Since February I focused on the high tension, high volatility, increasing inflation, increasing bond yields, decreasing equities scenario that favors haven currencies. As of June, bond yields are rising but volatility has scaled back, equities have increased, and inflation is within range.

Both FED’s continuing hiking before the increase of inflation, ECB’s clear forward guidance and BOJ unchanged stance, signal that world’s economy is doing well, and the tools to overcome any short of a crisis are there.

Last week I have avoided offering trading ideas, other than the long AUD trade that is currently on the red (even though both 0.7547 and 0.7526 levels offered a bounce to the down-trending AUD, following FED and ECB) and the short USD/CAD at 1.3138 that is also red. I keep my long bias towards safe havens currencies (USD and JPY) and focus on the implications of the different stance between US and EU on Iran.

Major last week’s events:

- Korea-USA Summit: The goal of complete, verifiable, irreversible denuclearization is out of reach. I note down Trump’s willingness to cancel joint military drills with South Korea, scheduled for the fall of 2018, the bonding of Trump and Kim, and Pompeo’s announcement that no sanction relief towards North Korea has been decided at his follow up visits to South Korea and China

- Tariffs front-Trade Tactics: New talking for a revised list of 50B$ worth of tariffs on Chinese goods started on Friday, while the ZTE agreed fine is questioned by US Congress and while China’s regulators agreed on the acquisition of NXP Semiconductors (China) by Qualcomm (USA)

- Iran Deal: Nothing new under my radar. Remember that USA is pushing European firms to stop their investments up until the 4th of September or they will phase sanctions and EU is pushing European firms to continue their investment plans in Iran or they will phase fines.

- FED-ECB-BOJ Monetary Decisions

- Italy: Worries from Italy are muted even though on Thursday we learned that another Minister of La League is thinking of going out of the CETA deal between Canada and EU. Note Italian exports 5.1B€ and imports 1.9B€ from Canada.

- Bayern (Germany) merged with Monsando (USA) and now 3 multinationals are controlling the 70% of world’s crops

- Cryptos: A new exchange hack (Coinrail), sent total market cap at 280B$, -19% w/w

Major next week events:

- An interesting round table, that may be watched live via the url of ECB, between the governors of ECB, Bank of Japan, Royal Bank of Australia and FED, will be held on Wednesday 13.30GMT. Mark it at your callendar.

- Thursday’s Monetary Meeting of Bank of England and Norges Bank (Norway). I want to see a clear communication by Norges Bank with the intention to hike on September.

- Thursday’s Eurogroup. Greek debt is included at the agenda.

- Friday’s OPEC meeting in Vienna when new levels of production and a new timeline is expected to be agreed.

- Sunday’s elections in Turkey. The brave ones may take short USD/TRY and EUR/TRY positions on Friday’s closing

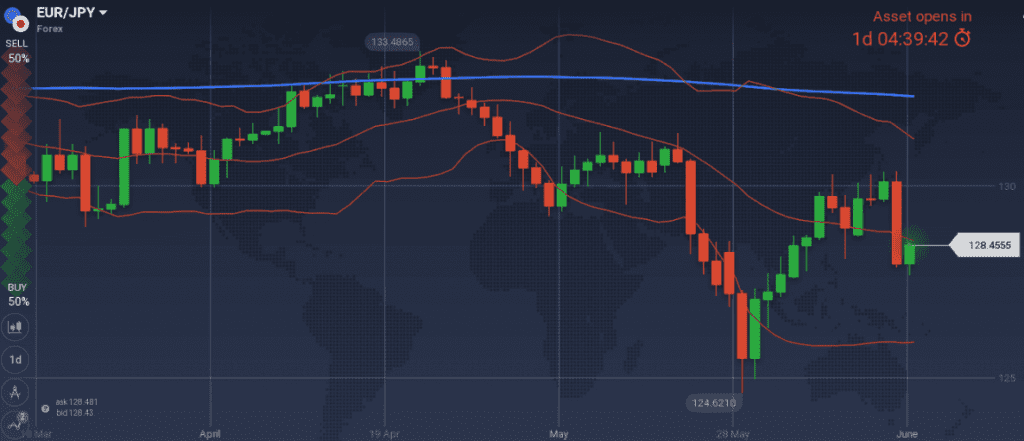

JPY

JPY strengthening came because of the ECB’s press conference. The Thursday’s move was so significant that the Friday’s BOJ announcement, instead of triggering a JPY strengthening, stopped the further falling of EUR/JPY.

