Worst place to be for an analyst is behind the curve. Before starting this 20 week’s long report, I tried hard to avoid being the anecdotal definition of Economist. The one that accurately describes today what has happened yesterday that made the past predictions fail.

Having passed a long period while my predictions were on spot, followed by a period that the market moved further while I was arguing in favor of consolidation, I am experiencing the awful feeling of being behind the curve.

The high bond yields – high tension environment, eventually followed by equities falling and volatility picking up. But this realization is worthless, while just a week ago, I was declaring that I was wrong arguing for equity sell off and volatility increasing.

Inflation seems contained. My main scenario that would trigger equities falling and safe haven assets increasing (USD, JPY) is off the table for the rest of 2018.

Trump’s agenda seems more real that was initially priced. On the positive side of the moon, tax law and fiscal expansion is a reality for the last 6 months. On the dark side of the moon, tariffs that started with too many exemptions and seemed rhetoric, now are real. And the only way to price in tariffs taking effect is by expecting a shrinking GDD. A 1.5% downwards revision of Global GDP from today’s 3.9% number is within the range of possible outcomes.

Major last week’s events:

- Korea, Iran: No news under my radar

- Tariffs front-Trade Tactics: The 50B$ worth of tariffs announced last Friday by US, is real. China’s Ministry of Commerce characterized US move as blackmail and extreme pressure. Remember that additionally 400B$ imports are threatened to be taxed and China could tax US autos. On Friday it was EU’s turn to announce retaliatory tariffs on US imports. Remember that US Congress has blocked ZTE deal, the foundational first step of previous weeks’ US-China understanding.

- US transformation: Following Paris Agreement on climate, Nafta, TPP, Iran deal, USA withdrew from UN’s Human Rights Council on Tuesday. I’ve had enough of believing that all rhetoric is part of a maximal approach of a deal maker that would eventually settle for what is productive. This is the real agenda of someone who seeks concentration of power, is morally unfit to run a country (as former FBI chief James Comey quoted) and regards all kind of unilateral agreements as decreasing his degrees of freedom. The realization of US transformation is more of a disclaimer to my readers, so that they filter my views with the correct lenses.

- Cryptos: Total market cap at 255B$, -9% w/w, -28% in the last two weeks

Major next week events:

- Look for next episodes of Tariffs drama.

- Sunday’s elections in Mexico

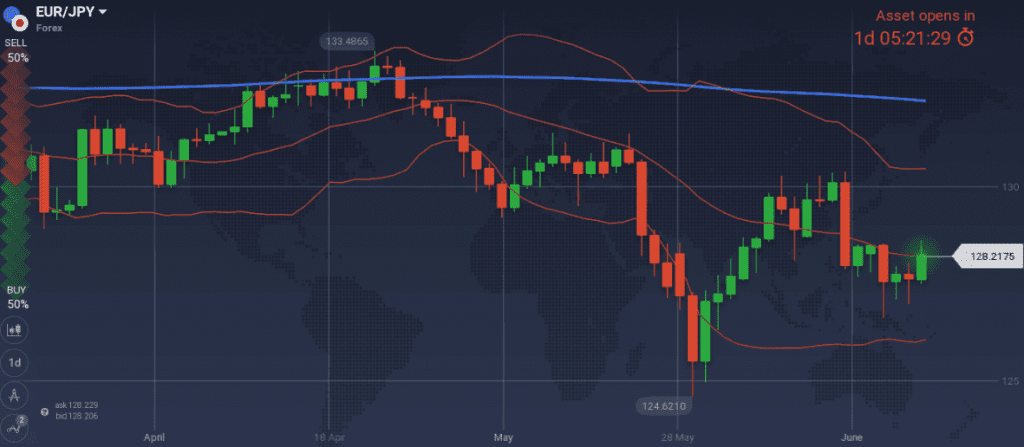

JPY

I keep my short bias on EUR/JPY and want to enter at 129.10 and 129.88 levels.

Snapshot unchanged:

- Inflation (excluding food-National core CPI) at 0.7% (vs 2.0% target and BOJ’s members expectation of 1.2~1.3% within 2018), BOJ rate at -0.1%

- GDP at 1.10% annual, -0.2% q/q, 10Y Government bonds yield at 0.04% (+0bps w/w) vs BOJ’s target of 0.00% level

- Unemployment at 2.5% (lowest levels since 1993)

Strengths of JPY:

- QQE up until core CPI (now at 0.7%) is above 2.0% in a stable manner

- increasing Manufacturing PMI at 53.1

- any turbulence in financial markets favors JPY as it enjoys safe haven status

Weaknesses of JPY:

- latest negative GDP reading and Trade Balance reading at -0.30T ¥

Watch:

- no market moving announcement under my radar.

- any news regarding the level of agreed wage increases in big Japanese corporation should be noted. Governor Kuroda would love to see a 3% level.

