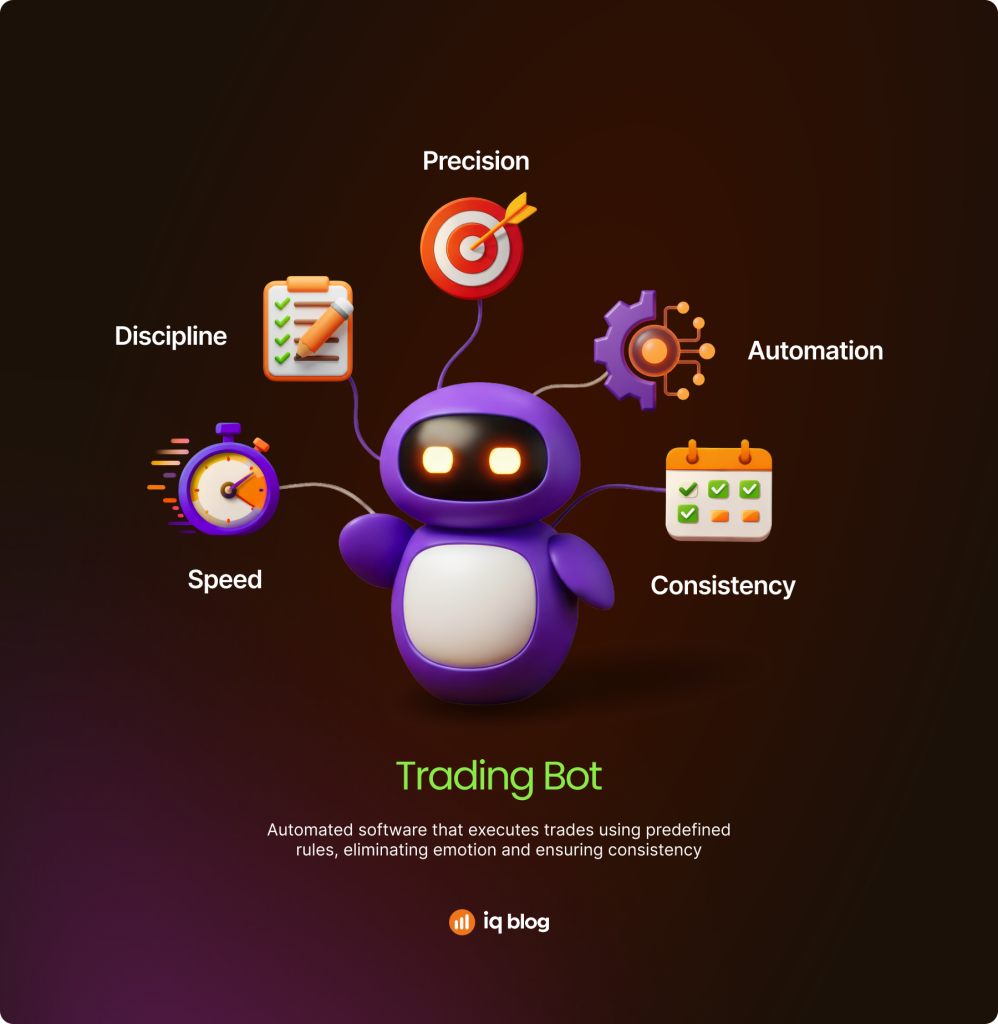

A trading bot is software that automatically enters and exits positions in a market based upon rules that the user preconfigures. This tool assists with eliminating emotion, increases the speed of decision-making, and sometimes even allows you to trade when not at your screen. Below is a guide to explain what a trading bot is, how it works, and how to set one up step by step so that you are confident in automating part of your strategy.

What Is a Trading Bot

A trading bot is any software based on pre-set rules that automatically opens and closes a trade. It doesn’t need you to react to each price move-your settings are used by the bot to scan the market, locate signals, and execute the trade without hesitation.

Bots use price data, indicators, and fixed conditions. When the market matches those conditions, the bot acts instantly. This removes emotional decisions and helps maintain consistency. The key idea is simple. You create the plan. The bot follows the plan exactly as written.