Snapshot unchanged:

- Inflation (excluding food-National core CPI) at 0.7% (vs 2.0% target and BOJ’s members expectation of 1.2~1.3% within 2018), BOJ rate at -0.1%

- GDP at 1.10% annual, -0.2% q/q, 10Y Government bonds yield at 0.04% (-1bps w/w) vs BOJ’s target of 0.00% level

- Unemployment at 2.5% (lowest levels since 1993)

Strengths of JPY:

- QQE up until core CPI (now at 0.7%) is above 2.0% in a stable manner. Rates at -0.1%, 10Y bonds yield controlling at 0.0% and maintaining QQE at 80T¥ per year (=50B€ per month), plus 6T¥ ETFs annual purchases (=3.8B€ per month) plus 90B¥ REITs annual purchases (=0.05B€ per month) which is 53.85B€ per month in total.

Weaknesses of JPY:

- latest negative GDP reading

Watch:

- Monday’s Trade Balance. A reading above 0.26T¥ favors JPY

- Friday’s National core CPI and Manufacturing PMI. PMI above 52.5 favors JPY

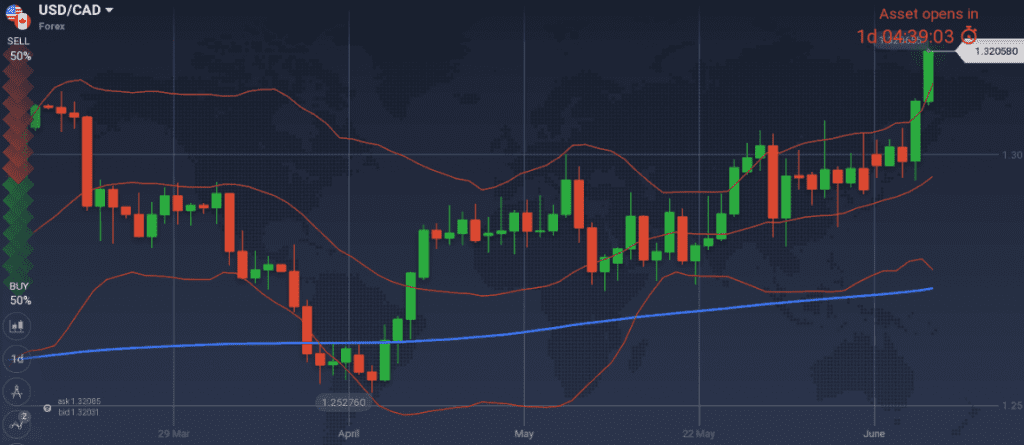

CAD

Canada is running at full potential with balanced macroeconomic readings. Other than the recent fall of oil prices that I expect them to rebound, I see no reason for the pair move higher.

I keep my short USD/CAD position.

Unchanged Snapshot:

- Inflation at 2.2% (vs 1.0%~3.0% target range, expected to increase again in 2018), BOC rate at 1.25% (3 hikes so far). Note BOC’s confidence on neutral rate within 2.5%~3.5% range.

- GDP at 2.3% (vs BOC expectations of 2.0% in 2018 and long-term potential of 1.8%), 10Y Government bonds yield at 2.22% (-10bps w/w)

- Unemployment at 5.8% and expected to decrease further.

Strengths of USD/CAD, weakness of CAD:

- Uncertainty on trade policies

- deteriorating housing market, decreased manufacturing sales

Weaknesses of USD.CAD, strengths of CAD:

- I believe oil is set to move higher during 2018 but one should carefully read the insights from Vienna meeting (OPEC). Correlation between oil and USD/CAD stands at -0.82

- at current levels USD/CAD seems expensive

Watch:

- Thursday’s OPEC meeting

- Next Monetary Meeting on 11th of July.

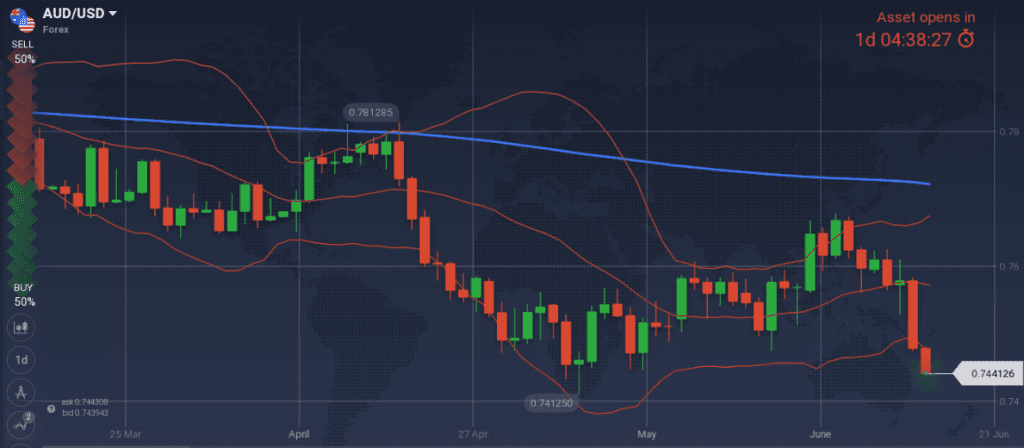

AUD

Australian economy is moving fast. I keep my long AUD/USD bias and stay confident that the position will soon turn green.

