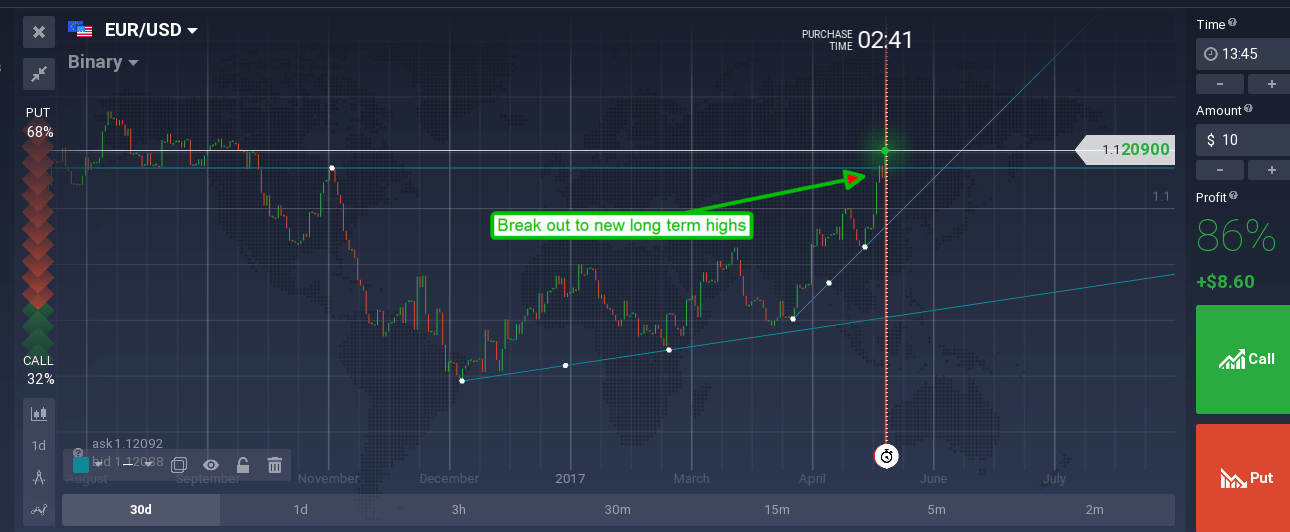

The dollar weakened significantly in the wake of escalating scandal on flight-to-safety and diminishing forward economic outlook. Adding o weakness is strength in both the euro and yen as economic data in one region points to a more hawkish central bank and safe haven inflows support another. In Europe, steady improvement in economic outlook has led traders to expect ECB action at the June meeting in the form of further tapering of bond purchases. This has helped strengthen the euro while the dollar loses ground, sending the EUR/USD up to an 8 month closing high. Upper target for this break-out is 1.1350 and will likely be hit before the ECB meeting.

Gold prices spiked to four week high in response to the dollar fall and supported by safe haven demand. The spot price topped out just above $1,260 however and is now trading beneath resistance. Resistance is in the range of $1,255 to $1,265 and will likely be tested again as the Trump scandal continues to unfold. A break above $1,265 would be bullish and could take price up to $1,300. Resistance will not be easy to break though, economic trends support a stronger dollar regardless of Trump’s antics and could easily send gold back to test for support.

Scandal Provides Opportunity For Traders

Will scandal continue to plague the White House? The answer is most likely. Will those scandals continue to plague the market? That answer again is most likely, and each time it will likely produce new entry points in the Trump Trade providing there is no change to underlying fundamentals. Trump may grab our attention but unless the democrats suddenly gain control of the government the US can expect business friendly and pro-growth conditions for the next 4 years with or without the Trump Agenda. In the end I wouldn’t be surprised to find out that all the scandal is fake news, created and “leaked” by the Trump team in order to confuse, confound and make fools of the mass media.