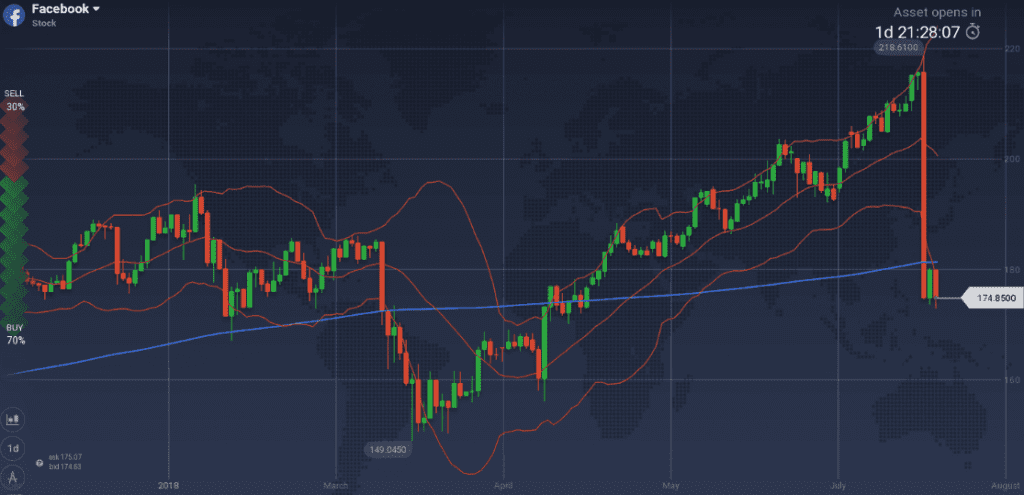

Last week I was noting that I am in the process of checking the validity of a Risk-on scenario where equities will be able to rally further, no unexpected geopolitical event taking place during August and currencies would gain back against USD.

If it had not been for market reactions on Facebook’s earnings, the scenario would have been validated in all fronts. But even with Facebook’s drop, I am willing to shift my position and go long equities up until the end of September. Three points should be made.

Point A. Facebook’s earnings, that disappointed markets, included a 32% y/y increase of EPS (Earnings per share), 42% increase of revenues and an operating margin of 44% (down from 47%). Point B. The next downtrend is so widely anticipated that the chance of actually happening is decreasing. Point C. I am more concerned with the October’s Bavarian elections and October’s Brexit deadline than the shape of US bond yields that is signaling a downtrend.

Major last week’s events:

- EU-USA: The effects of Junker’s visit in the White House, is presented as EU’s achievement. Trump will not think of imposing tariffs on European cars and would cancel the steel and aluminum tariffs that are in effect since 1st of June. Yet, no timeline has been agreed.

- Tariffs front: EU-USA expressed will to cooperate. Optimism from latest G20 meeting that Nafta talks are moving forward. China failed to approve or reject Qualcomm-NXP 44B$ merger within deadline, and the deal is off. Ambassadors of China and USA were rough at Thursday’s WTO meeting in Geneva.

- Turkey’s central bank has not increased rates. USA-Turkey relations further deteriorated and my view to short USD/TRY played awfully.

- Tensions between Iran and USA are rising

- US Transformation: Transcripts of Trump’s telephone conversations with foreign Leaders will no longer be published. I am betting on an increase of the frequency of phone calls between Trump and Putin.

- Cryptos: Total market cap moved again and crossed 300B$. Now stands at 298B$, another +8% w/w

Major next week events:

- Bank of Japan has a monetary meeting on Tuesday, FED on Wednesday, Bank of England and the Central Bank of Czech Republic on Thursday. Nothing significant is expected from the first three. The question becomes whether the rates of Czech Koruna (CZK) will rise