Snapshot improved further:

- Inflation at 1.9% (vs 2.0~3.0% target), RBA ‘s rate at 1.50% (no hike so far)

- GDP jumped to 3.1% (vs 2.4% previous reading. Remember that RBA was expecting 3.0% growth within 2018 and 2019), 10y Bond yields at 2.69% (-9 bps w/w)

- Unemployment decreased to 5.4%

Strengths:

- significant increase of GDP reading

- improved business confidence, business profits and private capital expenditure

- improved consumer confidence and home loans to Australians

Weaknesses:

- latest reading of wages growth, building approvals and new home sales do not support AUD strengthening. Anything that quantifies household consumption (credit growth, wage growth, private capital expenditure) should be carefully watched

- latest readings from China (fixed asset investments, industrial production, retail sales) were decreasing.

Watch:

- No market moving announcements are expected

- Next Monetary Meeting on 3rdth of July

USD

Last week I was noting my bias towards inflation rising, bond yields picking up and USD strengthening on the second half of 2018.

Last week I was noting my bias towards inflation rising, bond yields picking up and USD strengthening on the second half of 2018.

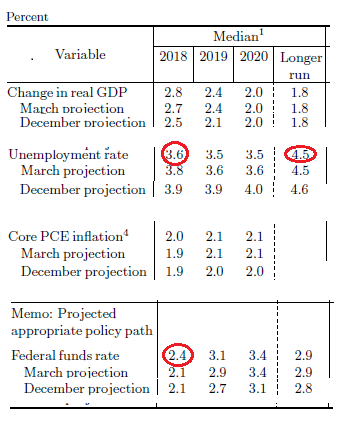

FED has not waited for inflation to increase. It raised rates and increased its projections for the federal fund rate to become 2.4% by the end of 2018. (i.e. 2 more hikes)

I keep my long USD bias but would not take any position during the next week as some consolidation and level retesting needs to happen.

Snapshot unchanged:

- Inflation (Core PCE) at 1.8% (vs 2.0 target and 2.0% FED’s revised upwards expectations for 2018), FED ‘s rate at 1.95% (IOER). 7 hikes so far in the business cycle and another 5 hikes expected by the end of 2019, to reach 3.1%. FED’s view of long run rate remains at 2.9%

- GDP at 2.8% growth (FED expects 2.8% in 2018), 10y Bond yields at 2.92% (-3 bps w/w)

- Unemployment decreased further to 3.8% (vs natural rate of unemployment of 5.1% in 2015, 4.7% in 2017, 4.5% according to FED’s latest view) FED expects 3.6% unemployment in 4Q18 and 3.5% for 2019 and 2020. Powell did not defend the 4.5% view during Q&A, as if he believes in a smaller number of natural rate of unemployment.

Strengths of USD:

- strong macros: PMI (Manufacturing, Services), Durable Goods orders, unemployment, retail sales

- 10y Government Bond yields are re-testing the 3.00% level even though latest auction resulted in 2.96% yield

- Central Bank is keep on raising the natural rate of unemployment as participation increases

Weaknesses of USD:

- very significant move that needs to be followed by some level retesting.

- Rising inventories are either due to more investing, or due to reaching the peak of the cycle.

Watch:

- Releases about the housing market on Monday and Tuesday. The view can only change with highly unlikely low readings

