Despite my last week’s low confidence my views were correct.

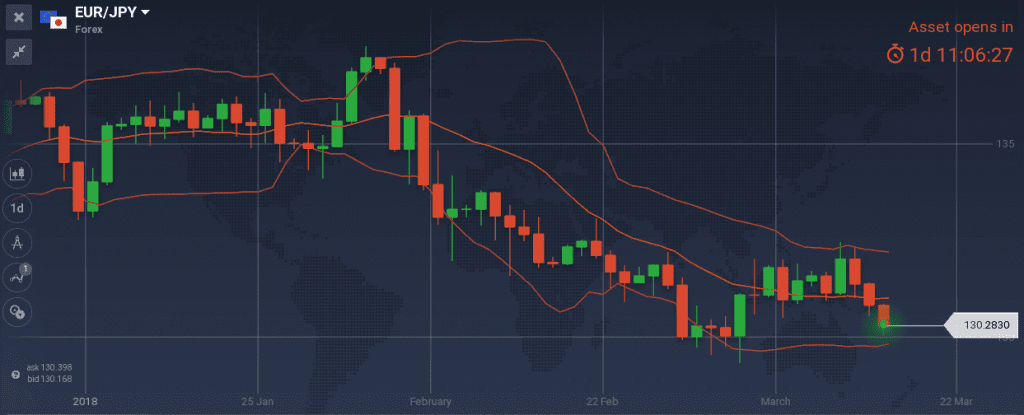

- Going short EURJPY at 131,85 level paid off

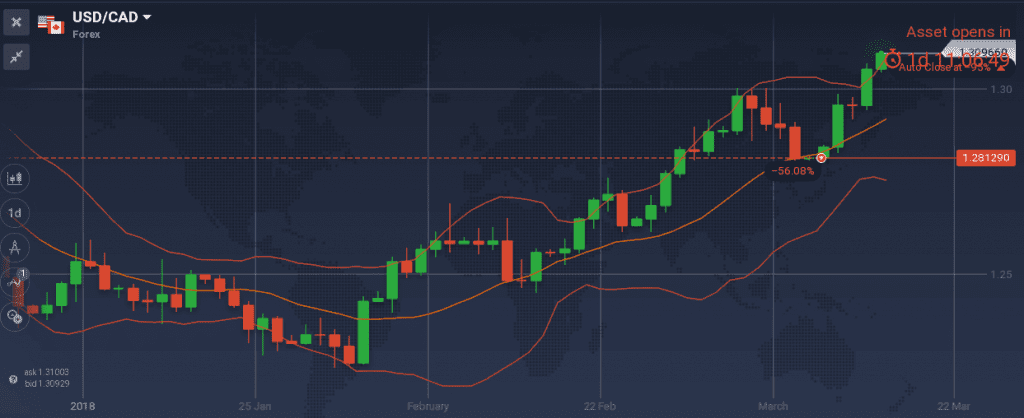

- USD/CAD is indeed in a healthy uptrend and almost reached my first target of 1.31 within a week. Yet 1,2719 level was never triggered to take advantage of the uptrend

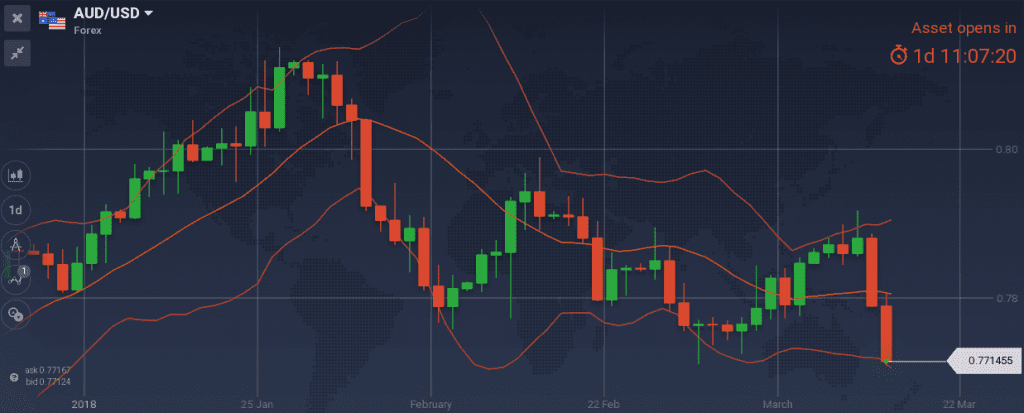

- AUD/USD is indeed weakening and short positions at 0.7810, 0.7850, 0.7880, 0.7900 levels paid off

- EUR/USD is indeed declining, yet I had not offered an entry point to take advantage of that.

