The Moving Average Convergence Divergence (MACD) Indicator

The MACD is by definition a trend-following momentum-indicator, which means that it is well suited for use by beginners as it can be made into the centerpiece of some of the simplest – yet still efficient – binary option trading systems. In the case of the MACD, the key word is EMA (Exponential Moving Indicator), which is used to calculate the MACD itself as well as the signal line which is used in combination with the MACD to generate trading signals. The MACD is calculated by subtracting the 26-day EMA from the 12-day one. The signal line will be the 9-day EMA.

There are three ways to gain a trading signal out of the way the MACD and the above said signal line relate to each other.

The first way is to look for the two to cross. If the MACD crosses under the signal line, there’s a bearish tendency developing. If on the other hand, the MACD crosses above the signal line, the signal is a bullish one.

Divergence is the second way to gain a “read” out of the MACD. When it and the asset price show a divergence, it is taken as a signal that the current trend is about to come to an end (and experience a reversal, obviously).

Last but not least, we have situations when the MACD rises sharply, which is an indication that the asset is in an overbought position, that is about to be corrected shortly. Considering that a rise in the MACD can be translated as the shorter-term moving average pulling away from the longer-term one, the above conclusion is a logical one indeed. Keeping with that train of thought: whether the MACD is above or below zero also carries a meaning. If it is above zero, it’s obvious that the short-term moving average is above the long-term one and that means a bullish outlook. If it is below zero, we’re dealing with a bearish outlook.

As said above, the MACD is great for spotting trend reversals as part of various trend-following strategies, and because of its simplicity, it lends itself well to beginner strategies.

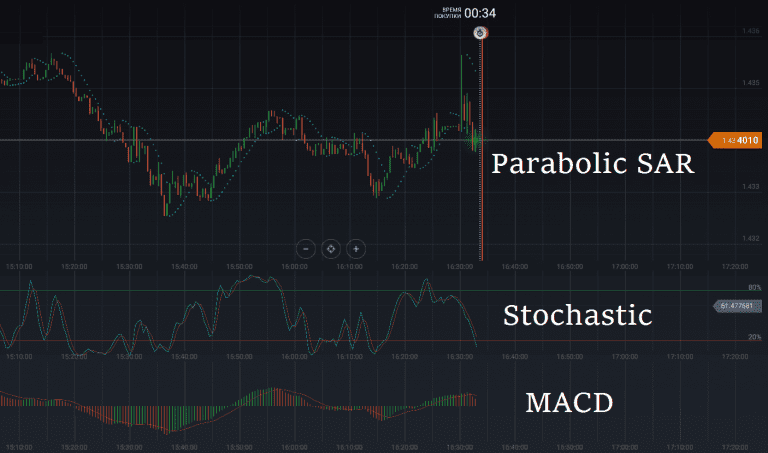

The Stochastic Oscillator

Like the MACD, the stochastic oscillator is a momentum-based indicator, which is also aimed at predicting trend-reversals in an asset-price, by comparing the current price of the asset with the range that the price had covered over a number of previous trading sessions. The stochastic oscillator can actually be expressed through a mathematical formula: %K (which is our oscillator) = [(current asset price-L14)/(H14-L14)]*100. In this formula, H14 is the highest asset-price level reached over the last 14 days, while L14 is the lowest such price. With that out of the way, it is clear how the stochastic oscillator works and what it sets out to accomplish. As in the case of MACD, where we needed a signal line as well to get our trading signals, with the stochastic oscillator, we use a %D, which is essentially the 3-day moving-average of %K. All the above taken into account, it is clear that what the stochastic oscillator does is to show us the consistency with which an asset price closes near its last few days’ highs and lows. In the case of a bullish trend, the asset-price tends to close near its highs, while in the case of a bearish trend, it closes near its lows on a more consistent basis.

As a range-bound variable, the stochastic oscillator is great for identifying overbought and oversold situations, and to that end, it can offer trading clues by itself: if it’s above 70, we are likely to have an overbought situation on our hands. Under 20, the asset-price is oversold and as such, trend-reversals are likely in both cases. Unfortunately, due to the false noise it often generates, %K alone isn’t a reliable source of trading signals. With the addition of %D though, we’ll be able to pinpoint shifts in momentum (as the two indicators cross) and that added to the overbought/oversold levels identified by %K as said above, we do indeed get rather reliable trading clues.

Another way that the stochastic oscillator will serve up trading signals is when it exhibits divergence with the asset-price action. Such a divergence is considered a sign of an impending trend-shift.

While the stochastic oscillator is a great tool in and of itself, it’s at its best when used as a complimentary tool for a different sort of strategy. If we get a trading signal off a pin-bar for instance, we can use the stochastic oscillator to have it confirmed/invalidated.

Use trader robots to completely remove the human/emotional factor from your trading. The Parabolic SAR is quite suitable for such mechanical trading indeed.

The Parabolic SAR

For a trending market, the Parabolic SAR (Stop and Reversal) is one of a most potent and easy-to-use tools, aimed at establishing the momentum of an asset-price and finding a point at which the probability of a trend-reversal is higher than normal. The drawback associated with the Parabolic SAR is the fact that it generates lots of false signals during periods of asset-price consolidation, so much so in fact that it’s not suitable at all to be used under these circumstances.

On a chart, the Parabolic SAR takes the shape of a series of dots positioned above or below the actual asset-price. If we have a bullish trend and the SAR dots are below the asset-price, we get a bullish signal, which essentially tells us that the bullish trend will continue. Dots showing up above the asset-price graph indicate a bearish trend. A sell signal is generated as soon as the first SAR dot shows up at the top of a price-action candlestick at the end of a bullish trend.

Being a mechanical indicator fully capable of responding to changing conditions, the Parabolic SAR isn’t just a very popular tool among those setting up their own trading systems around it, it is probably the most efficient way to set up one’s stop-loss order and thusly a superb way to lock in paper profits in trending markets.

As all the other indicators presented above, the parabolic SAR is at its best when used in combination with other indicators. For instance, a reversal signal generated by this indicator is much more valuable when it comes as the price is below a long-term moving average than otherwise.