- Wednesday’s 13.30GMT Current Account

- Friday’s 14.45GMT PMI readings

- Next Monetary Meeting on 1st of August

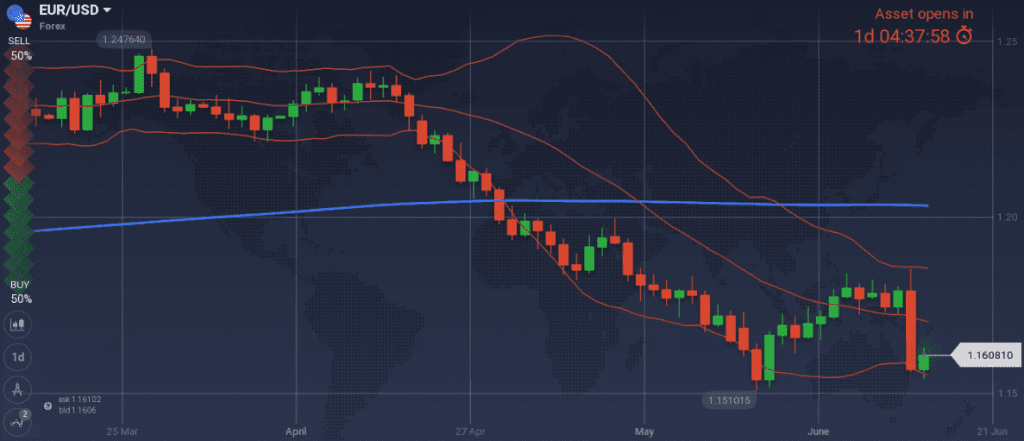

EUR

Besides the decreasing Italian bond yields, as overreaction fueled by fear fades away, the macro picture is the same. What has changed is that the road map of the ECB’s monetary policy has been given. QE will last for another 3 months (up until December 2018) and then will end. Rates will stay unchanged at least through the summer of 2019.

I am biased to short EUR/USD, but I can only do so when 1.1750 is retested.

Snapshot unchanged:

- Annual Core CPI at 1.1% (vs 2.0% target), ECB ‘s rate at 0.00%

- GDP at 2.5% growth (OPEC expects a 2.2% reading), 10y Bond yields of EFSF at -0.37% (+0bps w/w), 10y German Bond yields at 0.40% (-5bps w/w), 10y Italian Bond yield at 2.61%3.13% (-52bps w/w, almost +16bps in 3 weeks since the political crisis)

- Unemployment at 8.5%

Strengths of EUR/USD:

- increased M3 and inflation readings

- retail PMI back above the 50 thresholds

Weaknesses of EUR/USD:

- investor’s confidence and economic sentiment decreasing

- the different point in the cycle between US and EU economy

Watch:

- Tuesday’s 09.00GMT Current Account

- Thursday’s 15.00GMT Consumer Confidence. I am expecting a positive number but will not trade it

- Thursday’s Eurogroup that would include Greece in the agenda

- Friday’s 09.00GMT Manufacturing and Services PMI. Decreasing numbers are expected that favor the short EUR/USD trade.

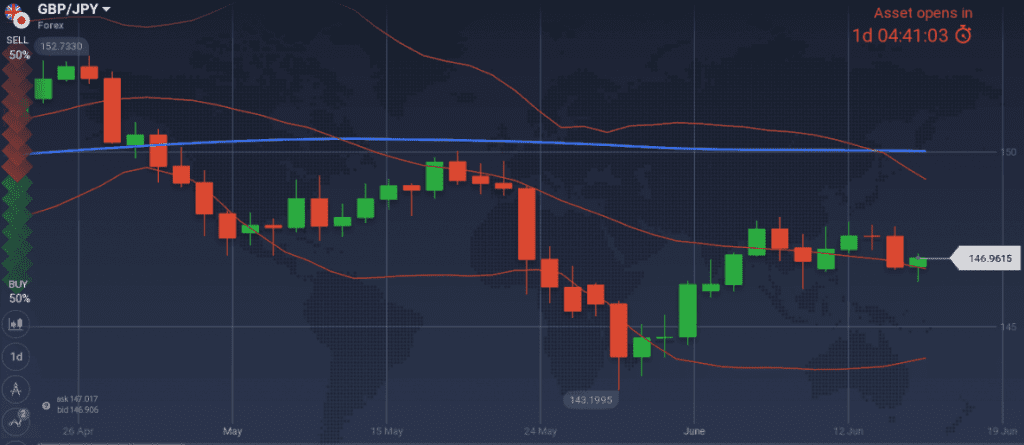

GBP

As we are heading towards Thursday’s Monetary Meeting, UK macro readings do not offer a good reason to go long GBP.

Snapshot unchanged:

- Inflation at 2.4% (vs 2.0% target), BOE ‘s rate at 0.50% (no hike expected in 2018)

- GDP at 1.2% growth (vs 1.4% previously vs 1.5% OPEC’s estimates), 10y Bond yields at 1.33% (-6bps w/w)

- Record low unemployment at 4.2% (BOE expects to fall further in Q2)

Strengths:

- the bad weather narrative regarding UK’s economy in 1Q18 needs to be supported by stronger macros

- disappointing last week’s numbers (retail sales, average earnings, manufacturing production, construction)

- decreasing inflation readings that postpone rate hikes. Last Wednesday’s readings were unchanged

Watch:

- Thursday’s Monetary Decision.