Last week’s remarks for being long USD and long JPY paid off. On the other hand, our view for consolidating AUD/USD and USD/CAD did not materialize as both pairs started a significant trend that did not range within the technical levels of the past.

Major last week’s events:

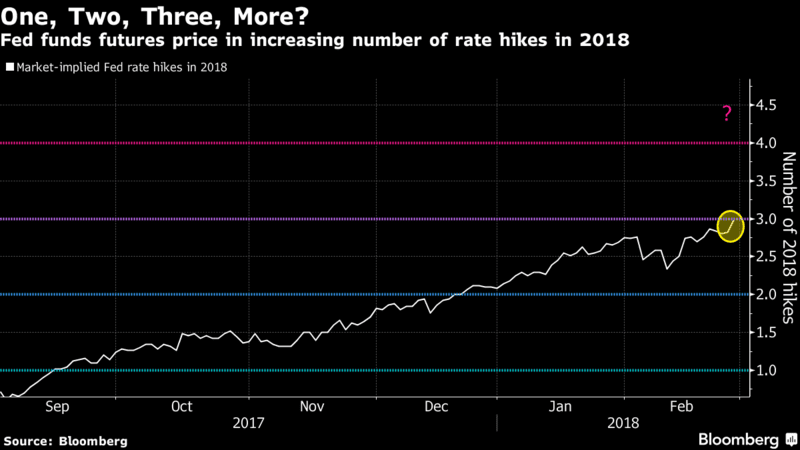

- The congressional hearing of Jerome Powell, new FED Governor. Markets interpreted his remarks as hawkish (expect 4 rate hikes within 2018) and USD strengthened.

- Trump imposed 25% tariffs on imported steel and 10% tariffs on imported aluminum and gave a good reason to US equities to cross south the 50DayMovingAverage. I cannot tell if the announced tariffs are an actual decision that will be followed, or it is a way to put pressure on LiuHe, the Chinese Top Trade Policy Maker that was visiting USA this past week.

Major Scheduled Next week events:

- Monetary policy meetings of RBA on Tuesday (AUD), BOC on Wednesday (CAD), ECB on Thursday (EUR) and BOJ on Friday (JPY)

JPY

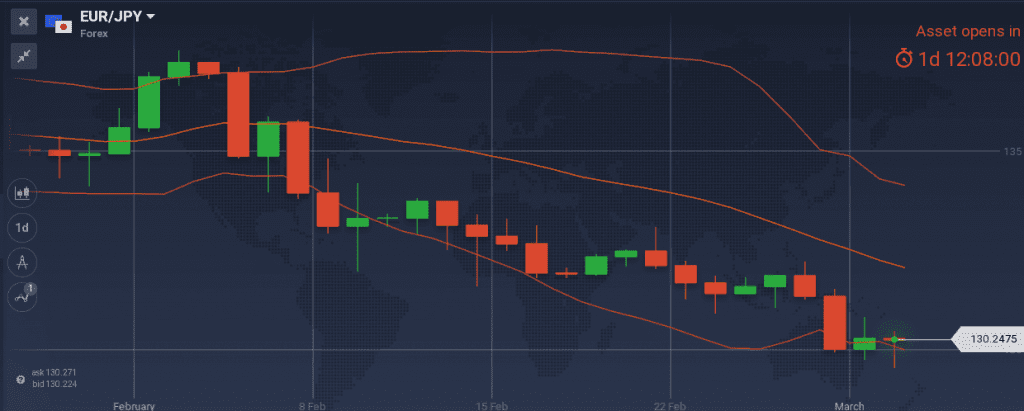

I could not have been more accurate on my views on EUR/JPY. JPY is getting stronger, the bounce at the technical significant level of 131.00~131.20 was indeed triggered and was indeed short lived. Now the pair has crossed south the 200DayMovingAverage, crossed 3Q17-4Q17 lows and is heading south. At 131.00~131.20 I am adding to my short positions.

Snapshot:

- 7% GDP growth in 2017 compared with 0.9% expected at the start of the year.

- 06% 10y Bond yields, compared with 0.09% last reading, and BOJ’s target of 0.00% level

Strengths of JPY:

- last reading of trade balance at 0.37T on 19 Feb

- announcement that Kuroda will serve for another 5 years

- turmoil intensified by Trump’s decision to impose tariffs on steel and aluminum. Turmoil weakens equities and strengthens JPY.

