The J.M. Smucker Company (SJM) Stock is expected to report its earnings on 8 June 2017 before the markets open. SJM is an Ohio-based manufacturer and marketer of consumer food, beverage products, and pet food. The company’s business is arranged in four separate divisions: U.S. Retail Coffee Market, U.S. Retail Consumer Foods, U.S. Retail Pet Foods and International and Foodservice.

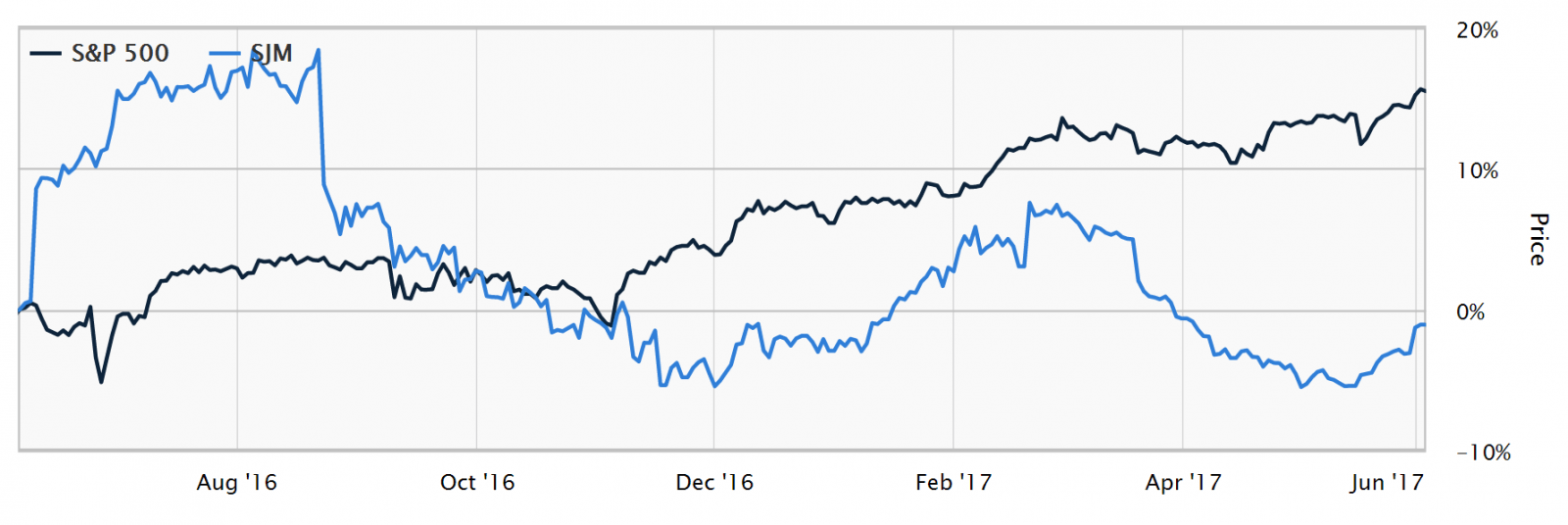

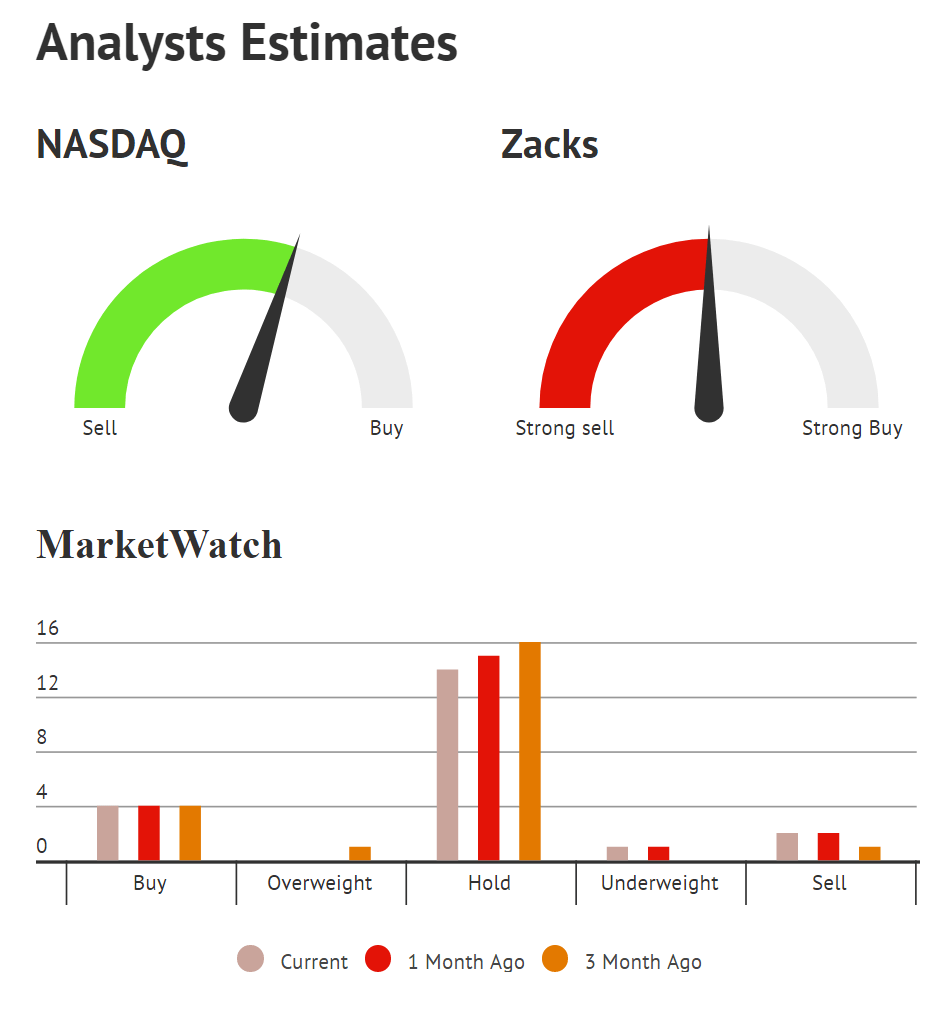

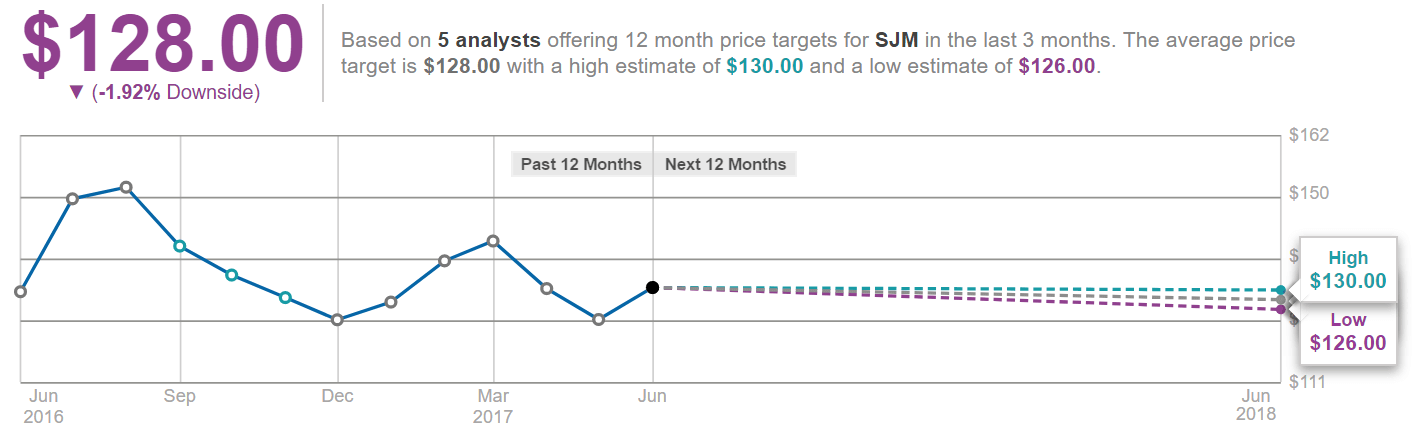

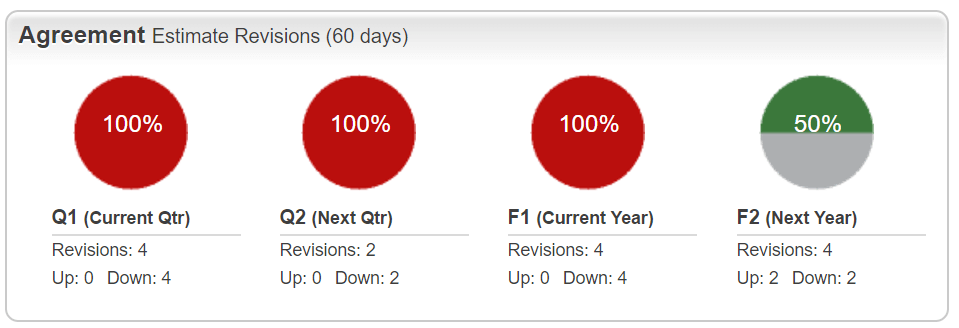

The company underperformed the industry over the last six months. The consensus EPS forecast for the fiscal quarter ending April 2017 is $1.73. The reported EPS for the same quarter last year was $1.86. The