Although macroeconomy and forex market is an ongoing process that never ends, this week is giving a feeling of season ending when the truths of the plot is revealed. Schools are out for summer; the World Cup 2018 is starting in Russia and we are heading towards 3 Major Banks’ monetary decisions and the long-awaited Trump-Kim Summit in Singapore.

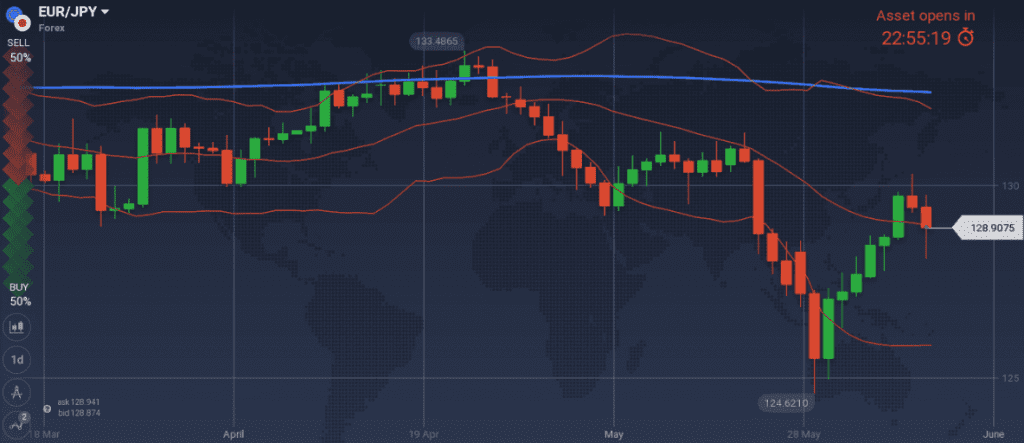

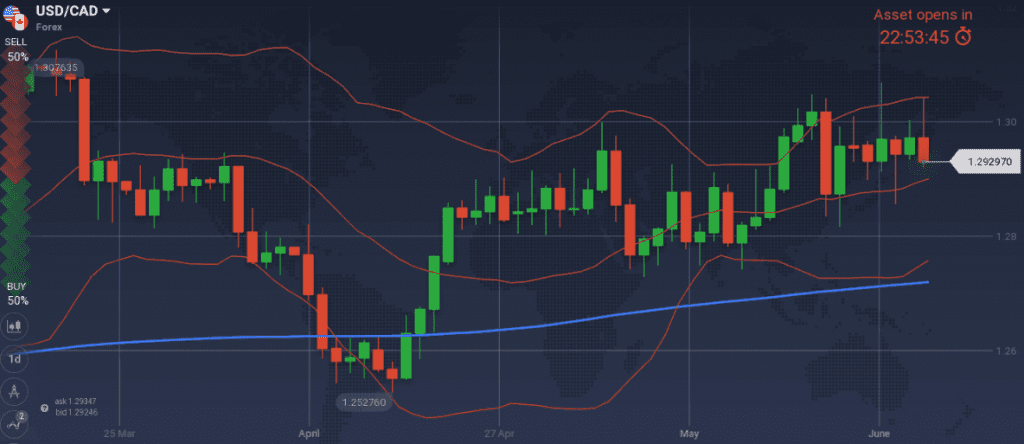

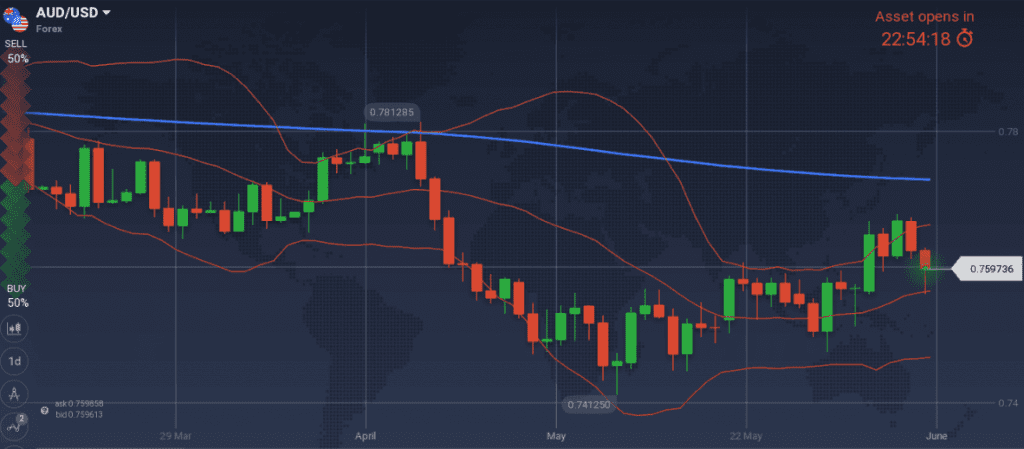

As too many things are at stake, and current market levels are not offering me wide enough deviations from my fair target levels, I will only offer my long bias towards AUD for the running week and a long idea for GBP. Previous week’s remarks played poorly. Besides my short EUR/JPY trade at 129.18 and 129.39 that turned green, no view was offered for USD, EUR, GBP, and the proposed levels of AUD/USD and USD/CAD were never triggered.

Major last week’s events:

- Korea: Nothing significant under my radar

- Tariffs front-Trade Tactics: As we passed the first week when no country was exempt from steel and aluminum tariffs, I found no new reaction from EU-Canada-Mexico-Japan. At G7 Leaders’ summit, there was no shared directive published other than the expressed will for EU and USA to establish a shared assessment and dialogue mechanism within the next two weeks. Meanwhile, ZTE (Chinese tech company) agreed on 1B $ fine, change of it’s board and US agents to monitor its operation, so that it is free to do business in USA and buy the much-needed American components.

- Iran Deal: Nothing new under my radar

- Italy: Italian Government bonds are rising again and their level next Friday, following ECB’s meeting will be decisive for the coloring of the big picture.

- Cryptos: Total market cap at 343B$, second week in a row that ended in the same level.

Major next week events:

- Tuesday’s USA-N.Korea Summit, scheduled to happen in Singapore

- FED’s Monetary meeting on Wednesday, ECB on Thursday and BOJ on Friday

JPY

I am expecting further JPY strengthening towards the end of the week and I would short EUR/JPY pair in the event 131.68 level is triggered.

Snapshot unchanged:

