“If dropped from high enough, even a dead cat will bounce back” – that’s how an old Wall Street saying goes. The idea is that even after a strong recession, the markets will bounce back and the prices, at least temporarily, will go up again. The phrase was first introduced in 1985, when the Malaysian and Singaporian stock markets bounced back after a sharp recession but continued to decline after that. Let’s see how a pattern with such a quirky name works and how traders can use it in their strategies.

What is a “dead cat bounce”?

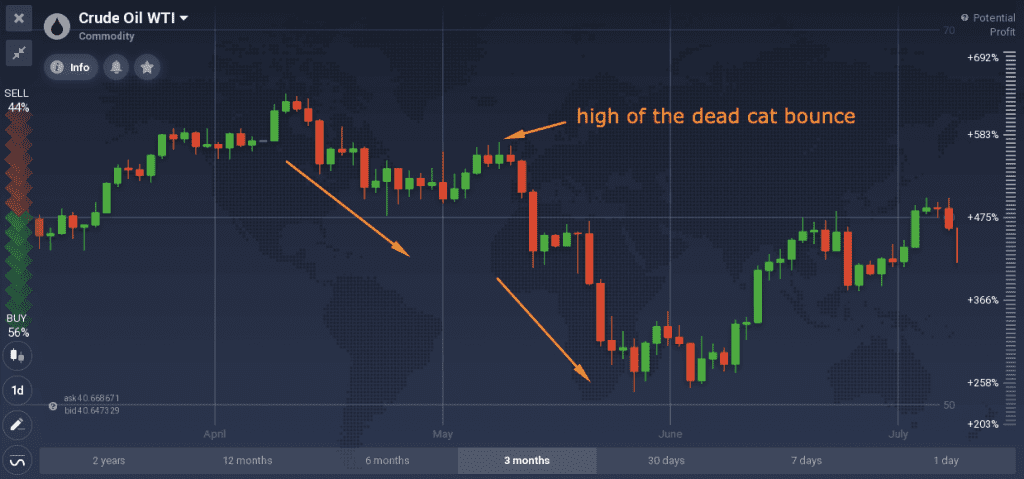

A trending market is almost always accompanied by small pullbacks, temporary price recoveries. “The dead cat bounce” is a short recovery of the price in a declining market. According to Thomas N. Bulkowski and his “Encyclopedia of chart patterns”, the “dead cat bounce” happens in three steps. First, the asset price declines around 30% in just a few trading sessions, then the prices bounce back, recovering a part of their loss. The third phase is when the prices decline once again, losing all their gains and more.

The “dead cat bounce” is a continuation pattern, which means that after the short recovery of the price, it continues its downturn. It is only considered confirmed if the price resumes its downward direction and reaches a new low, below its prior value.

How to trade this pattern?

At first, the pattern may look like a reversal pattern, as the price may simply continue rising after the sharp fall. This is why traders might need to use technical and fundamental analysis tools in order to estimate the length of the bounce and the possible price development afterwards. Traders may incorporate both oscillators and trend indicators in order to form a well-informed opinion. For instance, a combination of the Moving Average, MACD and the RSI indicator may be applied.

The “dead cat bounce” is normally observed in longer time frames, with the market in recession. However, both short-term and long term traders may use it. It is originally a stock-trading pattern, however, it can be universally applied to any asset that shows a severe decline in price.

Short-term traders may attempt to take advantage of the short bounce and “ride” the trend up. However, it takes a well thought out risk management strategy and general self control in order to exit the deal on time, before the price reaches a new low. Traders may set a tight stop-loss or a trailing stop loss in order to manage the risk.

Long-term traders may find the bounce an opportunity to enter a short position at a higher price, however, they need to be careful and differentiate a “dead cat bounce” from a trend reversal.

Whatever your strategy may be, remember that there is no pattern that would guarantee 100% results. The “dead cat” one might be especially tricky as it is quite hard to know the price behavior in advance. It may be a good idea to use additional tools like indicators and seek for additional information like economic news for additional conformations.