If you are thinking about trading stocks, you might need to consider some important points. We have put together this guide to help novice traders understand how stocks work. It may provide some ideas on how to analyse stocks and choose the ones that fit your trading approach.

Basic Facts About Stocks

When someone buys a stock (also called a share), they become owners of a small fraction of a business. Stock prices are generally determined by supply and demand: someone is always looking to buy stocks, while others are selling. To learn more general information about stocks, you may turn to Basics of Stock Trading Explained.

Stock Market Sectors

When picking stocks for trading, you may start by deciding on the market sector. Sectors have various factors influencing their businesses. Some tend to be more affected by external factors, such as economic and political conditions. Others develop according to certain business cycles (intervals of growth followed by a decrease in economic activity).

Business Cycles

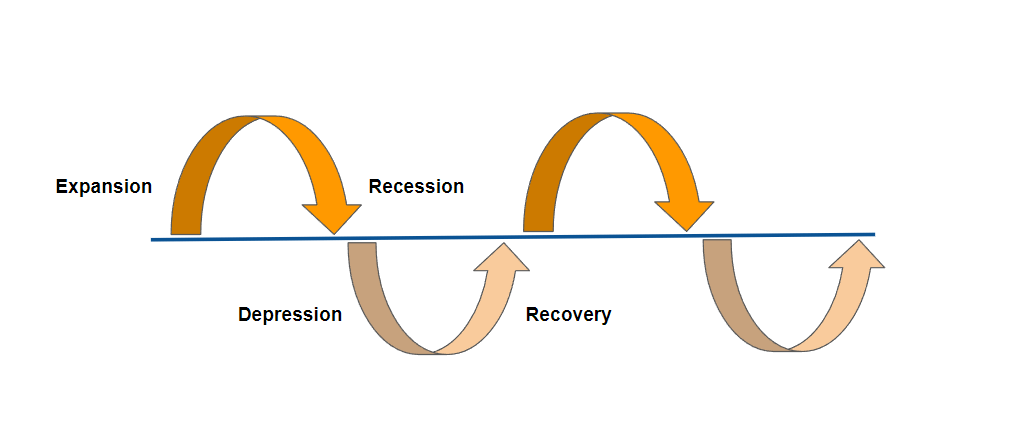

Business cycles are commonly divided into 4 stages: recession, recovery, expansion and slowdown. Each has its own characteristics and affects companies from various sectors differently.

For instance, during a recession (when economic activity is decreasing), companies from Real estate and Technology sectors show weaker results. This is because their businesses are tied to highly discretionary spending from consumers and businesses. To put it simply, people tend to save on these expenses when money is tight.

However, Consumer Staples, Utilities and Health Care usually perform better in such conditions. These sectors are called non-cyclical, as they are less affected by changes in the economy. Because people have to spend money on food and healthcare anyway, these businesses tend to do well even if the economy in general is struggling.

On the other hand, during a recovery, consumers expect economic growth and increase their discretionary spending. Businesses expand their commercial activities as well, which leads to growth in sectors like the Real Estate. But sectors that performed better during the recession — Consumer Staples, Utilities and Health Care — tend to go down as investors turn to more cyclical sectors to catch new market trends and get higher returns.

How to Use Business Cycles for Stock Trading?

It is important to understand business cycles to pick market sectors that may be performing better at the moment. And then choose stocks for trading that represent these sectors to achieve positive results.

When selecting individual stocks within a sector, it may prove useful to look at where and how each company fits in. What is its market share? Does it have some advantage over the competition? Answers to these questions may help choose stocks for trading that might provide interesting opportunities.

If you prefer trading stocks from a particular sector, it might also be useful to follow its main players and learn more about the competition. For example, have a look at this video showing price fluctuations of top video game stocks over a 5-year period. It offers an overview of how stock prices of different companies in this sector changed over the years. It may provide ideas on how this sector might be developing in the future.

Each sector develops in its own unique way. So it may be wise to analyse them separately and consider factors that influence them to choose stocks for trading.

Types of Stocks

There are different types of stocks that you may choose for trading. Here is a brief overview of the main ones.

