Major last week’s events:

- Korea: The summit between the two countries (North and South Korea) happened in good-natured atmosphere

- Tariffs front: restated news-good news. China is about to lower import taxes on cars from current 25% to 10 or 15% as early as June 2018

- Macron and Merkel visited Trump. Disengagement of USA from Syrian war, saving Iran’s deal (current deal ends on the 12th of May), Climate Change, and the expiration of the EU exception from steel and aluminum tariffs were most probably discussed.

- Cryptos: Total market cap increased to 416B as bigger financial firms are set to trade cryptos within the next 3 to 6 months and as Nasdaq could become a cryptocurrency exchange.

Last’s week’s forecasts played well:

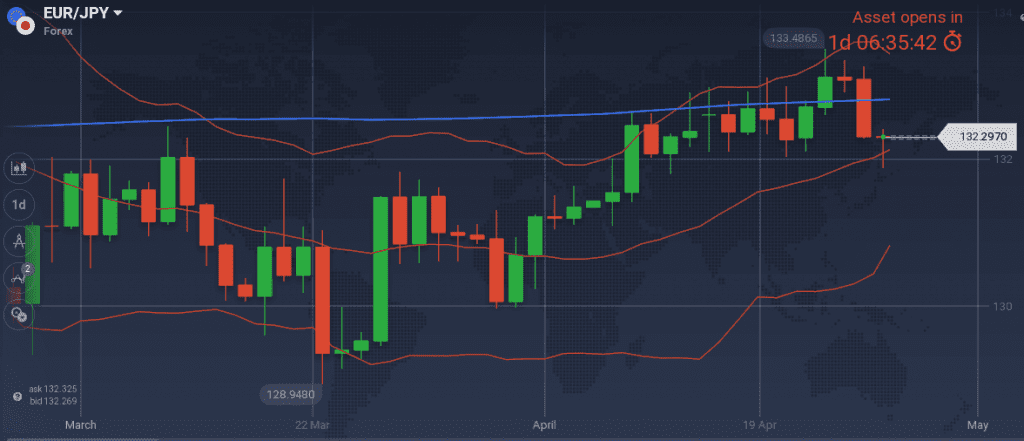

- Adding a short EUR/JPY position following ECB’s press conference paid off. The pair was trading far above my noted threshold of 131.88 and one could easily enter short.