- GBP strengthening scenario is indeed brought into play. Yet 1,3620 was never triggered to take advantage of the uptrend.

I keep betting on the high tension, high volatility, increasing inflation, increasing bond yields, decreasing equities scenario that favors haven currencies.

Major last week’s events:

- Another high ranked “adult” of Trump’s administration (Secretary of State Rex-Tillerson) resigned/fired. His probable replacement (Mr. Pompeo) has been hugely funded by the privately held oil and gas Koch Brothers company.

- Blocking of 117B USD takeover deal, on national security grounds, between Singapore’s Broadcom and USA’s Qualcomm.

- UK expelled Russian diplomats and earned the support of Australia.

- OPEC’s monthly oil market report that described a balanced market.

- EU and Japan attempt to be exempt from Trump’s tariffs

- Potential Trump (USA) and Kim Jong Un (North Korea) meeting, up until May

Major Scheduled Next week events:

- G20 meeting on Monday and Tuesday

- Wednesday’s (18.00 GMT) FED’s decision and (18:30 GMT) press conference

- Thursday’s (12:00 GMT) BOE Monetary decision.

JPY

My EUR/JPY short bias paid off during the last week and 131.85 level proved a nice entry point for the downtrend. The pair decisively crossed the 200-Day Moving Average and is heading south.

I maintain my short bias; any testing of the 131.20 level is a nice level to add to the short position. My target is the 127.60-127.10 zone

Snapshot:

- 0% GDP growth, all time low unemployment at 2.4%

- Inflation (excluding food) at 0.9% (vs 2.0% target)

- 05% 10y Bond yields vs BOJ’s target of 0.00% level (next auction on 4th April)

Strengths of JPY:

- last strong Current Account reading of 2.02T

- decisiveness communicated by the Central Bank. Next meeting is scheduled within the end of April

- Trump’s tariff drama or any other turbulence favors JPY as it maintains it’s safe haven

Weaknesses of JPY:

- diminishing geopolitical risk (although I am not certain to categorize a potential summit between Trump and Kim Jong Un as decreasing or increasing geopolitical risk).

- the pair may halt the downtrend at 129.70-129.34

Watch:

- Monday’s (00.00GMT) Trade Balance release. Any reading above 0.27T is within my scenario

- Remember that Wednesday is a bank holiday for Japan

CAD

My last week’s view was that USD/CAD is in a healthy uptrend that could potentially reach 1.31 or even 1.34 level. 1.31 has quickly been reached making this week’s call, very difficult.

On the one hand, all expressed arguments supporting the CAD weakening scenario are still valid, the expected market moving events of the week (like the FED’s meeting) may result in further weakening, the most important event that could strengthen CAD (=the increase of oil prices) happened and failed to strengthen CAD. On the other hand, the 131.50-131.66 level (that has almost been reached) could be regarded as a level were CAD weakness is well priced for the moment.

I maintain my long bias for the pair, but I can only enter at lower levels (i.e. 1.2976-1.2944 levels)

Snapshot:

- Inflation at 1.7% (vs 1.0%~3.0% target range). Expected to pick up as gasoline, electricity and minimum wage increase

- GDP at 2.9% annual, 0.4% qoq.

- US crude oil inventories are rising again (last Wednesday’s reading was +5.0Mbarells), yet Friday’s increase of oil price did not strengthen CAD

Strengths of USD/CAD, weakness of CAD:

- The fact that Central Bank simplistically continued to assume no change in trade deals at its models and does not incorporate neither the range of outcomes of NAFTA talks nor Trump’s tariffs, makes me regard it as a continuing pressure on CAD that will stay until the release of Business Outlook Survey, expected on 9th of April.

- I continue correlating any increase of inflation with further weakening of CAD.

- My last week’s interpretation of the 8th of March communication of Central Bank was wrong. I no longer expect a rate hike at next month’s meeting (18 April). I regard the last speech (13th of March) of the Central Bank’s Governor, saying that economy carries untapped potential, as an indication that no rate hike is considered in the months ahead.

Weaknesses of USD/CAD, strengths of CAD:

- The pair is reaching 1.3150-1.3166 level and a short-lived bounce back is probable

Watch:

- Wednesday’s 14:30GMT US Crude oil inventories. I believe that any number above 2.5Mbarrels is weakening CAD

- Friday’s (12:30GMT) inflation announcements

AUD

Last week I was correct to argue in favor of AUD/USD weakening, using 0.7810, 0.7850, 0.7880, 0.7900 as potential levels to build a short position. My reasoning was that Australia’s terms of trade are declining, the Central Bank (RBA) is unwilling to start increasing rates and that during any new equity sell off (which I think is still very possible) AUD would weaken because it does not enjoy a haven status.

