Risk on scenario with equities increasing is still valid, as we are moving towards the first week of August, when many geopolitical, market moving events took place in the past.

Last week’s views can be filed in the red box. No opinion was expressed on EUR/JPY, the long 0.7367 AUS/USD trade played well, the short 1.3122 USD/CAD was not triggered, USD appreciated contrary to what was argued, long 1.1510 EUR/USD was not triggered, long 1.3042 GBP/USD is 40 pips in the red, and Facebook closed the week north but not impressively.

Major last week’s events:

- Tariffs front: Trump threatened to increase the tariffs rate from 10% to 25% for the next sum of 200B$ worth of Chinese products, to be affected within September. China’s response was a list of additional 60B$ US goods (farm products, machinery, chemicals, coffee) to be taxed once US proceeds with their actions. Meanwhile both CNY and China’s stock market is falling.

- NAFTA: Talks are progressing. On Thursday there was a meeting between Mexican and US officials in Washington

- Turkey: Troubles are mounting, as USA imposed sanctions on two Turkish ministers for refusing to detain an American Pastor. A rate hike and a bounce at 5.1500 USD/TRY is the only hope for TRY bulls.

- Iran, Syria, North Korea: New activity at Pyongyang nuclear site has been reported

- US Transformation: No news.

- Cryptos: Total market cap retraced back at 266B$, -11% w/w

Major next week events:

- Market reaction on Wednesday, as the first 90day period ends, for companies to wind down on their projects and trading in Iran and obey to US sanctions.

- Monetary meeting of RBA (Australia) on Tuesday and Central Bank of New Zealand on Wednesday night.

- Bitcoin enthusiasts will need to wait further away from Friday 10 of August (possibly up until 21 September) to find out SEC’s decision on the creation of an ETF on Bitcoin.

JPY

JPY strengthened in all fronts, following Tuesday’s BOJ meeting, when sticking to the accommodative policy was once again confirmed.

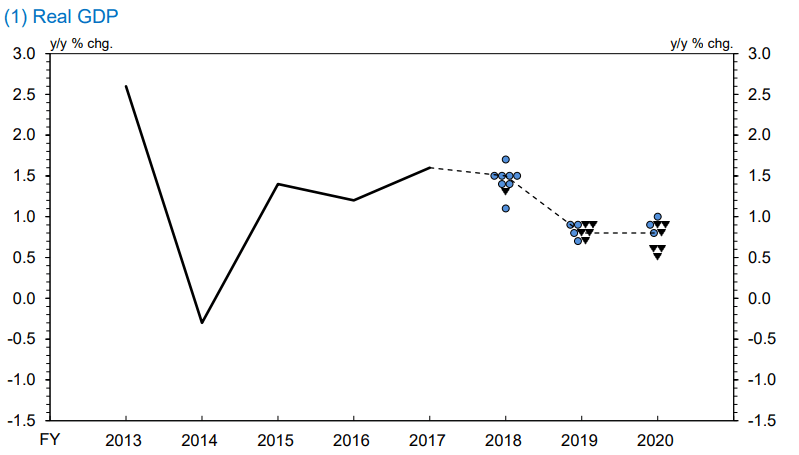

BOJ will let the yields of 10Y government bonds within a wider range of ±0.20% vs the older ±0.10% target range and left their views on GDP almost unchanged.

I expect consolidation within 128.30-131.88 EUR/JPY range.

Snapshot mixed:

- Inflation (excluding food-National core CPI) at 0.8% (vs 2.0% target and BOJ’s members expectation of 1.2~1.3% within 2018), BOJ unchanged at rate at -0.1%

- GDP at 1.10% annual, -0.2% q/q (new improved reading expected this week), 10Y Government bonds yield at 0.11% (+1bps w/w) vs BOJ’s target of 0.00±20% level

- Unemployment increased to 2.4%

Strengths of JPY:

- QQE will stay, up until core CPI reads 2.0% in a stable manner. The scheduled VAT hike on Oct19, rules out any possible monetary policy change, earlier than 2020.

