Major last week’s events:

- Korea: US-North Korea summit is set. Pompeo (US Secretary of state) returned from North Korea with 3 US citizens that were released from North Korea’s prisons. Meanwhile, Kim (North Korea) met Xi (China) in China and Abe (Japan), Moon (South Korea) and Li (China’s premier) met in Tokyo. Note that China was not represented by President Xi Jinping, but rather by Premier Li Keqiang at the Tokyo meeting.

- Tariffs front: No news under my radar.

- NAFTA Talks: Restarted on Monday. Intellectual property, dairy, agriculture, energy and labor standards are the issues. The low wages of Mexican auto workers seem to worsen the chances of a deal. If deal is not achieved within the week, talks will drag forever.

- Iran Deal. On Tuesday Trump announced that USA is out of the deal and new sanctions are set to be imposed. Trump’s administration stated that all companies from allied countries will have a 6 to 9 months period to move out of Iran. Also advised countries to step down from importing oil from Iran if they want to be exempt from imposed tariffs. On Thursday, the world learned that Iran launched missiles from Syria to Israel and Israel responded.

- A possibility of snap elections in Italy, to resolve the stalemate, is getting higher.

- Cryptos: Total market cap at 374B$, -19% from previous week. Worth noted that on Monday 7th of May, there were news quoting both Warren Buffet and Bill Gates believes that they would short Bitcoin if they had an appropriate instrument to do it.

It was a low trading activity week for people that read my forecasts:

- Advised levels to add short positions at EUR/JPY and EUR/USD were not triggered.

- USD/CAD bounced 30 pips away from my advised level of 0.27 and we could not take advantage of it.

- Entering long AUD/USD at 0.7475 at 0.7440 plaid well

- No position taken on GBP, given the poor numbers before Thursday’s BOE meeting.

Major next week events:

- OPEC’s monthly report

- EU Summit on Thursday. Possibly JCPOA Joint Comprehensive Plan of Action with Iran and Greece will be discussed

- UK’s Royal Wedding on Saturday

JPY

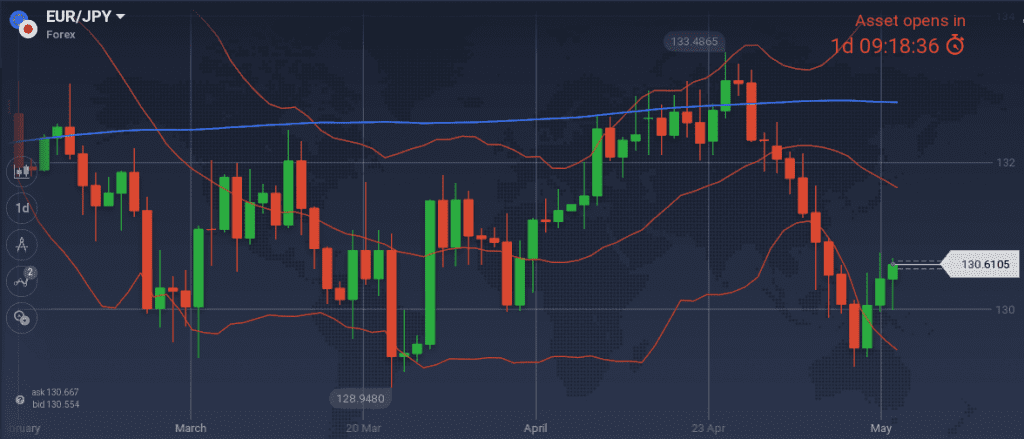

I still want to short EUR/JPY, but I am only adding positions at 131.73 and131.92 levels.

Snapshot Unchanged:

- Inflation (excluding food-National core CPI) at 0.9% (vs 2.0% target), BOJ members expect a reading of 1.2~1.3% within 2018, BOJ rate at -0.1%

- GDP at 2.0% annual, 0.4% q/q, 10Y Government bonds yield at 0.05% (+1bps w/w) vs BOJ’s target of 0.00% level

- Unemployment at 2.5% (lowest levels since 1993)

Strengths of JPY:

- QQE could stay in place up until 2020 or beyond. It will take time to change the attitudes of Japanese firms so that they start increasing the wages and their prices, and thus putting pressure to inflation

- Increased Current Account

Weaknesses of JPY:

- Equities seem to have found their support, following the high volatile February

- Weak readings expected during the week

Watch:

- Wednesday’s 0.50GMT GDP reading, Thursday’s core machinery orders and Friday’s national core CPI. Market expects decreasing numbers that do not help the short EUR/JPY scenario.

