According to the latest round of US labor data the rally is still on in equities, but sends the dollar to new lows.

Labor Data Supports Global Markets, Weakens The Dollar

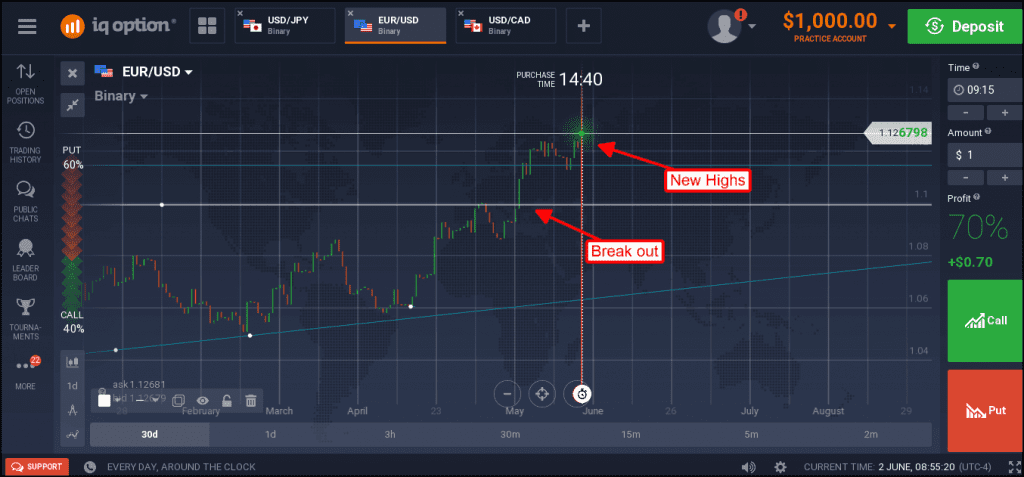

The latest round of US labor data has global indices moving to new highs. The Dow Jones Industrial Average is the latest US index to break out to a new all-time high, following the NASDAQ Composite and S&P 500, with only the Dow Jones Transportation Average and Russell 2000 left to confirm.

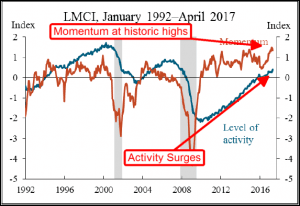

Labor trends have been positive for more than 8 years and are an underlying fundamental driver of economic and market expansion. These trends have culminated in a very powerful signal from the Kansas City Federal Reserves Labor Market Condition Indicator, a composite index of 24 of the Fed’s most closely watched labor market indicators. The signal, is a cross above the zero line from below which occurred a little more than 18 months ago. What it means is this; we can expect to see economic strength for at least the next 10 years with periods of +5% GDP growth along the way.

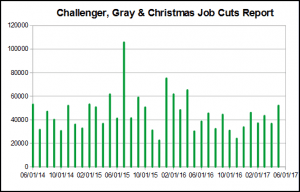

The recently released NFP, ADP, Challenger and Unemployment figures suggest just such a period is at hand. The data shows a marked uptick in labor market conditions that extend ongoing trends and reveal further tightening in an already hot market. Due to a holiday shortened week the Challenger report led off this month’s round of macro data. It revealed a 41% jump in planned lay-offs from the previous month but a deeper look reveals strength in the jobs market. On a year-to-date basis job cuts are down 28% from last year and expected hiring is up nearly 500%.

Weekly jobless claims also show strength in the labor market. Initial claims, continuing claims and total claims are all trending lower long-term and hovering at historic lows which suggest hiring and job security if not jobs creation. The ADP confirmed that sentiment, foreshadowing the NFP, with a stronger than expected 253,000. This number is not only hotter than expected, it is a strong figure in and of itself, and above the 12 month trailing average showing upward momentum in job creation.

The NFP figures were a disappointment on the headline but once again it was the data within the data that moved markets. Headline NFP was weak at 138,000 plus downward revisions to the previous two months; unemployment was strong at a better than expected 4.3% and hourly earnings at +0.2%. Unemployment is now at the lowest levels since May of 2001, hourly earnings have been growing at an average greater than 2.0% YOY for more than a year now and on pace to induce inflation.

A rise in inflation will lead the FOMC to raise rates at a pace faster than expected. Data over the past month has been tepid to the point of reducing forward outlook to only 2 more rate hikes this year, if that many. Today’s data did little to change that. The next Fed meeting is just 2 week’s away with about a 90% chance of a rate hike. Looking out to the end of the year the CME Fed Watch Tool indicated about a 90% chance of another 25 basis points with a less than 50% chance at 50 bass points.

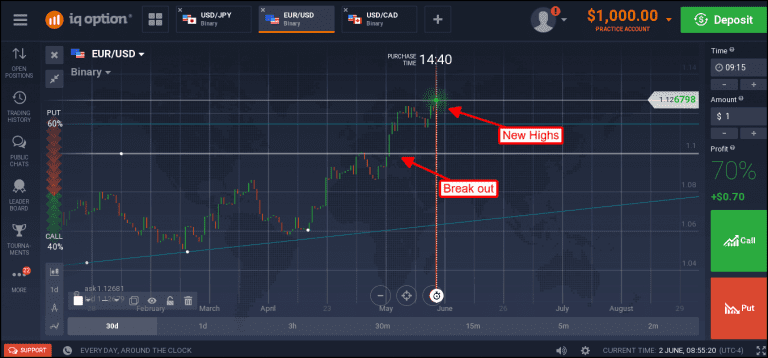

The dollar reacted by losing a bit of ground versus the basket of world currencies. The EUR/USD rose more than 0.6% to trade above 1.1275. The pair has broken above the 1.100 resistance level earlier this month and is moving up toward the 1.1500 range. Weakening FOMC outlook is being compounded by intensifying expectations the ECB will add to ongoing taper efforts. With this tailwing the EUR/USD looks like it could hit 1.1500 by the end of June providing no surprises arise in the data or in central bank activities.