- Inflation (excluding food-National core CPI) at 0.7% (vs 2.0% target and BOJ’s members expectation of 1.2~1.3% within 2018), BOJ rate at -0.1%

- GDP at 1.10% annual, -0.2% q/q, 10Y Government bonds yield at 0.05% (0bps w/w) vs BOJ’s target of 0.00% level

- Unemployment at 2.5% (lowest levels since 1993)

Strengths of JPY:

- QQE set to stay in place up until 2020 or beyond. I want to see some confirmation at BOJ’s communication on Friday.

- High trade balance and increasing Current Account announced last week

- Increased PMI manufacturing and housing starts readings

- Next week’s announcements are expected to add to the improving macro picture

Weaknesses of JPY:

- latest negative GDP reading

Watch:

- Friday’s Monetary Meeting

CAD

Canada is running at full potential with balanced macroeconomic readings. My view is that from now on, the direction will be given by the uncertainties from trade policies and the Canadians reactions to new mortgage rules. The week contained readings in both fronts with mixed signals. On the one hand trade balance improved, on the other hand housing activity decreased more than was expected.

I keep my willingness to short USD/CAD in case 1.3138 level is triggered.

Unchanged Snapshot:

- Inflation at 2.2% (vs 1.0%~3.0% target range, expected to increase again in 2018), BOC rate at 1.25% (3 hikes so far). Note BOC’s confidence on neutral rate within 2.5%~3.5% range.

- GDP at 2.3% (vs BOC expectations of 2.0% in 2018 and long-term potential of 1.8%), 10Y Government bonds yield at 2.32% (+7bps w/w)

- Unemployment at 5.8% and expected to decrease further.

Strengths of USD/CAD, weakness of CAD:

- Uncertainty on trade policies

- deteriorating housing market

Weaknesses of USDCAD, strengths of CAD:

- I believe oil is set to move higher during 2018. Remember that the correlation between CAD was very volatile during the last couple of months, but now it stands at -0.8 (=oil and CAD move in the same direction) which is the relation most market participants are expecting

Watch:

- No market moving announcement expected during the week, other than FED’s meeting.

- Next Monetary Meeting on 11th of July.

AUD

Australian economy is moving fast, only thing that needs to be confirmed is housing consumption and AUD/USD should head North.

