When your horizon is not the day but the next 12 months, changing once view is like maneuvering a big ship. You do commit to daily or weekly trimming, exploiting of market’s overreactions, waiting for your desired levels to be triggered, but your main scenario needs to be proved and favored by everyday macro releases and events. My main scenario since the beginning of the year, that markets are underpricing risks and eventually we will notice equities falling, inflation and rates rising is not validated by the everyday releases and facts.

On the other hand, SP500 should have already been able to cross the 2822 level, fueled by the impressive released earnings, and not form a weekly doji candle, that signals a reversal.

I am in the process of checking the validity of a risk on scenario where equities will be able to rally further, no unexpected geopolitical event taking place during August and currencies gaining back against USD.

Major last week’s events:

- EU-JAPAN: The biggest trade deal ever signed by EU is a fact and will take effect within 2019. Current annual trade volume is at 150B$ (EU exports cheese & wine, Japan exports automobiles & electronics)

- Trump-Putin Summit in Helsinki was almost a non-event. I assume it is positive that there is a line of communication between them but worrisome that they preferred to have private talks with no-one else in the room except their translators. Democrats already called Trump’s translator to testify. US sanctions on Russia for occupying Crimea are still on, North Stream II project is still on, both leaders looked in a consensus for the next steps in Syria. Trump’s responses to keep the same distance from US intelligence services findings and Putin’s word has been heavily criticized.

- Tariffs front: nothing new under my radar.

- Cryptos: Total market cap jumped briefly to 300B$ and now stands at 276B$, +11% w/w. I could note down the devaluation of CNY and CFA Institute’s published intentions to include cryptos and blockchain into its curriculum as arguments for the bull scenario. On the other hand, I could also note that the impressive/1 hour/ Tuesday’s /Bitcoin’s rally, could have been a short squeeze. Note that daily volume is around 363M$ (7 times less than the 2500M$ highs of December ’17).

Major next week events:

- Tuesday’s Monetary Meeting of Central Bank of Turkey. It could pay off to build a short position on USDTRY before the meeting.

- Thursday’s Monetary Meeting of ECB (Europe) where nothing new is expected

JPY

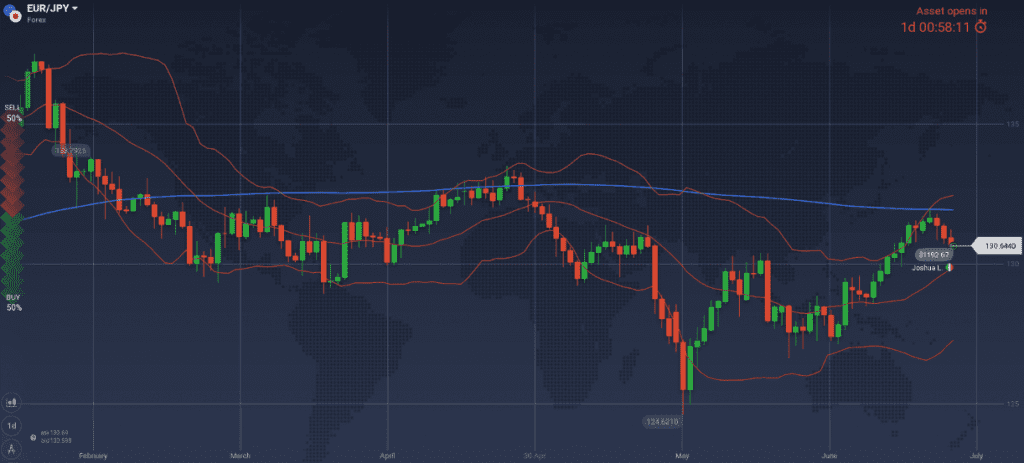

Refusing to turn bullish on EUR/JPY has been my view last week and it played well, as the pair rebounded on the 200Day Moving Average.

Choosing a narrative between the corporate earnings that could drive equities higher and the failure of equities indexes to cross north technically significant levels, is crucial. I am favoring the first argument and search to go long EUR/JPY at 129.36.

