As we move towards August, when all unexpected game changing military actions are taken, markets are moving in the most optimistic mode, making my last week’s views and emphasis obsolete. Equities rallied, 10Y US government bonds latest auction is stuck below 2.85% yield level, and my fears that Leaders would fail to come up with a common communique at NATO’s summit -as happened at the latest G7 leader’s summit- have not materialized.

I guess strong earnings, robust GDP growth, full employment is more important in a weekly horizon than the actual impact of tariffs, the tough political situation in UK, the continuously possible Trump’s impeachment, the next European Elections on May 2019. One could even argue that the initial consequence of tariffs was positive, as market participants rushed to trade and build inventory before tariffs took effect.

Major last week’s events:

- NATO: a commonly signed 79 paragraphs long document, reaffirming NATO’s unity, with strong line against Russia, reaffirmation of defense spending of each county reaching 2% of its GDP by 2024, training camp in Iraq to fight ISIS, further support of security forces in Afghanistan, and a 4×30 (30ships, 30 battalions, 30 air squadrons within 30 days readiness) target, has been the concrete result of the summit. An excellent job of Norway’s former PM Jens Stoltenberg, in my book.

- Tariffs front-Trade Tactics: China’s response has been to tax on cars, American meat and soybean and could well include delays in inspections and boycotting. The funny thing is that USA’s list of new tariffs under consideration that would amount to 200B$ worth of goods, included items that are not traded with China, like car tape players, electricity, LNG.

- Cryptos: Total market cap at 248B$, -8% w/w, diverging from the equities rally

Major next week events:

- Monday’s Trump-Putin meeting in Helsinki

- Weekend’s G-20 summit

JPY

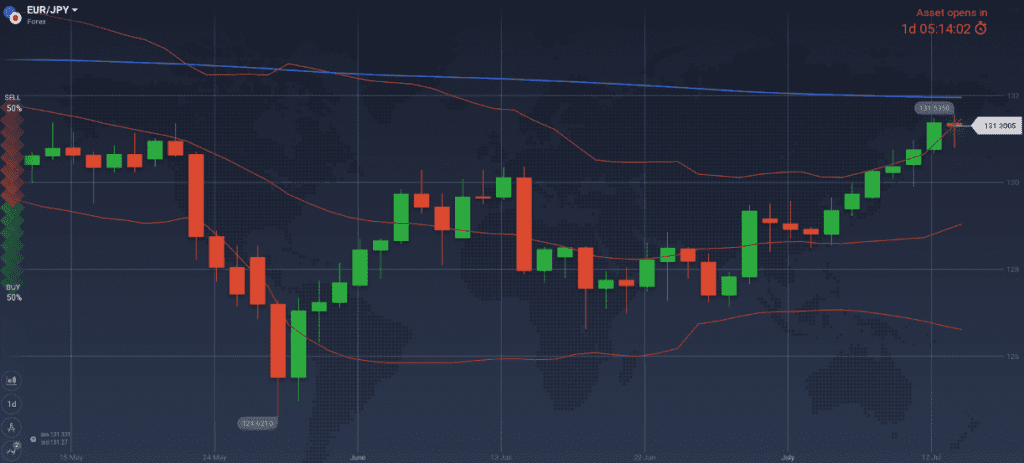

Avoiding loading the short EUR/JPY trade was my last week’s advise that now looks poor, following the impressive 5 days equities rally and the big bullish move of the pair.

I will not turn bullish on EUR/JPY, as I am not convinced that the equity rally will continue.

Snapshot unchanged:

- Inflation (excluding food-National core CPI) at 0.7% (vs 2.0% target and BOJ’s members expectation of 1.2~1.3% within 2018), BOJ rate at -0.1%

- GDP at 1.10% annual, -0.2% q/q, 10Y Government bonds yield at 0.04% (+1bps w/w) vs BOJ’s target of 0.00% level

- Unemployment at 2.2% (lowest levels since 1993)

Strengths of JPY:

- QQE will stay, up until core CPI reads 2.0% in a stable manner

- increasing Manufacturing PMI, Bank Lending, decreasing unemployment

Weaknesses of JPY:

- equities rallied.

- latest negative GDP reading and Trade Balance at -0.30T ¥

- last week’s decreased readings of monetary base, household spending and machine orders

Watch:

- Thursday’s Trade Balance and Friday’s National Core CPI. Both numbers are expected to increase, favoring short EUR/JPY positions

- next Monetary Policy meeting on 31 July.

