Exceptionally good results for last week’s offered ideas. Only two ideas [to search going long AUD/USD at 0.7474 level and to enter long EUR/USD at Tuesday’s European opening], both hit bulls-eye and ended my last report’s expressed frustration, when I was communicating my regret for having jumped off early, instead of curving/staying in the winning long safe havens trades (i.e. long USD, long JPY).

Major last week’s events:

- Korea: The 12th of June N. Korea-USA summit is still on and there is a chance that both S. Korea would participate. Denuclearization on the one hand and the removing of 28K US troops from Korean peninsula on the other, is at stakes.

- Tariffs front: The exceptions of EU, Canada and Mexico from imposed steel and aluminum tariffs have not been renewed, as none accepted the proposed quotas in negotiations with US Commerce Secretary Wilbur Ross. Canada and EU filled challenges with the WTO (World Trade Organization) and plan to retaliate on US orange juice, whiskey, blue jeans and Harley-Davidson motorcycles

- Iran Deal: Nothing new under my radar

- Italy: Week began with President Mattarella refusing to accept an anti-euro Finance Minister and Italian government yields rising above 3.00%. Yet, the week ended with the formation of a new government and bond yields decrease.

- Cryptos: Total market cap at 341B$, almost the same level as previous week

Major next week events:

- Meeting of oil ministers of UAE, Kuwait and Saudi Arabia that is happening during the weekend, while this report is produced. Remember that OPEC’s Vienna meeting is scheduled for the 22nd of June.

- US Commerce Secretary Wilbur Ross arrival in Beijing to talk trade (farm and energy commodities)

- Tuesday’s Monetary meeting of Bank of Australia (RBA).

- Poseidonia 2018 fair in Athens Greece, the most prestigious expo of maritime industry as trade in no longer growing double as much as Worlds GDP growth.

- Friday’s and Saturday’s G7 Leaders meeting at Quebec, Canada

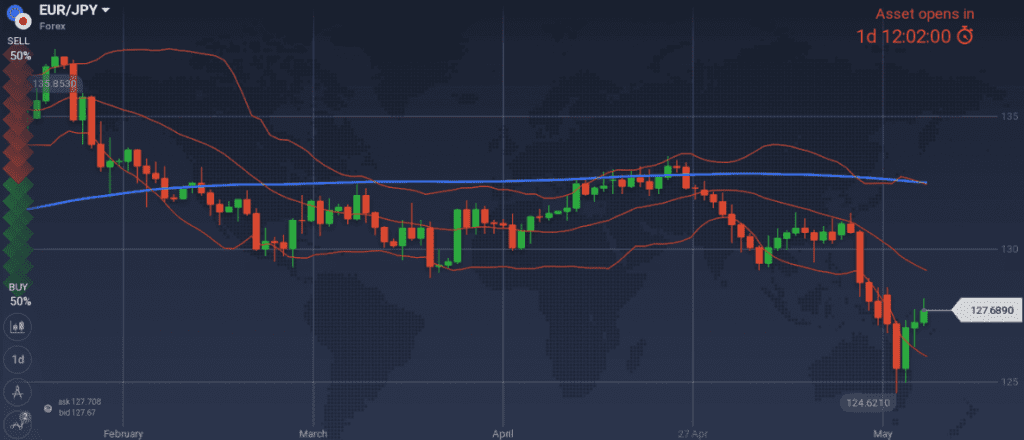

JPY

JPY strengthened across the board, braking easily all significant technical levels, but is now back at the levels it has been a week ago.

I could easily short EUR/JPY in case 129.18 ~129.39 levels are triggered.

Snapshot unchanged:

- Inflation (excluding food-National core CPI) at 0.7% (vs 2.0% target and BOJ’s members expectation of 1.2~1.3% within 2018), BOJ rate at -0.1%

- GDP at 0.90% annual, -0.2% q/q, 10Y Government bonds yield at 0.05% (+1bps w/w) vs BOJ’s target of 0.00% level

- Unemployment at 2.5% (lowest levels since 1993)

Strengths of JPY:

- QQE set to stay in place up until 2020 or beyond.

- Significantly high trade balance at 0.55T JPY

- Increased PMI manufacturing and housing starts reading

Weaknesses of JPY:

- major political uncertainties across the board, seem to be settling down

- latest negative GDP reading

Watch:

- Monday’s 0.50GMT Monetary Base growth. Any number above 7.5% favors JPY.

