CFD or Contract for Difference is a financial instrument that doesn’t involve the purchase of the underlying asset. The investor’s goal is to predict the direction of the future price movement and capitalize on the difference between current and future prices.

In general, CFD trading means you must close the deal in future to get either profit or loss in result. Forget about expiration time – you can close your deal at any time you want.

If the prediction is correct, the trader will earn a profit. The amount of it will depend on conditions of each particular deal. This makes difference between options and CFD trading, because while trading binary, classic or digital options you may just wait for expiration time and the deal will close automatically.

In CFD trading there is no expiration time. But you are able to set stop/loss and trigger a market order if the price gets a certain level.

Why to trade CFDs?

CFD is an alternative way of trading, which has its own advantages and disadvantages. When compared to more conservative trading tools, contracts for difference can boast the following benefits:

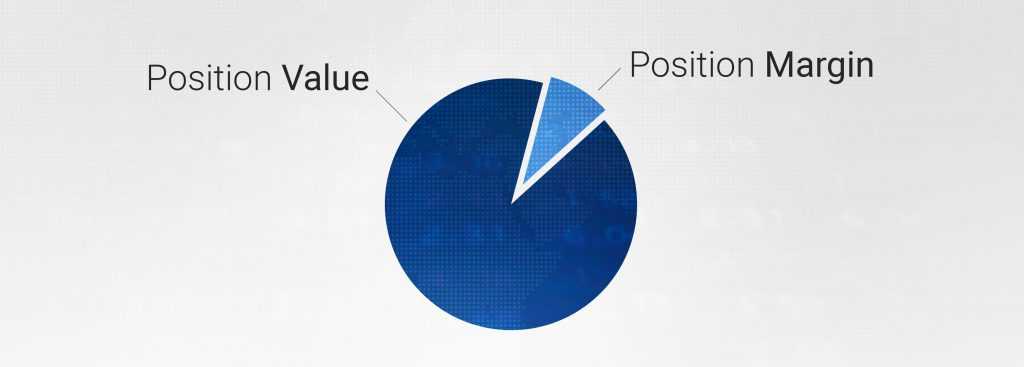

Margin trading. Contracts for difference offer the usage of a multiplier, an extremely powerful trading tool. With it, one can control the position that exceeds the amount of money invested in it.

When picking the 10:1 multiplier the trader gets an opportunity to open a $1000 deal with only $100 at hand. The other $900 would be automatically provided by the lender. What are the benefits and risks of trading on margin? The potential profitability (as well as risks) will also be magnified. Imagine investing $100 and getting the return that is comparable to a $1000 investment. That’s the opportunity a multiplier can offer. However, remember that the same goes with potential losses as these would be multiplied as well.

Fast trading. Trading on CFDs does not require massive time commitment and can be practiced both professionally and casually. Of course, for tangible results it is required not only to spend enough time on trading but also to undergo an in-depth training. Still there is a possibility of executing several deals spending less than 15 minutes a day, which certain traders will find beneficial.

Available CFD types

New CFD types, available in the IQ Option trading platform include CFD stocks, Forex and CFD cryptocurrencies.

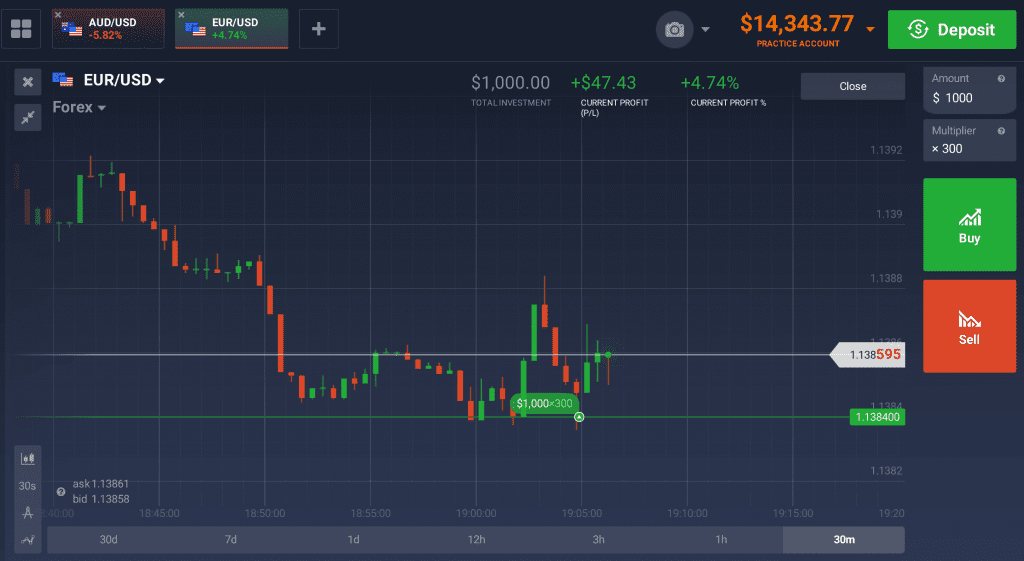

Forex

The Forex market is the world’s largest and most liquid financial market. When performing the exchange of currencies, you’re expecting the price of a currency will grow and you’d be able to sell it back to make some profit off of that price difference. This kind of price speculation is the basic principle behind trading on the Forex market. For quite a while Forex trading was available solely to institutional investors such as banks, yet the development of the Internet let ordinary people join the international currency market.

