Here’s the deal: risk management is probably the most important thing to master in trading. Yeah-yeah. It does sound boring, but think about it: how are you even going to make profit in a high-risk environment, when you don’t know how to secure what you have?

If you are serious about trading and looking to get returns on your investments, having a proper risk-management strategy is a must. Agreed? Then let’s get you armed with a good strategy!

The key principle of risk-management is making sensible investments. A popular guideline goes like this:

“An investment should not exceed 5% of your current balance”

If you have a balance of $100, a 5% limit means you can place as many as 30 orders, so even if some are unsuccessful, there’s still a great chance that the others will make up for the lost investments. And besides, having more opportunities to trade means the freedom to try different assets and a variety of technical indicators to better adjust to a market setting.

And while the guideline recommends 5% investments, most traders follow either of the 2 money-management strategies:

|

Conservative |

Aggressive |

|

| What it does | Investing 1-2% of the account balance into a single order. Total amount invested never exceeds 3-4% of the balance. | Investing 5-10% of an account balance. Total amount invested always within the 15-20% range. |

| Why use it | This method is particularly good for beginner traders who need more time to analyze the market or to apply a specific strategy. | This method better suits experienced traders, who can confidently make use of various technical indicators. And even then it’s quite a risky approach. |

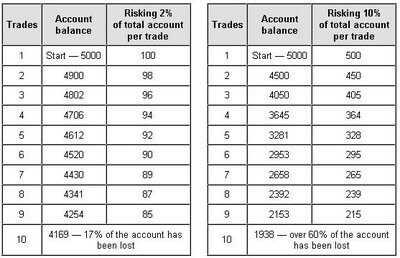

To better understand the risks associated with the aggressive money management strategy, say “Hi” to Joe and Mike. Joe is a very conservative trader, who never invests more than 2% of his account per trade. Meanwhile Mike is a trading daredevil – he is willing to risk as much as 10% in each trade.

They both deposited $5000 and unfortunately wound up in a bit of a losing streak… Look at them both go through 10 unsuccessful trades. The only difference is the amount they are reinvesting each time.

Joe Mike

Uh-oh! After ten unprofitable deals Mike blew through over 60% of his account! And what about Joe? He only lost 17%. Joe still has 4169 dollars of the original 5000. Good job, Joe!

Joe and Mike’s story proves: less is more. Less risk = more funds secured.

Now, obviously, 10 losing trades in a row is the worst-case scenario, and yet – it could happen.

No matter what strategy you pick for yourself in the end, keep in mind that trading should never be treated as gambling. Your decisions should be carefully weighed, and the risk-to-profit ratio should be minded every step of the way. Good luck!