Snapshot improved:

- Inflation (excluding food-National core CPI) increased at 0.8% (vs 2.0% target and BOJ’s members expectation of 1.2~1.3% within 2018), BOJ rate at -0.1%

- GDP at 1.10% annual, -0.2% q/q, 10Y Government bonds yield at 0.04% (+1bps w/w) vs BOJ’s target of 0.00% level

- Unemployment at 2.2% (lowest levels since 1993)

Strengths of JPY:

- QQE will stay, up until core CPI reads 2.0% in a stable manner

- increasing inflation, bank lending, trade balance, decreasing unemployment

Weaknesses of JPY:

- equities bear scenario is fading away as earnings are impressive and the negative effects of tariffs on global GDP is priced in without exaggerations

- decreased readings of monetary base, household spending and machine orders

Watch:

- Tuesday’s Manufacturing PMI. A reading above 53.1 favors the long EUR/JPY scenario

- Next Monetary Policy meeting on 31 July.

CAD

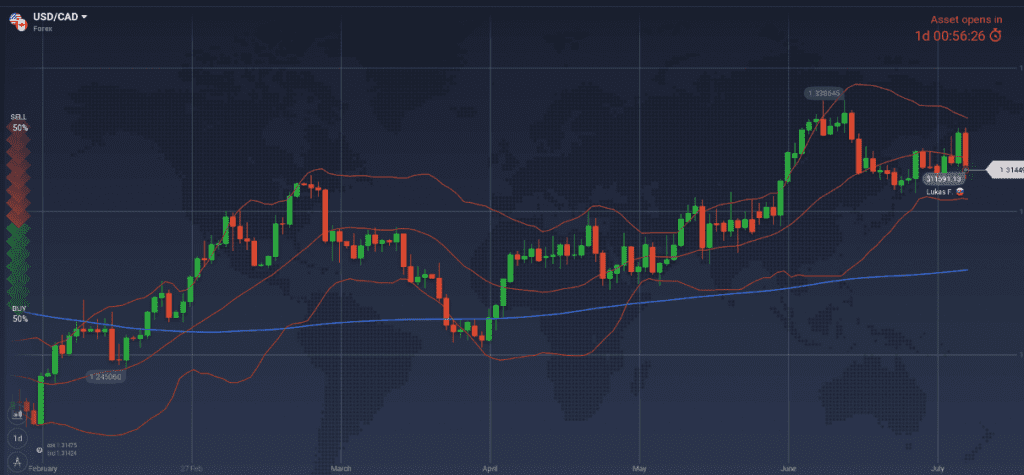

Due to last week’s contradicting data (improving macros + signs of decreasing price of oil), I have not offered a view. I only noted that Friday’s inflation readings were expected higher and would favor the short USD/CAD trade, which happened.

Snapshot improved:

- Inflation increased at 2.5% hitting the expected number for 3Q18 (target range is 1.0%~3.0%), BOC rate at 1.50% (4 hikes so far, neutral rate according to BOC within 2.5%~3.5% range).

- GDP at 2.3% (vs BOC expectations of 2.0% in 2018 and long-term potential of 1.8%), 10Y Government bonds yield at 2.18% (+5bps w/w)

- Unemployment at 6.0%

Strengths of USD/CAD, weakness of CAD:

- decreased manufacturing sales, and decreased trade balance

- Nafta negotiations not concluding and tariffs on steel from both sides taking effect

- oil is not moving north as expected.

Weaknesses of USD/CAD, strengths of CAD:

- latest housing starts release, one of the main sources of uncertainty besides trade policies, increased impressively by 27%, making central bank’s decision (to proceed with hiking) correct

- impressive increase of retail sales

Watch:

- Thursday’s meeting of the 13 OPEC countries and additional 11 oil producing countries

- Next Monetary Meeting on 5th of September.

