With Bitcoin’s price wallowing at $7,500 traders are asking themselves what will come next. Here are five reasons why I think the price of Bitcoin will skyrocket this year. The bottom line, Bitcoin is gaining acceptance around the world and that acceptance will unlock a flood of money into the world’s reserve digital currency.

The US gears up for regulation

The US CFTC/SEC joint working-group to investigate cryptocurrencies has resulted in a very positive development. The appointment of a cryptocurrency czar to centralize and direct the implementation of US securities laws across government agencies. The newly appointed czar is Valerie Szczepanik, a longtime employee of the SEC and the former head of cryptocurrency research and led the CFTC/SEC working-group. Her oversight will include emerging digital technologies as well as ICO’s and cryptocurrencies.

The South Korean supreme court set a precedent

The South Korean Supreme Court, in a totally unrelated case, has set a precedent that will have wide ranging repercussions. They have ruled that digital assets can be received and held as profits making it legal for them to be seized by law enforcement agents. This means that a national level court has ruled that cryptocurrencies are in fact assets, answering a question dogging the minds of regulators around the world.

Outspoken support from Tech Gurus

Apple co-founder Steve Wosniak and Twitter co-founder Jack Dorsey have come out in vocal support of Bitcoin and digital currency. In their words, Bitcoin should become the webs currency. This news is not surprising as Bitcoin is the leading digital currency but is a plus as it helps spread the word to the global masses.

Attention is at a low

A look at the Google trends website will show you that searches related to Bitcoin are down roughly 75% since the first of the year. This is due largely to a lack of positive catalyst and the fact that prices have fallen to long term lows. With BTC trading at $7,500 most small miners and hobbyist are struggling to make profits if they can at all. This means they will likely hold their mined BTC until prices rise, helping to create a shortage in the market. When the public begins to flood back into cryptocurrency prices are sure to move higher because Bitcoin is the first step into the crypto market, everyone should buy it or LTC or ETH to buy anything else digital. What it means for traders is that now is the time to buy before the next wave of panic-buying hits the market.

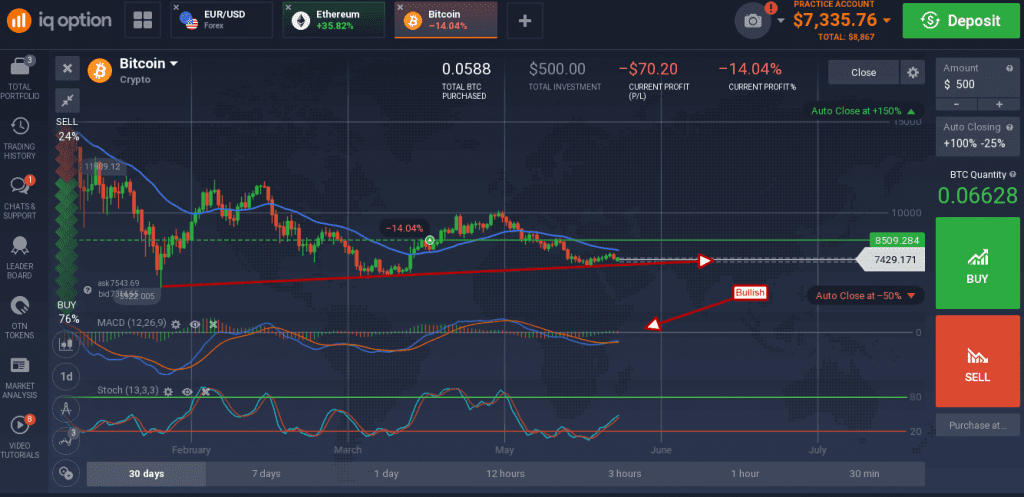

The price of Bitcoin is down near $7,500 pressured lower by the short term moving average. This has the token trending at the long term low and looking like it could go lower if not for support levels at $6,675 and $7,000.

It is important to note that support is at a higher level with the current bounce than with the previous two, a sign of growing strength within the market. The indicators are also bullish, if weak, indicative of upward momentum in prices despite the presence of resistance and suggest upward movement in the near term. Resistance is at $7,900, a break above there would be bullish.