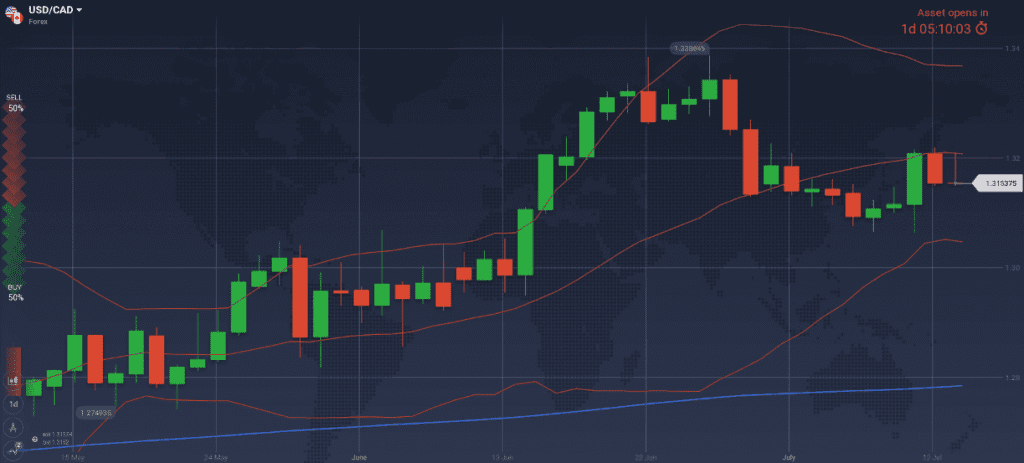

CAD

Unfortunately, the advised 1.3220 level to go short, was missed for 3 pips. In the meantime, BOC increased rates as expected, but the announcement was made during a big oil sell off (-4$/barrel) fueled by OPEC’s monthly report.

I cannot take a position with so many moving parts in place.

Snapshot unchanged:

- Inflation at 2.2% (vs 1.0%~3.0% target range, expected at 2.5% in 3Q18), BOC rate at 1.50% (4 hikes so far). Neutral rate within 2.5%~3.5% range according to BOC.

- GDP at 2.3% (vs BOC expectations of 2.0% in 2018 and long-term potential of 1.8%), 10Y Government bonds yield at 2.13% (+0bps w/w)

- Unemployment at 6.0%

Strengths of USD/CAD, weakness of CAD:

- decreased manufacturing sales, and decreased trade balance

- Nafta negotiations not concluding and tariffs on steel from both sides taking effect

Weaknesses of USD/CAD, strengths of CAD:

- oil is supposed to head north for the rest of 2018, yet the latest OPEC report revealed increasing supply and decreasing demand forces. Worth-noted that correlation of oil with USD/CAD increased to -0.55

- latest housing starts release, one of the main sources of uncertainty besides trade policies, increased impressively by 27%, making central bank’s decision (to proceed with hiking) correct

Watch:

- Friday’s Inflation readings are expected higher, favoring the short USD/CAD trade

- Next Monetary Meeting on 5th of September.

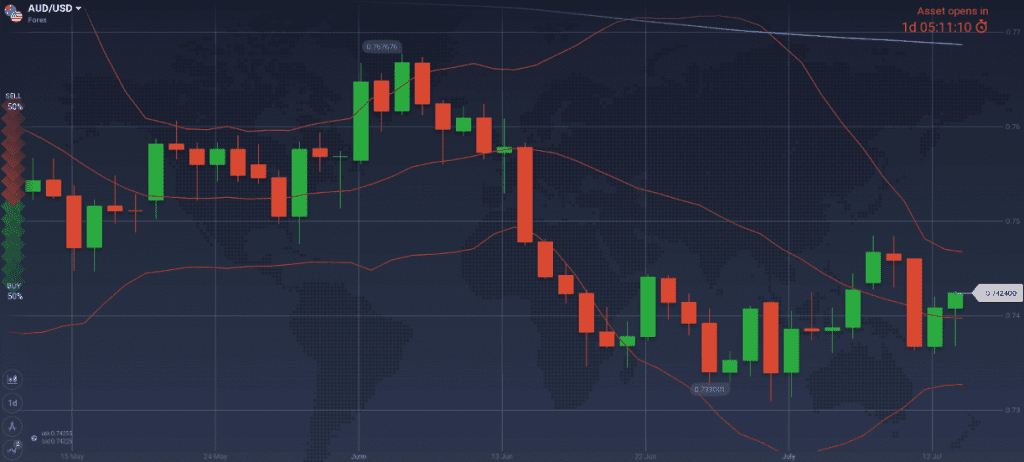

AUD

Going long AUD/USD at 0.7380 played well. Nevertheless, Aussie refusing to skyrocket during a week when US equities rallied, puzzles me.