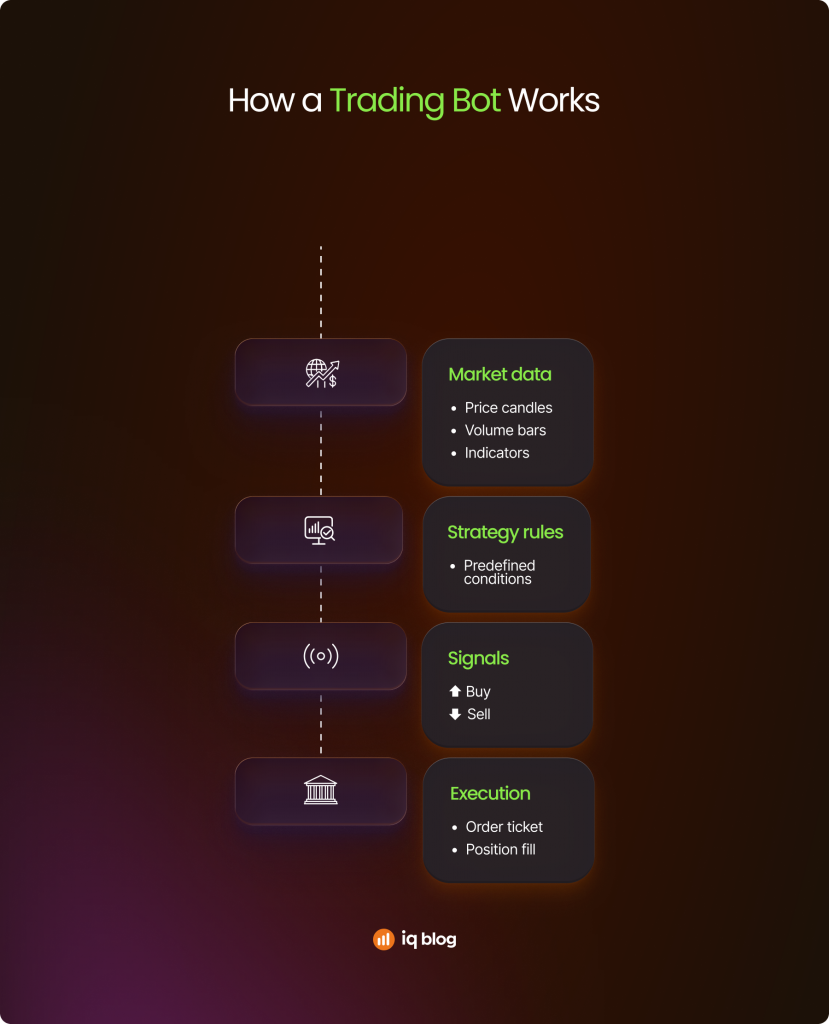

How Trading Bots Work

Trading bots follow a simple structure. First, they read market data such as price, volume, and indicator values. Then they compare this data with the rules you set. If the conditions match, the bot opens, manages, or closes a position automatically.

A bot can react much faster than a human. It does not hesitate, get tired, or second guess the plan. It simply checks the rules and executes them. This makes bots useful for strategies that rely on speed or strict discipline.

The performance of a trading bot depends on the logic behind it. Strong rules produce stable results. Weak rules produce inconsistent trades. The bot itself does not think or adapt unless you design it to do so. It only follows instructions.

Types of Trading Bots

Trading bots come in several forms. Each type is designed for a specific style of trading and market behavior.

- Trend Following Bots – These bots look for markets that move in one clear direction. They use indicators such as moving averages or trend lines. When the trend is strong, the bot enters and holds positions until momentum fades.

- Grid Bots – Grid bots use fixed price levels to open buy and sell orders at regular intervals. They work best in ranging markets where price moves up and down within a set zone. The goal is to profit from repeated small moves.

- Arbitrage Bots – Arbitrage bots look for price differences between markets or instruments. When they find a gap, they open trades to capture the difference. These bots act fast and rely on small but frequent profits.

- Market Making Bots – These bots place buy and sell orders around the current price to gain from spreads and small price moves. They work in liquid markets and aim for steady returns.

- Signal-Based Bots – These bots follow indicator rules. They open trades when conditions match signals created by RSI, MACD, or custom rules. The bot waits, reacts, and follows strict criteria.

What You Need Before Setting Up a Trading Bot

A trading bot cannot replace a strategy. It only automates the strategy you already have. Before setting one up, traders need a few essential elements to avoid random or risky behavior.

A Clear Strategy

The bot needs to have rules set by you on how it will operate. This should include entry rules, exit rules, and rules on risk management. If the strategy is not well defined, then the bot will give variable results.

Knowledge of Your Indicators

Various indicators drive bots, including moving averages, RSI, and MACD. Understand how the selected indicators work and why they support your setup. This prevents the bot from acting on weak signals.

Risk Management Rules

Bots need strict limits. Position size, stop loss, take profit, and max trades per day must be set in advance. These risk management rules protect your account from unexpected market moves.