- increasing inflation, retail sales, expected improved GDP reading, trade balance, increased Manufacturing PMI

- continues devaluation of CNY

Weaknesses of JPY:

- equities bear scenario is fading away as earnings are impressive and the negative effects of tariffs on global GDP is priced in without exaggerations

- decreased readings of Services PMI, monetary base, household spending, machine orders,

Watch:

- Household spending, bank lending, current account reading, machinery orders and M2 are scheduled to be released this week, with limited market moving effect

- An expected GDP reading above 0.2% q/q, to be released on Friday could favor short EUR/JPY positions

- Next Monetary Meeting on 19 September

CAD

As USD/CAD is approaching to the midpoint of the 1.3150~1.2700 range it is getting difficult to offer a view.

Snapshot unchanged:

- Inflation at 2.5% hitting the expected number for 3Q18 (target range is 1.0%~3.0%), BOC rate at 1.50% (4 hikes so far, neutral rate according to BOC within 2.5%~3.5% range).

- GDP at 2.3% (vs BOC expectations of 2.0% in 2018 and long-term potential of 1.8%), 10Y Government bonds yield at 2.35% (+5bps w/w)

- Unemployment at 6.0%

Strengths of USD/CAD, weakness of CAD:

- last week’s south move was huge, given that oil did not appreciate, so a bounce back up until 1.3120 level, is possible

Weaknesses of USD/CAD, strengths of CAD:

- strong GDP and trade balance readings

- latest housing starts, impressive increase of retail sales (new readings are coming this week)

- Nafta negotiations heating up again

- as we are approaching on Wednesday to the first deadline of US sanctions on Iran, oil may rally

Watch:

- Monday is a bank holiday

- Wednesday’s building permits and Thursday’s housing starts. Increasing numbers favors the short USD/CAD scenario

- Next Monetary Meeting on 5th of September.

AUD

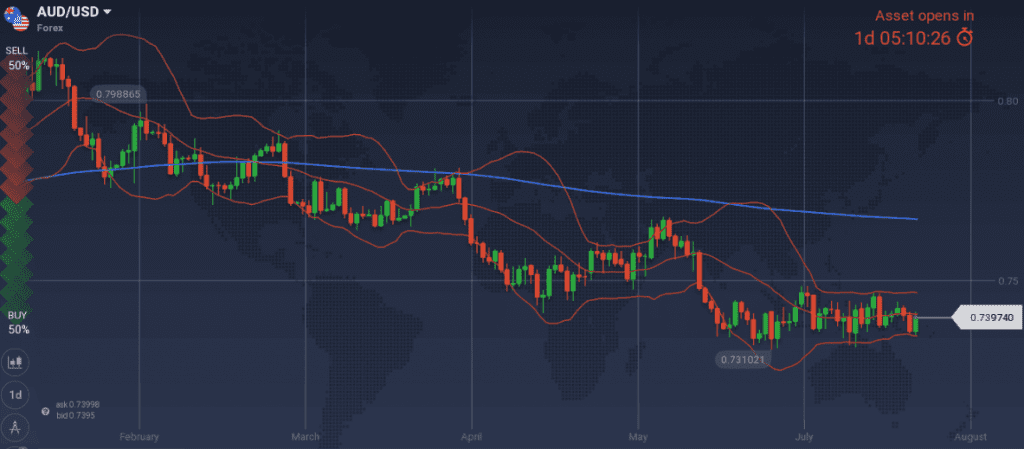

Expected favorable news during last week materialized and entering long at 1.7365 played well.

I am re-entering long AUD/USD at 1.7365 and do not plan to close winning trades.

Snapshot unchanged:

- Inflation at 2.1% (vs 2.0~3.0% target), RBA ‘s rate at 1.50% (no hike so far)

- GDP at 3.1% (RBA expects more than 3.0% within 2018 and 2019), 10y Bond yields at 2.73% (+9 bps w/w)

- Unemployment at 5.4%

Strengths:

- significant increase of GDP, inflation, inflation expectations and impressive trade balance

- improved business confidence & profits, private capital expenditure, home loans, building approvals, new home sales and latest impressive increase of consumer sentiment

Weaknesses:

- latest readings of wages growth (next release on August) do not support AUD strengthening.

