Almost everything people do has a seasonal cycle component to it. Stock markets are not an exception. This phenomenon is hard to explain, and it still is possible to use seasonality to your advantage. Not only mid- and long-term investors can benefit from it. Short-term traders can also put this information to good use. It is commonly accepted that most money on the stock market are made in the period between November 1 and April 30 (the so-called winter), while the period between May 1 and October 31 (the so-called summer) should be avoided. But is it just a Wall Street legend?

Back in 2012, two Massey University professors have written two articles on this exact subject: Are Monthly Seasonals Real? A Three Century Perspective and The Halloween Indicator: Everywhere and all the time. Results, obtained from 108 countries and 319 years of observation, conclude that summer-winter divide is more than real.

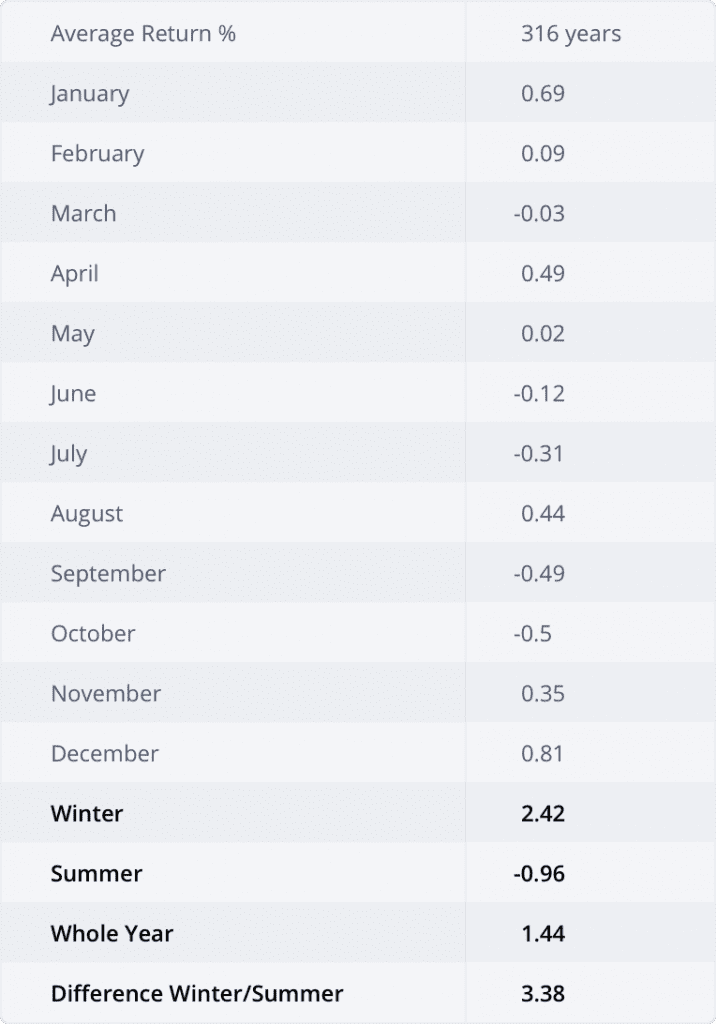

The table below features monthly average returns of the stock market (source):

January and December are the two most profitable months of the year, while September and October demonstrate the worst overall performance. As you can see, winter is on average more profitable that summer, which doesn’t necessarily mean that the market will behave the same each year. Of course, when 300 years of history are observed, outliers are more than expected. However, the general patterns, observed through the centuries, can really tell a lot about the nature of seasonal fluctuations and give you the upper hand. In the end, it is up to you to use this knowledge in your trading pursuits.

How to use this information in trading? A bullish investor may prefer to trade during the months with a higher average return: December, April, January. A bearish investor on the other hand, may choose to open a short position during July, September and October.

Of course, you are not guaranteed to stay in the black when following seasonal patterns. After all, your success (or failure) will depend mostly on your trading strategy. Yet on the financial markets it is always good to know more than others do.