AUD

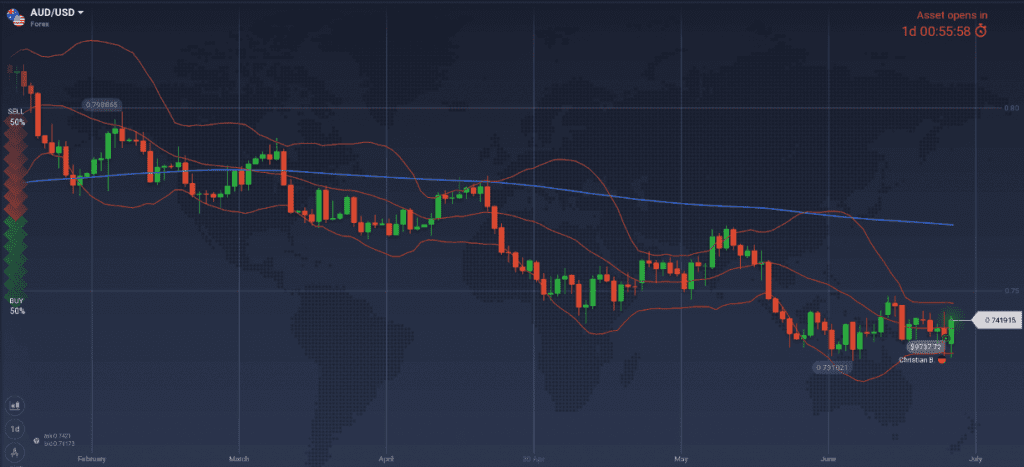

The macro picture and my remarks are identical from the previous week. I keep focusing on household consumption, as low numbers seem contained and possible big numbers will shoot AUD higher.

I could open a long AUD/USD position at 1.7360 level, targeting 1.7570

Snapshot unchanged:

- Inflation at 1.9% (vs 2.0~3.0% target), RBA ‘s rate at 1.50% (no hike so far)

- GDP at 3.1% (RBA expects more than 3.0% within 2018 and 2019), 10y Bond yields at 2.62% (-1 bps w/w)

- Unemployment at 5.4%

Strengths:

- significant increase of GDP, inflation expectations and trade balance

- improved business confidence & profits, private capital expenditure, home loans to Australians and latest impressive increase of consumer sentiment

Weaknesses:

- latest readings of wages growth (next release on August), building approvals and new home sales do not support AUD strengthening.

- Market participants expect the rates to remain unchanged for a considerable period of time

Watch:

- Wednesday’s inflation reading, that is expected to be higher, could fuel an AUD/USD rally.

- Next Monetary Meeting on 7th of August

USD

On the one hand there is Powell (FED’s governor) reassuring that economy is doing well, the negative effects of tariffs have not yet been felt and that he will continue with the gradual increases of rates and the shrinking of FED’s balance sheet. On the other hand, there are politicians arguing in favor of maintaining the current 4.3T$ balance it and current rates.

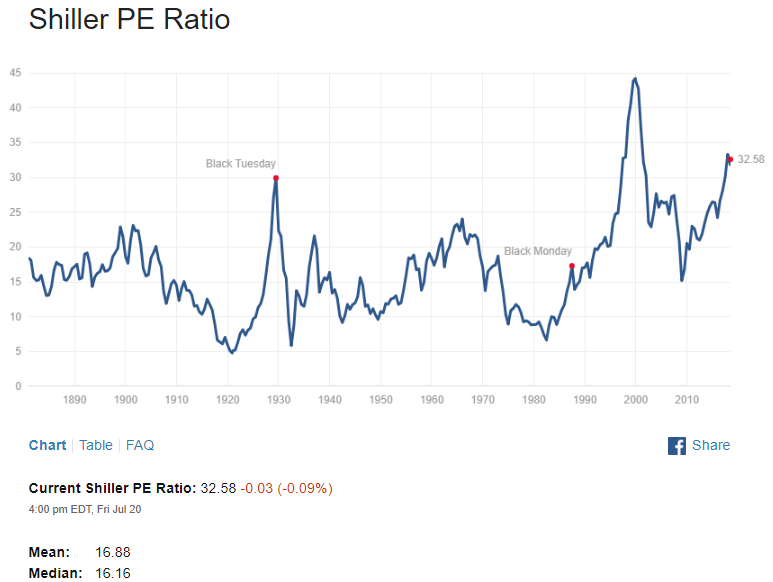

The most important thing is deciding on the possible direction of US equities. Below is a chart of their Price to Earnings ratio, as of Friday 20th of July. Market has reasons to move in both directions.