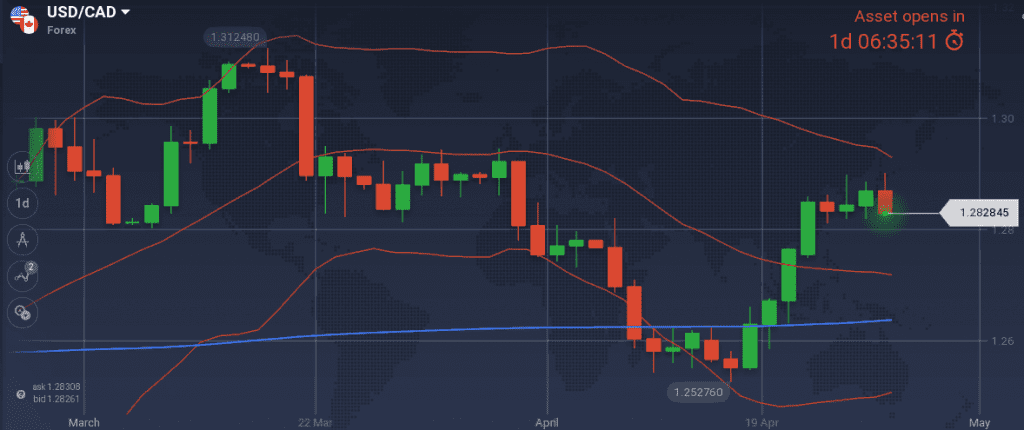

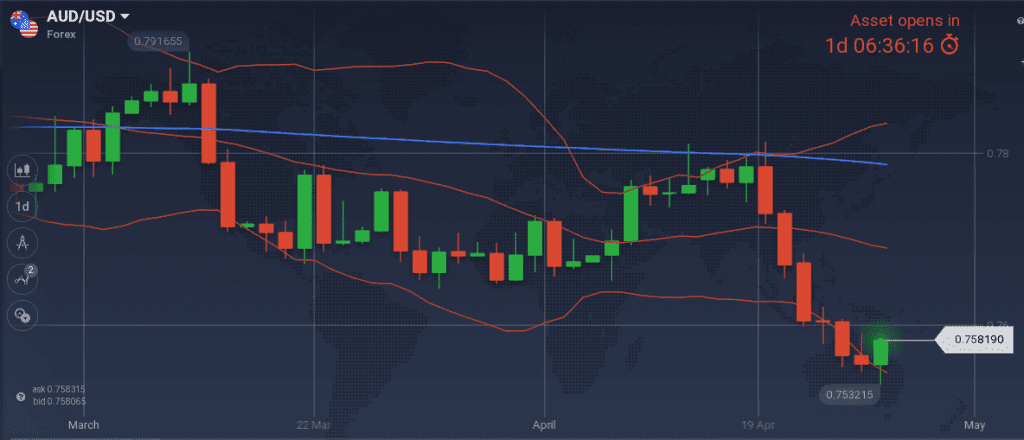

- No forecast was made for USD/CAD or AUD/USD

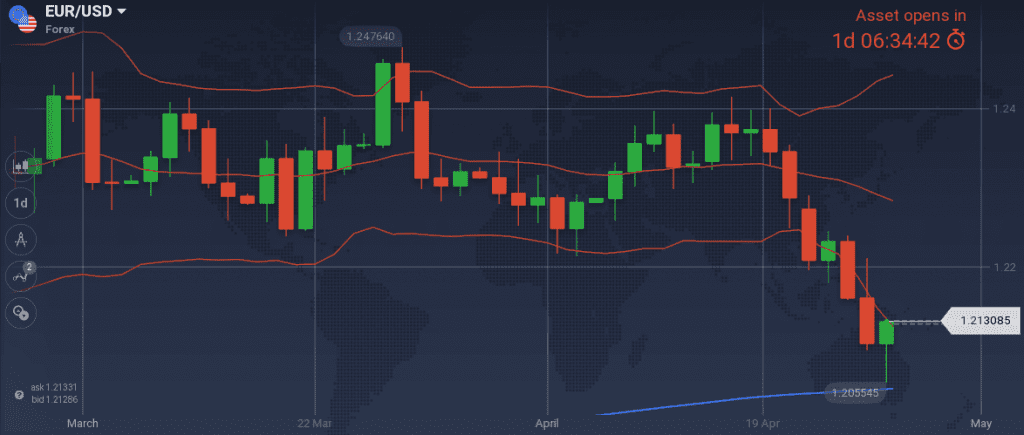

- My short bias on EUR/USD was correct, yet no entry point was advised.

- Closing all long GBP positions was the correct thing to do.

Major next week events:

- Thursday’s 13:30 GMT, US Preliminary Unit Labor Costs. Remember that the previous reading published on February set the beginning of the equity sell-off

- Monetary Meetings of FED (USA on Wednesday), Norges Bank (Norway on Thursday) and RBA (Australia on Friday)

- US trade team (Mnuchin, Lighthizer, Kudlow and Navarro may visit China on Thursday.

JPY

Bank of Japan’s Monetary meeting, left policy unchanged. Rates at -0.1%, 10Y bonds yield controlling at 0.0% and maintaining QQE at 80T¥ per year (=50B€ per month), plus 6T¥ ETFs annual purchases (=3.8B€ per month) plus 90B¥ REITs annual purchases (=0.05B€ per month) which is 53.85B€ per month in total.

On the other hand, the format of the released documents was completely changed, giving worth reading insights on Japan’s economy.

I keep my short EUR/JPY bias and add positions at 132.60~132.74 levels.

Snapshot:

- Inflation (excluding food-National core CPI) at 1.0% (vs 2.0% target), BOJ members expect a reading of 1.2~1.3% within 2018, BOJ rate at -0.1%

- GDP at 2.0% annual, 0.4% q/q, 10Y Government bonds yield at 0.06% (+0bps w/w) vs BOJ’s target of 0.00% level

- Unemployment at 2.5% (lowest levels since 1993)

Strengths of JPY:

- QQE could stay in place up until 2020 or beyond. It will take time to change the attitudes of Japanese firms so that they start increasing the wages and their prices, and thus putting pressure to inflation

Weaknesses of JPY:

- decreasing of bank lending

Watch:

- Monday, Thursday and Friday is Bank Holiday

- Wednesday’s 0:50GMT Monetary Base y/y release. I want to see a number above 9.2%

- Next Monetary Meeting on 15th of June

CAD

I believe that USD/CAD is set to range between 1.2695 and 1.3150 levels in the coming months.

Canada’s economy is running near it’s potential within macroeconomic targets. I am thinking of building a long position at 1.2690~1.2700 levels, but first I want to see some news regarding the Nafta deal, before executing this idea. Increased lending is what I want to see, to speculate on next rate hike.