Snapshot unchanged:

- Inflation at 1.9% (vs 2.0~3.0% target), RBA ‘s rate at 1.50% (no hike so far)

- GDP at 3.1% (RBA expects more than 3.0% within 2018 and 2019), 10y Bond yields at 2.63% (+1 bps w/w)

- Unemployment at 5.4%

Strengths:

- significant increase of GDP, inflation expectations and trade balance

- improved business confidence & profits, private capital expenditure, home loans to Australians and latest impressive increase of consumer sentiment

Weaknesses:

- latest readings of wages growth (next release on August), building approvals and new home sales do not support AUD strengthening.

Watch:

- No market moving announcement is expected during the week

- Next Monetary Meeting on 7th of August

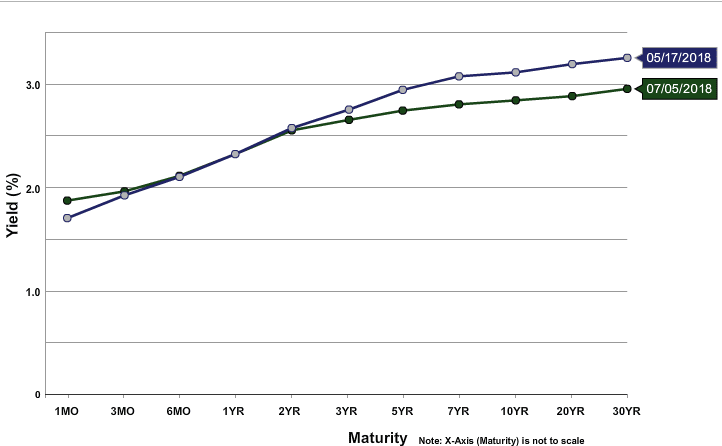

USD

My last week’s remark that USD would not strengthen during the first week of the official beginning of Tariffs on Chinese goods, was totally wrong. Up until I conclude what would drive markets more decisively, I would avoid offering a view.

Snapshot improved further:

- Inflation (Core PCE) at FED’s target of 2.0% (latest m/m CPI decreased), FED ‘s rate at 1.95% (IOER) expected to reach 3.1% within the cycle. FED’s view of long run rate at 2.9%

- GDP at 2.8%, 10y Bond yields at 2.83% (+1 bps w/w)

- Unemployment at 4.0% (vs natural rate of unemployment of 5.1% in 2015, 4.7% in 2017, 4.5% in 2018, could decrease further) FED expects 3.6% unemployment in 4Q18 and 3.5% for 2019 and 2020.

Strengths of USD:

- strong macros: Durable Goods orders, housing market. Manufacturing and Non-Manufacturing PMI at the roof.

Weaknesses of USD:

- Equities rally. Starting one day before day 1 of US tariffs on China on low volume, S&P500 is 22 points away from the technically significant 2822 level and 74 points away from the all-time high.

- 10y Government Bond yields refusing to cross 3.0%

- downward revision of GDP for 1Q2018, first increase of unemployment since a long time

Watch:

- Monday’s Retail sales and Business Inventories. Increasing Business Inventories and decreasing retail sales is typical when economic contraction starts.

- Tuesday’s Capacity Utilization rate. A decreasing number should also fuel concerns.

- Next Monetary Meeting on 1st of August

Yield curve on 17th May (10y yield highest point) and 5th July (a day before day 1 of ‘trade war’)

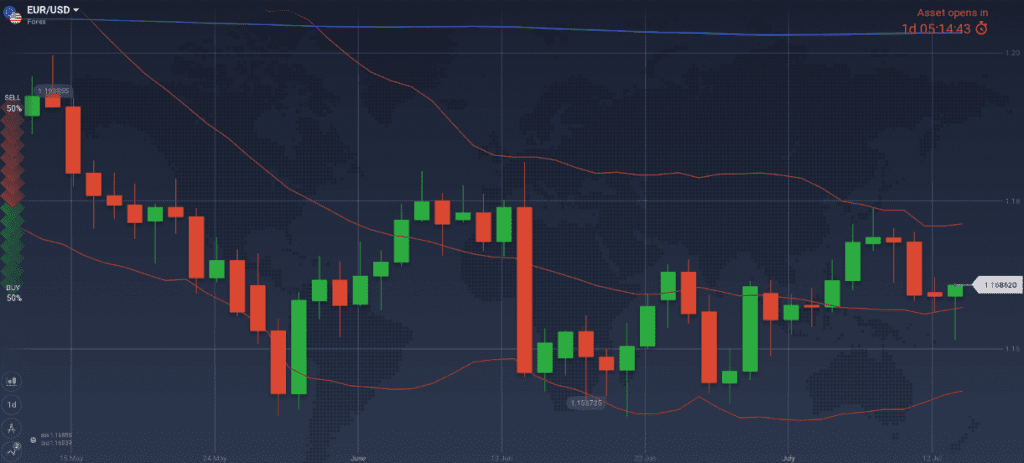

EUR

Similarly, I would avoid offering a view for EUR.