- Friday’s 0.50GMT Bank Lending and Current Account. Increased numbers favor JPY.

- Friday’s 6.00GMT Economic Watchers Sentiment.

- Next Monetary Meeting on 15th of June

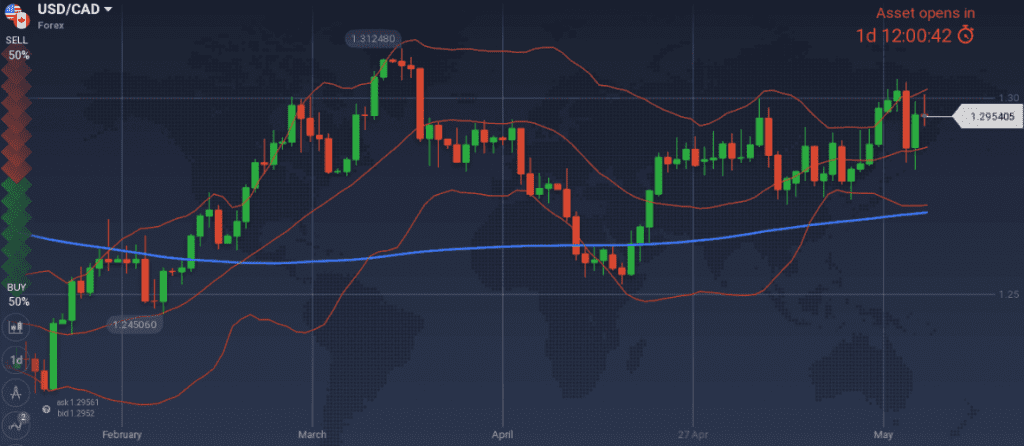

CAD

Bank of Canada did not surprised markets, but I believe that it is set to increase rates in the future as economy is running at full speed. The main concern was not the slightly decreased GDP reading, but rather the uncertainty from trade policies and Canadians reactions to the new mortgage rules. My focus becomes housing market and lending.

I could take short USD/CAD positions in case 1.3138 level is triggered.

Deteriorating Snapshot:

- Inflation at 2.2% (vs 1.0%~3.0% target range, expected to increase again in 2018), BOC rate at 1.25% (3 hikes so far). Note BOC’s confidence on neutral rate within 2.5%~3.5% range.

- GDP decreased to 2.3% (vs BOC expectations of 2.0% in 2018 and long-term potential of 1.8%), 10Y Government bonds yield at 2.25% (-10bps w/w)

- Unemployment at 5.8% and expected to decrease further.

Strengths of USD/CAD, weakness of CAD:

- Terms of trade (latest reading -4.1B CAD) favors USD

- Uncertainty on trade policies

Weaknesses of USD/CAD, strengths of CAD:

- oil moving higher. Remember that the correlation between CAD and oil used to be higher in the past. Last week was -0.35, now stands at -0.51

- confident communication from Bank of Canada

Watch:

- Wednesday’s 13:30GMT Trade Balance

- Wednesday’s 13.30GMT Building Permits and Friday’s Housing Starts. I want to see increasing numbers that would favor CAD.

- Next Monetary Meeting on 11th of July.

