The NFP, the Non Farm Payrolls number, is among the most heavily watched economic indicators on the market. It in fact a top 4 event in my opinion, comparable to FOMC interest rates, GDP and Unemployment. As such it is often a catalyst for big market moves but has some failings many market participants tend to ignore. When asked how to trade it my first impulse is always to say “very carefully”.

Like other major releases it comes once per month so there is lots of time for sentiment to wind up on expectations. It is also an estimate and more specifically the difference between two estimates, the number of jobs of created minus the number of jobs lost, so not a true indication of actual job creation. When you consider that the margin of error is usually larger than the number of jobs created or lost it makes you wonder why so many people put so much faith in it.

Getting back to the point how you trade the NFP depends on underlying conditions, expectations for the number and the actual result. In this case underlying conditions are expansionary, we have GDP growth in the forecast, long term labor market trends indicate robust conditions and the market is moving higher. This means the market will want to see positive NFP. Expectations are for jobs creation in the range of 180,000, in line with what ADP figures indicated, and perhaps a perfect number to ensure continued rally.

The single largest cloud hanging over the market is the FOMC and the interest rate hiking timeline. At present economic conditions are Goldilocks, not too hot and not too cold. Expansion is expected, inflation remains tame and labor markets continue to tighten without forcing the Fed to raise rates. If the NFP is too hot it raises the specter of interest rate hikes, if it is too cold it may indicate economic slowdown, neither of which will be good for today’s bull. Figures over 200,000 are hot but not necessarily too hot, figures over 250,000 might be considered scorching.

Looking to other indicators of the labor market a positive number is virtually guaranteed, how high it comes in the only question. The ADP and NFP are rarely in convergence but do tend to track each other over the long term, the ADP indicates job growth but not too strongly. The Challenger, Grey & Christmas report on expected layoffs/hirings indicates low level of lay-offs but large amounts of hiring. The monthly total was just released today and came in at 88,000. This is the third highest level this year and the strongest July in over 20 years which may suggest that NFP could run to the warm side of expectations.

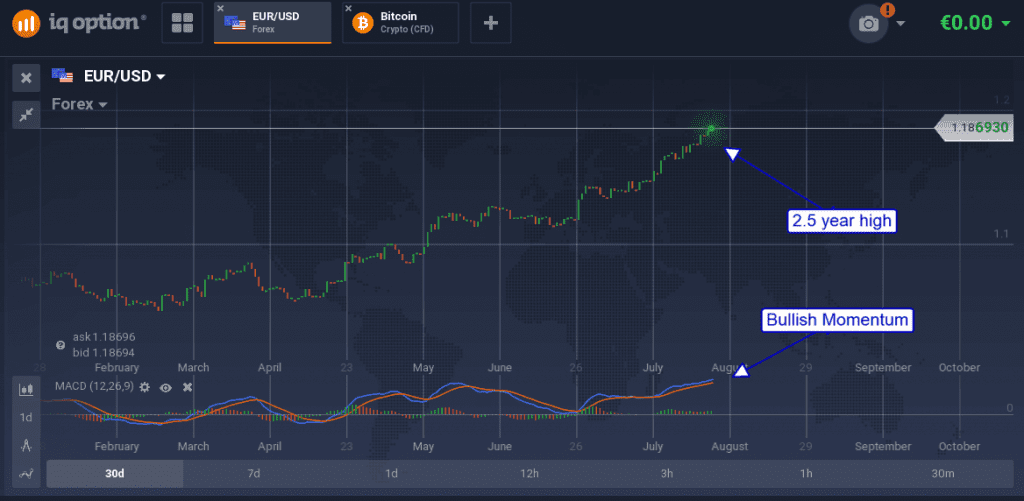

The two largest markets affect will be the dollar and gold. The EUR/USD has been in uptrend as central bank expectations adjust and may continue to do so should the NFP fail to bolster hawkish outlook at the Fed. The pair has just reached a new 2.5 year high on strong momentum with little in the way of technical resistance ahead of it. A continuation of trend could easily take the pair back to 3 and 5 year highs.

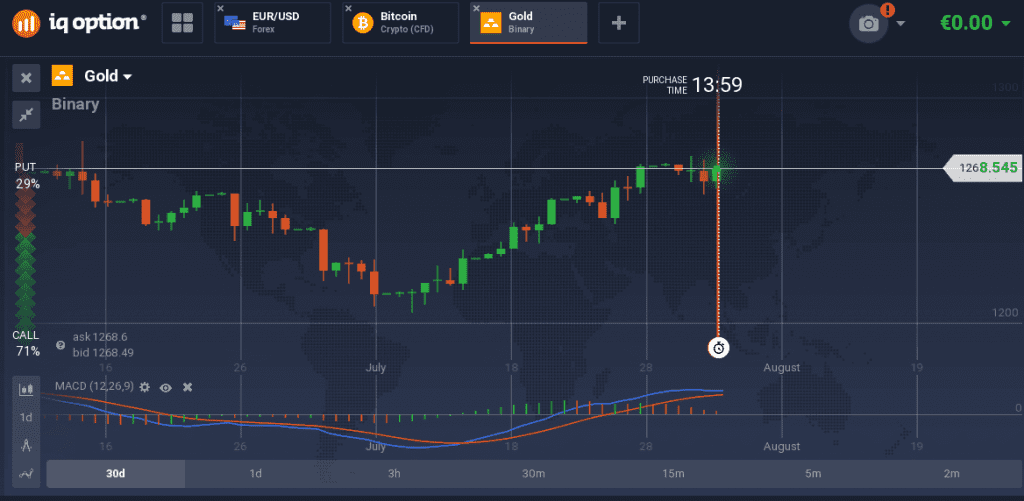

Gold is likewise in uptrend as the dollar weakens. Spot price is above the $1,250 level and in consolidation for a move higher. Anything less than an increase in hawkish tone from the Fed or NFP data so hot as to inspire expectation of increased hawkishness will support this move. Upside targets here are near $1,290 and $1,300 in the near to short term.