With the Trump rally losing steam market watchers are looking for what might lead the market higher. Earnings growth is expected to be good but those expectations have long been priced into the market. Economic growth growth is expected as well but once again forward outlook has been priced into the market for some time. Considering that both earnings and economic forecasts have been on the decline it’s a wonder the rally is still intact as it is.

One indicator I like to watch is the KC Fed’s Labor Market Conditions Index. It is a gauge of 24 major labor market indicators and one that is watched by the Fed. It has been signaling the onset of expanding economic growth for nearly 2 years and recently hit new highs. The signal given was a cross above 0, the first such cross since the Global Financial Crisis and a signal that has preceded the last several major economic cycles and equity bull markets. While a positive, the drawback to this indicator is that it’s timing is iffy, the actual starting point for expanding growth uncertain. That is where the Index of Leading Indicators comes in.

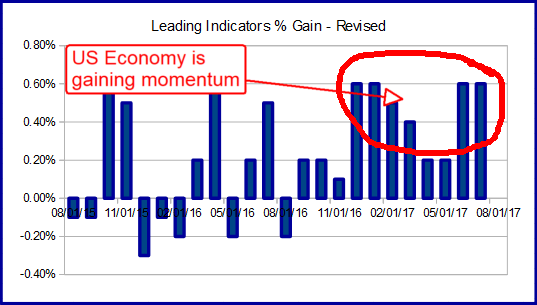

The Index of Leading Indicators is a gauge of forward looking economic indicators that typically signal preparation for growth within the economy. This indicator has been positive for the last 11 months and hovering at a multi-year high of 0.6% the last two. In the last press release economists at the Conference Board, the organization of business economists who track the index, said plainly that it was indicating the possibility of expanding growth as early as this fall.

The next read on the index is just a few days away, scheduled for 10AM ET Thursday morning, and will likely be more closely watched than usual. A weak number will merely indicate a continuation of current trends, a decline could spell doom for the market. What is more likely to happen though is yet another strong reading. While there are no hot spots within the economy evidence from all segments indicate activity is picking up. A strong reading may be all it takes to convince the market boom times are ahead.

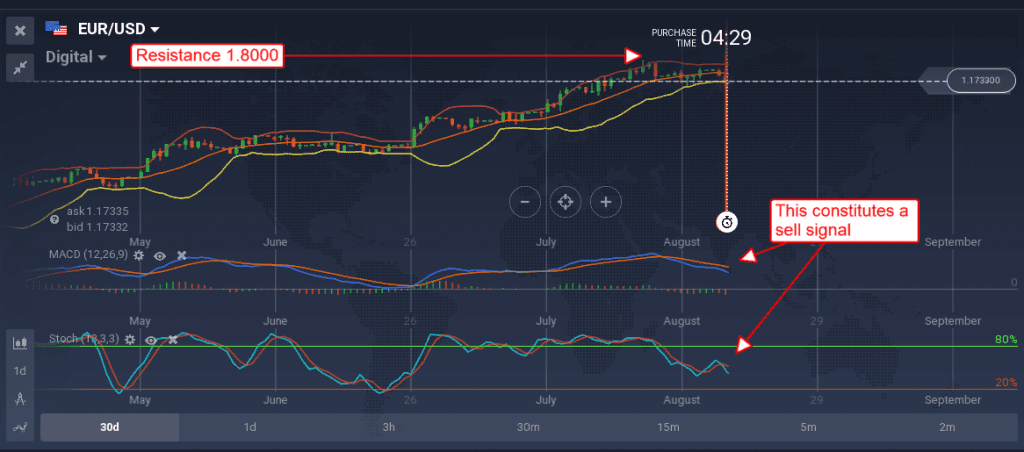

The EUR/USD is showing signs of topping between the 1.72500 and 1.8000 levels, a solid read on the LDI could firm the dollar and confirm this top. Mitigating this outlook however is EU and German GDP data expected out over the next few days which could strengthen the euro and undermine strength in the US.

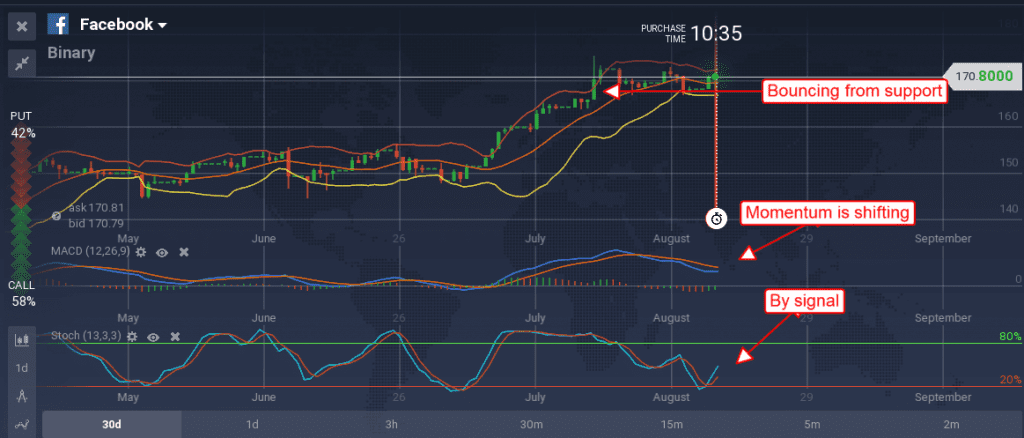

US equities are what really stand to gain from a solid read. A strong number will mean not only improving activity but increased revenues, a stronger consumer, better margins and more profits. This means companies like Facebook, Amazon and Google could easily move up to test current all time highs and/or set new ones. Facebook for one is in up trend with positive indications and bouncing from strong support. A move to new highs would signal an influx of new investors and the onset of a new wave higher.

Apple is already moving to new highs on strength globally and expected strength in the US. If US economic growth expectations were to increase, so too would global expectations and with them expectations for the entire market.