Weaknesses:

- Nothing to note

Watch:

- Current Account release on Wednesday night 23:50GMT. Any reading above 1.48T does not change my outlook for strengthened JPY.

- Friday’s 9 March Monetary meeting. My interpretation of the BOJ’s communication is that no change is expected up until the second half of 2019.

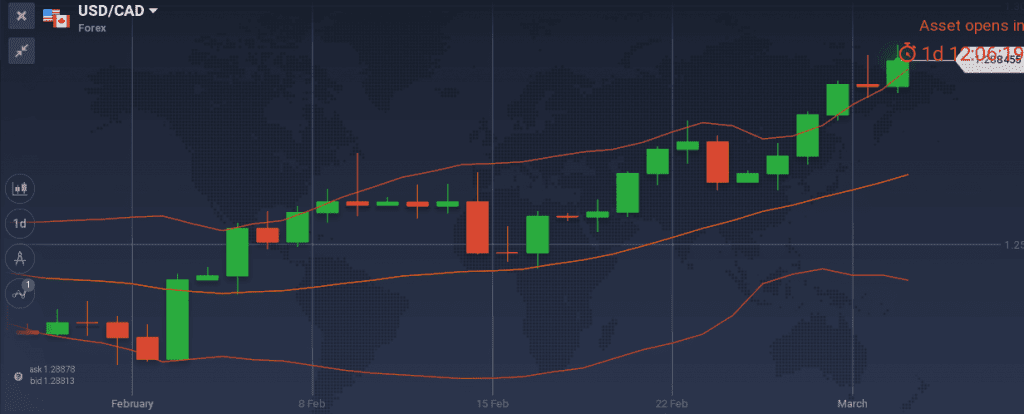

CAD

The rosy picture seems to have already been priced in USD/CAD long before February’s equity sells off, as the pair was at 1.2400 level and heading south and as the rates increased as anticipated to 1.25%, on the last BOC monetary meeting on 17 January. Since then, USD/CAD pair is up trending without consolidating at the 1.2480-1.2710 range, as I was expecting.

Snapshot:

- Desired level of inflation. Inflation stands at 1.7% vs 1.0%~3.0% target range.

- GDP growth is acknowledged by the Central Bank to be higher than long term average

- US crude oil inventories are rising again (last Wednesday’s reading was +3Mbarells), pressuring down both the price of oil and the correlated CAD.

Strengths of USD/CAD:

- The uptrend is well defined as the pair decisively crossed the 1.2710 level

- I am searching to go long in case the pair reaches the attractive 1.2690 level

Weaknesses of USD/CAD:

- Uptrend is approaching 1.2956 level and could well bounce back. So I am not going long at current levels

Watch:

- Wednesday’s (15:00 GMT) monetary decision. I do not expect a rate hike in this meeting. Yet I want to see how BOC quantifies the consequences of US tariffs, that are now a reality, and I want to focus on any hint for the timing of future rate hikes.

- Wednesday’s (15:30 GMT) US Crude oil inventories release

- Also note the trade balance reading on Wednesday (13:30 GMT) 90 minutes before the significant monetary decision.

AUD

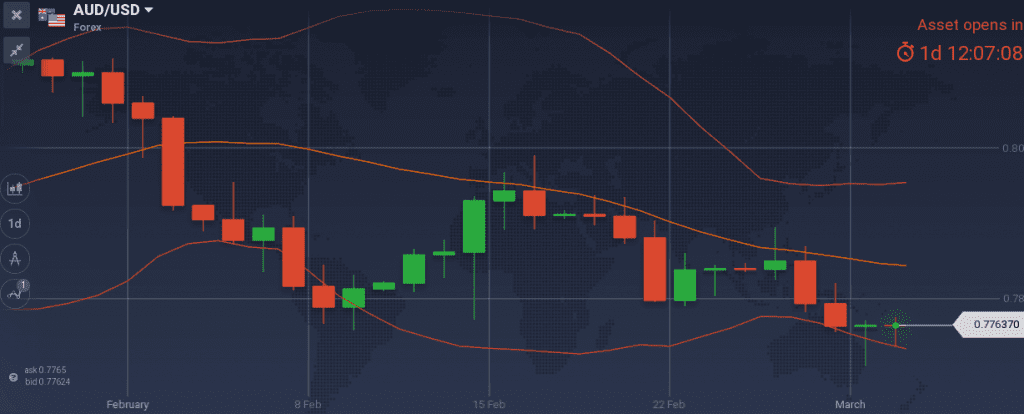

February’s equity sells off, found AUD/USD heading south from 0.80 all the way down to the 200 Days Moving Average. The 200MA has been decisively crossed during last week. I believe that if it had not been for Trump’s Thursday’s decision to impose tariffs causing equities to fall, we could have seen a far lower level for AUD/USD.