- Next Monetary Meeting on 15th of June

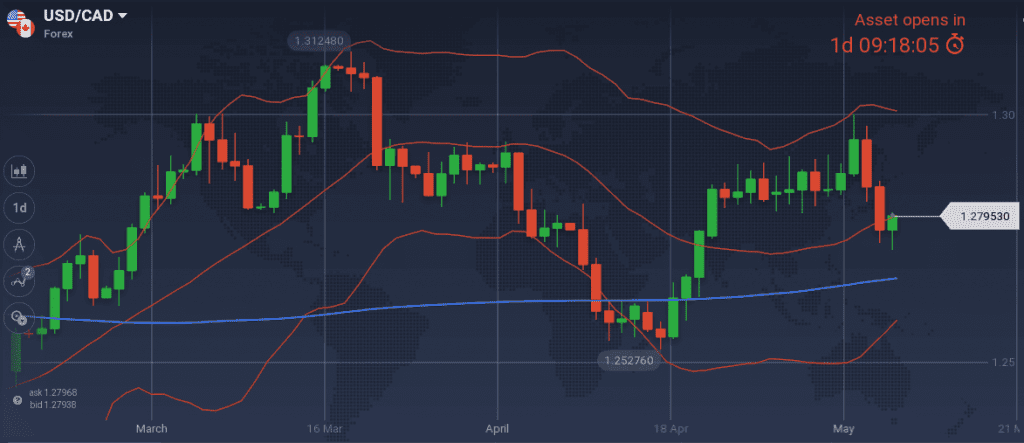

CAD

I can offer no view for this week’s move. Increased lending is what I want to see, to speculate on next rate hike.

During last week, NAFTA negotiations have not concluded, and market consensus was that if a deal is not reached within Thursday, negotiations would need to stop for Mexican elections and then wait for November’s US midterm elections.

Snapshot Unchanged:

- Inflation at 2.3% (vs 1.0%~3.0% target range), BOC rate at 1.25% (3 hikes so far). Note BOC’s confidence on neutral rate within 2.5%~3.5% range.

- GDP at 2.9% annual (near potential GDP), 0.4% qoq, 10Y Government bonds yield at 2.38% (+5bps w/w)

- Unemployment at 5.8% and expected to decrease further.

Strengths of USD/CAD, weakness of CAD:

- Terms of trade (latest reading -4.1B CAD) favors USD

Weaknesses of USD/CAD, strengths of CAD:

- high oil prices. Note that the correlation between CAD and oil, used to be positive and strong in the past (i.e. both moved with the same direction). During the last weeks, it fell to insignificant levels (0.15), turned negative and now is significantly negative (at -0.62). So the argument is not strong.

Watch:

- Manufacturing sales and Inflation readings are scheduled to be released this week. But as economy is growing with near potential output growth, I cannot generate any new idea for trading CAD

- Next Monetary Meeting on 30th of May

AUD

0.7475 proves to be the level where AUD/USD reversal is happening. The level was retriggered, and positions taken at 0.7475 and 0.7440 are already green. More long positions could be taken at 0.7485 (if the level is re-triggered)

Snapshot Unchanged:

- Inflation at 1.9% (vs 2.0~3.0% target), RBA ‘s rate at 1.50% (no hike so far)

- GDP at 2.4% growth (3.0% could be achieved within 2018 and 2019 according to RBA), 10y Bond yields at 2.78% (+1bps w/w)

- Unemployment at 5.5% and expected to decline further

Strengths:

- improved trade balance and increased building approvals

- improved business confidence published last Monday

Weaknesses:

- household consumption is a source of uncertainty. Anything that quantifies household consumption (credit growth, wage growth, private capital expenditure) should be noted in the coming months

Watch:

- Wednesday’s 2.30GMT Wage price index reading. I want to see a number higher than 0.6% for my long AUD/USD scenario to be valid

- Thursday’s 2.30GMT Employment change and Unemployment reading. Market expects a high reading of 20.3K new jobs and I want to see something better than that.