- next Monetary Policy meeting on 31 July.

CAD

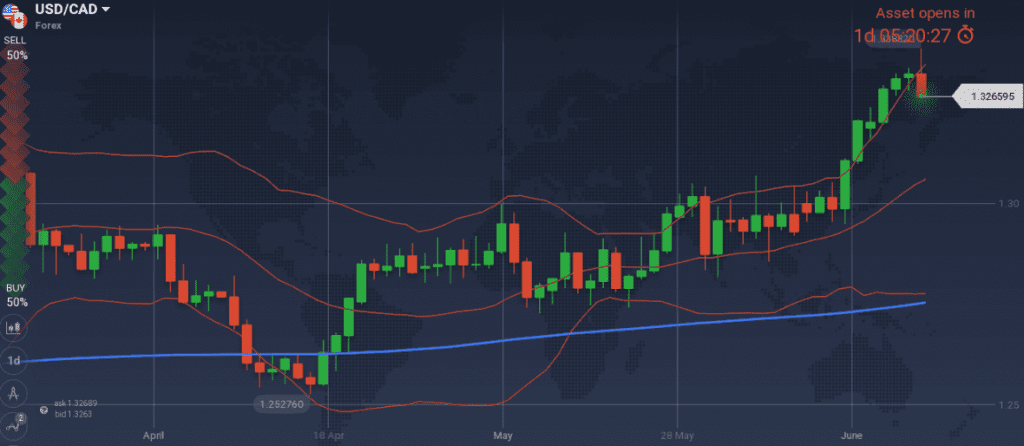

I keep my short USD/CAD position.

On Friday while everyone was watching for the OPEC’s decision and the realization of EU’s retaliatory response on tariffs, the pair has finally started moving south. Worth-noted that Friday’s unexpectedly low inflation reading announcement could not sent the pair higher. USD/CAD rallied for 10 minutes but eventually moved lower.

Snapshot is getting worse:

- Inflation at 2.2% (vs 1.0%~3.0% target range, expected to increase again in 2018), BOC rate at 1.25% (3 hikes so far). Neutral rate within 2.5%~3.5% range according to BOC.

- GDP at 2.3% (vs BOC expectations of 2.0% in 2018 and long-term potential of 1.8%), 10Y Government bonds yield at 2.13% (-9bps w/w)

- Unemployment at 5.8% and expected to decrease further.

Strengths of USD/CAD, weakness of CAD:

- latest inflation month on month decreasing reading. Note that the annual inflation of 2.2% only looks unchanged because it has not yet been calculated.

- deteriorating housing market, decreased manufacturing sales

Weaknesses of USD/CAD, strengths of CAD:

- Correlation between oil and USD/CAD stands at -0.79. OPEC’s decision, of bringing compliance from 120% back to 100%, with an additional 1MBpd production under further negotiations between countries that have not the capacity to raise and countries that are able to raise, translates to +0.4MBpd~ +0.6MBpd production. The number was small enough to send oil prices higher.

- USD/CAD has become even more expensive, formed a reversal pattern and has the potential of heading all the way to 1.3150 ~1.3065

Watch:

- Friday’s 13.30GMT GDP reading. I number above 0.3% is what I want to see

- Next Monetary Meeting on 11th of July.

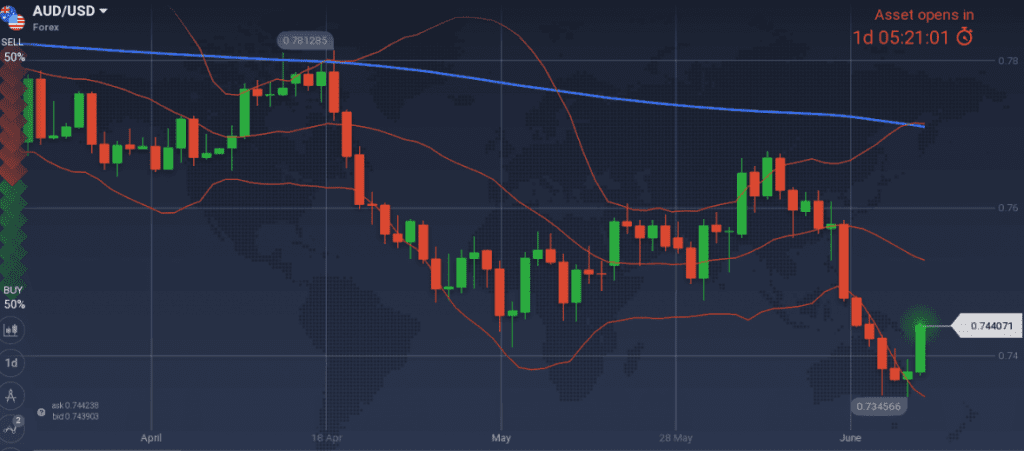

AUD

Australian economy is moving fast. I am still confident that my long AUD/USD bias will pay off and that 0.7680 level will be reached within summer.

