As a fast-paced and risky instrument, binary options require strategies that place importance on money management. The hedging binary options strategy is a way to potentially protect yourself from losses. Hedging a binary option involves entering both a Put (Higher) and a Call (Lower) position on the same asset, with strike prices (price goal at the position closure) that allow both to be in the money at the same time. Let’s learn more and explore how this strategy can be used.

Hedging Binary Options Strategy Explained

Hedging on binary options requires a trader to open two trades with the same expiration time. Ideally, both trades are expected to be profitable, so the strike price of the binary Call (Lower) option is lower than the strike price of the binary Put (Higher) option. You can choose any expiration time from the list, however, expirations less than 5 minutes are not suitable due to their quick execution.

If the actual price is between the two strike prices at expiration, both the Put and the Call options would be in the money, and you would make a profit over your investment into the deals. This is the best scenario, and it requires the price to be in a range, the size of which is up to you. Admittedly, the larger the range, the more room there is for the price to move. However, the necessary assessment and analysis need to be carried out prior.

How to Use the Hedging Strategy

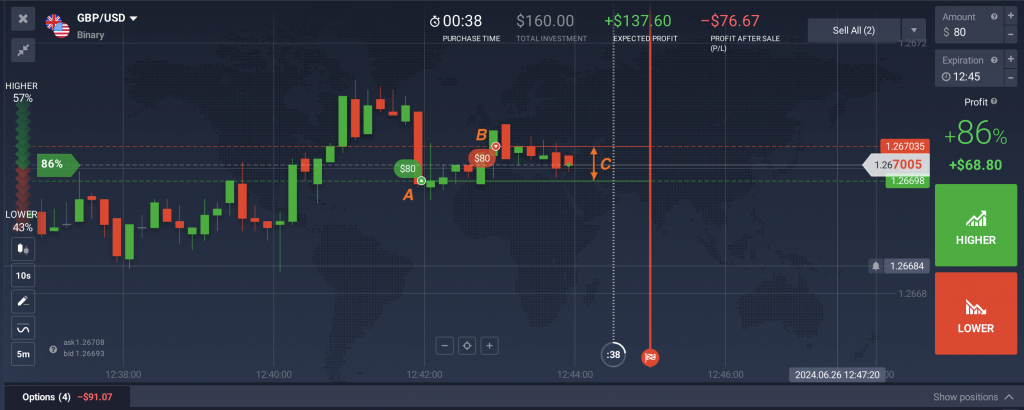

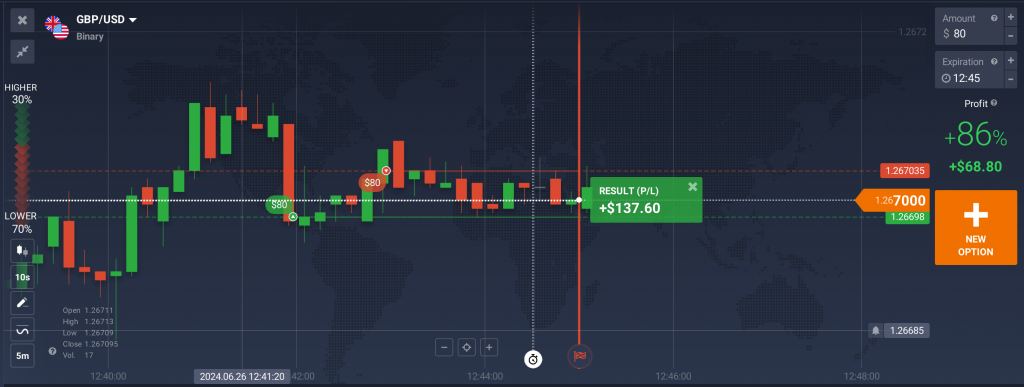

Let’s see an example of the usage of the binary options hedging strategy. For this example, we will be opening two trades on the GBP/USD currency pair.

In the screenshot above we are using the hedging strategy and opening a Higher position in point A, while also opening a Lower position in point B.

If, at the expiration time, the price is in the hedged area C, we will have profited from both deals. If the rate is outside the hedged area, then we will have profited either from trade A or trade B. In the example, the expiration was within the hedged range, which brought profit on both deals.

The unique advantage of this strategy is that a profit is reached for one of the trades in any case, even if the price closes outside the hedged range. With that said, it is important to only invest the amount that you are ready to lose. Binary options are a volatile and risky trading instrument, so appropriate risk management practices are a must.

Pros and Cons of Binary Options Hedging

Pros

- If used correctly, it can be profitable;

- It can be used in short expirations (for example, 15 minutes). However, in expirations less than 5 minutes the chart is moving too quickly and it can be hard to build the corridor;

- Uncomplicated to use and practice.

Cons:

- If the price goes against your prediction, you lose all your investment;

- Not suitable for expirations less than 5 minutes.

Practice and Excel

Like with any strategy, it is important to try the hedging approach on the practice balance first. When switching to the real account, it may be advisable to adhere to smaller investment amounts at first and implement the necessary risk management tools. Remember that it is always better to create a trading plan and stick to it, especially when trading rapid instruments like binary options.