company, though well-positioned for sustainable long-term growth, could lose a portion of its market value when the earnings report is released.

Performance indicators

| 52 Week High-Low | $157.31 – $122.05 |

| Dividend / Div Yld | $3.00 / 2.30% |

| EV/EBITDA Annual | 12.67 |

| Consensus EPS forecast Q1/17 | $1.73 |

| Reported EPS Q1/16 | $1.86 |

| Forward PE | 16.68 |

Growth Factors

Strong Portfolio. J.M. Smucker can boast a unique brand portfolio. In it, a wide range of Smucker’s, Folgers, Dunkin’ Donuts, Jif, Crisco, Pillsbury, Eagle Brand, Robin Hood, Five Roses, Carnation, Sahale Snacks and Bick’s products can be found. Most of them are well-known and praised by the customers. Offering top-quality products at a moderate price, J.M. Smucker gained a reputation of a trustworthy and reliable food manufacturer. The company’s desire to innovate and tailor to the needs of its customers is a sign of a successful product management strategy.

Strategic Cooperation. With coffee being a crucial part of its business J.M. Smucker can be expected to form strategic alliances with key players in the sphere of coffee manufacturing and distribution. In collaboration with Dunkin’ Brands Group, J.M. Smucker entered a multiyear agreement with Keurig Green Mountain to produce and distribute Dunkin’ K-Cup all over the United States and Canada, as well as online. Results of this cooperation exceeded the company’s brave expectations, helping to reach a $250 million retail sales threshold much faster.