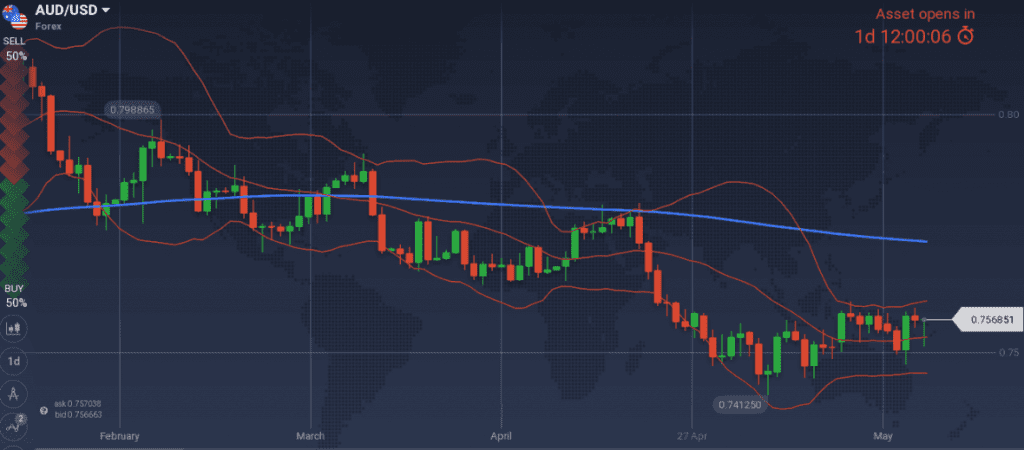

AUD

I am biased to go long AUD/USD at 0.7517 and 0.7498 levels and long AUD/JPY at 0.8150 level, following the upcoming monetary meeting. Before that, I want to see increasing new home sales.

Snapshot unchanged except from decreasing bond yields:

- Inflation at 1.9% (vs 2.0~3.0% target), RBA ‘s rate at 1.50% (no hike so far)

- GDP at 2.4% growth (3.0% could be achieved within 2018 and 2019 according to RBA), 10y Bond yields at 2.70% (-9 bps w/w)

- Unemployment increased slightly to 5.6% but is expected to decline.

Strengths:

- improved trade balance

- improved business confidence and private capital expenditure

- China’s good performance

Weaknesses:

- household consumption is a source of uncertainty. Anything that quantifies household consumption (credit growth, wage growth, private capital expenditure) should be noted in the coming months. Latest reading of wages growth and building approvals do not support AUD strengthening

- the 0.7580~0.7600 zone is behaving as a strong resistance.

Watch:

- Tuesday’s new home sales and current account. My long AUD scenario is only supported by growing numbers.

- Tuesday’s 5.30GMT Monetary Meeting

- Thursday’s 2.30GMT Trade Balance. June’s reading has been generally lower than May’s for the last couple of years, so a reading above 1B AUD is within my long AUD scenario.

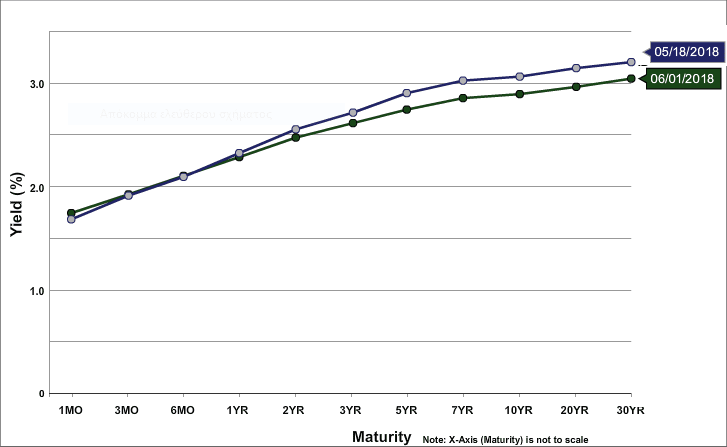

USD

The FED meeting in two weeks, could well include the second-rate hike for 2018, while at the same time USA is dealing with the consequences of infuriating all of its allies. An isolated USA was the theme in latest G7 Finance Ministers and Central Bank Governors Summit.

Snapshot with mixed signals:

- Inflation (Core PCE) at 1.8% (vs 2.0 target and 1.9% FED’s expectations), FED ‘s rate at 1.75%. 6 hikes so far in the business cycle and another 6 hikes expected by the end of 2019, to reach 3.25%. FED’s view of long run rate remains at 2.75%~3.00%

- GDP decreased to 2.8% growth (FED expects 2.7% in 2018), 10y Bond yields at 2.90% (-3 bps w/w)

- Unemployment decreased further to 3.8%

Strengths of USD:

- strong macros (PMI Manufacturing, PMI Services, Durable Goods orders, unemployment)

Weaknesses of USD:

- bond yields are showing that they have found their ceiling

- Tiny decrease of m/m home sales (-3%) and a consumer sentiment that is falling from March’s highs, when Americans were living the positive effects of the new tax law at their pockets. Latest Consumer Confidence bellow 128

- small decrease of GDP q/q to 2.2% from 2.3%

Watch:

- Tuesday’s 15.00GMT Non-Manufacturing PMI.

- Wednesday’s 13.30GMT Trade Balance

- Friday’s 15.00GMT Wholesale inventories as a double check of the point of the business cycle.

- Next Monetary Meeting on 13th of June.