Yet, I was also noting that I wanted to see lower reading of China’s Industrial production (7.2%yoy) and Retail Sales (9.7%yoy) so that my decreasing AUD/USD scenario is favored. The readings were higher and triggered a 12-hour rally of AUD/USD. Since then (Wednesday 14.00GMT) the pair is weakening.

Snapshot:

- Central bank ‘s interest rate is at 1.50% with no hike yet in this cycle.

- Inflation at 1.9% (vs 2.0~3.0% target), Unemployment at 5.5% and expected to decline

- GDP latest reading at 2.4% growth (2.8% was 2017 reading)

Strengths:

- Nothing to note

Weaknesses:

- Latest declined GDP reading

- Declining terms of trade

Watch:

- Thursday’s 00:30GMT, unemployment release. Only strong reading of bellow 5.3% would halt our AUD/USD weakening scenario

- Next Monetary Meeting on 3rd of April

- Remember that next release of Australian wages expected on the 16th of May. I believe that this is the only reading that could trigger an updated Central Bank’s view. Note that markets are expecting the first-rate hike no earlier than the first half of 2019.

USD

Last week, I avoided calling any shots on USD as I could not price the significance of proposed tariffs. I believe that the exceptions of the tariffs make them far less harmful and thus I maintain my long bias on USD. I refuse to believe that the multi-layered US political system will let the current President undermine the fundamental concept of shared reality.

Snapshot:

- US economy is growing at a healthy rate of 2.5%, unemployment is at 4.1%, the biggest tax reform is already a reality and PCE (the inflation reading watched by the FED) is at 1.7%

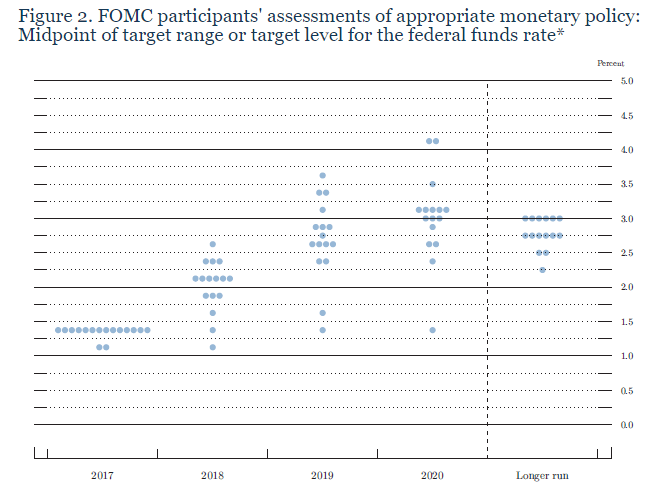

- We are counting 5 hikes of 25bps since Dec ’15, resulting to a current FED rate of 1.50% which Ι expect to reach the peak of 2.75% ~3.00% in this cycle.

Strengths of USD:

- 10y Government bond are yielding 2.89%

- Increasing Consumer inflation expectations at 2.9%

- the last week’s decreased Federal budget number was soon understood to be a consequence of last month’s short-lived government shut-down.

- proposed tariffs do not seem to be as significant as initially considered

Weaknesses of USD:

- protectionism

Watch:

- the first FOMC meeting of Jerome Powell as FED’s chairman, on Wednesday at 18:00GMT. 25bps hike is expected but I would like also to see the updated FED dots that could well include a more hawkish surprise

EUR

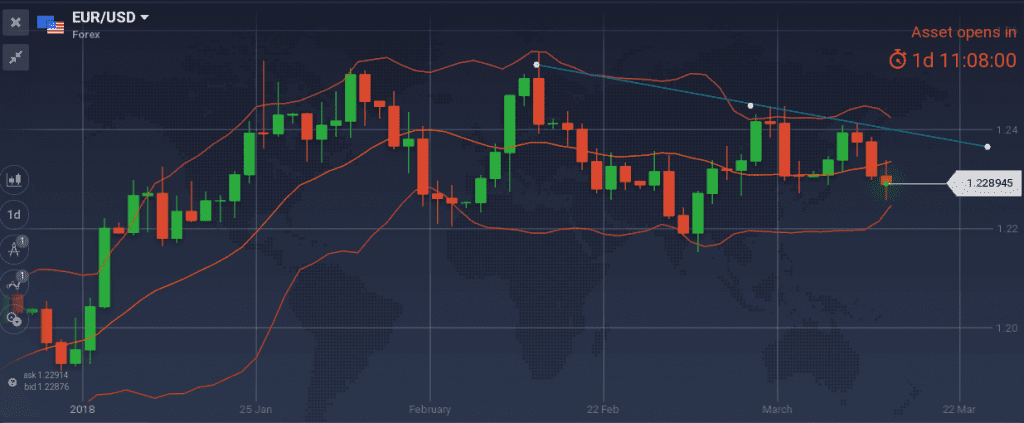

I am keeping my short bias on EUR/USD as we are heading to FED’s meeting and a week with many important macro-announcements.

