Margin trading allows you to borrow money from your broker so you can take larger positions than your cash would normally allow. Instead of paying the full cost of a trade upfront, you fund part of it and borrow the rest.

That borrowed portion is what traders call leverage. And leverage is where margin trading starts to feel exciting — and where it becomes dangerous.

When prices move in your favor, gains grow faster than they would in a cash account. But when prices move against you, losses expand just as quickly. That trade-off sits at the center of every margin decision.A familiar comparison helps. Buying on margin is like buying a house with a mortgage. You put money down and control the entire property. If the value rises, the upside is yours. If it falls, the debt doesn’t disappear.

How Margin Trading Actually Functions Day to Day

On the surface, margin trading seems straightforward. You borrow money, place a trade, and wait for the market to move.

In practice, it’s more dynamic than that. Your broker is constantly recalculating the value of your account. Prices move. Equity changes. Risk levels adjust in real time.

Rather than a one-time loan, margin works like a flexible credit line tied to your account’s value. When things are stable, it stays quiet. When markets turn volatile, it demands attention fast.

This is where many traders underestimate what they’re signing up for.

Your Collateral: What Keeps the Trade Alive

Every margin trade is backed by collateral. That collateral is made up of your cash and the securities already in your account.

From the broker’s perspective, this is the safety net. If your trade starts losing money, the broker relies on your collateral to protect the loan.

Early on, this feels abstract. Losses are small. Equity still looks healthy. The risk doesn’t feel real yet.

That changes once prices move far enough against you.

Buying Power: Why Margin Feels So Tempting

Buying power is the immediate benefit of margin. It’s also the hook.

With $5,000 in your account and 2:1 leverage, you can control $10,000 worth of assets. At higher leverage levels, that exposure grows even faster.

This extra reach makes traders feel capable. Opportunities that once seemed out of range suddenly feel accessible.

What’s easy to forget is that buying power increases exposure, not accuracy.

Interest: The Quiet Cost in the Background

Borrowed money always comes with a price. In margin trading, that price is daily interest.

Interest is charged every calendar day the position stays open. That includes weekends and market holidays.

At first, the cost seems small. Over time, it compounds. Flat trades slowly lose money. Long holds become more expensive than expected.

Many traders only notice interest after it has already eaten into their returns.

Closing a Margin Position

When you close a margin trade, repayment happens automatically. The broker takes back the borrowed amount plus accumulated interest.

What remains in the account is yours. That could be a profit. It could be a smaller balance.

If losses exceed your equity, however, you’re still responsible for the difference. Margin trading does not limit downside risk.