The Forex market is the world’s largest and most liquid financial market. When performing the exchange of currencies, you’re expecting the price of a currency will grow and you’d be able to sell it back to make some profit off of that price difference. This kind of price speculation is the basic principle behind trading on the Forex market. For quite a while Forex trading was available solely to institutional investors such as banks, yet the development of the Internet let ordinary people join the international currency market.

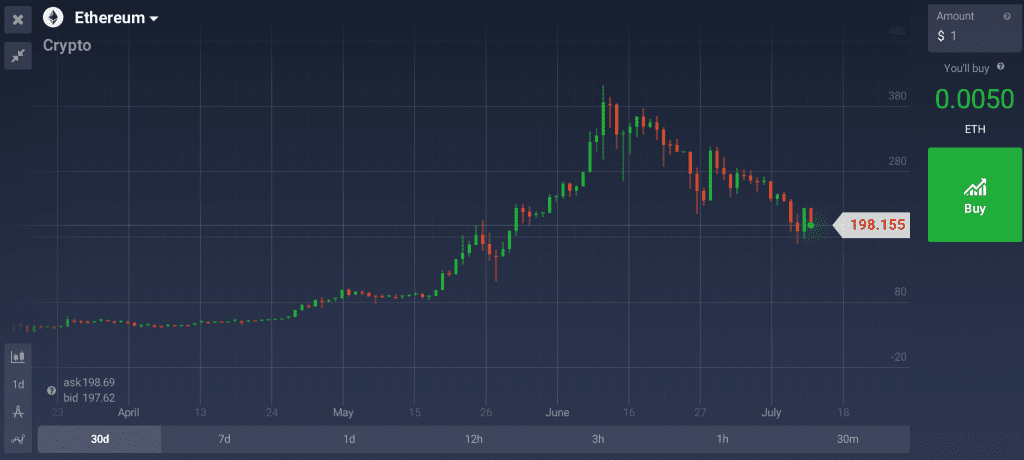

Cryptocurrencies

The hottest trend of the trading season, cryptocurrencies drew the attention of both finance professionals and regular people. Now you also have a chance to capitalize on the movement of the six most popular cryptocurrencies.

The hottest trend of the trading season, cryptocurrencies drew the attention of both finance professionals and regular people. Now you also have a chance to capitalize on the movement of the six most popular cryptocurrencies.

Bitcoin has been growing against the USD, though with a series of downfalls, for years. Ethereum demonstrated an exponential growth pattern and grew from $15 to $371 in a matter of three and a half months. Fast-paced growth and speculative opportunities are not the only reasons why the financial community is paying close attention to cryptocurrencies. They are believed by some experts to change the world financial system forever.

It is not necessary to invest in expensive hardware worth thousands of US dollars to mine cryptocurrencies on your own or deal with overcomplicated online exchange points. When trading with IQ Option, the process of trading the cryptocurrency of your liking is as smooth as any other trading operation. The world’s most popular cryptocurrencies are now close at hand.

CFD stocks

CFD stocks trading will be available on IQ Option platform in October.

When trading CFDs, instead of buying a share in a company and becoming one of its owner, you forecast the future direction of the price action and capitalize on the difference between the current and the forthcoming prices. Choose from the world’s largest and most known company. Follow corporate and industry news to capitalize on CFD stocks using fundamental analysis or apply your knowledge of technical analysis to trade existing market patterns.

The New York Stock Exchange is the largest stock market in the world that trades a daily volume of $22.4 billion. The FX market can boast $5.3 trillion of a daily volume traded. Forex, however, is not only 200 times bigger than the world’s largest stock exchange, it is also extremely volatile. Exchange rates constantly fluctuate, creating numerous speculative opportunities for traders willing to face the risks of high volatility.

Risks and multiplier

The risks associated with CFD trading mostly lie in the sphere of using a multiplier. A multiplier is a truly double-edged sword. When you get the forecast wrong, the losses your account will incur will also magnify. This is the main risk of using any amount of borrowed capital and especially high multiplier ratios, e. g. 100:1 and 1000:1.

The risks associated with CFD trading mostly lie in the sphere of using a multiplier. A multiplier is a truly double-edged sword. When you get the forecast wrong, the losses your account will incur will also magnify. This is the main risk of using any amount of borrowed capital and especially high multiplier ratios, e. g. 100:1 and 1000:1.

If you are not being deliberate enough you can incur heave losses in a relatively short period of time. When you trade with a multiplier and the trend starts moving in the wrong direction, you will start losing the money to cover the losses in borrowed capital. Volatility spikes can therefore eliminate your entire margin in no time.

Certain Forex dealers would offer multipliers as high as 3000:1. Not only it is risky, the strategies involving extremely high multiplier ratios have little to no chances of providing positive returns in the long run. Knowing the risks of margin trading is essential to successfully utilizing this tactic in the Forex market.