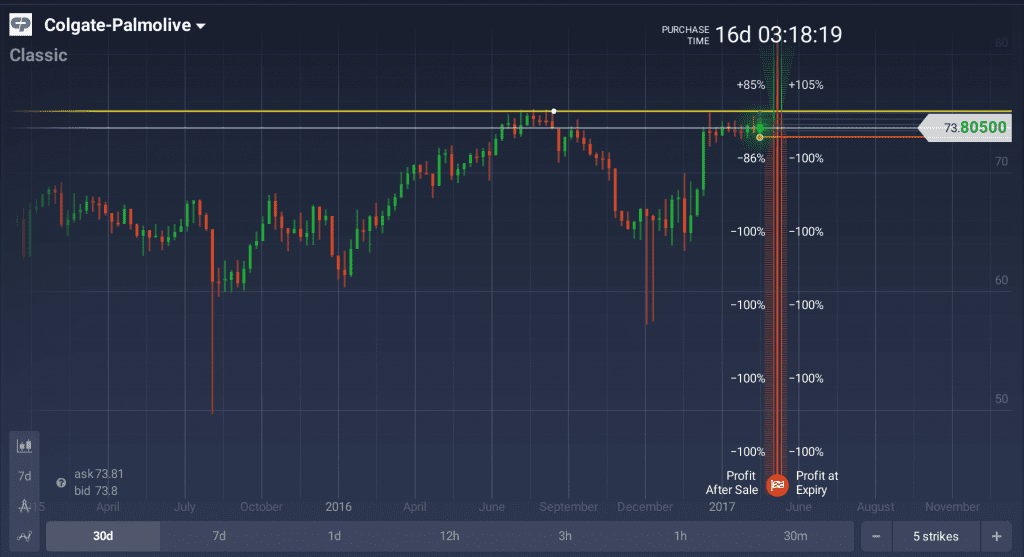

A New York City-based international consumer products giant is set to report earnings on 28 April 2017 before market open. Colgate&Palmolive (NYSE: CL) earnings reports have a potential to create powerful short-term fluctuations, thus spawning trading opportunities.

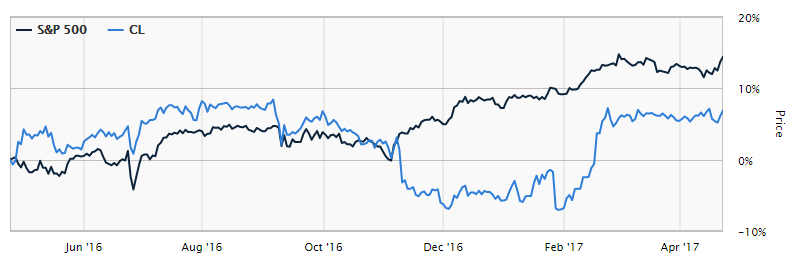

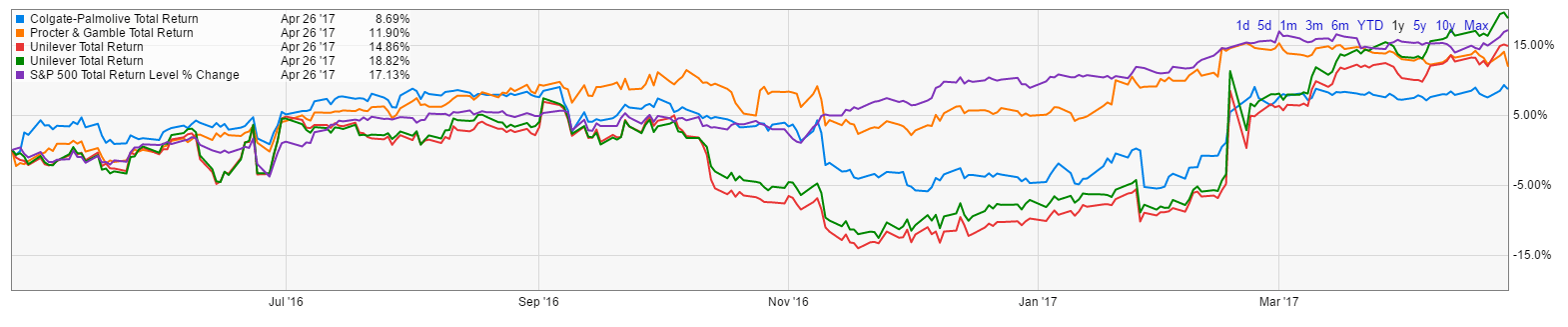

Though underperforming both S&P 500 and the industry in the past six months, the company has all the chances to beat experts’ estimates and show higher than expected financial results in the Q1 2017.