I would enter long AUD/USD in case 0.7547, 0.7526, 0.7498 levels are triggered.

Snapshot got better:

- Inflation at 1.9% (vs 2.0~3.0% target), RBA ‘s rate at 1.50% (no hike so far)

- GDP jumped to 3.1% (vs 2.4% previous reading. Remember that RBA was expecting 3.0% growth within 2018 and 2019), 10y Bond yields at 2.78% (+8 bps w/w)

- Unemployment at 5.6% but is expected to decline.

Strengths:

- significant increase of GDP reading

- improved business confidence, business profits and private capital expenditure

- China’s good performance

- the latest decreased trade balance reading was within expectations

Weaknesses:

- latest reading of wages growth, building approvals and new home sales do not support AUD strengthening. Anything that quantifies household consumption (credit growth, wage growth, private capital expenditure) should be carefully watched (two new readings are expected in that front)

Watch:

- Monday is a bank holiday in Australia, but M2 and new loans readings is published for China. I want to see increasing numbers for my long AUD scenario to hold

- Tuesday’s 2:30GMT home loans, Wednesday’s 2.30GMT Consumer confidence. I want to see increased numbers in both readings.

- Next Monetary Meeting on 3rdth of July

USD

The week includes FED’s meeting on Wednesday and markets are already pricing the second rate hike of 2018 despite the fact that both GDP growth and core PCE (=preferred measure of inflation followed by the FED) fell by 0.1% since the last meeting.

I am biased to see inflation rising, bond yields picking up and USD strengthening on the second half of 2018

Snapshot unchanged with Bonds picking up again:

- Inflation (Core PCE) at 1.8% (vs 2.0 target and 1.9% FED’s expectations), FED ‘s rate at 1.75%. 6 hikes so far in the business cycle and another 6 hikes expected by the end of 2019, to reach 3.25%. FED’s view of long run rate remains at 2.75%~3.00%

- GDP at 2.8% growth (FED expects 2.7% in 2018), 10y Bond yields at 2.95% (+5 bps w/w)

- Unemployment decreased further to 3.8%

Strengths of USD:

- strong PMI Manufacturing, PMI Services, Durable Goods orders, unemployment, non-manufacturing PMI

- 10y Government Bond yields are re-testing the 3.00% level

Weaknesses of USD:

- Tiny decrease of m/m home sales (-3%) and a consumer sentiment that is falling from March’s highs, when Americans were living the positive effects of the new tax law at their pockets. Latest Consumer Confidence bellow 128

- the tiny increase of m/m wholesale inventories can well be interpreted as a signal for the business cycle entering the downtrend. Falling GDP with rising prices seems to be the eventual outcome

- unit labor costs increased further

Watch:

- Monday’s 18:00GMT Auction of 10y Bonds. Latest auction yielded 3.00%

- Wednesday’s Bank’s Stress tests results. I am more interested to see the parameters used to describe the bad scenario, rather than the solvency numbers of banks in this scenario.

- Wednesday’s 19.00GMT FED’s Monetary Meeting.

- Thursday’s 15.00GMT Business Inventories. A reading above 0.3% m/m increase is alarming for the business cycle entering the downtrend, in my point of view.

EUR

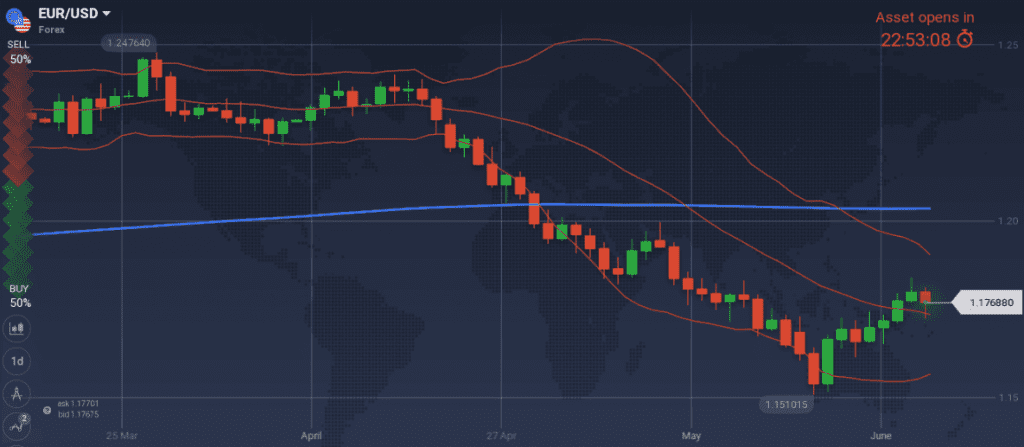

ECB’s communication so far has been for 30B EUR net purchases of bonds per month up until September 18 or beyond. As we are only 3 meetings away (this week, 26th of July and 13th of September) from September, a road map needs to be communicated.