Isolated Margin vs. Cross Margin

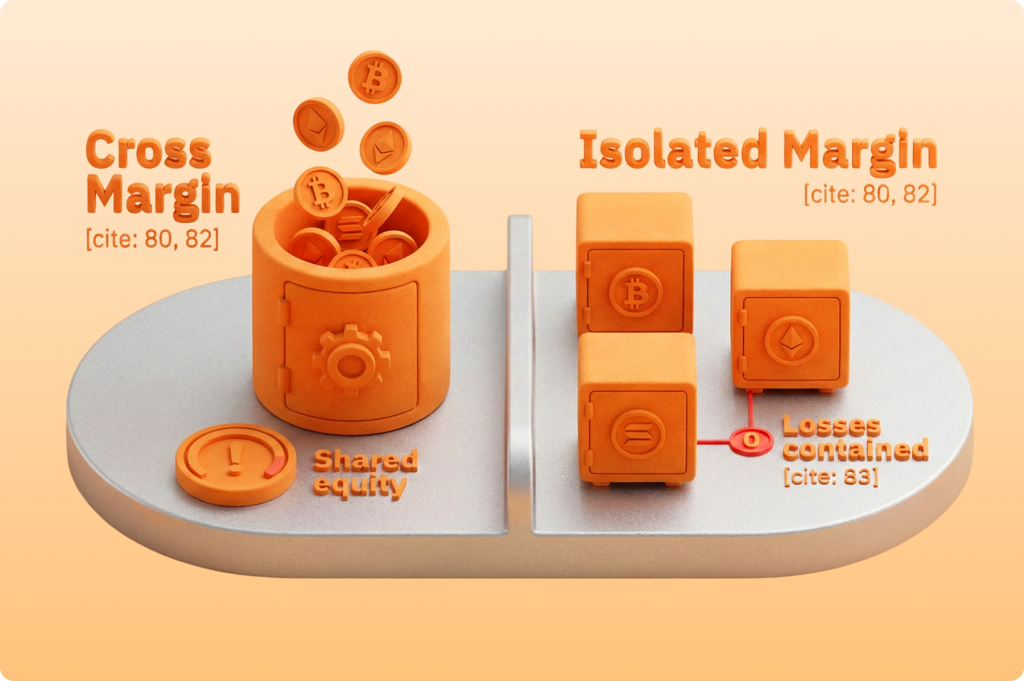

Modern platforms give traders two main ways to manage margin risk. Each approach handles collateral differently.

Choosing between them isn’t about preference. It’s about how much risk you’re willing to spread.

Isolated Margin

With isolated margin, you assign a specific amount of capital to one trade. That amount represents the maximum loss for that position.

If the trade fails, only the isolated funds are affected. The rest of your account stays protected.

This structure creates clear boundaries. You know exactly how much is on the line.

Best for: Newer traders, volatile assets, or setups where risk containment matters most.

Cross Margin

Cross margin pools your entire account balance as shared collateral. All open positions draw from the same equity.

This can help trades survive short-term volatility. But it also means one bad position can drain the entire account.

Cross margin offers flexibility, but mistakes spread quickly.

Best for: Experienced traders managing multiple positions who understand correlation and exposure.

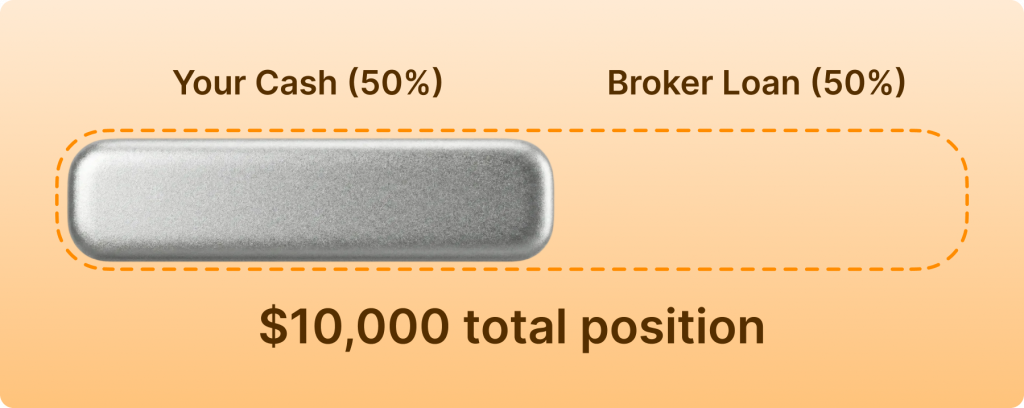

The 50% Margin Rule (Regulation T)

In the United States, margin trading follows a rule called Regulation T, set by the Federal Reserve.

Under this rule, traders must fund at least 50% of a new stock purchase with their own money. The broker can lend the remaining 50%.

For example, buying $10,000 worth of stock requires $5,000 in cash. The broker provides the rest.

This rule exists to slow down excessive leverage. It ensures traders have meaningful capital at risk from the start.

How Brokers Calculate Margin Risk

Behind every margin account is a set of clear calculations. These numbers decide how much you can borrow and when action is required.

Understanding them removes much of the confusion around margin calls.

