Crypto markets are a bit like a rollercoaster operated by a teenager. Wild drops? Oh, they happen. And knowing how to short sell on crypto might be your answer when those dips come rolling in.

This guide will walk you through the basics: how to short sell crypto, what to watch out for, and some classic examples to make it all sink in.

Short selling crypto explained

Short selling is a strategy to make some profits in the bearish crypto market.

Picture this: you’re absolutely certain that Bitcoin’s price is about to fall. That’s the spirit of short selling crypto — it’s betting against an asset, with hopes that the price will tank, so you can make a profit.

In traditional markets, short selling typically involves borrowing an asset, selling it at a high price, and then buying it back at a lower price to pocket the difference. But, as explained in this article on short selling in stocks and this one for Forex, there’s an easier way to short without actually owning the asset — using CFDs (Contracts for Difference). The same method applies to short selling crypto, where you can simply bet on the price drop without needing to handle the asset directly.

Why short sell crypto? Isn’t “HODLing” enough?

There’s nothing wrong with hodling (“Hold on for Dear Life” strategy popular among crypto traders), but short selling lets you play both sides of the market.

While the classic strategy is to buy and hold, there’s a huge advantage in having a way to profit when the market takes a dip.

- Hedge Against Losses: If you’re holding a bunch of Bitcoin but worried about a crash, you can use short selling to offset potential losses.

- Profit During Downturns: Everyone else is panicking and selling off their crypto — meanwhile, you’re profiting from the market’s woes.

- Fast-Moving Opportunities: Crypto markets move fast, and short selling lets you take advantage of quick downturns without having to cash out your long-term holdings.

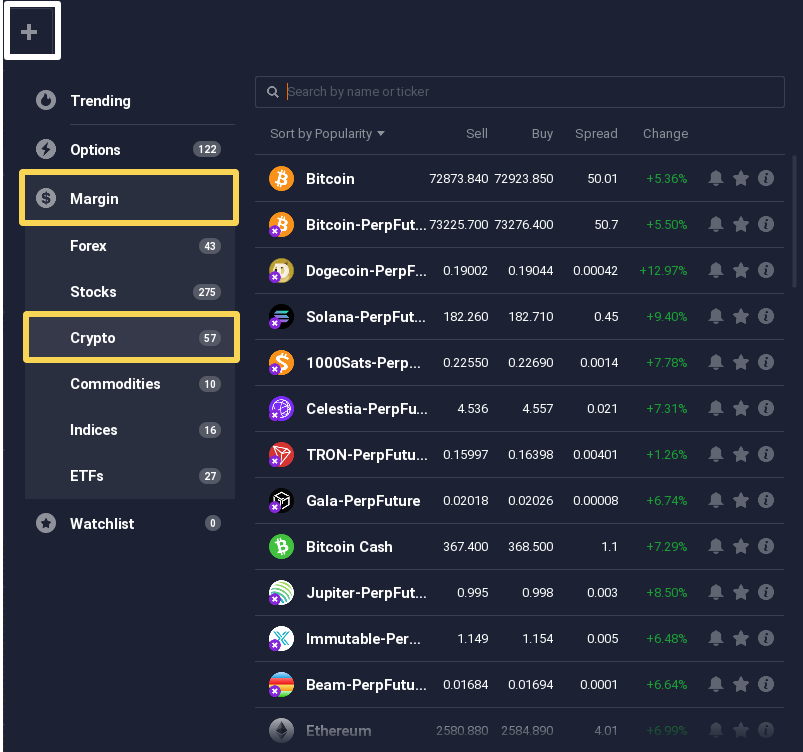

How to short sell crypto on IQ Option

Let’s get into the nuts and bolts of how to short sell crypto.

1. Pick a cryptocurrency that you think is going to decrease in price soon.

2. Analyze the chart with your favorite indicators for crypto.

3. Choose the amount you’d like to invest in this trade (in pips). Don’t forget to set the Stop-Loss!

4. Open a trade at the current price.

5. Close the deal if your prediction was correct, and the asset price went down.

And voila, you’re a short seller. Just don’t get too attached to the “betting against” mindset; it’s a tool, not a lifestyle.