EUR

The Italian political situation seems to be contained. Remember what was at stakes at the beginning of 2017, 18 months ago, when EUR/USD was trading at 1.06 and managed to jump above the 200MovingAverage in one weekend, following the first Sunday of France elections. Back then, the possibility of Lepen and Melenchon winning the first round was real. Yet, French elected Macron and Germans at the end approved a new Merkel’s government with the support of SPD. Trying to enforce unrealistic agendas was something that Greeks played hard. No reason to live one more similar drama.

At current EUR/USD levels, and with the different point in business cycle of European and American economy, on the one hand I keep my short EUR/USD bias, but on the other I cannot offer an entry point.

Snapshot improving:

- Annual Core CPI Inflation increased to 1.1% (vs 2.0% target, vs 0.7% previous reading), ECB ‘s rate at 0.00%

- GDP at 2.5% growth (OPEC expects a 2.2% reading), 10y Bond yields of EFSF at -0.36% (+8bps w/w), 10y German Bond yields at 0.39% (-2bps w/w), 10y Italian Bond yield at 2.69% (+24bps w/w, but already back from the 29 June’s 3.10% highs)

- Unemployment at 8.5%

Strengths of EUR/USD:

- increased M3 and inflation readings

- sentiment remains high

Weaknesses of EUR/USD:

- decreasing PMI Manufacturing and PMI Services readings

- the different point in the cycle between US and EU economy

Watch:

- Monday’s 9.30GMT investor’s confidence reading that is expected to fall

- Tuesday’s 9.30GMT Services PMI reading

- Wednesday’s 09:10GMT Retail PMI reading

- Next Monetary Meeting on 14th of June

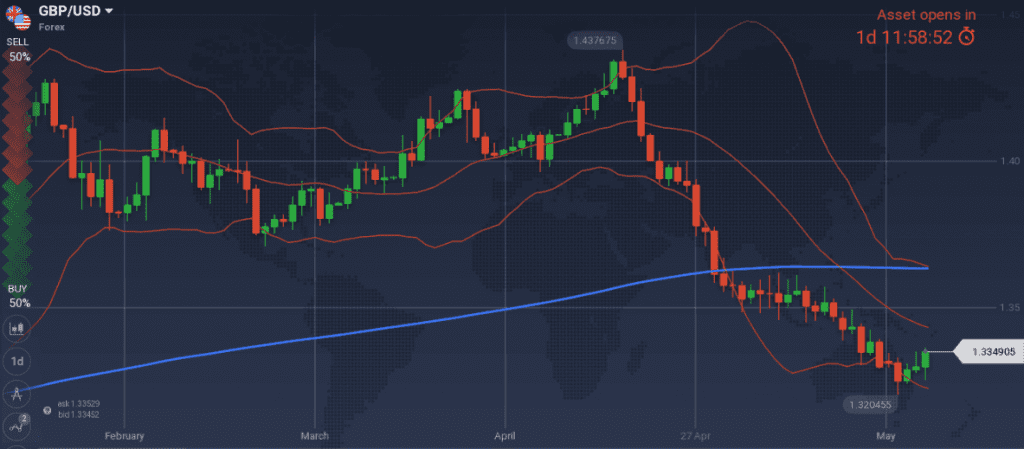

GBP

Snapshot unchanged:

- Inflation at 2.4% (vs 2.0% target), BOE ‘s rate at 0.50% (no hike expected in 2018)

- GDP at 1.2% growth (vs 1.4% previously vs 1.5% OPEC’s estimates), 10y Bond yields at 1.28% (-4bps w/w)

- Record low unemployment at 4.2% (BOE expects to fall further in Q2)

Strengths:

- the bad weather narrative regarding UK’s economy in 1Q18 may prove to be true.

- latest retail sales m/m increase at 1.6% and increased m/m lending to individuals

- unexpectedly higher latest reading of M4(at 0.2%) and Manufacturing PMI (at 54.4)

Weaknesses:

- decreasing inflation readings that postpone rate hikes

- decreasing bond yields

Watch:

- Monday’s 9:30GMT Construction PMI and Tuesday’s 9:30GMT Services PMI. Any number above 52.5 and 52.8 favors my scenario

- Friday’s 9:30GMT Consumer Inflation expectations. I want to see the same 2.9% or higher number.

- Next Monetary Decision on 21 June.