Stable Internet and Platform Access

A bot must stay connected at all times. A weak connection or frequent interruptions can cause delayed trades or missed signals. Stability is key.

Familiarity With Your Trading Platform

Every platform does automation differently. Knowing where the tools are, how orders execute, and how the interface behaves just makes setup smoother and safer.

How to Choose a Trading Bot

Choosing the proper trading bot is just as important as setting it up correctly. Not all bots work the same way, and each one fits a specific trading style.

- Look for Transparent Rules – A good bot shows the exact logic it uses. Hidden rules or unclear algorithms make testing difficult. Transparency allows you to understand every trade the bot makes.

- Check Ease of Setup – Some bots are simple to configure. Others require coding skills. Choose a bot that matches your experience so you can adjust settings without confusion.

- Review Supported Indicators – Your strategy may rely on specific indicators. Make sure the bot supports them. If the bot cannot use the indicators you need, it will not follow your plan.

- Look for Backtesting Features – Backtesting lets you check how the bot would have performed in past markets. This feature is essential because it reveals strengths and weaknesses before you risk real money.

- Check Costs and Subscription Model – Some bots have one-time fees. Others use monthly subscriptions. Choose a cost structure that fits your trading frequency and account size.

- Evaluate Safety and Permissions – A bot should only execute trades. It should not have permission to withdraw funds or make account-level changes. Always check the permission settings to avoid unnecessary risk.

How to Set Up a Trading Bot Step by Step

Setting up a trading bot is a structured process. Each step builds the foundation for consistent and automated execution. A bot is only as effective as the rules behind it, so every stage matters.

Define Your Strategy

Before activating any bot, you need clear trading rules. These rules describe when to enter, when to exit, and how to react to different market conditions. A bot cannot solve a weak strategy. It only repeats what you tell it to do.

Configure Your Indicators

Most bots rely on indicators such as moving averages, RSI, MACD, or custom formulas. Set the exact parameters your strategy uses. The bot will read these values and act only when they match your rules.

Set Entry and Exit Conditions

Every trade should have precise triggers. The bot must know the exact moment to open and close a position. Entry and exit logic should match your strategy without guesswork. Clear rules prevent random trades.

Configure Risk Management

Risk settings protect your account. Set your position size, stop loss, take profit, and maximum number of trades. These rules keep the bot within safe limits even during sudden market movements.

Test the Bot

Before going live, run the bot through backtesting or a demo environment. This shows how well the rules perform in past and real time conditions. Testing reveals weaknesses that you can refine.

Deploy the Bot Live

Once testing is complete, activate the bot on a live chart. Monitor the first sessions closely. Make sure it behaves as expected and follows your rules without errors. If needed, make small adjustments to improve performance.

Backtesting and Optimization

Backtesting shows how your bot would have performed in past market conditions. It uses historical price data to simulate each trade the bot would have taken. This helps you understand if your strategy is stable or if it fails under certain conditions.

Good backtesting will show the win rate, average profit, drawdown, and overall performance. This gives an idea if the rules make sense or are in need of adjustment. If large losses or unstable behavior are shown in the results, the strategy needs refinement before going live.

Traders proceed with forward testing on a demo account after backtesting. This step checks how the bot is doing in real time. What they want to confirm is that the bot reacts well to the live movement of prices. During this process, small adjustments can be made to improve timing and reduce unnecessary trades.

It has to be done with care. Modifications of too many settings for matching past data create curve fitting. That makes the bot look perfect in history, but it also means it’s weak in real markets. Good optimization focuses on stability rather than perfection.

Risks of Using Trading Bots

Trading bots provide speed and consistency, but they also carry real risks. Understanding these risks is essential before running any automated system.

- Over Optimization – A bot may perform well during backtesting but fail in real markets. This happens when the strategy is tuned too closely to past data. It looks perfect historically but cannot adapt to live conditions.

- Sudden Market Volatility – Bots follow rules. They cannot react to news events, unexpected spikes, or sharp reversals unless programmed to do so. Volatility can trigger multiple entries or stop losses in a short time.

- Technical Failures – Bots rely on stable internet, platform signals, and server performance. Any disruption can delay orders or lead to missed trades. A stable setup is critical for automation.

- Emotional Distance – Bots remove emotion, but this can also create a false sense of safety. Traders may increase position size or risk because the bot is handling execution. This often leads to oversized losses.

- Lack of Supervision – Bots need monitoring. Leaving a bot active for long periods without checking performance can lead to large drawdowns if the market changes direction.

