A magnificent week for my latest forecasts. Shorting EUR/USD at 1.1720 and USD/CAD at 1.3192 both hit bulls’ eye. Shorting USD/TRY anticipating the Turkish Central Bank’s announcement played well. Shorting EUR/JPY at 130.23 offered 200pips and is currently 1 pip in the red. Going long AUD/USD at 0.7000 was not triggered, yet the advised upward direction was correct. My calls on USD and Ethereum were bad. USD fell by 0.5% and Ethereum tested the 167$ level instead of bouncing at 204$. The good thing is that the token is now trading at 221$.

Major last week’s events:

- Tariffs’ front: The intensity of this drama keeps on changing. On Tuesday China challenged USA at the WTO (Word Trade Organization), on Wednesday we learned that Mnuchin (US Treasury Secretary) will have a new round of trade talks with Chinese officials, and on Friday there was a Bloomberg headline saying that Trump instructed his officials to go ahead with the new round of tariffs on $200bn worth of Chinese products.

- NAFTA: “Nothing is done until everything is done” summarizes the progress of negotiations. An agreement within the 1st of October, would help the timeline and political capital of Mexicans, would accommodate the timeline of US congressional procedures and is still possible. Remember that dairy, chapter 19, access to US government contracts, imposed tariffs on steel and aluminum, and the expiration of the deal is at stakes.

- US Transformation: no news

- Turkey-Russia: Both Central banks have raised rates helping their currencies. Turkey’s key rate stands at 24% and Russia’s stands at 7.5%

- North Korea-South Korea: New summit between Trump and Kim is under way. The 3rd summit of Kim and Moon is scheduled for Tuesday.

- Cryptos: Total market cap at $204bn, +0% w/w, -75% from the $821bn peak. On Wednesday, market cap has reached $186bn (-78% from the peak) and 8% rally has been recorded since then.

Major next week’s events:

- Wednesday’s Monetary Policy meeting of Bank of Japan and Thursday’s LPD (governing party in Japan) leadership elections.

- Thursday’s Monetary meetings of Central Bank of Switzerland and Norway. I would short EUR/NOK pair at 9.6000 level as early as Monday targeting 9.4300.

- Thursday’s EU leaders’ summit. Brexit negotiations can take place

- On Friday the suspension period issued by SEC, for crypto related products that are traded at Stockholm exchange (Bitcoin Tracker One and Ether Tracker One) ends.

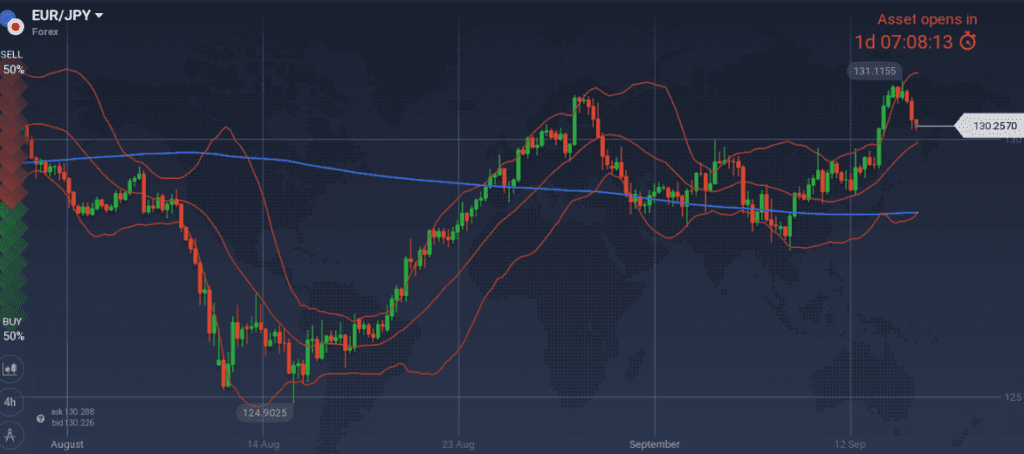

JPY

I keep my short EUR/JPY bias and would re-enter short at 131.77 as we are heading to this week’s monetary policy meeting and leadership elections