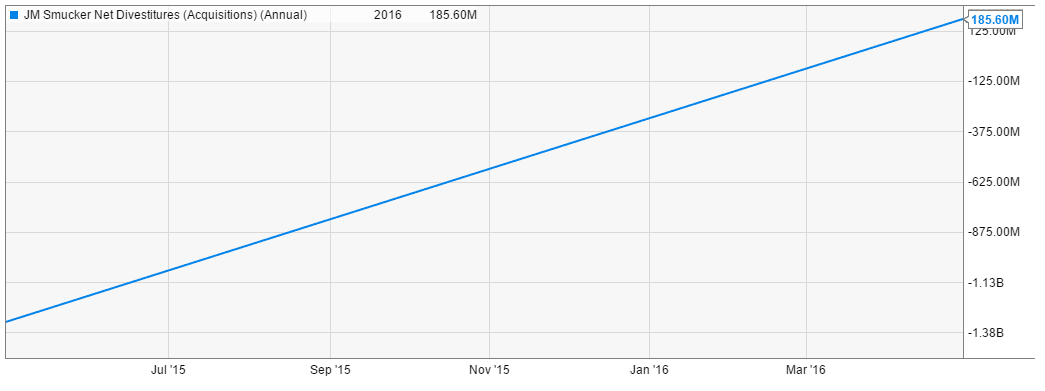

Mergers & Acquisitions. The majority of Smucker’s well-known brands previously belonged to independent companies. Sooner or later they all have been acquired by SJM and for good reasons. Strategic acquisitions have fueled the J.M. Smucker Company’s growth for quite some time already. Wesson oil brand is the most recent acquisition, still being subject to regulatory approval. Earlier acquisitions include Enray, Seamild, Rowland Coffee and many others. J.M. Smucker is glad to expand its network of profitable businesses both domestically and overseas.

Restructuring Initiatives. The company is not afraid to delegate separate business divisions to partners who can potentially do the work better than in-house production. Eagle Family Foods Group, now responsible for US canned milk brands, is one of such examples. According to its management, the company can save up to $50 million with the help of third-party manufacturing.

Policy of Dividends and Buybacks. Stable dividend growth and share buybacks benefit the investors by pushing the stock price up. During last year, SJM’s dividend grew 12%, while also increasing 5% and 10% in 2015 and 2014 respectively. Over $750 million have been transferred to the company’s shareholders in the form of dividends and buybacks.

Possible Headwinds

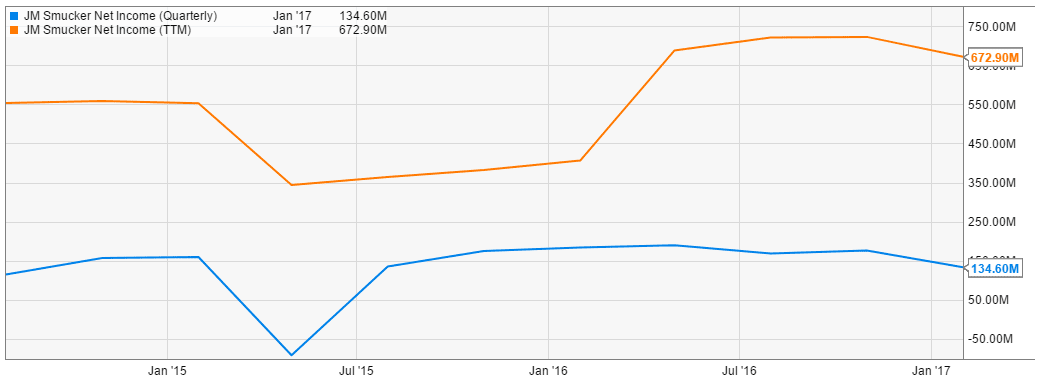

Weak Recent Performance. Financial performance is one of the factors to consider when estimating the direction of the future price action. SJM’s bottom line missed estimates for the first time in seven quarters, which can be either a sign of future hurdles or an accidental deviation. The company’s sales, however, do also lag behind the estimates for three consecutive quarters. Net sales dropped 3% year over year. Weak sales constrain the growth of SJM stock prices. The company underperformed the industry, growing only 3.4% in three months.

