If you’ve ever opened your IQ Option app on the weekend, you might have noticed that some markets are still available, even though global exchanges are closed. That’s thanks to OTC (Over-the-Counter) trading. But what exactly is OTC trading, and how can you use it to your advantage?

In this article, we’ll dive into what OTC means in IQ Option, the types of assets you can trade over-the-counter, when the OTC market is open, and how to develop a smart OTC IQ Option strategy that helps you make the most of these unique trading hours.

What Does OTC Mean in IQ Option?

In financial markets, OTC refers to trading that happens outside of formal exchanges such as the NYSE or NASDAQ. Instead of being executed through centralized exchanges, OTC trades occur directly between two parties — or, in the case of IQ Option, between the trader and the platform itself.

This setup allows IQ Option to offer asset prices that are not dependent on external market activity. Instead, the platform uses internal pricing models to simulate market conditions and provide a trading environment, even during the weekend when most global markets are closed.

So, when someone asks “What is the OTC market in IQ Option?”, the answer is: it’s a simulated market that allows you to trade select assets on Saturdays and Sundays. These trades are “off-exchange,” meaning they operate with different liquidity, price behavior, and trading hours compared to regular weekday markets

How Are OTC Prices Formed?

Unlike traditional markets where prices are influenced by global supply and demand, IQ Option OTCmarket prices are generated through the platform’s proprietary algorithms. These algorithms use a combination of factors to simulate realistic price movements, including:

- Historical price patterns of the underlying asset

- Volatility models based on previous market behavior

- Internal liquidity simulations to reflect a tradable environment

- Statistical noise to introduce natural fluctuations

Because OTC prices are not linked to real-time exchange data, they may differ slightly from prices seen on other trading platforms during weekdays. However, the pricing model aims to mimic natural market conditions closely enough to provide a useful learning and trading environment.

IQ Option maintains control over price feeds to ensure consistent and fair execution across all users. While this allows for seamless weekend trading, it’s important to remember that the absence of a centralized exchange means you are trading in a closed ecosystem. Always verify the asset’s “Trading Conditions” to understand how spreads, fees, and timing may differ from live markets.

IQ Option OTC Market – What Can You Trade?

On IQ Option, the OTC market includes assets like:

Forex

| EUR/USD | EUR/AUD | NZD/CHF | EUR/THB |

| USD/JPY | EUR/CHF | USD/CHF | USD/HKD |

| AUD/USD | EUR/CAD | USD/CAD | USD/SGD |

| AUD/CAD | GBP/JPY | CAD/CHF | USD/THB |

| AUD/CHF | GBP/NZD | CHF/JPY | USD/NOK |

| AUD/NZD | GBP/CAD | JPY/THB | USD/ZAR |

| AUD/JPY | GBP/CHF | NOK/JPY | USD/SEK |

| CAD/JPY | GBP/AUD | PEN/USD | USD/TRY |

| EUR/GBP | GBP/USD | USD/BRL | |

| EUR/JPY | NZD/CAD | USD/COP | |

| EUR/NZD | NZD/JPY | USD/MXN |

Crypto

| Arbitrum | ETH/USD | Jupiter | Render |

| Beam | Fartcoin | MELANIA Coin | Ripple |

| Bitcoin Cash | FET | NEAR | Ronin |

| Bonk | DYDX | NOT | Sandbox |

| BTC/USD | Floki | Ondo | Sei |

| Cardano | Gala | Onyxcoin | Stacks |

| Celestia | Graph | ORDI | TAO |

| Chainlink | Hamster Combat | Pepe | TON |

| Cosmos | HBAR | Polkadot | TRON/USD |

| Dash | ICP | Polygon | TRUMP Coin |

| Decentraland | Immutable | Pudgy Penguins | Vaulta |

| Dogecoin | Injective | Pyth | Worldcoin |

| Dogwifhat | IOTA | Raydium | 1000Sats |

Stocks & Commodities

| Alibaba | Ebay | Microsoft | Tesla/Ford |

| Alphabet | Microsoft/Apple | Gold/Silver | |

| Alphabet/Microsoft | Intel Corp. | Morgan Stanley | Natural Gas |

| Amazon | Intel/IBM | Netflix/Amazon | XAG/USD |

| Apple | JPMorgan | Nike | XAUUSD |

| Baidu | McDonald’s Corp. | Nvidia/AMD | UKO/USD |

| Citigroup | Meta | Snap Inc. | USO/USD |

| Coca-Cola Company | Meta/Alphabet | Tesla |

Indices

| US30 | US100/JP225 | HK33 | FR40 |

| US100 | US500/JP225 | JP225 | Musk vs. Trump |

| US500 | EU50 | GER30 | |

| US2000 | UK100 | GER30/UK100 | |

| US30/JP225 | AUS200 | SP35 |

These assets are available outside normal market hours, especially on weekends — Saturday and Sunday. You’ll see “OTC” written next to asset names to indicate that they’re available for over-the-counter trading.

IQ Option OTC Market Time

The OTC market becomes available after the traditional markets close on Friday evening. It remains open throughout the weekend and typically closes late on Sunday night. Although times may vary slightly depending on your time zone, here’s a general idea:

- OTC Market Opens: Friday night after global markets close

- OTC Market Closes: Sunday night before global markets reopen

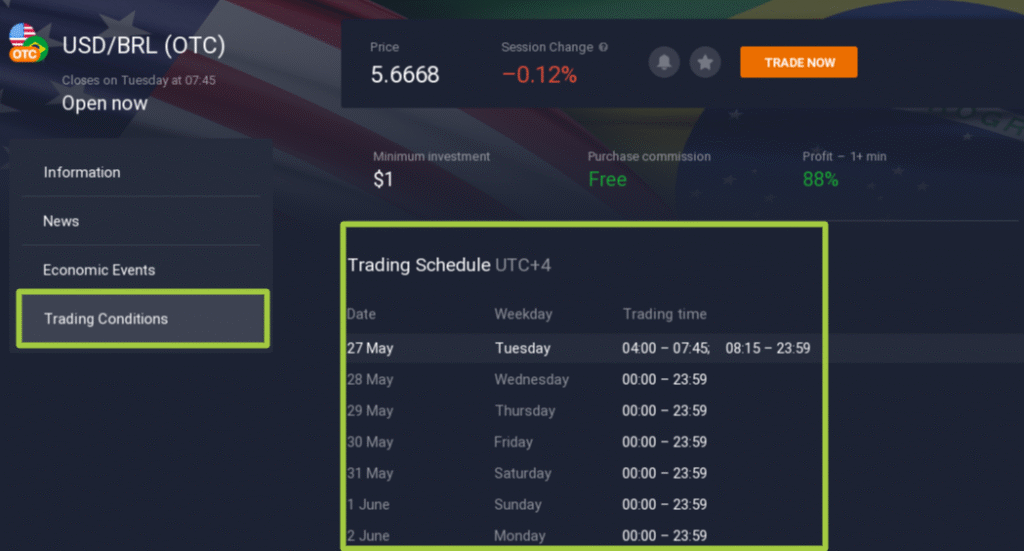

To find the exact trading hours for a specific OTC asset, simply click the “Info” icon next to its name and navigate to the “Trading Conditions” section.

Why Trade on the OTC Market?

Now that the question “What does OTC mean in IQ Option?” has been answered, another question naturally arises: “Why should I trade the OTC market instead of the traditional market?”

There are several compelling reasons traders might want to participate in the IQ Option OTC market:

1. Weekend Trading Opportunities

OTC trading allows you to stay active during the weekend, which can be especially useful if you’re a full-time worker or student and have limited time to trade on weekdays.