Tips for successful short selling crypto

1. Follow the hype

Crypto doesn’t follow regular market patterns; prices are often driven by hype, news, and FOMO (fear of missing out). A sudden Tweet or news item can turn the market on its head, so make sure to subscribe to some crypto news portals and follow the headlines in our Newsfeed.

2. Use the right indicators to spot bearish conditions

Use these indicators as your reliable GPS signals in a land of random crypto price swings.

Moving Averages — Spotting Trend

The grandparent of all indicators, a Moving Average (MA) smooths out all the daily price wiggles, letting you see the bigger trend.

- If your MA is trending upwards, the asset is likely in an uptrend.

- If it’s pointing downwards, it’s time to short sell.

This indicator helps you cut through the noise and spot the overall direction of a crypto’s price.

MACD — Trend Reversals

The MACD helps you spot shifts in momentum and trend changes.

MACD uses two moving averages and a “signal line” to give you clear buy or sell signals. When these lines cross, it’s time to pay attention because it might be a good moment to make a move:

- A downtrend is expected when the fast (blue) line turns up and crosses below the slow (red) line.

- An uptrend is expected when the fast (blue) line turns up and crosses above the slow (red) line.

RSI — Reality Check

If you’re new to crypto trading, RSI is as simple as it gets, yet it tells you when a price is probably a bit out of line with reality. It’s all about helping you identify when the price might have stretched too far in one direction.

- An RSI score of 70 or above? The asset might be overbought, and the trend might reverse to bearish soon.

- Under 30? It might be oversold, returning the trend to the bullish phase.

The good thing about RSI is that it can give you both entry and exit signals, helping you cap your profits before the trend goes up again.

Short selling example (Dogecoin)

Let’s see how it works in action.

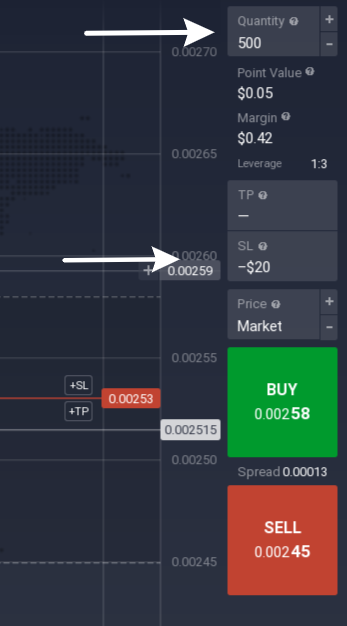

In the example below, we opened a trade on Dogecoin-PerpFuture asset.

Here’s a breakdown of the action:

- Trend Check: Doge was climbing steadily — a strong uptrend was detected.

- MACD Analysis: We saw a trend reversal signal from MACD as the blue line crossed the red from below, signaling a potential shift.

- Entry: We set our test investment (2000 pips), configured risk management, and hit “Lower,” anticipating a bearish turn.

- Exit: As the market began to flatten, we closed the trade with a profit.

What to watch out for

Short selling is risky, and in the volatile world of crypto, that risk is amplified. Here are some things to keep in mind:

- Leverage is a Double-Edged Sword: Many platforms offer leverage, which can multiply your gains, but it can also magnify losses. Crypto prices are volatile, and one wrong move with leverage could cost you.

- Market Mania: Crypto doesn’t follow regular market patterns; prices are often driven by hype, influencers’ moves, etc. You need to develop a very specific crypto trader’s brain to feel comfortable trading digital assets.

- Fees and Interest: Shorting crypto can come with interest rates or fees, especially if you’re using a CFD or margin trading. Make sure you know what those costs are before diving in.

Final thoughts

Short selling crypto can be a smart way to navigate the crazy ups and downs of this market. Just remember to treat it like any powerful tool — with caution. Start small, keep an eye on the trends, use relevant indicators, and always use stop-loss orders.