Trading indices is more than just a financial activity; it’s a blend of art and science. It requires a keen eye for detail, an understanding of economic indicators, and the ability to anticipate market trends. This article will explore the intricacies of index trading, starting with a clear definition of what an index is. We’ll also discover the ways you can trade indices on IQ Option and compare strategies for trading indices vs. stocks.

Additionally, we’ll provide answers to popular questions from traders about indices to enhance your understanding and confidence in trading. What is US 30? Are stocks better than indices? What is the best time to trade indices? Let’s dive in!

What is an index in trading?

An index in trading is a tool that tracks the performance of a group of assets. This score helps traders understand market trends and movements. Indexes can be broad-based, reflecting the overall market by including a wide range of large-cap stocks.

There are also specialized indexes that focus on specific market segments, such as small-cap stocks, providing insights into those particular areas. This means that trading indices can offer access to a whole sector or industry within one single position.

Here’s a list of the IQ Option indices available for trading on the platform.

For example, the US 100 is generally seen as one of the most indicative benchmarks for the performance of the American stock market. It tracks 100 of the largest and most liquid American publicly traded companies, whose shares are listed on the NASDAQ. In that case, what is US 30? It is an index that reflects the performance of 30 large publicly traded American companies.

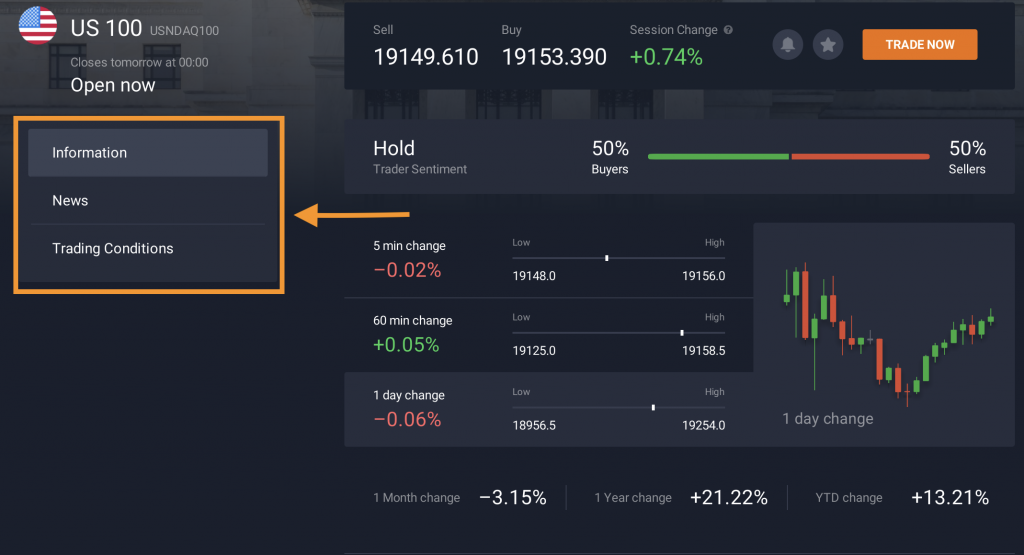

You can click on any index to learn more about its recent price changes, read some news related to this asset and understand its trading conditions.

You might also have heard of a term ‘mini index’. A mini-index refers to a smaller segment of a broader stock market index. Unlike comprehensive indices that cover a wide range of stocks or other assets, a mini-index might focus on a specific sector or type of company, allowing traders to invest in a more targeted part of the market. For example, a mini-index could track technology stocks exclusively within a larger index. Some traders might ask, “How much is each point worth in the mini-index?” This depends on the price of the larger index that it’s tracking, making it essential for traders to understand the relationship between the mini-index and its broader counterpart.

Mini-indices tend to be less popular as they require more detailed analysis due to their narrower focus. Additionally, they aren’t currently available on the IQ Option platform.

Main types of indices

There are several types of indices, each with distinct characteristics. These include stock indices that reflect the performance of a group of stocks and commodity indices that track the prices of commodities, such as gold, silver, oil. There are also currency indices that follow the prices of different currencies. For example, the US Dollar Index (DXY) measures the value of the US dollar against major currencies and serves as a key benchmark for the currency strength.

Each type of index provides unique insights and serves specific trading strategies, allowing traders to choose their methods based on market conditions and individual goals.

How to trade indices on IQ Option?

You can use different strategies to trade indices on IQ Option. Here are some of the most effective approaches you may want to consider.

Day Trading

Day trading involves buying and selling indices within the same day, ensuring all positions are closed before the market closes. This strategy aims to avoid overnight costs or risks and capitalize on quick, modest profits from small price movements. Day trading requires constant attention to the markets, making it suitable for those who can dedicate time to monitor price changes, often influenced by economic or geopolitical news. Staying informed helps traders understand and anticipate short-term trends, leading to more informed buying or selling decisions.