- Based on market capitalization (the total worth of all their shares):

| Type | Market Capitalization |

| Large-cap companies | $10 billion to $200 billion |

| Mid-cap companies | $2 billion to $10 billion |

| Small-cap companies | $300 million to $2 billion |

- Based on growth potential:

| Type | Characteristics |

| Value stock | Successful companies, usually leaders in their sector. They do not grow as fast (if at all), but maintain more stable stock prices. These stocks might be a good choice for long-term investment. |

| Growth stock | Companies with fast rising profits that are developing quickly. They might provide higher returns, but also carry more risks. Constant growth is their main strength, so if it slows down, stock prices may drop. As these stocks are more volatile and tend to fluctuate, they may offer more interesting opportunities for traders. |

- Based on the perceived stock quality:

| Type | Characteristics |

| Blue-chip stocks | Large companies – leaders in their sectors. They can generally provide a sense of stability and lower risks for investors. May be less interesting for short-term traders. |

| Penny stocks | Smaller companies with considerably inexpensive stocks, often less than $1 per share. They tend to be affected by many external factors, so prices might often fluctuate. This may be attractive for traders, but also carries potential risks. |

Diversification – having a portfolio that consists of assets from different sectors and various stock types – might be an idea to consider. This approach may help to manage risks in a changing market, when some sectors perform better than others. In any case, make sure you carefully weigh all the risks before making trading decisions.

How to Choose Stocks?

Once you have chosen the market sectors and types of stocks you are interested in, you may turn to analysis of specific companies.

Learn Asset Analysis

There are 2 main types of stock analysis for trading: fundamental and technical. They may be used separately or in combination for more precise results.

Fundamental Analysis of Stocks

This involves examining the company’s financial state and related factors, such as conditions within its sector or the economy overall. The goal is to understand whether the stock price is correctly evaluated by the market at the moment. As a result of fundamental stock analysis for trading, a trader should be able to compare the findings with the current market price. And conclude whether the asset is overvalued or undervalued. Which, in turn, may present a trading opportunity.

This type of analysis is commonly used for long-term investments, as stock prices might take some time to catch up with the company’s true value. However, it might still come in useful when assessing stocks for short-term stock trading. Check out this article to learn more about specific steps you may take to conduct fundamental analysis of stocks for trading.

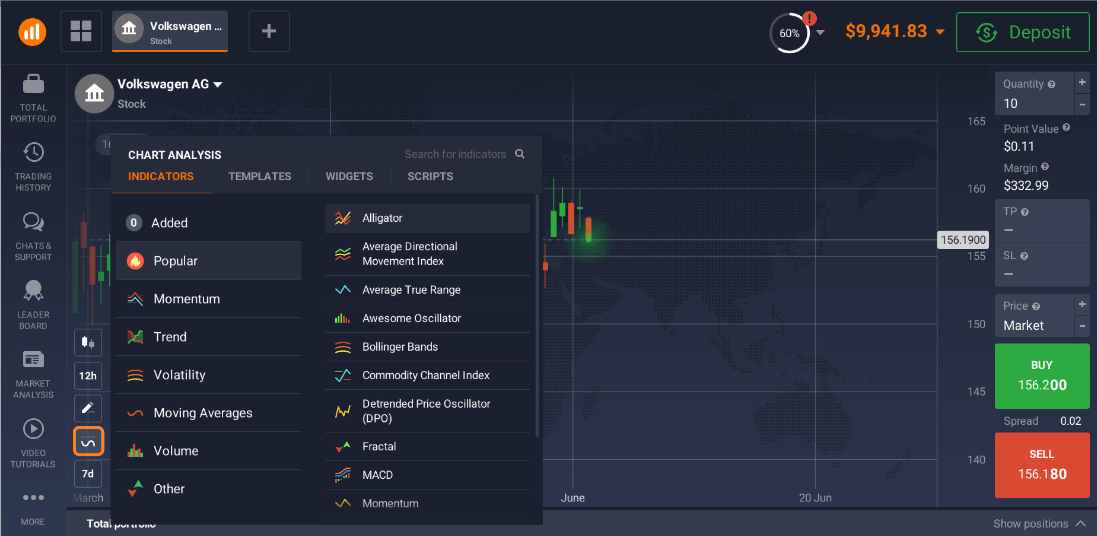

Technical Analysis of Stocks

For this approach, traders use indicators to try and predict the future performance of a stock based on its past fluctuations and trade volumes. They might apply them separately or in different combinations for more accurate readings. The conclusions from this type of analysis are based on patterns on stock charts that may hint at future price movements.

You may find step-by-step guides on how to apply indicators for technical analysis of stocks on this blog, such as 5 Most Popular Indicators Explained in 5 Minutes.