Snapshot improved:

- Core CPI (=BOJ’s compass) unchanged at 0.8% (vs 2.0% target and BOJ’s members’ expectation of 1.2~1.3% within 2018), BOJ rate at -0.1%

- GDP unchanged at 1.00% annual, increased at 0.7% q/q, 10Y Government bonds yield at 0.12% (+1bps w/w) vs BOJ’s target of 0.00±20% level

- Unemployment increase to 2.5%

Strengths of JPY:

- in my book, both major upcoming events (monetary meeting and leadership elections) are favoring JPY

- QQE will stay, up until core CPI reads 2.0% in a stable manner. The scheduled VAT hike in Oct’19, rules out any possible monetary policy change, before 2020.

- further increase of GDP reading, increasing bank lending, retail sales, Manufacturing PMI (new reading expected this week), capital spending and sentiment readings

Weaknesses of JPY:

- decreased Services PMI, trade balance (new reading expected this week) and current account

- increased unemployment reading

Watch:

- Monday is a Holiday

- Wednesday’s Trade Balance and Monetary Meeting of BOJ

- Thursday’s leadership elections of the Liberal Democratic Party where Prime Minister Abe is set to be re-elected for a third term. JPY should strengthen during that time.

- Friday’s core CPI and Manufacturing PMI readings. Increasing numbers are expected and would favor JPY

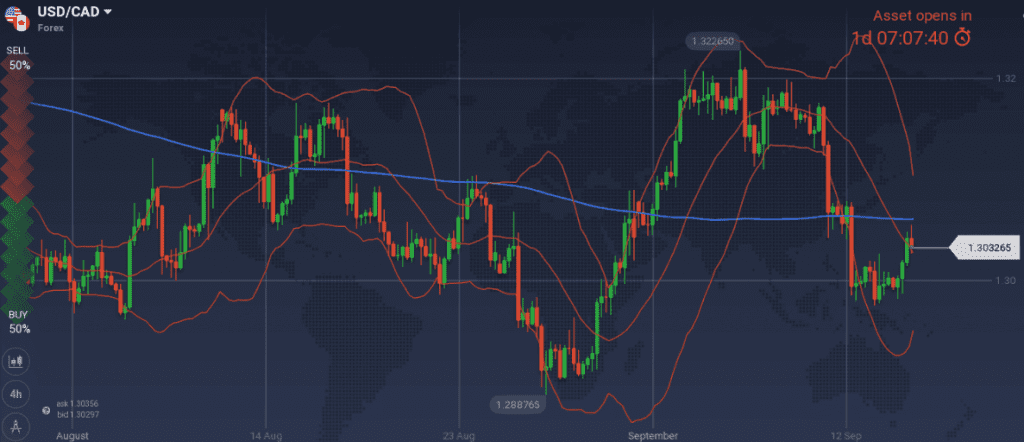

CAD

I am exiting my short USD/CAD position at current levels and want to re-enter short at 1.3154.

Snapshot unchanged.

- Inflation at 3.0% (vs 2.5% target, BOC expects 2.0% within 1Q19), BOC rate at 1.50% (4 hikes so far, neutral rate according to BOC within 2.5%~3.5% range).

- GDP at 1.9% (vs. BOC expectations of 2.0% in 2018 and long-term potential of 1.8%), 10Y Government bonds yield at 2.35% (+6bps w/w).

- Unemployment at 6.0%

Strengths of USD/CAD, weakness of CAD:

- I am no longer expecting an oil rally during the next two weeks. OPEC included a 2mb/day downward revision of world’s demand and Draghi (Governor of ECB) revealed, during the latest Q&A session, that lower energy prices are included in ECB’s macroeconomic models. Worth noted that the only upward revision of OPEC’s worldwide expectations for GDP growth was limited to India, and India could well cover its extra oil needs from Iran at a discount.