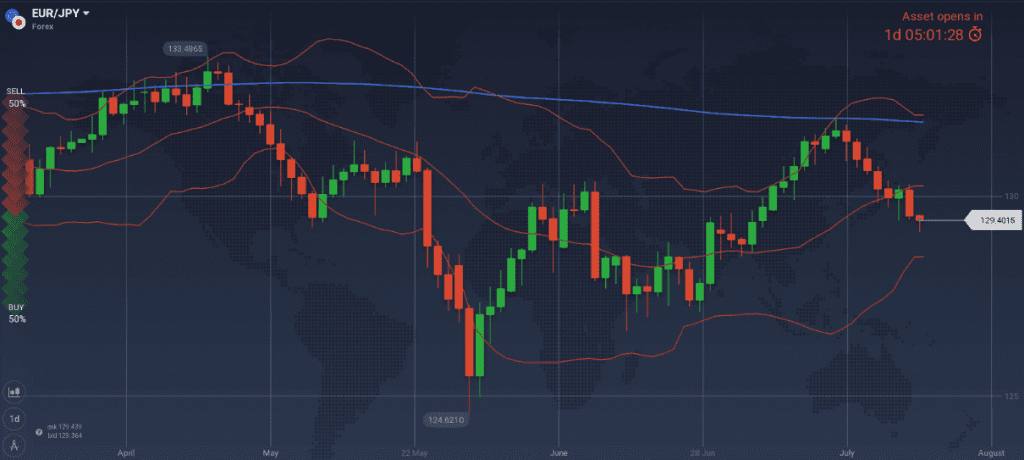

JPY

In a week that started with an impressive increase of the yields of 10y Government Bonds, I could not take any credit for calling to go long at 129.36 EUR/JPY level. The level was only reached on Friday and is less than 10pips on the green.

Note that BOJ is explicitly targeting 0% yield for the 10y Government bonds and that a 6-basis points change is 6 times bigger than the usually unmovable Japanese yields.

It is difficult for me to offer a view and wait for BOJ’s message.

Snapshot improved:

- Inflation (excluding food-National core CPI) increased at 0.8% (vs 2.0% target and BOJ’s members expectation of 1.2~1.3% within 2018), BOJ rate at -0.1%

- GDP at 1.10% annual, -0.2% q/q, 10Y Government bonds yield at 0.10% (+6bps w/w) vs BOJ’s target of 0.00% level

- Unemployment at 2.2% (lowest levels since 1993)

Strengths of JPY:

- QQE will stay, up until core CPI reads 2.0% in a stable manner

- increasing inflation, bank lending, trade balance, decreasing unemployment

Weaknesses of JPY:

- equities bear scenario is fading away as earnings are impressive and the negative effects of tariffs on global GDP is priced in without exaggerations

- decreased readings of Manufacturing PMI, monetary base, household spending and machine orders

Watch:

- Monday’s Retail Sales

- Tuesday’s Monetary Policy Meeting. Last week, there were concerns regarding BOJ’s intentions to scale down on current monetary policy. I am not buying that argument.

- Thursday’s Monetary Base change

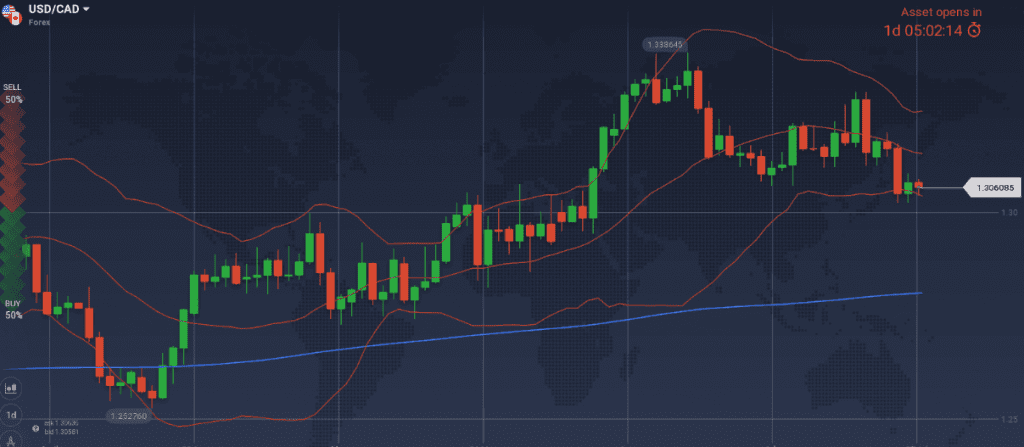

CAD

I am biased to go short USD/CAD at 1.3122 level

Snapshot unchanged:

- Inflation at 2.5% hitting the expected number for 3Q18 (target range is 1.0%~3.0%), BOC rate at 1.50% (4 hikes so far, neutral rate according to BOC within 2.5%~3.5% range).

- GDP at 2.3% (vs BOC expectations of 2.0% in 2018 and long-term potential of 1.8%), 10Y Government bonds yield at 2.30% (+12bps w/w)

- Unemployment at 6.0%

Strengths of USD/CAD, weakness of CAD:

- decreased manufacturing sales, and decreased trade balance (new reading expected this week)

Weaknesses of USD/CAD, strengths of CAD:

- latest housing starts, impressive increase of retail sales

- Nafta negotiations heating up again

- new tensions between Iran and Saudis, coupled with an impressive decrease of US crude oil inventory (-6.1MBarrels) are pushing oil higher

Watch:

- Tuesday’s GDP m/m reading that is expected to be higher and would favor the short USD/CAD scenario

- Wednesday’s Manufacturing PMI

- Friday’s Trade Balance. An increasing number favors my scenario

- Next Monetary Meeting on 5th of September.