- Next Monetary Meeting on 5th of June

USD

Before focusing to US economy keep in mind that USA is concurrently concerned with Nafta, China trade war, Russia sanctions, EU/Canada/Mexico aluminum and steel tariffs exceptions, Japan tariffs exceptions, North Korea nuclear program, Iran sanctions. Within two years, USA is out of Paris Climate Agreement, TPP (Trade deal between Japan, Australia, New Zealand, Canada, Mexico, Singapore, Malaysia, Vietnam, Chile, Peru, Brunei) and now JCPOA (Iran deal).

At the same time, China is enjoying amazing imports growth (+21%), exports growth (+12%) and increasing trade balance to 28.8B$ per month. Inflation seems contained at 1.9% and loan’s growth looks healthy.

On the other hand, USA is also looking good. Latest auction for its 10y bonds yielded 3.0%, latest core CPI m/m growing at a decreasing level of 0.1%, consumer sentiment is stuck on the roof.

Exiting USD long positions at current levels was my advice last week and the weekly doji of USD index proved me correct. Same advise this week. The long USD bet is turning overcrowded.

Snapshot:

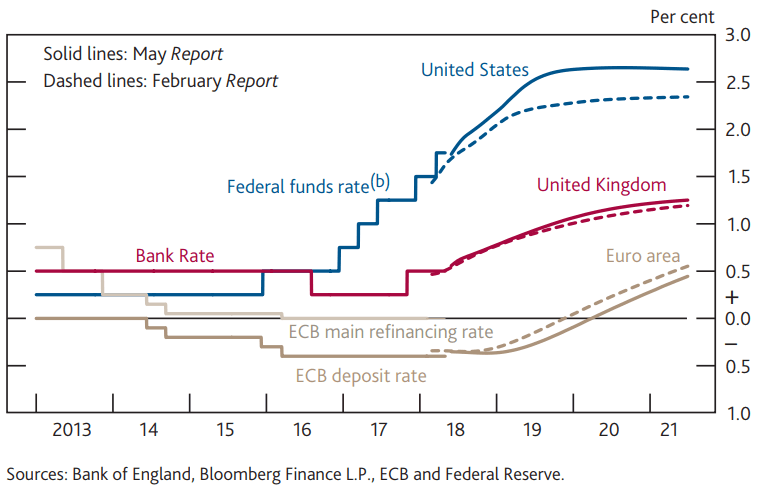

- Inflation (Core PCE) at 1.9% (vs 2.0 target and 1.9% FED’s expectations), FED ‘s rate at 1.75%. 6 hikes so far and another 6 hikes expected by the end of 2019 to reach 3.25%. FED’s view of long run rate remains at 2.75%~3.00%

- GDP at 2.9% growth (FED expects 2.7% in 2018), 10y Bond yields at 2.97% (+2bps w/w)

- Unemployment at 3.9% and expected to fall to 3.8% in 2018

Strengths of USD:

- strong macros, increasing bond yields

- geopolitical risk

Weaknesses of USD:

- protectionism

- increasing oil prices

Watch:

- Outcome of Nafta deal.

- No market moving announcement is expected. I will note down the Tuesday’s retail sales and inventories readings, Wednesday’s housing starts and capacity utilization rate to keep my feel on US economy

- Next Monetary Meeting on 13th of June.

