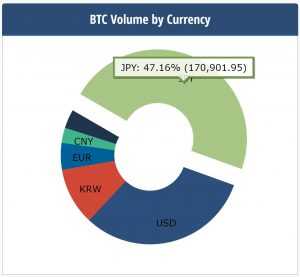

The Communist Party of China has recently banned all cryptocurrency exchange-related activities within the national borders. As a result, many crypto enthusiasts and active traders, as well as their money, are leaving China. Where do they flee? Most probably, neighboring countries. Japan and South Korea are the most prominent options as both nations enjoy free and unrestricted cryptocurrency exchange policy. Japan is now the leading Bitcoin exchange market in the world, surpassing even of the United States. Up to 44% of all BTC deals are committed in the Japanese yen.

Unlike Chinese counterparts, Japanese officials seem understand the role cryptocurrencies will play in the economy of tomorrow and benefits early adopters will enjoy. Hence, a more liberal stance on Bitcoin and altcoins. However, the Land of the Rising Sun is not intended to leave this sphere completely unsupervised. Japanese government is looking for opportunities to surveil and investigate Bitcoin exchanges but only for a certain time, most probably limited to the month of October. Judging by the results, gathered during the surveillance period, it will then conclude what are the actions that should be taken in order to make the market a better and a safer place. Some believe that a special licensing program for BTC exchanges is on its way.

Unlike Chinese counterparts, Japanese officials seem understand the role cryptocurrencies will play in the economy of tomorrow and benefits early adopters will enjoy. Hence, a more liberal stance on Bitcoin and altcoins. However, the Land of the Rising Sun is not intended to leave this sphere completely unsupervised. Japanese government is looking for opportunities to surveil and investigate Bitcoin exchanges but only for a certain time, most probably limited to the month of October. Judging by the results, gathered during the surveillance period, it will then conclude what are the actions that should be taken in order to make the market a better and a safer place. Some believe that a special licensing program for BTC exchanges is on its way.

One of the Japanese Financial Services Agency (FSA) officials stated, “We pursue both market fostering and regulation enforcement.” The move, therefore, is not introduced to hinder cryptocurrency market growth. Just the opposite, it can contribute to healthy transactions in the long run.

What does it mean for an industry as a whole? Cryptocurrencies are now big enough to be recognized by the central governments as an important part of the financial system. Earlier this week Mario Draghi, head of the European Central Bank, pointed out it is beyond his authority to control peer-to-peer operations. Further development of safe and sustainable cryptocurrency trading infrastructure will most certainly contribute to the long-term growth of crypto trade volumes.