Five most important news to start your day. These events are very likely to influence the market and trigger exchange rate fluctuations. Read to stay informed.

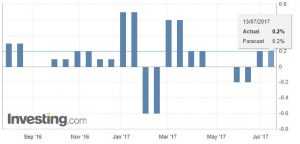

German Consumer Price Index (Jun)

Time: 06:00 GMT

Consumer Price Index is an indicator that examines average prices of a standardized consumer goods basket. It is most often used to calculate the inflation/deflation over a set period. The index, being a measure of inflation, is used to formulate the fiscal policy of the state. As predicted, CPI in Germany demonstrated a reasonable growth of 0.2%. The exchange rate of the Euro can be affected by inflation-tracking indicators. High enough inflation can trigger the depreciation of the national currency.

Consumer Price Index is an indicator that examines average prices of a standardized consumer goods basket. It is most often used to calculate the inflation/deflation over a set period. The index, being a measure of inflation, is used to formulate the fiscal policy of the state. As predicted, CPI in Germany demonstrated a reasonable growth of 0.2%. The exchange rate of the Euro can be affected by inflation-tracking indicators. High enough inflation can trigger the depreciation of the national currency.

U.S. Producer Price Index

Time: 12:30 GMT

The U.S. Producer Price Index (PPI) measures the change in the price of goods sold by manufacturers. The PPI is one of the key indicators that help to estimate the inflation. The latter has a direct influence on the exchange rate of the national currency.

Experts believe the indicator would demonstrate negative growth of -0.1%. If the forecast holds true, the USD can lose a portion of its value.

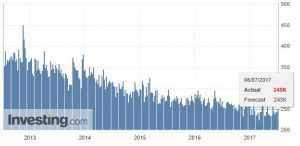

U.S. Initial Jobless Claims

Time: 12:30 GMT

Reported by the Department of Labor, U.S. Initial Jobless Claims is an indicator that tracks the number of people who have filed for unemployment insurance for the first time. The unemployment rate of around 5% is considered natural. Everything above that is harmful to the national economy.

Reported by the Department of Labor, U.S. Initial Jobless Claims is an indicator that tracks the number of people who have filed for unemployment insurance for the first time. The unemployment rate of around 5% is considered natural. Everything above that is harmful to the national economy.

Higher than expected readings will therefore negatively affect the exchange rate of the USD, while lower than expected readings will lead to the appreciation of the US dollar.

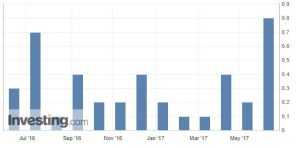

Canada New Housing Price Index

Time: 12:30 GMT

Obviously, the New Housing Price Index indicates the change in retail prices of new residential property in Canada. The prices are growing when the housing market is expanding and the economy in general is doing well. Therefore, growing prices are perceived as somethings good for the national currency. Should the Statistics Canada report higher than expected New Housing Price Index readings, the exchange rate of the CAD can also be expected to go up.

Obviously, the New Housing Price Index indicates the change in retail prices of new residential property in Canada. The prices are growing when the housing market is expanding and the economy in general is doing well. Therefore, growing prices are perceived as somethings good for the national currency. Should the Statistics Canada report higher than expected New Housing Price Index readings, the exchange rate of the CAD can also be expected to go up.

Fed Chair Yellen Testifies

Time: 14:00 GMT

For the second day in a row Fed Chair Janet Yellen will testify before the Joint Economic Committee. The economic outlook and monetary policy are to be discussed. Volatility spikes in all currency pairs including the USD can be observed during the testimony. The direction of the price action will ultimately depend on the information provided by Janet Yellen. The Fed has the power to designate national interest rate and can therefore influence the exchange rate of the national currency.