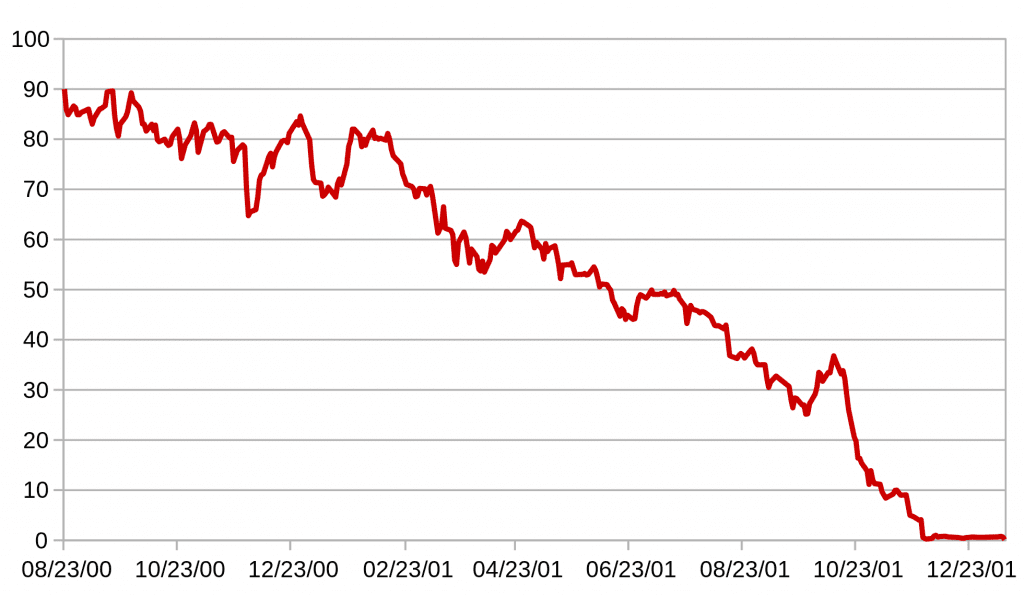

More than 15 years have passed since the moment of truth for Enron Corporation (NYSE: ENE). Once the world’s sixth largest energy company, it has become the synonym of wire fraud and money laundering. Enron shares were worth $90.75 in August 2000 but dropped to $0.67 in January 2002.

It is important to understand the reasons behind the Enron scandal and look at how the events unfolded in this case. It’s been our experience that even the most trusted and publicly praised companies can collapse in a matter of months or even weeks. Read the full article to learn more about the greatest corporate hoax in history and protect the investments you make.

America’s Most Innovative Company

Enron Corporation came to existence in 1985 after the merger of Houston Natural Gas and InterNorth. For the next 15 years Kenneth Lay, the man behind the deal, occupied the position of the CEO in a newly founded company. In the 1990s, he also helped to initiate the selling of electricity at market prices. Deregulated natural gas market allowed energy producers to enjoy much higher prices and dramatically boost their revenues.

Initially focused on natural gas, the company later turned to product diversification strategy. In the end of the 90s, Enron operated in the fields of gas pipelines, electricity plants, as well as paper production and water plants. On 31 December 2000, the company was worth $60 billion, 70 times its earnings and six times book value. Not to mention the title of the most innovative company in the United States, received for six times in a row. The market definitely expected Enron to demonstrate outstanding performance in the future. However, it did not follow…

Pressure Intensifies

It turned out, the company’s record-high track record was not entirely true. Enron’s top management used elaborated accounting techniques and confusing financial statements with the sole purpose of sustaining high stock price growth rates. Not all of them were particularly real.

Problems first arose on 5 March 2001, when Bethany McLean published her ‘Is Enron Overpriced?’ article in the Fortune magazine, in which she claimed Enron shareholders and analysts do not even know how exactly the company makes money.

It takes some time for a giant like Enron to kneel down. The official downfall has begun when then-CEO Skilling (who briefly occupied the position in 2001) resigned from his position and 450 000 Enron shares. Despite impressive 2001 results, the stock price kept falling. The departure of Skilling and opaque accounting practices did not add to the credibility of Enron’s top management. First concerns have been voiced in the professional environment.

The Collapse

By October 2001 the public no longer believed the Enron managers. The company kept promising to explain everything: from unrealistically high results in the past to grandiose plans in the future. Everyone was eager to see factual proof of its financial performance. While Kenneth Lay hesitated, the stock kept falling. In the beginning of November 2001, ENE shares hit the $7 mark. Remember that less than one year ago it was traded at $83.

Dynergy Inc. offered to buy out the company for only $8 billion but unilaterally broke the deal on 28 November 2001, triggering the downgrade of ENE shares to junk status. The stock collapsed to $0.61 by the end of the same day.

The European part of the company filed for bankruptcy two days prior the American office, on November 30. The bankruptcy became the biggest one in the United States’ history. The top management probably thought it would get away with everything committed on behalf of the company but it didn’t.

The Outcome

U.S. Securities and Exchange Commission (SEC) initiated an investigation against Enron to finally see what was going on inside the company. Following the investigation, Kenneth Lay was sentenced to 45 years in jail on multiple account of fraud but died before getting to prison on 5 July 2006. Skilling was initially sentenced to 24 years and 4 months in prison but the deal between him and the United States Department of Justice reduced it by 10 years. Fastow, the CFO of Enron, was sentences with 98 cases of fraud, money laundering and insider trading. He was sentenced to ten years with no parole. All in all, 16 Enron employees have been found guilty.

The results of the orchestrated corporate hoax have been devastating for the company, its employees, investors and the American public, that once again lost its face in almighty Wall Street. Shareholders lost as much as $74 billion in four years prior the bankruptcy. Many employees lost billions in pension benefits.

Another company lost credibility and goodwill following the investigation: Arthur Anderson, a long-time auditor of Enron and the company that covered all shady activities of Enron’s top management. The company was charged with obstruction of justice (for destroying Enron documents) and charged guilty. Arthur Anderson was pushed out of business and 85 000 employees lost their jobs.

The Sarbanes-Oxley Act was introduced on 30 July 2002 to prevent Enron-like scandals from happenings in the future.