The macroeconomic picture of Europe is good, Italian situation and the increasing yields does not worry me but on the other hand the business sentiment is getting worse and it is difficult for me to imagine what the new reality of imposed tariffs and retaliatory actions from EU would look like.

Snapshot unchanged, macros are mixed:

- Annual Core CPI Inflation increased to 1.1% (vs 2.0% target), ECB ‘s rate at 0.00%

- GDP at 2.5% growth (OPEC expects a 2.2% reading), 10y Bond yields of EFSF at -0.37% (-1bps w/w), 10y German Bond yields at 0.45% (+6bps w/w), 10y Italian Bond yield at 3.13% (+44bps w/w, +68bps in 2 weeks)

- Unemployment at 8.5%

Strengths of EUR/USD:

- increased M3 and inflation readings

- retail PMI back above the 50 thresholds

Weaknesses of EUR/USD:

- investor’s confidence plunged

- decreasing PMI Manufacturing and PMI Services readings

- the different point in the cycle between US and EU economy

Watch:

- Tuesday’s 10.00GMT Economic Sentiment reading

- Thursday’s 12:45GMT ECB’s decision and the subsequent press conference

GBP

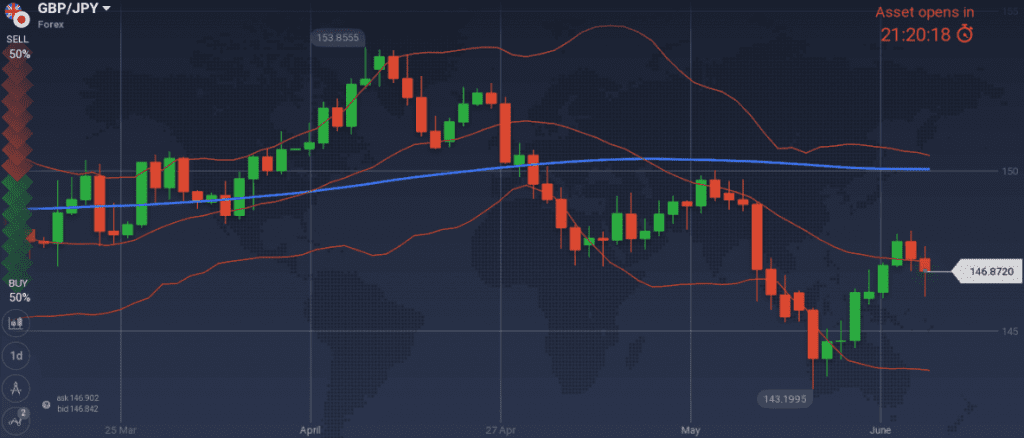

I could open long GBP/JPY positions in the event that Wednesday’s CPI reading is higher than 2.4% and the pair is trading well below 149.00 level.

Snapshot unchanged:

- Inflation at 2.4% (vs 2.0% target), BOE ‘s rate at 0.50% (no hike expected in 2018)

- GDP at 1.2% growth (vs 1.4% previously vs 1.5% OPEC’s estimates), 10y Bond yields at 1.39% (+11bps w/w)

- Record low unemployment at 4.2% (BOE expects to fall further in Q2)

Strengths:

- the bad weather narrative regarding UK’s economy in 1Q18 is proving true, as macros are improving

- retail sales, lending to individuals, M4, services PMI, Manufacturing PMI increased, Construction PMI maintained previous months reading

Weaknesses:

- decreasing inflation readings that postpone rate hikes (new releases expected during the week)

Watch:

- Tuesday’s 9:30GMT Average Earnings Index and Wednesday’s 9:30GMT CPI. I am expecting any increasing number to trigger a GBP rally

- Next Monetary Decision on 21 June.