- Market participants expect the rates to remain unchanged for a considerable period of time

- Political landscape in Australia is changing following elections in Tasmania and Queensland

Watch:

- Tuesday’s Monetary Meeting

USD

Latest readings affecting inflation decreased, confirming that current fiscal and monetary mix is effective and right on spot. Wednesday’s Monetary Meeting has not added anything new.

I stay confident with my view that USD will weaken as rate hikes are already priced.

Snapshot improved:

- Inflation (Core PCE) decreased to 1.90%, FED ‘s rate unchanged at 1.95% (IOER) and expected to reach 3.1% within the cycle. FED’s view of long run rate at 2.9%

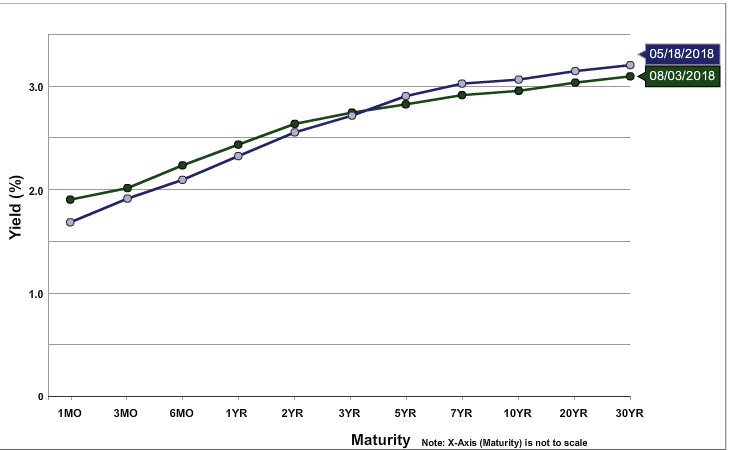

- GDP at 4.1%, 10y Bond yields at 2.95% (+0 bps w/w, once again failed to cross 3.0%)

- Unemployment decreased to 3.9% (vs natural rate of unemployment of 4.5%), FED expects 3.6% unemployment in 4Q18 and 3.5% for 2019 and 2020.

Strengths of USD:

- strong macros: Factory orders increasing, Manufacturing and services PMI continue to be above 55 for an extended period

- latest q/q GDP reading

Weaknesses of USD:

- Equities are rising and S&P500 closed the week above the technically significant level of 2822.

- 10y Government Bond yields refused to cross 3.0% yield once again.

- I cannot name any new readings/events that could fuel the further strengthening of USD as it has reached technical significant levels

Watch:

- Wednesday’s auction of 10y Bonds and Friday’s Wholesale inventories m/m change. An increasing inventories reading does not help my long equities, short USD scenario

- Next Monetary Meeting on 26 September, when a new hike is expected.

EUR

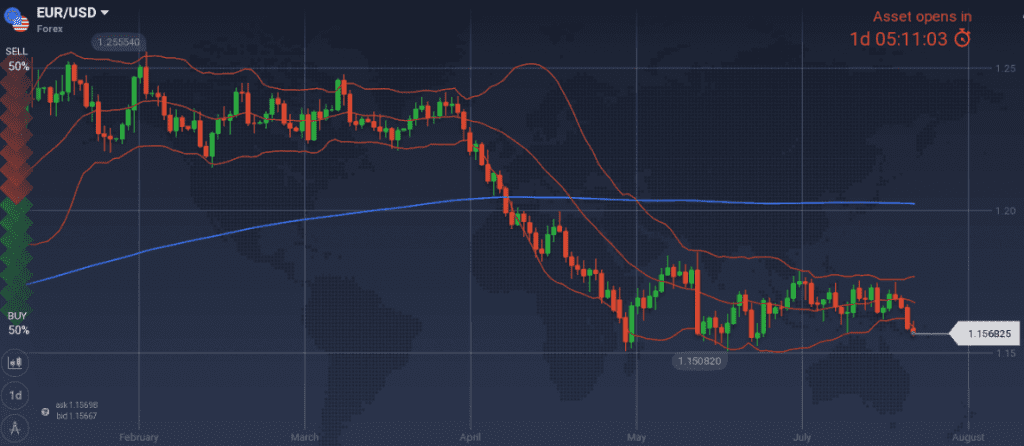

I keep considering 1.1510 as a buying opportunity.

