The FOMC increased their expectations for economic growth and inflation, pushing the dollar to new highs.

Focus Turns to the Important NFP Report

The FOMC didn’t provide quite the surprise some traders were expecting but they did get a little more hawkish on the economy. They see expansion accelerating over the next year and that expansion will fuel inflation. Inflation is expected to continue rising, reaching their target over the next 12 months. Because of the outlook traders are now expecting a slightly faster pace of rate hikes than they were the day before. That means any data indicative of expansion in the economy or increase in costs will lift the dollar.

Te greenback paused its advance on Thursday on a round of mixed data, mixed in that it supported acceleration in the US economy but not accelerating inflation. The Challenger, Gray & Christmas report on planned layoffs shows the number of planned job cuts fell nearly 40% from the previous month as hiring plans ramp up. The initial jobless claims figure fell to a new 45 year low, a sign of ongoing improvement in the labor market, while labor costs itself fell short of expectations. Unit labor cost, a measure of labor expense offset by productivity, came in at 2.7% and below the 3% expectation as productivity (efficiency) within the labor force asserts itself.

What this means for traders is that the April NFP report will be more important than ever. The unit labor cost figure is important but rear looking, the data is for the first quarter of 2018, and the NFP average hourly earnings is a more current look being the first monthly read of for the second quarter. Average earnings have been growing at a pace above 2.5% YoY, anything in that range is going to be dollar positive.

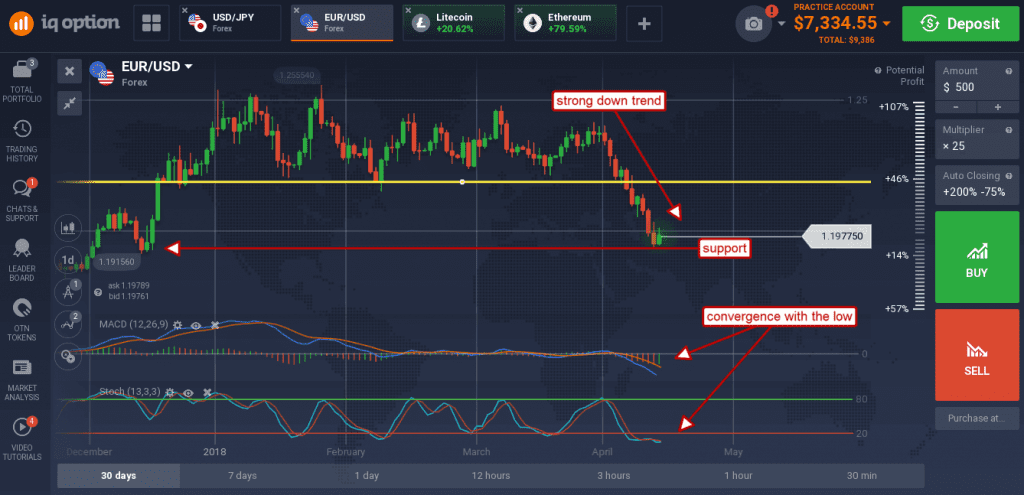

The EUR/USD regained a little of its lost ground in Thursday trading but the bounce was weak. The pair appears to be in a fairly strong downtrend and is indicated lower. MACD momentum and stochastic are both bearish and convergent with the new low suggesting underlying weakness in the market. This does not mean the pair will move lower definitively but it does set it up for a fall should a bearish catalyst emerge. Support may hold at the Wednesday low, near 1.9380, but it does not look likely. A break below support would be bearish and could take the pair down to my next target at 1.9000. Longer term the pair is expected to move down to 1.7000 as the Fed raises rates, and the ECB holds them steady.

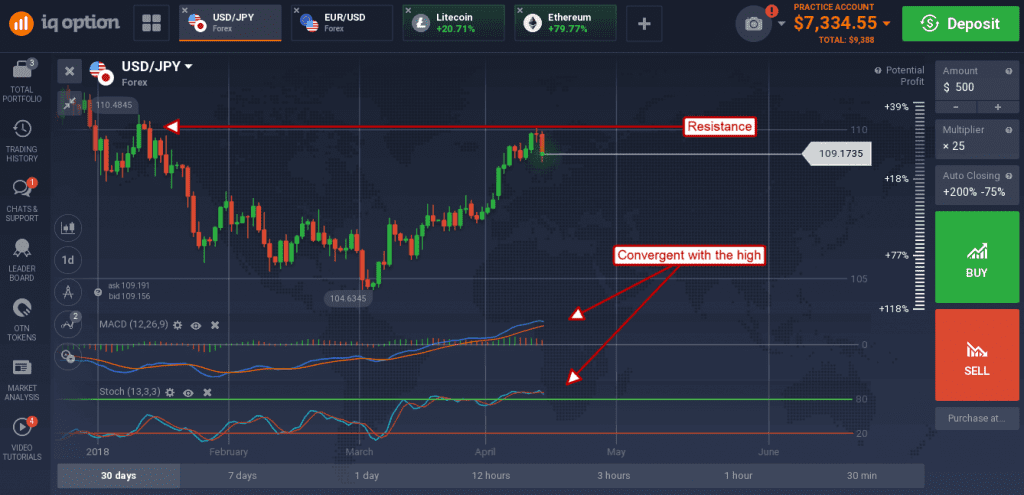

The dollar gave up quite a bit of ground to the Japanese yen but this may be related to low holiday trading volumes, Japanese financial markets are closed for Constitution Day. In any event the USD/JPY shed more than 0.60% in a move creating an ominous looking red candle and possible Dark Cloud Cover. This candle set-up suggests a top has been hit and may lead to reversal although that is not likely. The BoJ are firmly dovish at this time, there is no expectation for policy tightening in Japan, a condition that puts them at odds with the FOMC. The indicators are consistent with a peak within the up trend but are also convergent with that peak, suggesting it will be retested at least. A break above 110.00 would be bullish and lead to continuation of the current up trend.