Gold and silver are among the most popular commodities for trading. Yet, many traders don’t have a solid understanding of how they work. In this article, we’ll cover the main concepts about these assets and analyse the key factors to consider when trading gold and silver via CFDs.

What are CFDs on gold and silver?

One major advantage of trading CFDs on commodities is that you don’t need to buy the asset itself. Instead, you have an opportunity to trade the price difference. This often requires a smaller investment, as gold and silver themselves are expensive.

However, there are also a few important factors to keep in mind as well as risks before you consider trading gold and silver through CFDs. Let’s examine them to understand whether these assets might be worth considering for your trading portfolio.

Trading gold: main factors affecting gold prices

Gold is one of the most popular assets for investment and trading. Investors often purchase it as a way of diversifying risks. Its price dynamics are normally influenced by several key factors.

1. Correlation with the US Dollar

Gold prices often move inversely to the strength of the US dollar. A rise in the dollar’s value may lead to a decrease in gold prices and vice versa. Traders may want to monitor currency trends alongside gold prices to spot potential trading opportunities.

For example, the US interest rates tend to have a significant impact on the price of gold. Normally, lower interest rates might weaken the US dollar. Consequently, this may make gold more attractive for international buyers, increasing the demand for gold and leading to a price hike.

2. Inflation

Historically, gold has often served as a potential hedge against inflation. When inflation is increasing, investors may purchase more gold as a store of value, driving up its price. Traders may consider following the latest inflation trends to enter and exit gold CFD positions according to their trading approach.

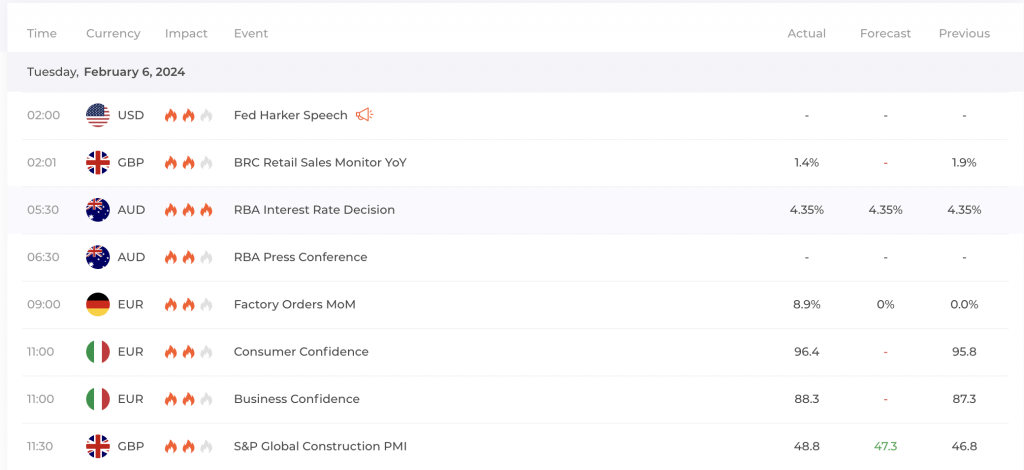

The economic calendar may be a great tool for tracking the main events that may influence inflation levels. These include announcements from the US Federal Reserve, inflation rate reports and other important news. If you aren’t familiar with the economic calendar or not sure how it may be used, have a look at this material: How to Make Sense of the Economic Calendar? Step-by-Step.

3. Global political and economic events

Significant geopolitical or economic disturbances may also impact gold prices. Wars, political instability, or economic downturns may increase demand for gold as a safe-haven asset. So it may be a good idea to stay informed about global developments to anticipate potential market reactions.

Trading silver: main factors affecting silver prices

Silver, while often overshadowed by gold, may present its own set of opportunities and challenges for traders. Here are the main factors to bear in mind if you intend to trade silver via CFDs.

1. Industrial Demand

Unlike gold, silver has significant industrial applications, particularly in sectors such as electronics and renewable energy (solar panels). An increase or a decrease in industrial demand can greatly influence silver prices. That’s why it may be essential to track technological advancements and market trends when you consider trading silver via CFDs.

2. Safe-Haven Appeal

While not as prominent as gold, silver may also attract investors seeking refuge during times of uncertainty. So traders may want to monitor geopolitical events and macroeconomic indicators to estimate the silver’s safe-haven appeal and potential price movements.

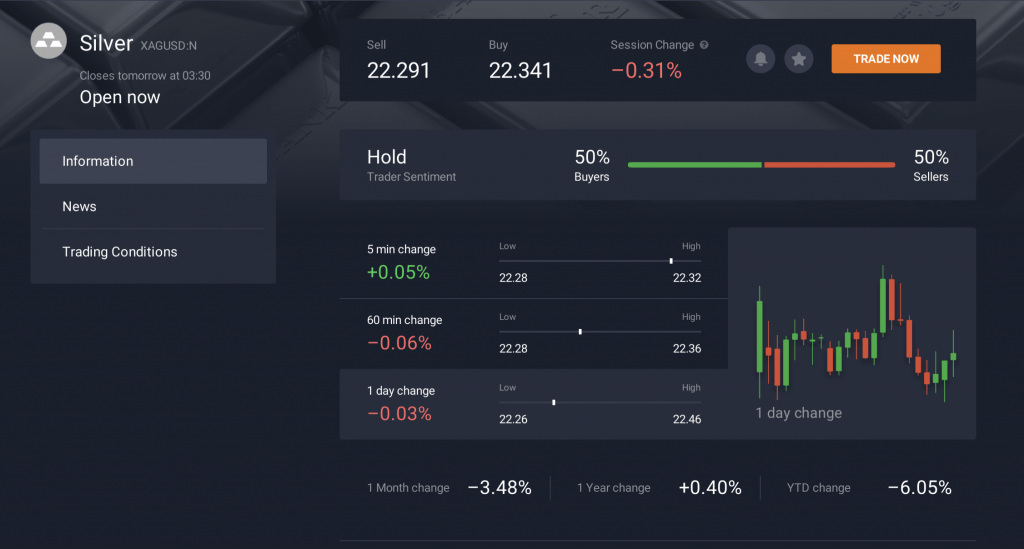

You may keep track of the silver price fluctuations directly from the IQ Option traderoom. Just click on the ‘Info’ tab below the asset symbol to review the latest price changes, trader sentiment and news related to this asset.

Trading gold and silver in 2024: market outlook and trading considerations

Some of the recent forecasts suggest a bullish outlook for gold in 2024. This is mostly due to the expectations of upcoming interest rate cuts by the US Federal Reserve. As we mentioned before, lower interest rates tend to weaken the US dollar, making gold more attractive to international buyers and potentially driving up its price.

Silver, although historically underperforming compared to gold, may also grow in demand following interest rate cuts. Additionally, both gold and silver may continue attracting investors as safe-haven assets in the uncertain geopolitical settings. Experts suggest that the global silver demand may reach 1.2 billion ounces in 2024. If this happens, it would become the second-highest level in history, which may boost the price even higher.

Conclusion

By considering trading gold and silver, traders may attempt to diversify their portfolios and capitalize on the unique characteristics of these commodities. However, thorough analysis and a basic understanding of market dynamics are essential. By staying informed about factors affecting gold and silver prices, you may navigate the complexities of trading CFDs on commodities with confidence and manage the risks that arise from trading.