Snapshot:

- Inflation increased at 2.3% (vs 1.0%~3.0% target range), BOC rate at 1.25% (3 hikes so far). Note BOC’s confidence on neutral rate within 2.5%~3.5% range.

- GDP at 2.9% annual (near potential GDP), 0.4% qoq, 10Y Government bonds yield at 2.32% (-2bps w/w)

- Unemployment at 5.8% and expected to decrease further.

Strengths of USD/CAD, weakness of CAD:

- Terms of trade favoring USA

Weaknesses of USD/CAD, strengths of CAD:

- high oil prices. Yet the correlation with CAD decreased further to 0.15 (from 0.63) pointing that the idea of trading CAD and thinking of oil is not right

- possible Nafta deal within this week or next week.

Watch:

- Tuesday’s 13:30GMT GDP release and 14:30GMT Manufacturing PMI release. A reading below 0.3% m/m growth and bellow 55.7 favors long USD/CAD scenarios

- Thursday’s 13:30GMT Trade balance. I want to see a lower than -2.7B CAD number, for my long USD/CAD scenario to be valid.

- Next Monetary Meeting on 30th of May

AUD

As we are heading to Tuesday’s Monetary Meeting, AUD/USD has decreased a lot and potentially becomes attractive.

Snapshot:

- Inflation at 1.9% (vs 2.0~3.0% target), RBA ‘s rate at 1.50% (no hike so far)

- GDP at 2.4% growth (2.8% was 2017 reading), 10y Bond yields at 2.82% (+2bps w/w)

- Unemployment fell back to 5.5% and expected to decline further

Strengths:

- all weaknesses are priced at 0.7526, 0.7426 levels. 0.7526 has already been tested. I consider 0.7475 and 0.7426 levels, buying opportunities.

- expected improved trade balance and increased building approvals

Weaknesses:

- the downtrend was significant and catching a falling knife creates anxiety. Reading the Central Bank’s (RBA) press release is important.

Watch:

- Tuesday’s 5:30GMT Monetary meeting. Markets are expecting the first-rate hike no earlier than the first half of 2019

- Thursday’s 2:30GMT Trade Balance and Building Approval readings. Both releases are expected to show increased readings and could trigger a move north.

USD

My long bias on USD played well. If it hadn’t been for the Friday’s US session with the release of latest GDP q/q at 2.3%, USD was getting stronger throughout the whole week. PMI Manufacturing and Service readings, Home Sales, Consumer Confidence were higher than market’s expectations and my last week’s published thresholds.

I am keeping my long bias as we are heading to this week’s FOMC meeting (Monetary meeting of the FED).

Snapshot:

- Inflation (PCE) at 1.6% (vs 2.0 target and 1.9% FED’s expectations), FED ‘s rate at 1.75%. 6 hikes so far and another 6 hikes expected by the end of 2019 to reach 3.25%. FED’s view of long run rate remains at 2.75%~3.00%

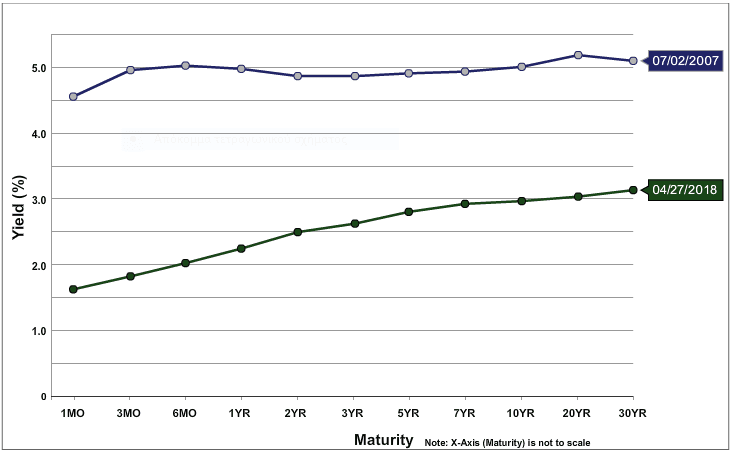

- GDP at 2.9% growth (FED expects 2.7% in 2018), 10y Bond yields at 2.96% (+0bps w/w)

- Unemployment at 4.1% and expected to fall to 3.8% in 2018

Strengths of USD:

- strong macros, increasing bond yields

- geopolitical risk

Weaknesses of USD:

- protectionism, although I should note the absence of new episode in that front and Draghi’s quote (Governor of ECB during the latest press conference) that “protectionism is now rhetoric, almost rhetoric”

- increasing oil prices

Watch:

- Monday’s 13:45GMT Core PCE reading. Higher than 0.2% strengthens my scenario

- Tuesday’s Vehicles sales. I want to see higher than 17.1M to strengthen my scenario

- Wednesday’s 19:00GMT Monetary Meeting. Market expects the next rate hike on 13 June meeting, but the increase of Government yields may accelerate things

EUR

The title for current week’s report was taken from Draghi’s press conference. Steady hand, patience, prudence, caution. ECB could not have changed its communication to become more hawkish, as latest readings of European economy are pointing to a decreasing momentum.