Snapshot unchanged:

- Annual Core CPI at 1.0% (vs 2.0% target), ECB ‘s rate at 0.00%

- GDP at 2.5% growth (OPEC expects a 2.2% reading), 10y Bond yields of EFSF at -0.39% (-2bps w/w), 10y German Bond yields at 0.34% (+5bps w/w), 10y Italian Bond yield at 2.55% (-17bps w/w)

- Unemployment decreased to 8.4%

Strengths of EUR/USD:

- increased M3(latest reading at 4%), retail PMI above the 50 threshold, Manufacturing PMI and Service PMI at high levels, increasing industrial production and investor’s sentiment

- trade war between USA and China. Remember that CNY devaluations are generally boosting EUR

Weaknesses of EUR/USD:

- equities are reaching technically significant levels that will be difficult to be crossed within the next week. Microsoft, Netflix, Blackrock & Goldman Sachs are among the companies to release their earnings.

Watch:

- Monday’s Trade Balance and Friday’s Current Account

- Next Monetary Meeting on 26 July. Nothing significant is expected

GBP

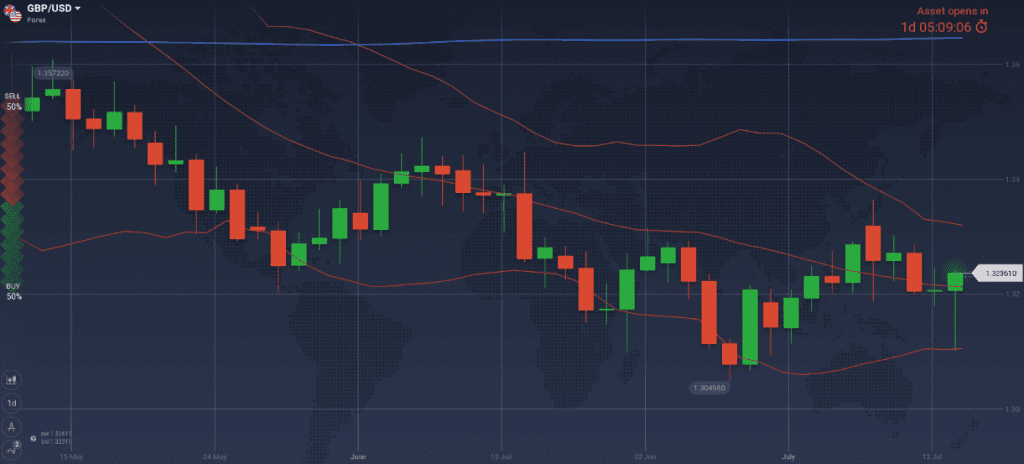

Going long GBP/USD at 1.3170 played well. I could re-enter long at 1.3160 level.

Snapshot unchanged:

- Inflation at 2.4% (vs 2.0% target), BOE ‘s rate at 0.50%

- GDP at 1.2% growth (1.4% OPEC’s estimates vs 1.75% BOE’s expectations), 10y Bond yields at 1.27% (+0bps w/w)

- Unemployment at 4.2% (BOE expects to fall further in Q2)

Strengths:

- the bad weather narrative for Q1 could be valid

- increased GDP qoq, M4, Current account, Manufacturing PMI, Construction PMI and Services PMI. Latest

- growing number of BOE’s members voting for a rate hike (3 members out of 9 instead of 2)

- May (UK’s Prime Minister) managed to reach a consensus with her Cabinet and issue a White Paper on Brexit. The resignation of the two hard-liner Ministers can have both a positive (increases the degrees of freedom of May) and negative sign (increases the chances of a new political crisis).

Weaknesses:

- latest retail sales, average earnings were disappointing.

- the expected re-rise of inflation has not yet materialized

Watch:

- Tuesday’s Average Earnings. A number above 2.5% favors my long GBP/USD scenario

- Wednesday’s inflation readings that are expected to show higher numbers

- Next Monetary Meeting on 2nd of August