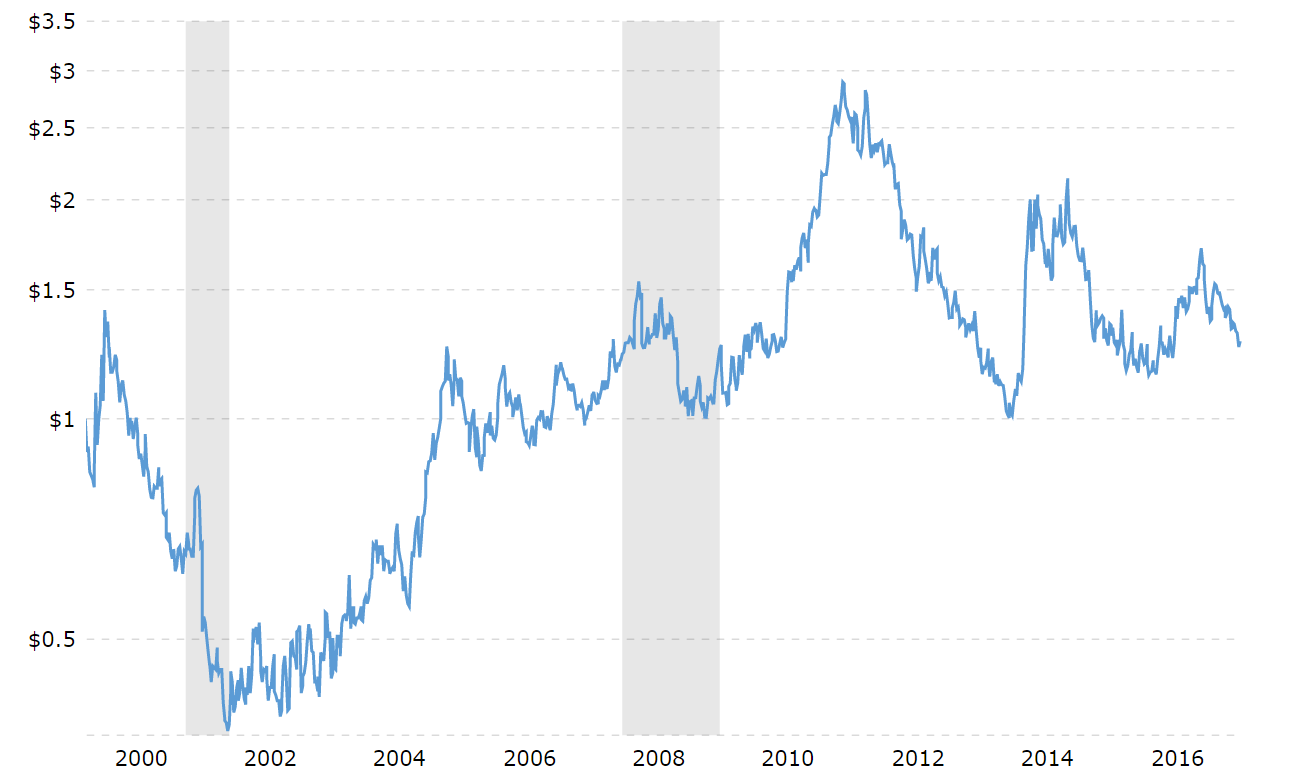

Growing Coffee Prices. Due to higher coffee prices, J.M. Smucker was forced to raise the prices of packaged coffee products. Higher prices always mean lower sales. During the previous periods, the company sought opportunities to lower the price of coffee-related products and increase the volumes, which is no longer possible due to globally increasing green coffee prices.

Troubled Pet Food Segment. The company is facing tough competition in the pet food segment from both premium and everyday dog and cat food manufacturers. The problem could eventually be solved with the introduction of brand new premium dog food product line, while of course nothing guarantees it. Smucker found it difficult to adapt to Millennials’ needs, not being able to provide simpler and healthier recipes of pet food.

International and Foodservice. For two and a half years International and Foodservice business segments remained a constant pain for SJM management. Currency headwinds and declining volumes in coffee business pose a serious threat to the top and bottom lines of the company.

Conclusion

The J.M. Smucker Company can be expected to grow in the long term thanks to restructuring initiatives, sound acquisition policy and strategic cooperation with its key partners. However, it is very well possible that the company’s stock will lose a portion of its value once the earnings report is released. The main reasons for that are soft sales and a lower than expected bottom line. Whether positive or not, data released in the quarterly earnings report is expected to influence the stock price considerably.