ECB left rates unchanged and offered no clue for the road-map on potential tapering, following current QE (Currently QE stands at 30B €/ month net bond purchases and ends on September 2018). Worth noted, the remarks of Vito Constancio, on broadening the target rate of ECB to a wider set of rates, to make the transmitting mechanism of ECB’ monetary policy, more efficient.

I am keeping my short bias towards EUR/USD.

Snapshot:

- Core CPI Inflation at 1.0% (vs 2.0% target), ECB ‘s rate at 0.00%

- GDP at 2.7% growth, 10y Bond yields of EFSF at -0.43% (-1bps w/w)

- Unemployment at 8.5%

Strengths of EUR/USD:

- slight increase of latest Service PMI reading at 55 (from 54.9)

Weaknesses of EUR/USD:

- Straight forward recommendation from Paul Thomsen (IMF) for continuation of very accommodating monetary policy in EU

- the different point in the cycle between US and EU economy is becoming evident

- decreased Business Sentiment, decreased Manufacturing PMI readings, decreasing Government bond yields

Watch:

- Tuesday is a Holiday

- Wednesday’s GDP, Unemployment and PMI readings. Worsening numbers, favors my scenario

- Thursday’s Inflation releases. Unchanged or decreasing inflation strengthens my scenario

- Next Monetary Meeting on 14th of June

GBP

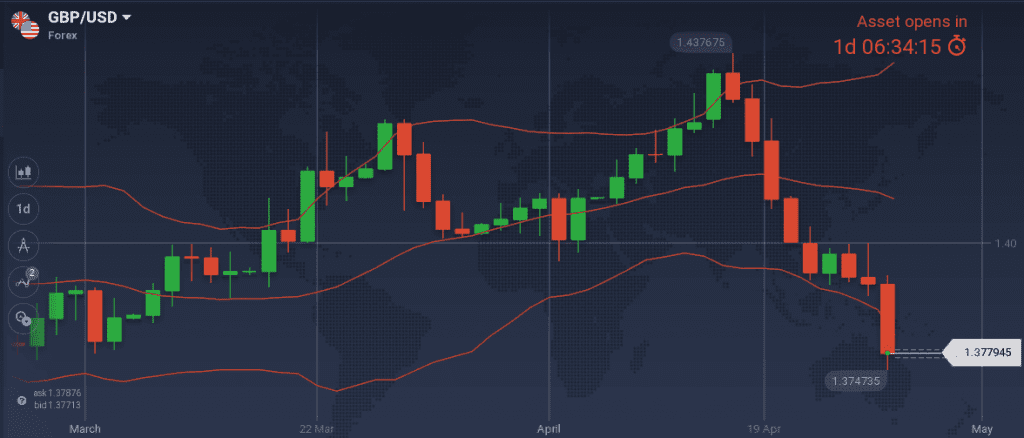

My advice to close all long GBP positions played well. As new macro readings are announced, GBP economy does not seem to run the risk of overheating. Chances of a rate hike on May’s meeting, that was well anticipated a couple of weeks ago, are now decreasing.

Lending decreased, consumer confidence was not significantly improved and latest GDP q/q reading was even lower than the expected decreased number (previous 0.4%, consensus 0.3%, latest actual 0.1%).

Snapshot:

- Inflation at 2.5% (vs 2.0% target), BOE ‘s rate at 0.50% (a second hike on 10th of May used to be probable but now is not)

- GDP at 1.2% growth (vs 1.4% previously), 10y Bond yields at 1.45% (-3bps w/w)

- Record low unemployment at 4.2% (42 years low)

Strengths:

- Next week’s PMI announcements and M4 reading could remind markets that UK is growing fast

- The size of Friday’s big downwards GBP move is a market’s overreaction. A small move back up could be expected.

Weaknesses:

- As inflation is returning to BOE’s target without further tightening, GBP lost strength

Watch:

- PMI Manufacturing on Tuesday, PMI Construction on Wednesday and PMI Services on Thursday (all releases at 9:30GMT). If the Construction PMI and Services PMI decrease instead of increasing, I could even short GBP.

- Next Monetary meeting on 10th of May