Snapshot with mixed signals:

- Annual CPI increased to 2.1%, core CPI excluding food and energy increased to 1.1%, ECB ‘s rate at 0.00%

- GDP decreased to 2.1% growth (OPEC expects a 2.2% reading), 10y Bond yields of EFSF at -0.38% (+0bps w/w), 10y German Bond yields at 0.41% (+1bps w/w), 10y Italian Bond yield at 2.93% (+19bps w/w)

- Unemployment decreased to 8.3%

Strengths of EUR/USD:

- M3 growth, service and manufacturing PMI levels

- increasing inflation and decreasing unemployment

Weaknesses of EUR/USD:

- the devaluation of CNY argument is pointing more to EUR/USD weakening than strengthening.

- any possible equity sells off

- latest decreased GDP reading, business climate and confidence readings refusing to increase

- divergence of monetary policy between EU and US, that can only be simulated with two expected down facing waves on September and December

Watch:

- Monday’s Sentix Investors’ Confidence reading. I want to see an increasing number to favor my long EUR/USD trade

- Next Monetary Meeting of ECB on 13th of September.

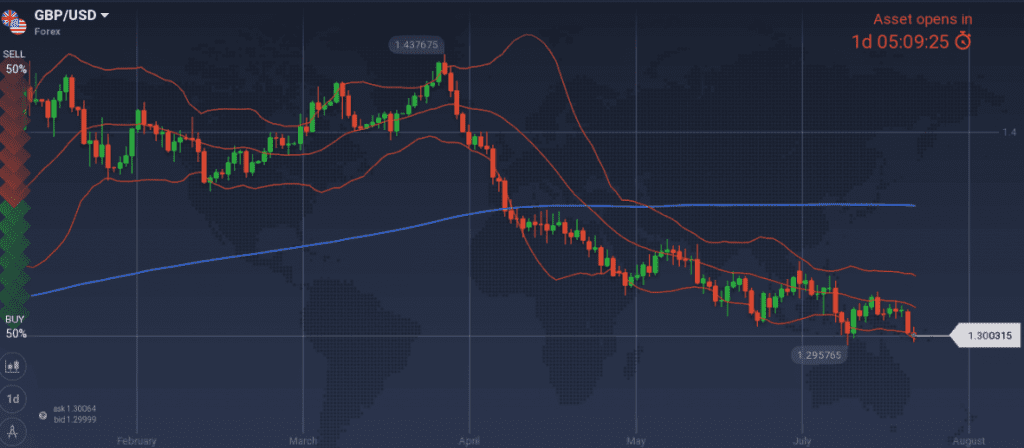

GBP

Despite the negative reaction to May’s White Paper that followed Chequeens, from both her Cabinet and EU, May is pushing her Brexit plan with a visit in France. UK’s car industry is at her side.

BOE raised rates with an unexpected 9-0 vote, signaled 3 more hikes within the next 3 years and carefully noted that BOE’s reaction function assumes of a smooth Brexit transition and that the range of Brexit outcomes is still wide.

I am confident with my last week’s view to be long GBP/USD, despite the initial market’s reaction that sent GBP lower

Snapshot unchanged:

- Inflation at 2.4% (vs 2.0% target), BOE ‘s rate increased to 0.75%

- GDP at 1.2% growth (1.4% OPEC’s estimates vs 1.75% BOE’s expectations), 10y Bond yields at 1.33% (+5bps w/w)

- Unemployment at 4.2% (BOE expects to fall further in Q2)

Strengths:

- the bad weather narrative for Q1 still makes sense.

- I believe that markets are overpricing the probability of a hard Brexit with no transition period

- impressive readings of construction activity and housing market

Weaknesses:

- latest M4, retail sales and average earnings

- latest Manufacturing and Services PMI that were decreasing

Watch:

- Friday’s GDP, manufacturing production and construction output readings that I expect to send GBP higher

- Next Monetary Meeting on 13th of September