Anything that quantifies household consumption (credit growth, wage growth, private capital expenditure) should be carefully watched. RBA’s governor explicitly argued in favor of growing wages (3% growth would be the magic number) rather than growing debt, to increase inflation.

Rosy Snapshot unchanged:

- Inflation at 1.9% (vs 2.0~3.0% target), RBA ‘s rate at 1.50% (no hike so far)

- GDP at 3.1% (RBA expects 3.0% within 2018 and 2019), 10y Bond yields at 2.65% (-4 bps w/w)

- Unemployment at 5.4%

Strengths:

- significant increase of GDP reading

- improved business confidence, business profits and private capital expenditure

- improved consumer confidence and home loans to Australians

Weaknesses:

- latest reading of wages growth, building approvals and new home sales do not support AUD strengthening.

- latest readings from China (fixed asset investments, industrial production, retail sales) were decreasing.

Watch:

- Friday’s New Home Sales announcement. An increasing number is what I want to see.

- Next Monetary Meeting on 3rdth of July where no hike is expected.

USD

Last week’s view that further continuation of USD strengthening is unlikely, and levels need to be retested proved correct. I keep my long USD bias but still cannot pick a level or a triggering event that would make me enter the market.

Any reasonable decreased reading of confidence, consumer sentiment, personal spending can now be interpreted as something good for a sustainable growing US economy, as they do not fuel inflation, and not as something that postpones future rate hikes.

Snapshot unchanged:

- Inflation (Core PCE) at 1.8% (vs 2.0 target and 2.0% FED’s expectations), FED ‘s rate at 1.95% (IOER) expected to reach 3.1% within the cycle. FED’s view of long run rate at 2.9%

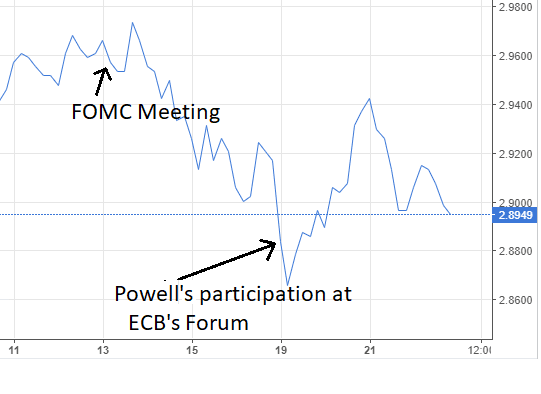

- GDP at 2.8% growth (same as FED’s expectations), 10y Bond yields at 2.89% (-3 bps w/w)

- Unemployment decreased further to 3.8% (vs natural rate of unemployment of 5.1% in 2015, 4.7% in 2017, 4.5% in 2018 that could well decrease further) FED expects 3.6% unemployment in 4Q18 and 3.5% for 2019 and 2020.

Strengths of USD:

- strong macros: Durable Goods orders, unemployment, retail sales, housing market

- Central Bank is keep on raising the natural rate of unemployment as participation increases

Weaknesses of USD:

- it’s been 6 trading days after FED’s meeting, 3 trading days after Powell restating that the current rate is 100bps below the natural rate at the ECB’s forum, and yet the 10y Government Bond yields have not passed the 3.00% threshold

- Any signal that we are at the peak of the cycle, like the rising inventories

- PMI Manufacturing & Services decreased slightly from the last highs

Watch:

- Tuesday’s 14.00GMT Consumer Confidence release

- Wednesday’s 13.30GMT Wholesale Inventories. A likely higher reading puzzle me

- Thursday’s 13.30GMT GDP release.

