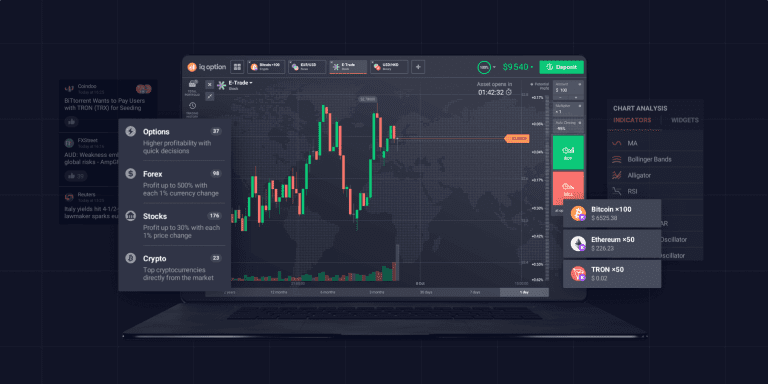

When working with IQ Option, you get access to a wide variety of trading instruments. For a newcomer, the abundance of choice can be intimidating. We, therefore, prepared this article to let you go through the list of all trading instruments on IQ Option that are currently available on the platform.

As one of the 20th century’s most successful investors said, don’t trade what you don’t understand. Hopefully by understanding the instruments better, you might be able to trade them more effectively.

Binary Options

Binary Options automatically calculate the profitability/loss of the deal based on the distance between the current price and the closing price you chose. As always in trading, the higher the risk, the higher the potential return.

CFDs on Stocks

Contracts for difference on stocks use stocks as an underlying asset (yet, it is not the same as trading stocks themselves). Not only CFDs on stocks behave differently when compared to currency pairs, they are also traded quite differently. When working with stocks on the IQ Option platform, there are no strike prices and expirations. All you have to do is buy the asset of your choice and wait for its price to go up (down in case of short selling), then manually close the deal. The trader can choose the multiplier and thus adjust the risk/return ratio according to his needs.

Forex

Forex is the world’s most popular trading instrument, and for a good reason. It is simple enough to let anyone in, yet it offers unmatched depth and engagement. When working with Forex, traders buy and sell currency pairs that fluctuate in accordance with technical and fundamental factors. In order to trade Forex with IQ Option, you will need to choose the currency pair, then click ‘Buy’ or ‘Sell’ depending on your forecast and close the deal when the moment is right.

Crypto

Cryptocurrencies have lost a huge portion of their appeal since the period of unstoppable growth back at the end of 2017. Still, those who understand Bitcoin and its younger peers definitely have a chance to trade them successfully. Cryptocurrencies and fiat money have little in common yet are traded in the same fashion. You could follow the same steps as you would when trading, say, a conventional currency pair. Note that certain assets have a pre-activated multiplier that will greatly increase both the potential returns and losses.

CFDs on ETFs, Commodities, Indices

All three, despite being drastically different in nature, fall into the same category due to the fact that they are traded in the similar fashion. Fundamental factors play an important role in all three. The profitability/losses of these deals will depend on the difference between the asset price at the opening and the current price.

As you can see, all the trading instruments on IQ Option platform fall into one of the two major categories. Those that utilize expiration and strike prices, and those that don’t. The former will close automatically at the expiration. The outcome of the deal will depend on the mutual arrangement of the strike price and the actual price. The latter need to be closed manually. For all assets with no set expiration, there is also an auto-closing feature available.