Snapshot:

- Central bank ‘s interest rate is at 1.50% with no hike yet in this cycle.

- Inflation at 1.9% (expected to be above 2.00% in 2018, reach 2.25% on mid-2020, target is 2.0~3.0%)

- GDP expected at 3% growth, (2.8% was 2017 reading)

- My interpretation is that Central Bank is avoiding hiking, due to the high levels of household debt and would remain at the current 1.50% rate unless we see significant increases on wages. Next release on Australian wages expected on the 16th of May.

Strengths:

- The 0.7810 or even 0.7850 level could well be retested but this time I would use them to close any long positions of the past and start opening short positions with the intention to keep them up until 0.7640 level

Weaknesses:

- I cannot see wages increasing and this seems to be the only reason that could push the Central Bank to hike.

- Terms of trade are expected to decline

Watch:

- Tuesday’s early in the morning (3:30GMT) monetary policy meeting. I expect no change in monetary policy. Note that markets are expecting the first-rate hike from Central Bank, no earlier than the first half of 2019.

- Current Account (on Monday midnight 0:30GMT), Trade Balance (on Wednesday midnight 0:30 GMT) to confirm the decline of terms of trade.

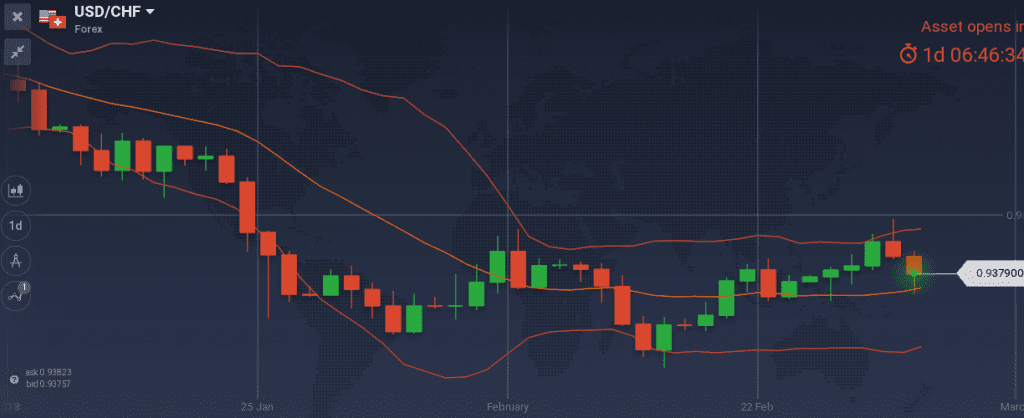

USD

My long bias on USD has paid off. Yet, I cannot argue in favor of USD, in a week that follows Trump’s blunder to impose tariffs. I strongly believe that tariffs are hurting growth and that current global financial markets are quick enough to price in everything, way too sooner than the actual bad consequences become evident in macro-releases.

I conservatively open no extra position in USD, except for creating a long USD/CHF position at 0.9320-0.9340 level and a long position at GBP/USD.

Snapshot:

- US economy is growing at a healthy rate of 2.5% (last week’s reading confirmed it), unemployment is at 4.1%, the biggest tax reform is already a reality.

- Tightening cycle has begun with a very gradual pace of rate hikes since Dec 15. We are counting 5 hikes of 25bps so far, resulting to a current FED rate of 1.50% which Ι expect to reach the peak of 2.75% ~3.00%

- On the other hand, Trump’s tariffs materialized. This is bad for growth.

