Coca Cola (NYSE: KO) will report 2016 end of year earnings on February 9th, 2017. Let’s look at the 7 key factors to consider before trading Coca Cola.

1) Price Action

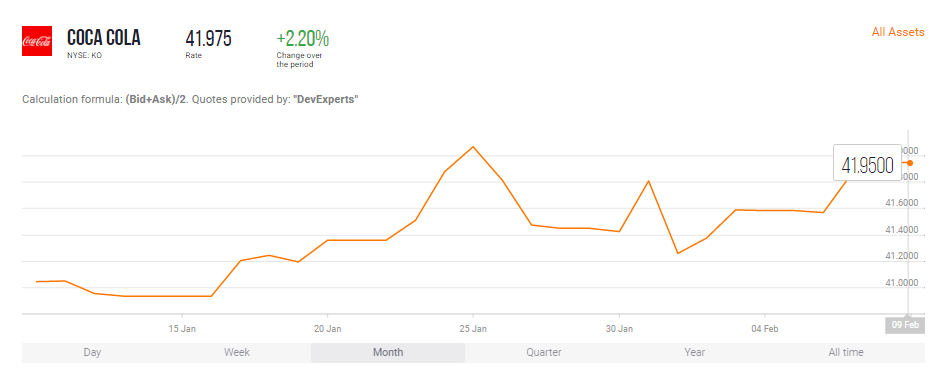

With volatile moves and achieving only marginal gains since the start of the year the Coca Cola share price indicates a sideways channel trajectory, at best, over the short to medium term.*

Considering a directional view the share price has drifted lower since peaking in April 2016.* This is disappointing compared against one of its main competitors, Pepsi Co (NYSE:PEP) – which is up over 2 percent since April 2016.*

Factoring in the earnings calendar the Coca Cola share price has furthermore fallen by an average of 2.7% on the day of reporting for each of the past three quarters and 1.8% for five of the past six quarters.*

2) Profits

The profit outlook is not promising. Wall Street analysts are forecasting the seventh consecutive quarter of declines in year on year profits for Coca Cola.**

Earnings excluding nonrecurring items of 37 cents a share are expected for Q4 2016, down YoY from 38 cents a share for Q4 2015.** In addition, an unimpressive 4.5% YoY decline in annual earnings to 1.91 USD per share is expected.**

3) Revenues

Mounting concerns over the negative effects of sugary drinks has led to declining revenues over six consecutive quarters.* Revenues were reported as 10.6USD billion for Q3 2016 – declining by 7% YoY due to adverse foreign currency movements combined with the impact of acquisitions and divestitures.* For Q4 2016, analysts expect Coca-Cola to report revenue of 9.14 USD billion, a decline compared with Q4 2015 (10.01USD billion).** Meanwhile, revenue for the full year is forecast to contract 5.8% (41.67USD billion).**

Half of Coca Cola’s revenues are generated overseas and this market has suffered from a stronger dollar.* These declines have been partially offset by applying higher prices and reduced package sizes in the US market but this can only achieve so much. Going forward the biggest challenge to generating revenues will be fighting the trend of falling soft drink consumption – which has dropped every year since the 1990s and is forecast to decline at 2.8% annually between 2017 and 2022.**

4) Institutional Holdings

One positive sign for buying Coca Cola shares is that you are in good company. Warren Buffett’s Berkshire Hathaway Inc. is Coca-Cola’s largest shareholder, owning 9.3% of outstanding shares, (400 million shares) as of Q3 2016.*

As a titan of smart investing Berkshire Hathaway’s holding is a positive signal to traders of the strength of company fundamentals. In addition this provides market confidence which can have a reflexive upwards effect on the share price.

5) US climate

One of the main reasons for under-performance in Q3 2016 was the strengthening dollar.* This trend is likely to continue. With Trump as President looking to enact a number of business boosting policies alongside the expected rate rise from the Federal Reserve we can expect further dollar strengthening and this will impact Coca Cola sales negatively – making their exports more expensive worldwide.**

On the other hand Trump’s plan to reduce corporate taxation rates could provide a boost to Coca Cola’s bottom line.** When and by how much remains the crucial question for every US corporation.

6) CEO Succession

James Quincey, will become CEO in May 2017 – a positive move for the company. Quincey has a strong track record – taking the role of COO in August 2015 and previously working as president of Coke’s Europe Group.

He has directly enhanced profit making in a number of areas in the business in the past. Additionally, Mr. Quincey has had a hands-on role in implementing a new international operating structure and leadership team through the course of his COO tenure which has enhanced efficiency and agility across all levels of the business.

7) Diversification

As part of a strategy to diversify Coca Cola has developed new lines of sodas – including more flavors such grape and cherry cola, and a range of sparkling waters. They have also expanded into energy drinks.

Coca Cola closed on a 2.15USD billion deal to buy a 16.7% stake in Monster (MNST) in June 2015 – giving them a piece of Monster’s thriving brand range.* When the new CEO takes his place in May 2017 one possible strategic aim of the company will be to acquire the remaining stake in Monster Beverage Corp.

This will be a positive signal to traders that Coca Cola is taking an aggressive, proactive approach to capturing a wider section of the evolving drinks market.

There are still opportunities for growth at Coca Cola – but it will be a delicate balance for company leadership. Dynamic external factors are difficult to successfully navigate – but not impossible.

* Past performance is not a reliable indicator of future performance.

** Forecasts are not reliable indicator of future performance.