- decreased GDP m/m and increased unemployment reading

- housing market, wholesale sales and retail sales readings

Weaknesses of USD/CAD, strengths of CAD:

- NAFTA negotiations are proceeding. I am expecting a CAD rally once a deal is reached

- next monetary meeting on the 24th of October may include a rate hike

Watch:

- Any news on NAFTA negotiations

- Monday’s Foreign securities purchases are expected low and are giving a good reason to exit short USD/CAD positions.

- Friday’s inflation readings. Increasing numbers would favor rate hiking and CAD strengthening

- Next Monetary Meeting on 24 October

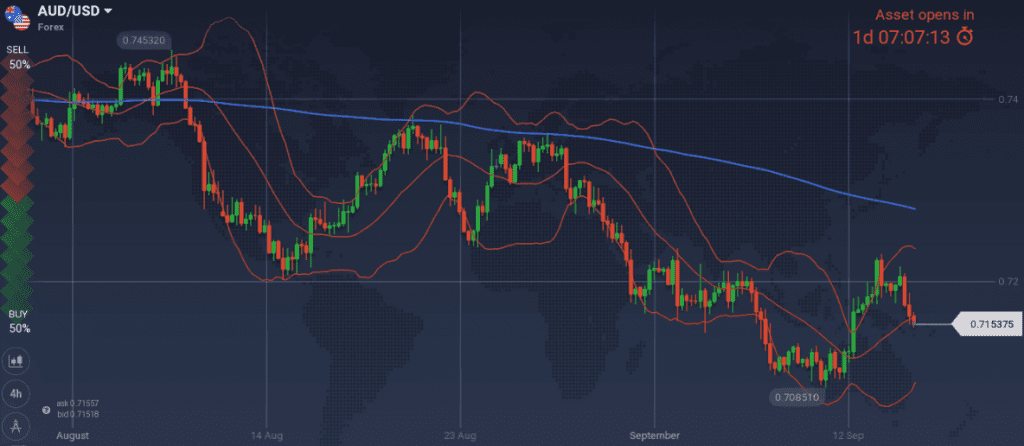

AUD

I am offering no view for AUD/USD

The unfortunate situation for the AUD bulls is its correlation with CNY and the significant devaluation that followed trade tensions. In the same way that I expect USD/CNY to balance around 6.65 level, I expect a higher level for AUD/USD than the current one.

Snapshot unchanged:

- Inflation at 2.1% (expected at 1.75% later in 2018 and then higher in 2019), RBA ‘s rate at 1.50% (no hike so far)

- GDP at 3.4% (RBA expects more than 3.0% within 2018 and 2019), 10y Bond yields at 2.60% (+5 bps w/w)

- Unemployment at 5.3% (expected to reach 5.0% by 2020)

Strengths:

- AUD continues being undervalued at current 0.7150 level

- Australian political drama is over

- GDP is increasing, latest employment change number was 3 times bigger than expected

Weaknesses:

- market participants expect the RBA’s rate to remain unchanged for a considerable period of time

- decreased trade balance, current account and company operating profits

- decreasing capital expenditure, building approvals, home sales, confidence and consumer sentiment

Watch:

- Tuesday’s release of latest Minutes of Monetary Meeting. My focus would be on household consumption remarks and any comment regarding the latest political changes.

- Next Monetary Meeting on 2 October

USD

I keep my long USD bias

Snapshot almost unchanged with a decreased inflation reading:

- Core PCE (=FED’s inflation compass) at 2.0%, CPI fell to 2.7%, FED ‘s rate at 1.95% (IOER) and expected to reach 3.1% within the cycle. FED’s view of long run rate at 2.9%

- GDP at 2.9%y/y, 4.2% q/q, 10y Bond yields at 2.99% (+10 bps w/w)

- Unemployment at 3.9% (vs natural rate of unemployment of 4.5%), FED expects 3.6% unemployment in 4Q18 and 3.5% for 2019 and 2020.