- Next Monetary Meeting on 1st of August

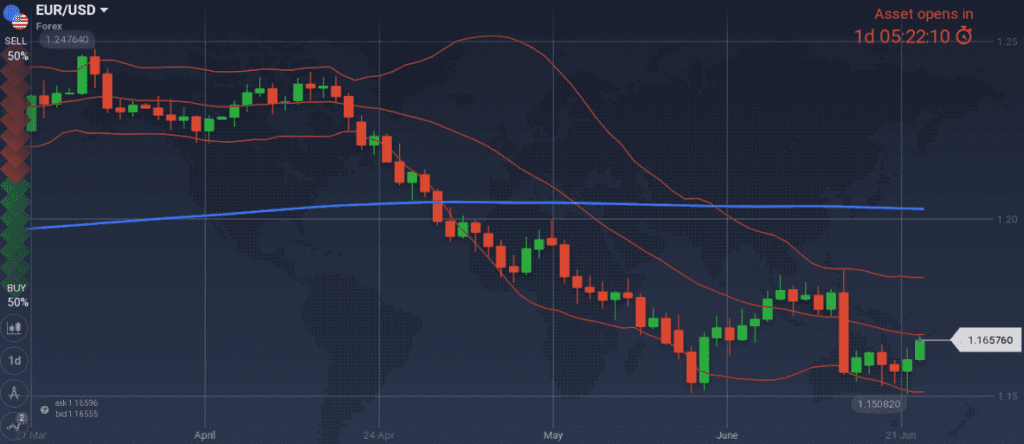

EUR

The macroeconomic picture is mixed and described in one word, unchanged. On the one hand, one may note the healthy levels of GDP growth, PMI readings and Draghi’s conviction that inflation expectations are well anchored, but on the other hand all kind of confidence / sentiment readings are alarmingly decreasing.

Last week I was pointing to my short EUR/USD bias. I keep the same view and could enter when 1.1750 is retested.

Worth-noted the low liquidity expected on CAC contracts on Tuesday and the DAX contracts on Wednesday as France and Germany are playing at FIFA World Cup. Range trading is what generally happens under such circumstances.

Snapshot unchanged:

- Annual Core CPI at 1.1% (vs 2.0% target), ECB ‘s rate at 0.00%

- GDP at 2.5% growth (OPEC expects a 2.2% reading), 10y Bond yields of EFSF at -0.37% (+0bps w/w), 10y German Bond yields at 0.34% (-6bps w/w), 10y Italian Bond yield at 2.69% (+8bps w/w, almost +24bps in 3 weeks since the political crisis)

- Unemployment at 8.5%

Strengths of EUR/USD:

- increased M3 and inflation readings, retail PMI above the 50 threshold, Manufacturing PMI and Service PMI at high and growing levels

- increasing oil prices. Correlation between oil and EUR/USD at 0.48

Weaknesses of EUR/USD:

- investor’s confidence and economic sentiment decreasing

- current account decreased by 15% mom (from 32.8B€ to4B€)

- the different point in the cycle between US and EU economy

Watch:

- Monday’s 09.00GMT Business Climate

- Wednesday’s 09.00GMT M3 reading

- Friday’s 10.00GMT CPI readings

- Next Monetary Meeting on 26 July. Nothing significant is expected

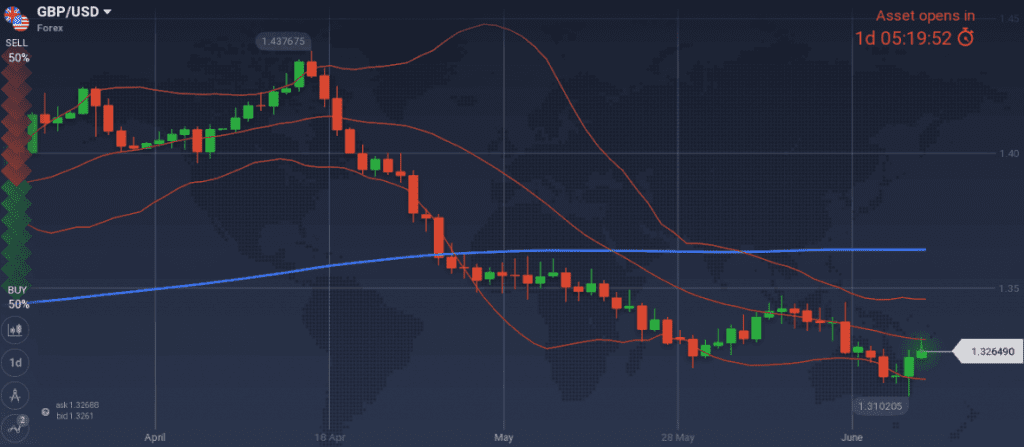

GBP

Bank of England left an optimistic flair for UK’s economy, restated that it expects an excess demand growth by 2020 that would fuel inflation and restated the bad weather narrative regarding 1Q18. Worth noted that there are now 3 members of BOE voting for rate hike instead of 2, of previous meetings.

Snapshot unchanged:

- Inflation at 2.4% (vs 2.0% target), BOE ‘s rate at 0.50% (no hike expected in 2018)

- GDP at 1.2% growth (1.5% OPEC’s estimates vs 1.75% BOE’s expectations), 10y Bond yields at 1.32% (-1bps w/w)

- Record low unemployment at 4.2% (BOE expects to fall further in Q2)

Strengths:

- the bad weather narrative needs to be supported by stronger macros

- strong industrial orders expectations

Weaknesses:

- latest retail sales, average earnings, manufacturing production, construction was disappointing.

- Inflation at 2.4% expected to pick up again. Yet this has not materialized

Watch:

- Friday’s 09.30GMT releases. Current Account, GDP, M4. I expect positive surprises that could send GBP higher