EUR

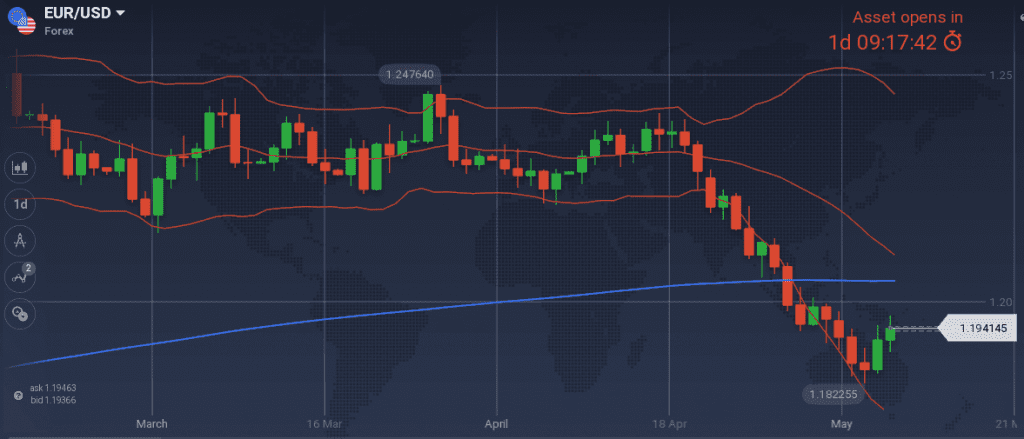

Last Wednesday’s Germany’s 30y bond auction that resulted in 1.26% yield, way higher than my 1.15% threshold, was a significant alarm to exit from the short EUR/USD scenario. Shorting EUR/USD has been my position since the 12th of February but at current levels it is not worth keeping it.

I would re-enter short at 1.2040 and 1.2080 (last week’s noted level).

Snapshot:

- Annual Core CPI Inflation fell to 0.7% on April (vs 2.0% target), ECB ‘s rate at 0.00%

- GDP at 2.5% growth, 10y Bond yields of EFSF at -0.40% (+0bps w/w)

- Unemployment at 8.5%

Strengths of EUR/USD:

- latest yield increase of 30y Germany’s bonds

Weaknesses of EUR/USD:

- possibility of snap elections in Italy that would either result into a continuation of current deadlock or an irresponsible government with populists.

- the different point in the cycle between US and EU economy

Watch:

- Watch Tuesday’s GDP and Economic Sentiment, Wednesday’s yield of 10y German Bond, Friday’s Current Account and Trade Balance. I am expecting to see readings in favor of EUR so all short EUR/USD positions are off for the week.

- Next Monetary Meeting on 14th of June

GBP

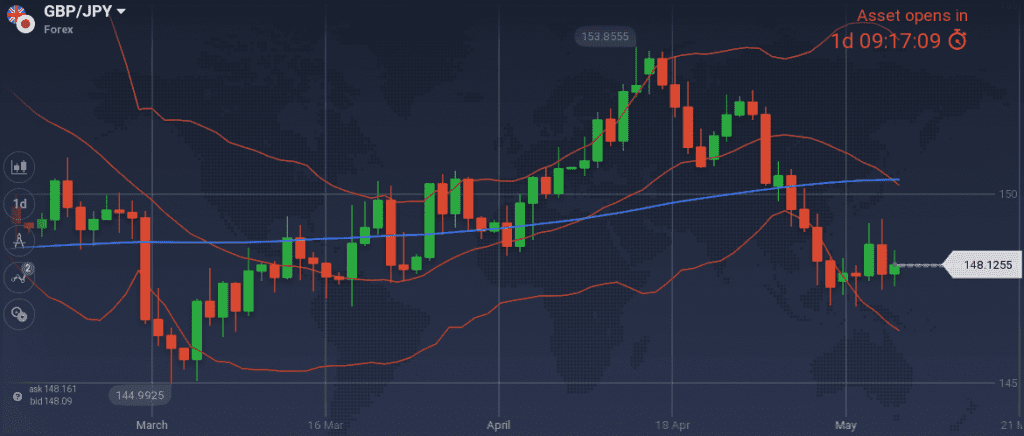

Manufacturing Production, Goods trade balance, Construction, Retails Sales, Housing Prices, all readings where unfavorable for UK’s Economy. Yet, the Report of the Bank of England that followed Thursday’s Monetary Meeting gives me enough reasons to restart searching for long opportunities on GBP.

Possible levels to build a long GBP/JPY position are 147.67, 147.00 and 146.80

Snapshot:

- Inflation at 2.5% (vs 2.0% target), BOE ‘s rate at 0.50% (no hike expected in 2018)

- GDP at 1.2% growth (vs 1.4% previously), 10y Bond yields at 1.44% (+4bps w/w)

- Record low unemployment at 4.2% (BOE expects to fall further in Q2)

Strengths:

- the bad weather narrative regarding UK’s economy in 1Q18 may prove to be true.

- inflation and unit labor costs are expected to rise again, before falling back

Weaknesses:

- disappointing macroeconomic announcements

Watch:

- Tuesday’s average earnings and unemployment readings. I want to see a number above 2.7% and equal or below 4.2% respectively, for my scenario to be valid

- Next Monetary Decision on 21 June.