2. Extended Learning and Practice

With more time to test strategies and observe how prices behave, weekends can be a great opportunity for refining your technical analysis skills.

3. Different Market Behavior

OTC pricing can be smoother or follow more distinct trends due to the absence of external news shocks. Some traders find the behavior of OTC assets to be more predictable within short-term technical setups.

4. Diversification of Trading Routine

Incorporating OTC trading into your overall plan can help diversify your trading schedule, especially if you’re looking to maintain momentum or explore new strategies.

5. Flexible Schedule for Global Traders

Because OTC trading is available during weekends, it accommodates traders from different time zones and schedules, allowing more inclusive access to market activity.

6. Opportunity to Build Consistency

Using OTC markets to develop a steady trading rhythm can help build confidence and discipline, especially for newer traders honing their skills in real-time scenarios.

Risks of OTC Trading

While OTC trading offers flexibility and unique opportunities, it also comes with certain risks that every trader should understand:

1. Non-Transparent Pricing

Because OTC prices are determined internally by the broker, there is less transparency compared to exchange-traded assets. This means prices may not always align with broader market trends or other platforms.

2. Limited Liquidity

OTC markets do not benefit from the same depth of liquidity as centralized exchanges. This can result in wider spreads, less predictable execution, and potentially more slippage.

3. Higher Risk of Volatility Spikes

Although OTC markets can sometimes be more stable, they are also vulnerable to sudden price movements due to lower trading volume and lack of global news drivers.

4. Strategy Mismatch

Techniques that work well in regulated markets may not perform the same in OTC environments. Over-reliance on weekday strategies can lead to misjudged trades.

5. Emotional Bias

With fewer market-moving events and slower activity, traders may fall into overconfidence or boredom-induced overtrading, increasing their risk exposure unnecessarily.

OTC IQ Option Strategy – How to Approach It

Now that the question “What is OTC market in IQ Option?” has been answered, we can move on to exploring how OTC assets can be traded. Here are some practical tips for building a winning OTC IQ Option strategy:

1. Stick to Simple Price Action Patterns

OTC markets often behave in a more structured, technical manner. Patterns such as triangles, flags, and breakouts can be more apparent. Focus on clean chart formations that provide clear entry and exit signals.

2. Use Support and Resistance Zones

These levels tend to hold relatively well in OTC environments. Mark your key support and resistance lines before entering trades and use them to set logical stop-loss and take-profit levels.

3. Test Strategies in Demo Mode

Because OTC market conditions differ from standard trading hours, it’s wise to test any new strategies in a demo account first. This helps you gauge performance without risking real funds.

4. Avoid Emotional Overtrading

The slower pace of OTC markets can give a false sense of control. It’s easy to get drawn into making too many trades in quick succession. Stick to a clear plan and avoid revenge trading.

5. Manage Risk Tightly

Always define how much of your capital you are willing to risk per trade. Even if OTC trades appear “easier,” never assume reduced volatility means reduced risk.

6. Track Session Behavior Patterns

Even though OTC trading isn’t linked to global markets, price behavior may vary slightly between early Saturday, mid-Sunday, and pre-close periods. Monitoring these rhythm shifts can help you time entries and exits more precisely.

✍️ Pro Tip: Treat OTC trading as a complement, not a substitute. It’s a good space for practice and secondary income opportunities, but don’t rely solely on it for your trading success.

Final Thoughts

So, what does OTC mean in IQ Option? It means extra trading opportunities when the rest of the world is taking a break.

The OTC market allows access to a range of instruments like forex pairs, cryptocurrencies, and commodities during the weekend.

While it offers flexibility and learning opportunities, it also requires a unique mindset. Because the prices are set internally by IQ Option rather than by external exchanges, it’s important to approach OTC trading with a dedicated strategy and a healthy awareness of its differences.

Whether you’re curious about IQ Option OTC market time, want to build a reliable OTC IQ Option strategy, or just want to keep your trading going on Saturday morning — now you know where to start.