Performance indicators

| 52 Week High-Low | $75.38 – $63.43 |

| Dividend / Div Yld | $1.60 / 2.16% |

| EV/EBITDA Annual | 16.55 |

| Consensus EPS forecast Q1/17 | $0.66 |

| Reported EPS Q1/16 | $0.63 |

| Forward PE | 25.43 |

Reasons to buy

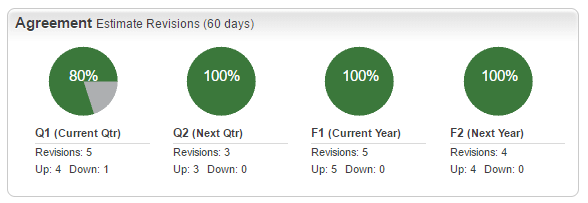

Impressing earnings estimates. According to Zacks, the company has all the chances to beat experts’ estimates and deliver outstanding financial results in its Q1 2017 report. With four out of five Q1 and three out of three Q2 estimate revisions being positive, Colgate-Palmolive is very likely to satisfy investors’ craving for the ever-growing top line.

Strong brand portfolio. Colgate-Palmolive products are well known all over the world, in developed and developing countries. Company’s leading position in oral and personal care segments can facilitate further growth. Focus on innovation is very likely to provide additional opportunities in the future.

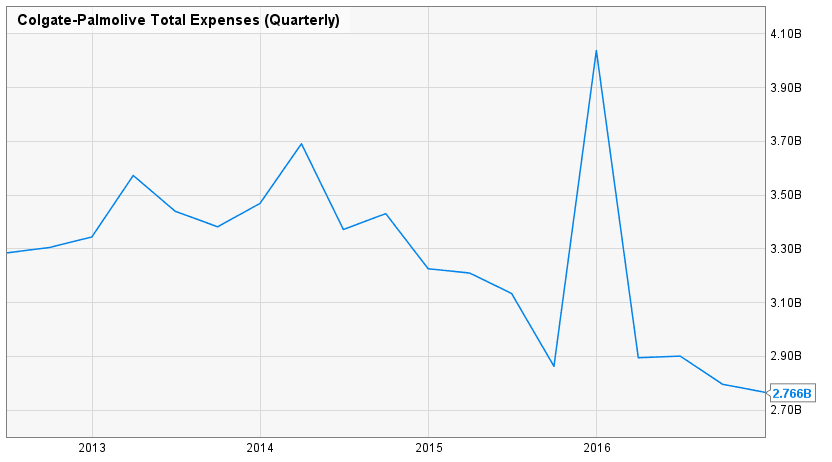

Strategic initiatives. Colgate-Palmolive has initiated a whole range of cost-cutting programs in the last few years. Cost reduction programs have a positive effect on gross and operating margins. Among the most noticeable undertakings are Global Growth and Efficiency Program, Restructuring Program and Funding the Growth. Not only they contribute to the financial goals of the company by bringing the expenses down but also make Colgate-Palmolive more environmentally friendly and sustainable. The latter can satisfy conscious consumers, creating a positive buzz around the company.

Focus on innovation. Over the years, innovation has become a major driver of Colgate’s business success. In the last five years, the gap between the company and its closest competitor grew from 70 basis points to seven full points. In the modern world, consumers want not only their cars and gadgets to be innovative, toothpaste and toothbrushes are expected to stand a test of innovativeness, too. By investing heavily in R&D Colgate-Palmolive makes the company even more viable and competitive in the upcoming years.

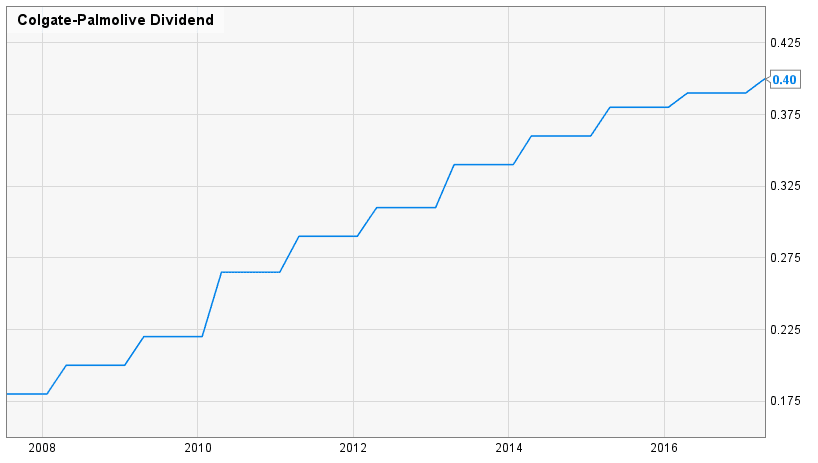

Capital strategy. The company is well-known for its financial discipline. “Innovation and shareholder satisfaction” could easily become the Colgate’s official motto. By organizing regular share repurchases and offering generous dividends, the managers hope to boost company’s value. Thanks to stable operating profits Colgate was able to spend $1.5 billion on dividends in 2016 alone.