Trend Trading

Trend trading indices commonly uses technical analysis tools to identify when an index price moves in a specific direction over time. By analysing these trends, traders can determine whether the price is likely to continue in the current direction or if a reversal is imminent. This approach helps traders choose the best indices to trade, allowing them to buy or sell based on the expected continuation or reversal of the trend, enhancing their chances of making profitable trades.

Position Trading

Position trading involves buying and holding an index for a longer period, ranging from days to weeks or even months. With this strategy, traders focus less on short-term market fluctuations and more on potential long-term gains. This strategy results in fewer trades, each with a greater potential for profit, but also increased risk due to the extended holding period. Position traders might enter or exit positions around critical events like economic reports or earnings seasons, aiming to benefit from significant market movements.

Main factors affecting index prices

It’s also important to keep in mind that index price movements can be affected by different events in the markets. Here are some of the main factors that can influence index prices, as well as their potential impact.

| Factor | Description | Potential Impact on Index Prices |

| Economic News | Changes in interest rates, inflation, central bank announcements, employment data | Can affect investor sentiment and market volatility, causing index prices to shift |

| Corporate reports | Earnings reports detailing profits, losses, and future guidance of companies | Can influence the share prices of companies within the index, changing the overall index value |

| Company Announcements | Unexpected news like management changes or mergers | May cause fluctuations in individual stock prices, impacting the broader index, either positively or negatively |

| Currency Fluctuations | Exchange rate changes affecting companies generating revenue in foreign currencies | Can influence stock prices within the index and the index itself |

| Geopolitical Events | Political instability, economic agreements, elections | Might lead to market volatility and affect the index price |

| Changes in the Index Composition | Rebalancing, adding or removing assets from the index | Can lead to shifts in index prices as traders adjust their positions |

| Investor Sentiment | The collective mood of investors, influenced by news, company performance, and geopolitical events | Bullish sentiment can drive demand and increase index prices, while bearish sentiment can lead to lower prices |

Now, let’s answer some popular questions traders ask about index trading on IQ Option.

Can you trade indices on weekends?

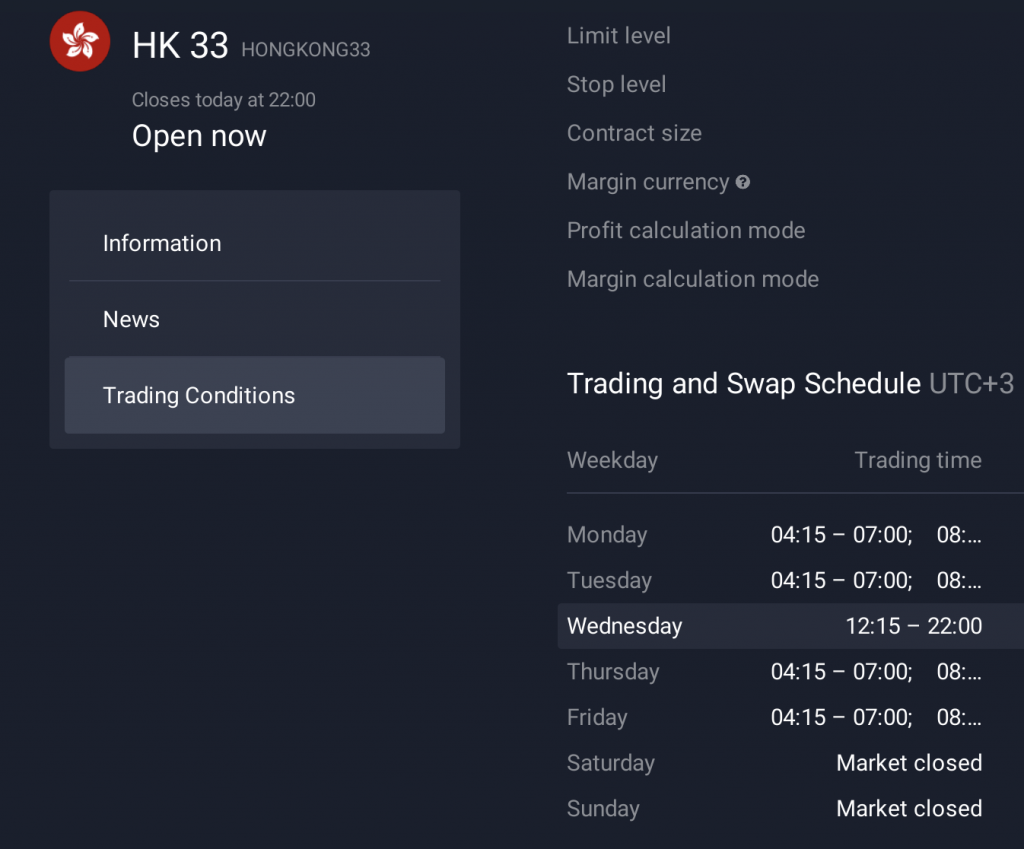

When it comes to the indices trading hours on IQ Option, it’s quite simple. You can trade them every day during the working week (Monday to Friday). This means that indices aren’t available for trading over the weekend.