Watch:

- 2nd reading of unit labor cost on Wednesday 13:30GMT. Remember that this release initiated the big equity sell-off in February. No impact is expected, but the reading needs to be noted

- Trade balance on Wednesday 13:30GMT (same time with the above)

- Friday’s Unemployment rate release at 13:30 GMT

- Next FOMC meeting is scheduled for the 21st of March

EUR

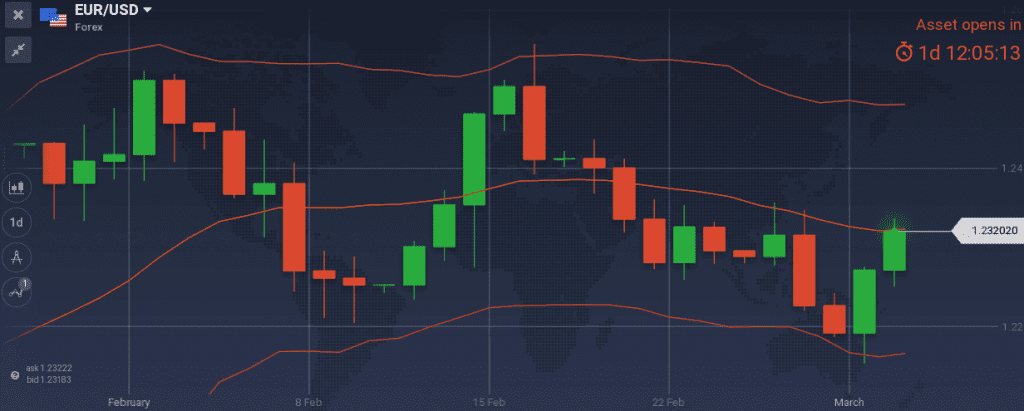

The past week while the opening of EUR/USD was at 1.2293, I was pointing to the upcoming Italian elections and was advising to minimize any open positions. As the current report is produced, the Elections results are not known, yet a EUR/USD gap at the opening is likely and the best way to trade it is to buy the opening until the gap closes.

Snapshot:

- European’s Economy is doing well. Actual GDP growth at 2.4% vs beginning of 2017 consensus for 1.3%~1.8%. But the rosy picture seems to have already been priced at the 1.25 peak

Strengths:

- Trump’s tariffs announcement, made EURUSD to rally all the way up to its 20DayMovingAverage

Weaknesses:

- Decreased European current account, economic sentiment and PMI readings have found their ceiling, double top formation at the 1.2500 level.

- Last week’s 10year German-France-Italian-Spanish bonds auctions yielded lower yields, confirming the convergence of European vs US Economies.

Watch:

- ECB monetary decision (12:45GMT) and press conference (13:30GMT) on Thursday. I am expecting unchanged monetary measures and communication that would result in EUR weakening

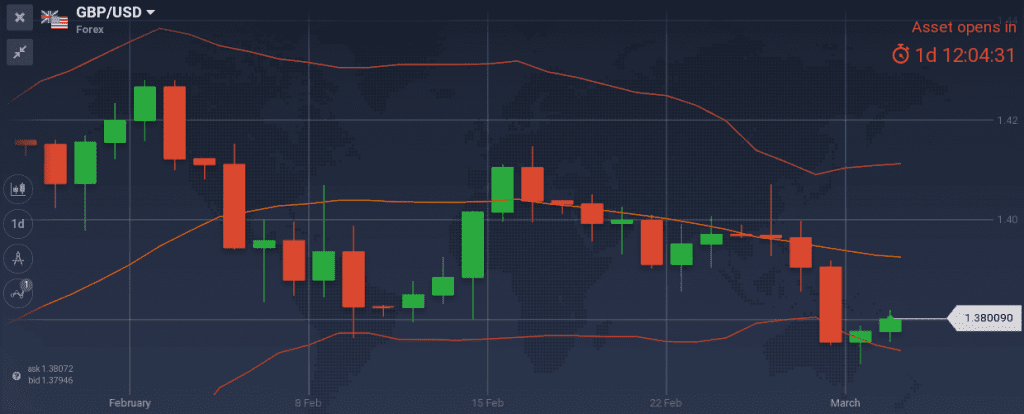

GBP

Snapshot:

- UK’s economy at a glance stands at 1.5% GDP growth, 4.4% unemployment and 3.00% inflation

- Note that UK is the only major economy that experiences higher inflation than the targeted 2%.

- Second rate hike on the 10th of May is probable.

Strengths:

- The CPI reading released on the 13th Feb at 9:30GMT indicated that the 3.00% inflation is not declining as expected, and thus a rate hike becomes even more probable

- Manufacturing PMI above 55.2 reading emphasized the growing economy scenario and allow me to create long position at the 1.3700-1.3750

Weaknesses:

- Brexit negotiations and their outcome

Watch:

- Monday’s 9:30GMT Service PMI reading. A figure above 53.0 confirms our scenario

- 30y government bond auction on Tuesday. We need to see a yield higher than 1.81% to feel confident in our scenario.

- Next Monetary policy meeting on 22 March