AUD

My TRY view was bad, my JPY view cannot be judged for being 10 pips in the green but going long AUD/USD at 1.7360 hit bulls’ eye.

I am expecting favorable news during the week and could add to my long position at 1.7365, targeting 1.7570 as previous week.

Snapshot improved:

- Inflation increased at 2.1% (vs 2.0~3.0% target), RBA ‘s rate at 1.50% (no hike so far)

- GDP at 3.1% (RBA expects more than 3.0% within 2018 and 2019), 10y Bond yields at 2.64% (+2 bps w/w)

- Unemployment at 5.4%

Strengths:

- significant increase of GDP, inflation, inflation expectations and trade balance

- improved business confidence & profits, private capital expenditure, home loans to Australians and latest impressive increase of consumer sentiment

Weaknesses:

- latest readings of wages growth (next release on August) do not support AUD strengthening.

- Market participants expect the rates to remain unchanged for a considerable period

Watch:

- Tuesday’s Building approvals, New Home Sales and Private sector Credit. Expected increasing number will help elevate the main fear factors of current state of Australian economy

- Thursday’s Trade Balance. A number above 0.85B AUD is favoring the long AUD/USD trade

- Friday’s Retail Sales. A number above 0.3% m/m is also favorable.

- Next Monetary Meeting on 7th of August

USD

I believe that US equities are set to increase for the second part of 2018 and under these conditions, I expect a weaker USD.

Snapshot improved:

- Inflation (Core PCE) at FED’s target of 2.0% (new reading is expected this week. Note that latest m/m CPI decreased), FED ‘s rate at 1.95% (IOER) expected to reach 3.1% within the cycle. FED’s view of long run rate at 2.9%

- GDP at 4.1%, 10y Bond yields at 2.95% (+6 bps w/w)

- Unemployment at 4.0% (vs natural rate of unemployment of 4.5%), FED expects 3.6% unemployment in 4Q18 and 3.5% for 2019 and 2020.

Strengths of USD:

- strong macros: Durable Goods orders increasing, Manufacturing and services PMI continue to be at the roof, capacity utilization increasing

- latest q/q GDP reading

Weaknesses of USD:

- Equities rally continues, and I am buying the bull’s arguments. Although SP500 closed the week bellow 2822 level, on Wednesday (before Facebook 20% drop) it easily managed to cross the level north.

- 10y Government Bond yields refused to cross 3.0% yield even during a week that started with an impressive increase of 10y Japan’s Bond yields.

- Housing market readings continue deteriorating

- latest disappointing releases on housing market & retail sales while the business inventories are kept on rising, as it generally happens during the latest stage of the business cycle.

Watch:

- Tuesday’s PCE and personal spending reading. Decreasing numbers may help the Risk-on scenario as they give FED some reasons to hold on rate hiking.

- Wednesday’s FED’s Monetary meeting.

- Friday’s unemployment reading, Non-Manufacturing PMI and Trade Balance

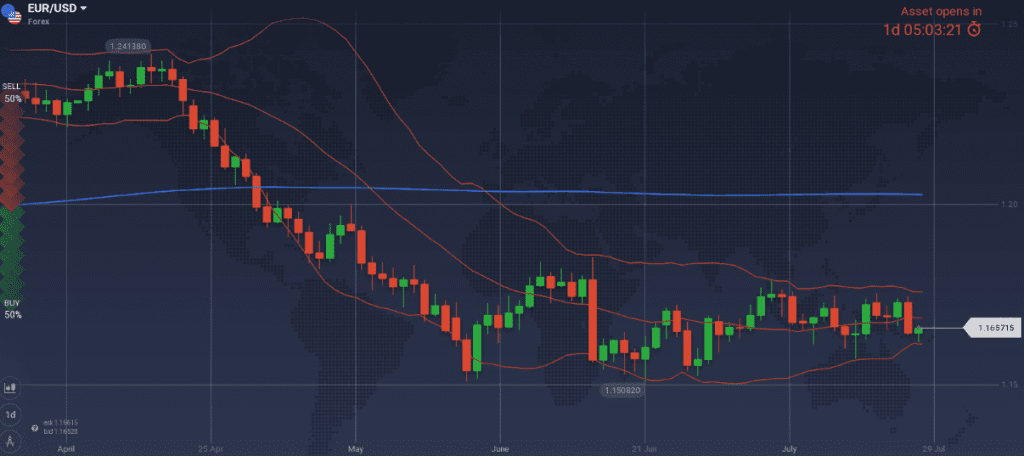

EUR

ECB’s Monetary meeting included no change in the outlook on GDP, on inflation expectations and on the monetary policy message. European economy is growing, is experiencing some downside pressure from weaker exports and some upside pressure from increasing consumption as wages, household and corporate investments are growing.

