Around the month of August, Monero showed that it has the potential to be the next big token when it reached $150. But then it started to gain a gradual downward momentum.

Key highlights

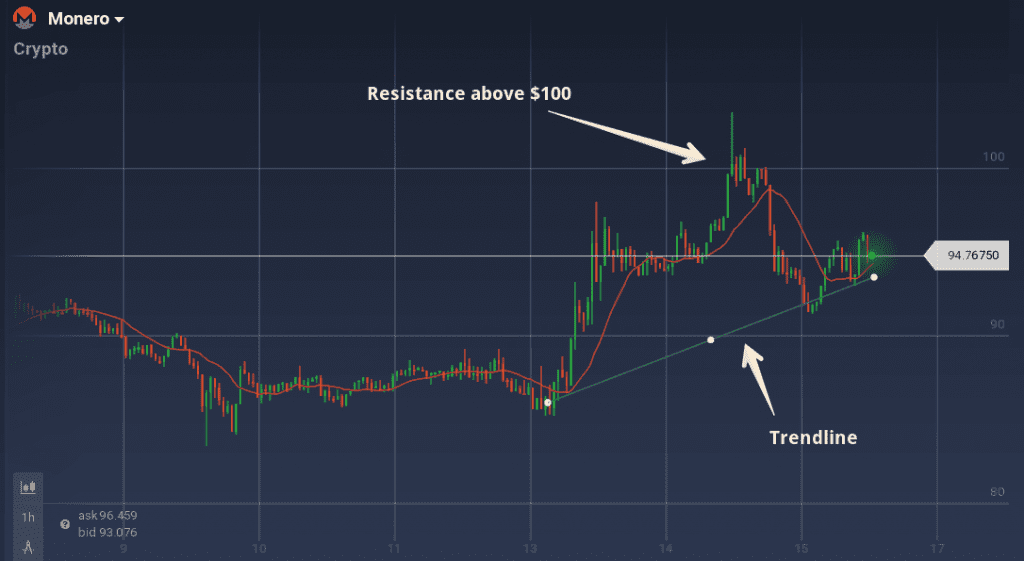

- XMR/USD gained 12% week-on-week and is trading around $95

- Significant resistance is seen above $100

Last week was not bad for XMR/USD as it gained around 12% week-on-week. Currently its trading at around $95.

Though the week started with a downward trend, a strong support around the $85-$84 resulted in any further dip in the value.

In the last 48 hours, a significant buying surge took the value of XMR/USD to above $100, but strong resistance resulted in a sudden dip. Though an upward trend can be seen since 12 hours.

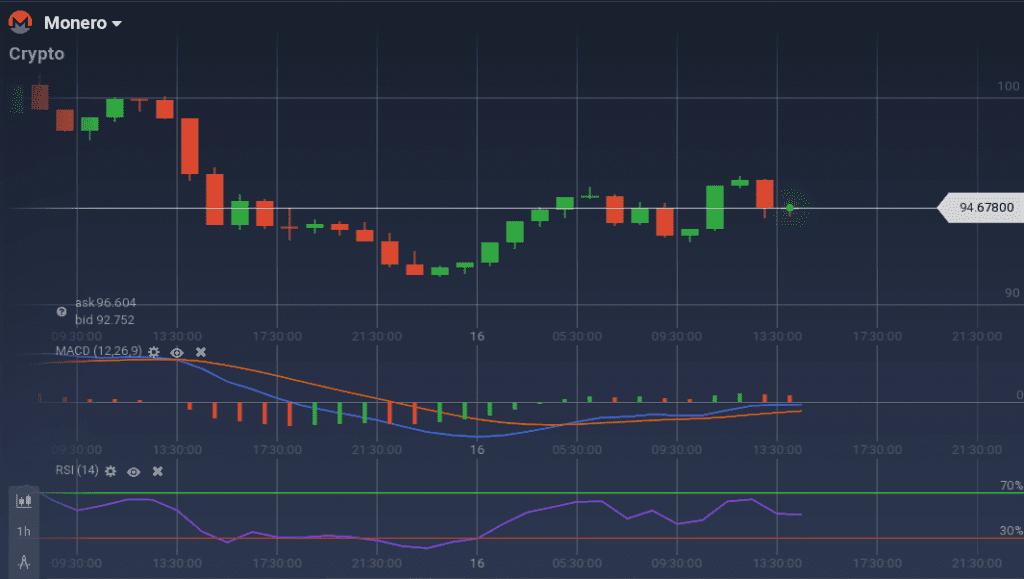

The MACD of last 24 hours, shows that a bullish momentum can follow the bearish trend. The RSI is also around 50%.

For XMR/BTC, the value is stabilized after a dip of 22%. XMR/BTC is currently trading at 0.017BTC.

Overall, XMR/USD value is going up gradually, but to regain its prime value a huge trust among the buyers is required.