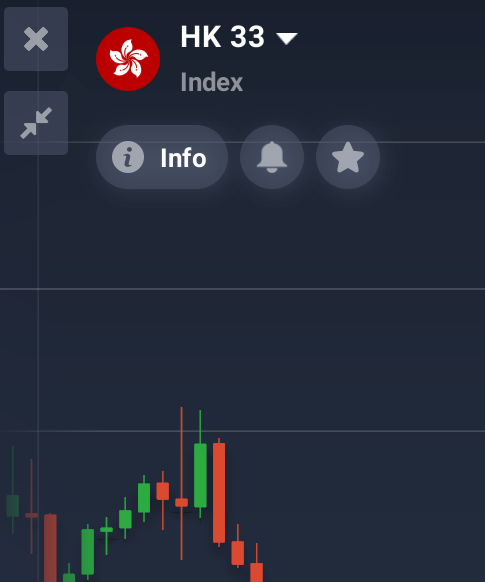

There may be some differences in the trading hours for certain indices. Please check the current schedule for a specific index. To do that, click on the ‘Info’ tab below the name of the asset.

Then choose the ‘Trading conditions’ tab on the left side of the screen.

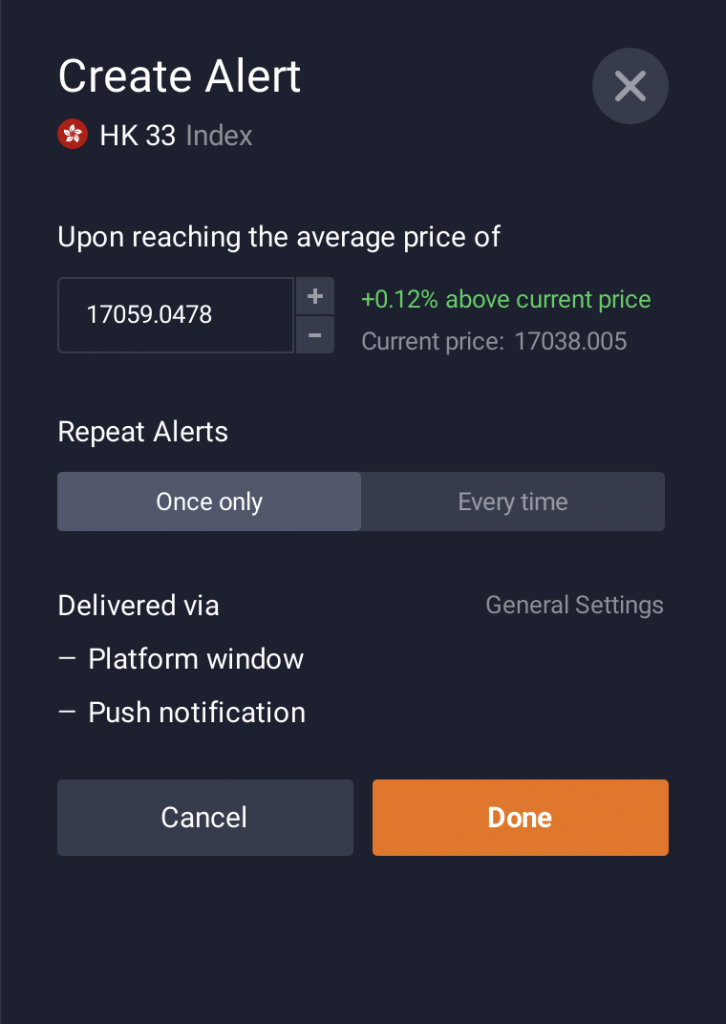

You can also create an alert for a chosen asset to get a notification when the price reaches a certain level.

That way, you won’t have to constantly track the price in the traderoom waiting for a change in the trend.

There are more useful features in the IQ Option traderoom that can help you save time and make trading more efficient. Have a look at this material to learn more: IQ Option Traderoom: Top Features You Need to Know.

Trading indices vs. stocks: what’s better?

Not sure whether you should trade indices or individual stocks? There are a few key differences between these assets that can affect your choice of strategy and potential outcomes.

| Aspect | Stock Trading | Index Trading |

| Exposure | Focuses on individual companies, no diversification. | Offers access to a range of assets within a single position, creating diversification. |

| Volatility | Individual stock prices can experience volatility and big price swings due to news related to the company. | Index values fluctuate, but usually do not experience extreme changes unless affected by major events. |

| Risk | Potentially higher risk due to lack of diversification. If a company fails, its stock will lose value. | Lower risk due to diversification; a failing company within an index is replaced, reducing the negative impact. |

Ready to trade indices on IQ Option? You can test your ideas and strategies on the free $10000 demo account to get some practice before making a deposit and trading with real funds. Beware of common beginner mistakes: keep learning and trying new tools and approaches to stay on the right track.