Snapshot:

- European’s Economy is doing well. Actual GDP growth at 2.4% but the rosy picture seems to have already been priced at the 1.25 peak

Strengths of EUR/USD:

- Last week I was noting that US tariff drama strengthens the pair. Yet the new episodes of the tariff drama would have weakening effects on tariffs, as they included EU and Japan asking to be exempted. I keep believing that US led protectionism strengthens the pair.

Weaknesses:

- the divergence of EU’s and USA’s economy is becoming more evident as the European government bond’s yields are decreasing and at the same time US government bond yields are increasing.

- decreased European current account, economic sentiment and PMI readings seem to have found their ceiling. Note that new releases of these readings are expected within the week.

- double top formation at the 1.2500 level, and defined formation of downtrend

Watch:

- Monday’s 10:00GMT Trade Balance. I want to see a number below 23.8B for my scenario to be valid

- Tuesday’s 22.00GMT ZEW Economic Sentiment. My outlook is getting stronger if we see a decreased reading

- Wednesday’s German 10Y Bond auction. I want to see a number below 0.70% for my scenario to be valid. The lower the number, the more confident I become to wait for FED’s meeting on 18:00GMT with opened short positions on EURUSD.

- Thursday’s PMI (8:00GMT, 8:30GMT, 9:00GMT) and Current Account (9:00GMT) readings. I am expecting all numbers to be slightly decreased for my scenario to be valid

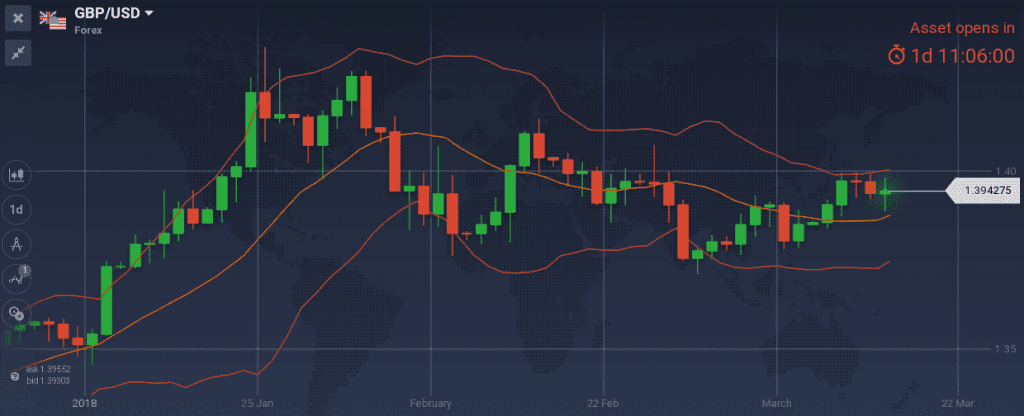

GBP

The scenario in favor of a strengthening GBP played well. Yet GBP/USD did not retest the 1.3620 level, where I was ready to build long positions. I am still biased to go long, but I will not do so in the current level, and especially as we are heading to the FED’s and BOE’s monetary meetings.

Searching to go long GBP/CAD, GBP/AUD or short EUR/GBP is what I am thinking.

- I could enter long GBPCAD at 1.8058, 1.8048, 1.8005 or even 1.7950 levels

- I could enter long GBPAUD at 1.7955, 1.7918 and 1.7862

- I could enter short EURGBP at 0.8858,0.8878 and 0.8888

Snapshot:

- 5% GDP growth, 4.4% unemployment and 3.00% inflation (only major economy with higher inflation than the targeted 2%)

- Second rate hike on the 10th of May is probable.

Strengths:

- Macro announcements showing that the economy is strong

Weaknesses:

Watch:

- Tuesday’s Inflation reading. If inflation keeps staying at the 3% and does not decrease, as expected by both markets and BOE, a rate hike becomes necessary. A 3% or higher reading, would complicate things because the scheduled monetary meeting is within the same week and markets are only expecting a rate hike at the 10 of May’s meeting.

- Wednesday’s 9:30 GMT Unemployment and Average earnings readings. Increased numbers would ask for rate hike, same as inflation.

- Thursday’s 12:00 GMT Monetary policy meeting. Markets are expecting an unchanged decision, yet I am not that convinced that a rate hike or decreasing asset purchases is totally out of this week’s meeting considerations.