1.1510 is a buying opportunity, in my book.

Snapshot unchanged:

- Annual CPI on target of 2.0%, core CPI excluding food and energy at 0.9%, ECB ‘s rate at 0.00%

- GDP at 2.5% growth (OPEC expects a 2.2% reading), 10y Bond yields of EFSF at -0.38% (-2bps w/w), 10y German Bond yields at 0.40% (+3bps w/w), 10y Italian Bond yield at 2.74% (+15bps w/w)

- Unemployment decreased to 8.4%

Strengths of EUR/USD:

- further increase of M3 (at 4.4%) and Manufacturing PMI (55.1). Still high but decreased Service PMI.

- trade war between USA and China. Remember that CNY devaluations are generally boosting EUR

Weaknesses of EUR/USD:

- any possible equity sells off

- Business climate and confidence readings refuse to increase

- divergence of monetary policy that can only be simulated with two expected down phasing waves on September and December

Watch:

- Tuesday’s inflation and unemployment readings

- Wednesday’s Manufacturing PMI and Friday’s Services PMI readings that would confirm last week’s readings

- Friday’s retail sales. I want to see an increasing number to enter long EUR/USD.

- Next Monetary Meeting of ECB on 13th of September.

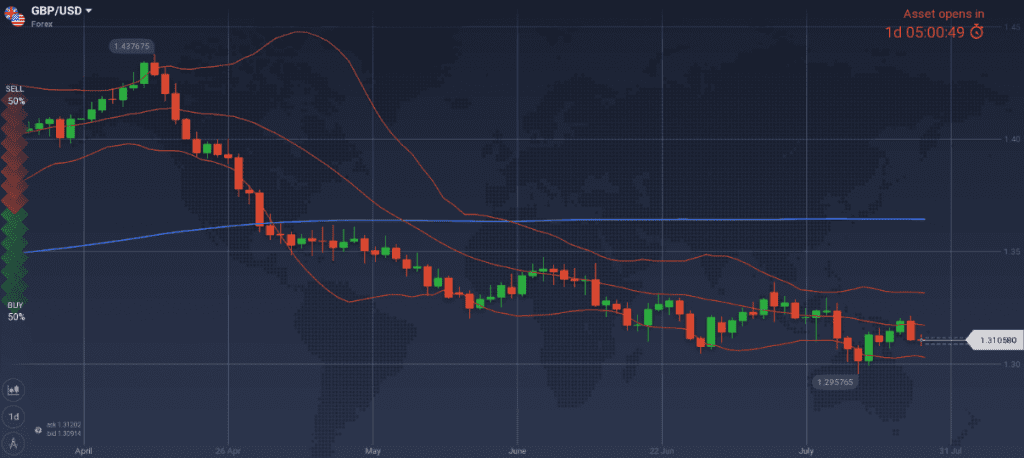

GBP

I keep my last week’s view to go long GBP/USD at 1.3042.

Snapshot unchanged:

- Inflation at 2.4% (vs 2.0% target), BOE ‘s rate at 0.50%

- GDP at 1.2% growth (1.4% OPEC’s estimates vs 1.75% BOE’s expectations), 10y Bond yields at 1.28% (+5bps w/w)

- Unemployment at 4.2% (BOE expects to fall further in Q2)

Strengths:

- the bad weather narrative for Q1 could be valid

- expected rate hike on Thursday

Weaknesses:

- latest retail sales, average earnings were disappointing.

- the expected re-rise of inflation has not yet materialized

- The White Paper of May’s Goverment, that followed Cabinet’s meeting at Chequers and caused the resignation of two Cabinet members, was not accepted by EU.

Watch:

- Monday’s M4, Lending to Individuals and Mortgage approvals. Increasing numbers are favoring the chances of a Thursday’s hike.

- Wednesday’s Manufacturing PMI

- Thursday’s Monetary Meeting where a rate hike is expected

- Friday’s Services PMI