Reasons to sell

Underperforming the industry. The company has severely underperformed both the industry and its S&P 500 peers. While Colgate-Palmolive shares grew only 5.2% in the last one year, the industry as a whole gained more than 10%. Though not the reason to divest from the company, slow growth and below the industry performance rarely satisfy the investors.

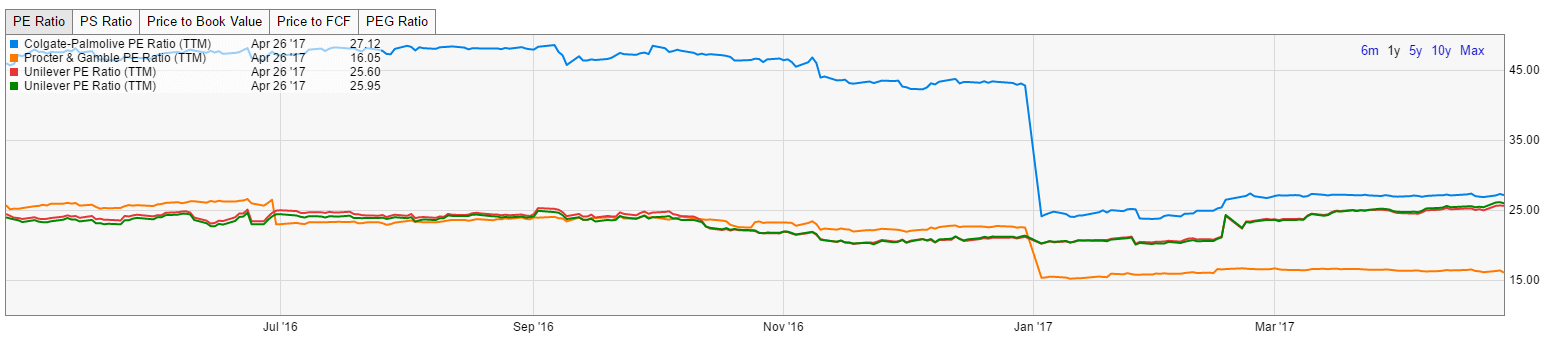

Stretched valuation. The company looks overvalued when compared with the industry and S&P 500. Colgate-Palmolive’s 12-month trailing Price-to-Earnings ratio of 26.03 is greater than 20.03 for the industry, 20.27 for the S&P 500 and even the company’s median level of 25.77. Whether investors would be glad to push the stock prices of the already overpriced company up is still an open question.

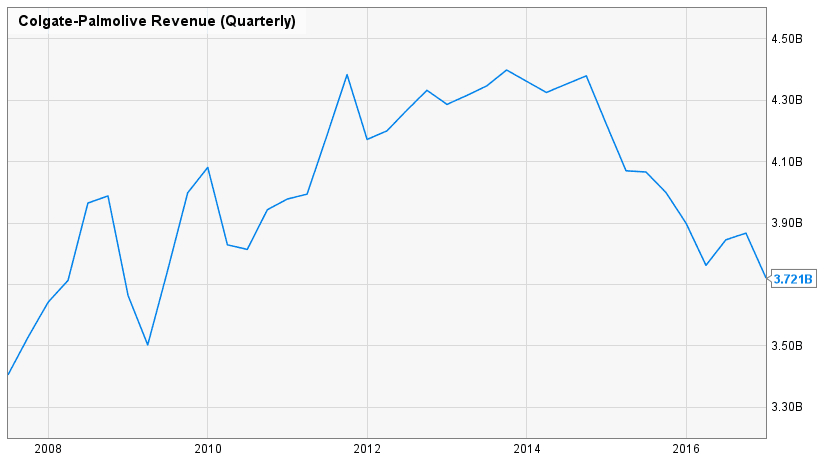

Soft sales. Colgate missed its sales estimates in six out of seven last quarters. Negative currency incomes can be expected with more than 75% of the company’s sales coming from abroad. Net sales are only expected to grow in low single digits range in 2017.

What to expect from CL shares?

All in all, the oral and consumer products giant’s shares are expected to appreciate at the very beginning of the trading session on 28 April 2017. This is mostly due to the innovative approach to business, geographic diversification, and competent growth initiatives.

With moderate to positive outlook, the company still has a chance to lose a portion of its value due to soft sales and low performance in the last one year.