Strengths of USD:

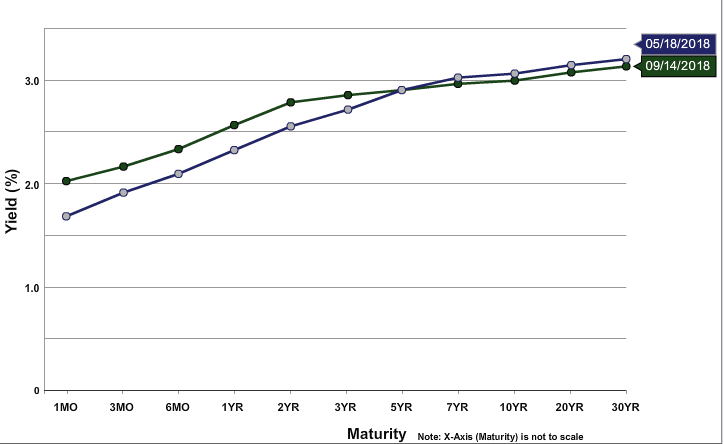

- inflation is not worrying (latest release showed a lower number; labor cost data decreased & Trump canceled a 2.1% wage raise for federal employees) and at the same time the Fed is set to rise rates within the next 10 days.

- GDP, Manufacturing PMI, Non-manufacturing PMI, Service PMI are all recording big numbers. Yet, business inventories rising and retail sales falling is the most alarming sigh for a downtrend

- two new narratives capable of boosting US markets for another semester are in the making (a) indexing inflation so that long term capital gains are taxed lower (b) publishing earnings every 6 months instead of every 3 months can bring creative accounting.

Weaknesses of USD:

- 10y Government Bond yields remains below 3.0%

- risk-on news like a Nafta deal, EU-UK negotiations concluding, consensus with China, may simultaneously hit the headlines sending USD lower

Watch:

- Wednesday’s Current Account, Thursday’s Manufacturing Index and Friday’s Manufacturing and Services PMI. All numbers are expected to increase, favoring USD.

- Next Monetary Meeting on 26 September, when a new hike is expected.

EUR

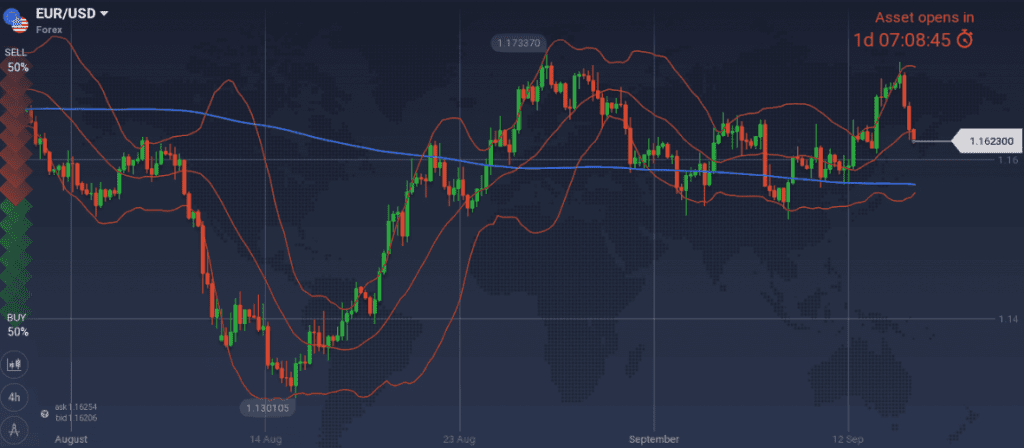

I am keeping my short EUR/USD positions and target 1.1573 as a take profit level

Snapshot unchanged:

- Annual CPI at 2.0%, core CPI (=ECB’s compass) at 1.0%, ECB ‘s rate at 0.00%

- GDP at 2.1% growth (OPEC reduced expectations to 2.0%), 10y Bond yields of EFSF at -0.41% (-4bps w/w), 10y German Bond yields at 0.45% (+8bps w/w), 10y Italian Bond yield at 2.81% (-1bps w/w), 10y Greek Bonds yields at 4.09 (-21bps w/w, at the fourth week following bailout protection)

- Unemployment at 8.2%

Strengths of EUR/USD:

- excluding Italy, fiscal policies will not be as neutral as previously expected

- improvement of labor market and wage growth

- decreasing bond yields of European periphery, decreasing unemployment

Weaknesses of EUR/USD:

- we are one month away from the Bavarian elections and the announcement of Italian’s government budget.

