In light of next week’s UK Inflation Report Hearings, I thought this might be the right time to discuss what inflation is exactly, and how it can affect your trading.

The BOE governor and MPC members will be discussing the economic conditions in the UK, along with current levels of inflation. Exciting right? No? Maybe none of that made much sense to you? Then again maybe it did… Regardless I will assume that it didn’t and do my best to explain.

So, let’s start with the ‘BOE governor’ part and answer some questions that may or may not be going through your head right now:

“What is BOE?”

Good question. So BOE stands for Bank of England, which is the central bank of the UK.

“What is a central bank?”

Another good question. The central bank is the body that attempts to maintain monetary stability in a country or economy. In other words, they control the supply of money.

“How do they control the supply of money?”

Short answer; Monetary Policy, but we will get to that.

“Who is the BOE governor, and what does he do?”

That would be Mark Carney, who along with the MPC members, makes decisions regarding the aforementioned monetary policy.

“MPC members — please explain…”

MPC stands for Monetary Policy Committee (yes, this is why I waited before expanding on this), and it consists of nine members including the governor himself.

Monetary Policy

So, as said before, monetary policy is how Central Banks control the money supply. This can be done through expansionary or contractionary means. I think it’s safe to say that just as a glass or two of wine can enhance any social outing, an example can enhance the explaining of economics.

Let’s consider Interest Rates: one of the main forms of monetary policy. These rates can be used to influence the money supply. Let’s say we have an economy that is struggling in terms of growth. The Central Bank might, in this case, lower the interest rates so that consumers have more purchasing power. If consumer spending increases, it can lead to a larger number of goods and services being produced within the economy in order to meet this higher demand, i.e. improving the Gross Domestic Product. Considering GDP is the primary gauge of economic health, you can see why the Central Bank would hope to achieve this outcome. This is an example of an expansionary monetary policy.

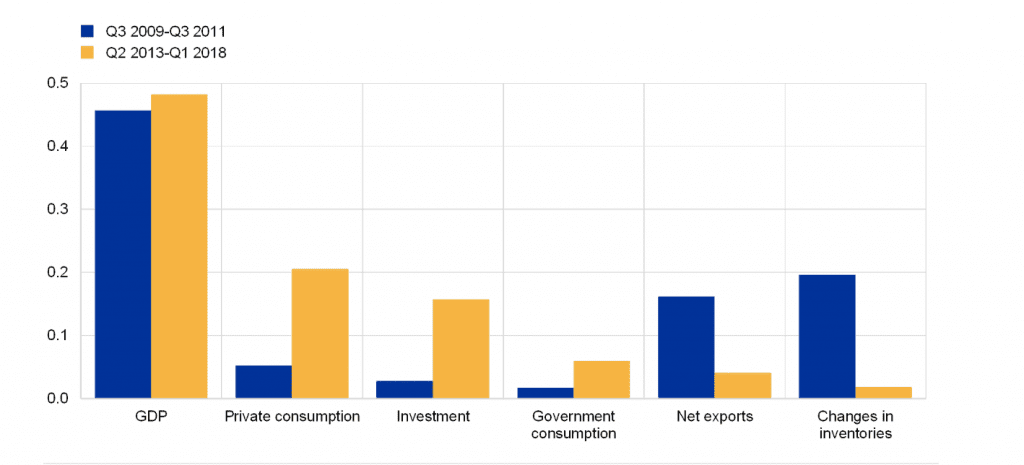

Image Source: https://www.ecb.europa.eu

Inflation

Now that we understand the role of a Central Bank, and the means in which they control the money supply, let’s talk about Inflation and why it matters. Inflation is a sustained increase in the prices of goods and services. As an economy is growing, the prices of its products and exports tend to grow as well. This makes inflation another fantastic indicator for economic health.

Now this might sound like a good thing, and it usually is, but not always. Inflation can become a problem if the levels of income don’t rise as efficiently. Unfortunately, this has been the case throughout history more often than not. In these cases, consumers end up less able to afford the goods and services that their hearts desire, as their incomes lose purchasing value. It’s a sad reality that affects middle to lower class households, and one that will most likely change in the near future.

Oh well, back to the topic. Let’s talk about what actually causes inflation. A general increase in prices can be caused by two main factors, and that is why we have Demand-Pull Inflation and Cost-Push Inflation. Let’s take a look at some examples, again. A higher demand for good/services can lead to a general increase in prices. Let’s say that household wealth increases due to a rise in the value of financial assets, or maybe as mentioned earlier interest rates go down; In both cases, consumers would end up with more money to spend. This could lead to less savings and a higher amount of consumption, thus increasing the demand for goods/services.

Another way this could happen is through the use of tariffs. Let’s think about what the president of the United States is currently doing. These taxes on trade could potentially shift the demand of US consumers from imports to domestic goods. All of these factors could end up with a higher demand for the products of local companies and if they are unable to increase their supply to match the demand, then they will probably just increase their prices. This is Demand-Pull Inflation.

One more example before we move on. You might be already aware that oil prices are currently surging. Think about firms that require oil in order to produce their goods, their costs of production are now higher right? Will this result to an increase in their own prices? Possibly, and if that happens then we now have Cost-Push Inflation. Interesting right? Well, I mean, I am going to assume that you find this interesting since you probably would have stopped reading by this point if you didn’t…

Inflation and trading

Since you now understand what inflation is and how it can be achieved through policy, you might be in a better position to understand the outcome of the Inflation Report Hearings on Tuesday. This might also help you distinguish the difference between a Hawkish and a Dovish tone, and why the currencies may or may not move because of it. Or maybe you already knew all of this… I don’t know… I hope it was a good revision then and not a total waste of your time.