Both types of stock analysis for trading may provide useful information and potentially lead to trading ideas. Traders might also use them in a combination: for example, apply fundamental analysis to pick the interesting companies and stocks. And then turn to technical indicators to catch the right moment to make an entry.

Choose your broker

There is a variety of stock trading platforms to choose from. Some focus on stock trading, others also offer investment opportunities. With some you might be able to buy actual assets, with others you don’t need to do that and just trade the price difference.

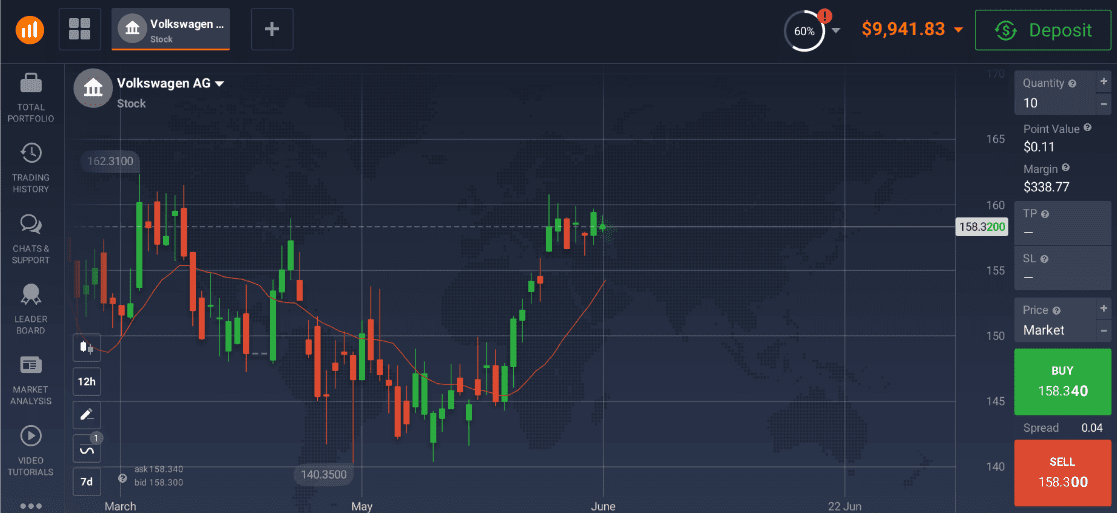

For instance, IQ Option has over 190 stocks available for trading as CFDs (Contract for difference). By buying a CFD stock, a trader does not purchase a share in the company itself. Instead, it is all about making a prediction regarding future price fluctuations of the asset. Depending on the result of the price movement, the trader receives profit or loses the initial investment.

What is more, with CFDs traders can get positive results not only when the stock is on the rise, but also if the stock is going down. Combined with margin trading, CFDs give traders more choice and a variety of trading opportunities.

Trading these instruments usually involves technical analysis of stocks, so it might be useful to check the tools in the traderoom. As an example, IQ Option has 100 different indicators that may help conduct technical analysis of stocks and lead to trading ideas.

The platform also offers a free demo account to get some trading experience without losing any money. This way, you may have some time to choose stocks for trading, practice using tools for analysis and pick the trading method that works for you.

Taking all these factors into account, it may be wise to consider trading conditions and instruments offered by different stock trading platforms before signing up. This approach might help you avoid disappointment and common mistakes novice traders face.

Make a Trading Plan

When trading any type of asset, it is important to come up with a trading plan. Stocks are no exception: getting a positive trading result requires planning and consistency.

Trading plan is a set of rules that helps organize this process. It may include:

- Your budget: how much money are you willing to put in?

- Trading schedule: when do you trade? How often do you check your deals?

- Your risk tolerance: when do you close your deals? How long do you keep losing trades open?

- Your trading method: do you open and close all deals within one day? Or do you keep them open until the trend changes? How many trades do you open per day?

You can revise and update the trading plan from time to time, but it is crucial to stick to it in most cases. This way, you may be able to avoid spontaneous decisions that might negatively affect your long-term trading goals.

Conclusion

When choosing stocks for trading, it is important to carefully consider different factors, such as economic conditions, stock market sectors and business cycles. Along with fundamental and technical analysis of specific stocks, they may provide traders with enough data to make an informed decision. After that, it is up to the trader to come up with a trading plan to use the acquired information and catch the right moment to make a move.