Key Margin Terms

| Term | What It Means | Typical Amount |

| Minimum Margin | Required balance to open a margin account | Usually $2,000 |

| Initial Margin | Portion of the trade funded by your cash | Often 50% |

| Maintenance Margin | Minimum equity needed to keep positions open | Usually 25%–30% |

These thresholds are monitored continuously.

The Core Formula

Brokers track your equity using a simple calculation:

Account Equity = Current Market Value − Borrowed Amount

When your equity divided by market value drops below the maintenance margin, a margin call is triggered.

That’s when things get serious.

What a Margin Call Really Means

A margin call is not a warning. It’s a requirement.

Your broker is telling you the account no longer meets risk standards. You must act to restore equity.

That usually means adding cash or closing positions.

If you don’t act quickly, the broker will.

Forced Liquidation

Brokers have the right to liquidate positions without your permission. They don’t need approval or confirmation.

These sales often occur during fast-moving markets. Prices may be worse than expected.

If liquidation doesn’t fully cover the loan, the remaining balance becomes your responsibility.

Expert Insight #1: Why Most Margin Calls Happen

A former brokerage risk manager put it this way:

“Most margin calls don’t come from bad ideas. They come from trades that were sized too large and held too long.”

Many traders focus on being right. Margin punishes traders who ignore timing and size.

Is Margin Trading a Good Idea?

Margin trading isn’t inherently good or bad. It depends entirely on how it’s used.

For professionals, margin is a tool. For beginners, it’s often a shortcut that backfires.

The Upside

Margin increases flexibility. It allows traders to act on short-term opportunities without tying up all their capital.

It also enables short selling, which requires margin access.

In trending markets, leverage can amplify disciplined strategies.

The Downside

Losses escalate quickly. Small price moves can have outsized effects.

Interest quietly reduces returns. Time becomes an enemy.

Emotional pressure increases. Borrowed money changes decision-making.

A Timing Risk Many Traders Miss

Interest accrues every day, not just on trading days.

Holding a margin position over long weekends means paying interest while markets are closed.

In short months with holidays, interest costs can matter more than price action.

How Traders Use Margin in Practice

Margin trading works best when preparation comes first.

Here’s how experienced traders approach it.

1. Open a Margin Account

- Brokers require agreements and disclosures. Some assess experience.

- Approval doesn’t mean suitability.

2. Fund the Account Properly

- The $2,000 minimum is just that — a minimum.

- Larger balances provide flexibility and reduce liquidation risk.

3. Check Margin Rates

- Interest rates vary by broker and account size.

- Small differences compound over time.

4. Choose Trades Carefully

- Margin favors clarity. Trades with defined catalysts and exits perform better.

- Uncertain ideas and leverage don’t mix well.

5. Always Use a Stop-Loss

- A stop-loss defines risk before the trade begins.

- It’s not optional. It’s essential.

6. Execute With Discipline

- Double-check size, leverage, and order type.

- Small errors scale quickly on margin.

Expert Insight #2: Exposure Matters More Than Leverage

A professional derivatives trader once said:

“Leverage doesn’t blow up accounts. Total exposure does.”

Many traders focus on ratios and ignore how much capital is actually at risk.

Margin magnifies whatever mistakes already exist.

Margin Trading in the 2026 Environment

As of 2026, margin regulations are evolving. Regulators are moving toward real-time risk monitoring rather than rigid equity thresholds.

This may give traders more access, but less forgiveness.

Risk control is becoming more important than account size.

Slippage: The Overlooked Risk

Stops are not guarantees. In fast markets, prices can jump.

That gap can turn a controlled loss into something larger.

On margin, those gaps matter.

Final Thoughts

Margin trading can be useful. It can also be unforgiving.

The traders who survive use it sparingly. They keep leverage low. They respect position size. They plan exits before entering.

Margin doesn’t reward confidence. It rewards discipline.