- the different stages of monetary policy between EU and US, can only be simulated with two expected dips of EUR/USD, in late September and mid-December

- a possible decline of US equities would fuel a risk off environment, where EUR is generally falling

- decreased M3, retail sales and trade balance reading

Watch:

- Monday’s Inflation readings

- Wednesday’s Current Account release. A number bellow 22bn could send EUR/USD lower

- Friday’s Manufacturing and Services PMI. Numbers are expected to be high and short EUR/USD positions should be closed.

- Next Monetary Meeting on 25 October.

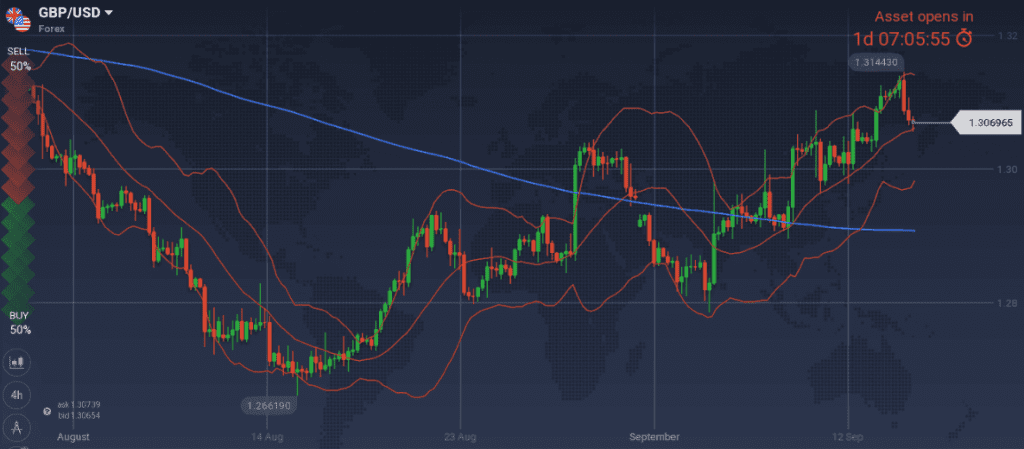

GBP

Last’s week’s GBP move has been marked by the expressed optimism of Michal Barnier, the European Chief Negotiator for the UK exit, that a Brexit deal could be struck in the next two months. This time, GBP gains were not short lived and were additionally fueled by the increased GDP m/m reading.

I am not offering a forecast for GBP under such a volatile environment

Snapshot improved:

- Inflation at 2.5% (vs 2.0% target), BOE ‘s rate at 0.75%

- GDP at 1.3% growth (vs 1.75% BOE’s expectations and 1.3% decreased OPEC’s expectations), 10y Bond yields at 1.53% (+7bps w/w)

- Unemployment unchanged at 4.0%

Strengths:

- the bad weather narrative for the abnormally low GDP number of 1Q18 is valid. GDP m/m growth increased to 0.3% and 3Q18 GDP q/q expected at 0.6%.

- Macro picture is improving: GDP, unemployment

- positive macro releases: Services PMI, Consumer Confidence, M4, consumer’s inflation expectations increased

Weaknesses:

- a no deal with EU is possible. In this case UK would be able to be competitive to EU regulatory wise but would lose tax revenues from the decrease of financial activity in the City.

- the no deal scenario has already been characterized as bad outcome by Mark Corney (Governor of BOE) and has been quantified to be equal to a £80bn in public finance by Philip Hammond (Head of Treasury)

- Negative macro releases: decreased average earnings, industrial order expectations, manufacturing and construction production and PMI

- UK politics and negotiation process.

- Wednesday’s inflation readings

- Thursday’s retail sales and any news from the scheduled EU summit

- Weekend’s Labor’s party conference

- Next Monetary Meeting on 1st of November.