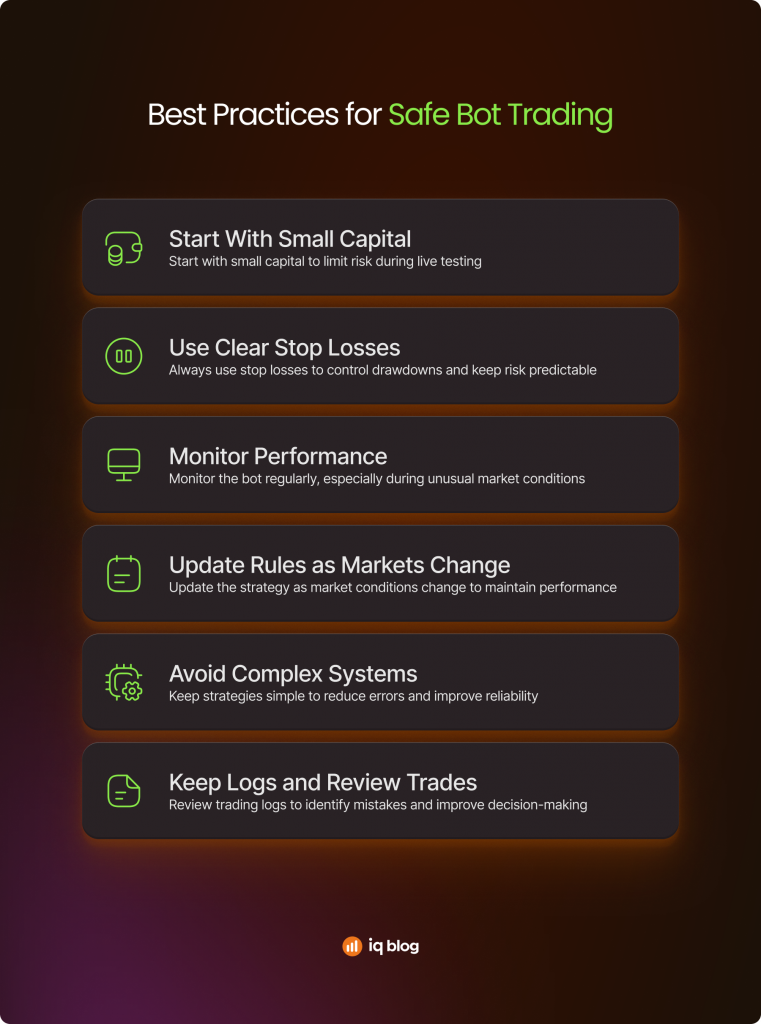

Best Practices for Safe Bot Trading

Using a trading bot responsibly increases stability and reduces unnecessary risk. These practices help traders maintain control and prevent large losses.

- Start With Small Capital – Begin with a small amount of capital while testing the bot in live conditions. This limits exposure if the bot behaves unexpectedly.

- Use Clear Stop Losses – Every automated strategy needs protective stops. They prevent large drawdowns and keep risk predictable. Bots should never run without stop loss rules.

- Monitor Performance – Check the bot regularly. Even well tested bots can behave differently during unusual market conditions. Monitoring allows early adjustments.

- Update Rules as Markets Change – Market conditions shift over time. A bot that works in one environment may struggle in another. Updating rules helps maintain performance.

- Avoid Complex Systems – Simple strategies often perform better. Complex rule sets increase the chance of errors and reduce the bot’s reliability. Focus on clarity and consistency.

- Keep Logs and Review Trades – A trading log shows how each decision was made. Reviewing logs reveals mistakes or patterns that can be improved.

Trading Bots on the IQ Option Platform

The IQ Option platform allows traders to automate parts of their strategy while keeping full control. Traders can use built in tools, indicators, and rule based systems to create simple automation flows without coding. This allows the bot to react to signals, manage trades, and follow a structured plan with consistency.

Automation on IQ Option works well for strategies based on moving averages, RSI, and price action rules. Traders can test these ideas on a practice account before switching to live trading. This reduces risk and helps confirm that the bot behaves exactly as expected. There are also third-party IQ Option trading bots.

IQ Option keeps execution transparent. The trader sets the rules, the platform follows them, and the positions open only when the market conditions match the criteria. This structure makes the process simple enough for beginners while still flexible for experienced users.

In Summary About Trading Bots

A trading bot is a useful tool for traders who want speed, consistency, and emotion free execution. It follows rules exactly as written and can operate even when you are away from your screen. Setting up a bot requires a clear strategy, well defined rules, proper testing, and ongoing supervision.

If applied correctly, a trading bot will support your trading plan and help you be disciplined in whatever market conditions come along. Long-term success with automation comes by way of testing, risk control, and gradual improvements.