Snapshot unchanged:

- Inflation (Core PCE) at FED’s target of 2.0% (latest m/m CPI decreased), FED ‘s rate at 1.95% (IOER) expected to reach 3.1% within the cycle. FED’s view of long run rate at 2.9%

- GDP at 2.8%, 10y Bond yields at 2.89% (+6 bps w/w)

- Unemployment at 4.0% (vs natural rate of unemployment of 4.5%), FED expects 3.6% unemployment in 4Q18 and 3.5% for 2019 and 2020.

Strengths of USD:

- Strong macros: Durable Goods orders, Manufacturing and Non-Manufacturing PMI at the roof, capacity utilization

Weaknesses of USD:

- Equities rally. Last week’s earnings (Blackrock, Goldman Sachs, Morgan Stanley,Microsoft) were impressive (even Netflix was impressive in my book), but failed to send S&P500 above the technically significant level of 2822. Next week Google, Amazon, Harley Davidson, Boeing and Twitter are among the companies that release their earnings.

- 10y Government Bond yields refusing to cross 3.0%

- downward revision of GDP for 1Q2018, first increase of unemployment since a long time

- latest disappointing releases on housing market & retail sales while the business inventories are keep on rising, as it generally happens during the latest stage of the business cycle.

Watch:

- Monday’s new reading on housing, Tuesday’s PMI readings

- Friday’s GDP reading that is expected to be strong

- Next Monetary Meeting on 1st of August

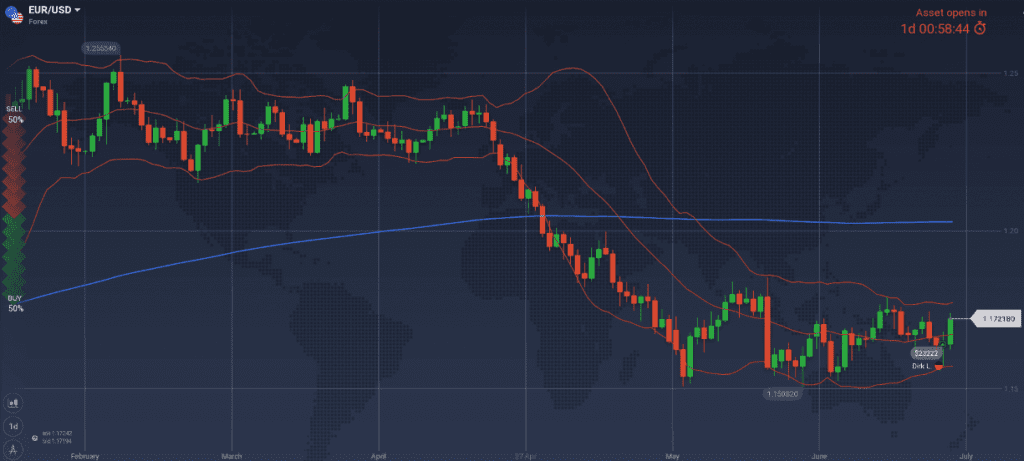

EUR

Snapshot unchanged:

- Annual Core CPI hit target of 2.0%, ECB ‘s rate at 0.00% (Apologies for last week’s typo)

- GDP at 2.5% growth (OPEC expects a 2.2% reading), 10y Bond yields of EFSF at -0.4% (-1bps w/w), 10y German Bond yields at 0.37% (+3bps w/w), 10y Italian Bond yield at 2.59% (+4bps w/w)

- Unemployment decreased to 8.4%

Strengths of EUR/USD:

- increased M3(latest reading at 4%), retail PMI above the 50 threshold, Manufacturing PMI and Service PMI at high levels, increasing industrial production and investor’s sentiment (updated releases of M3 and PMI are expected this week)

- trade war between USA and China. Remember that CNY devaluations are generally boosting EUR

Weaknesses of EUR/USD:

- any possible equity sells off

Watch:

- Monday’s Consumer Confidence, Tuesday’s Manufacturing and Services PMI, Wednesday’s M3, Private Loans, and Business Climate. All increasing numbers are favoring the long EUR/USD scenario

- Thursday’s Monetary Meeting of ECB. Nothing significant is expected

GBP

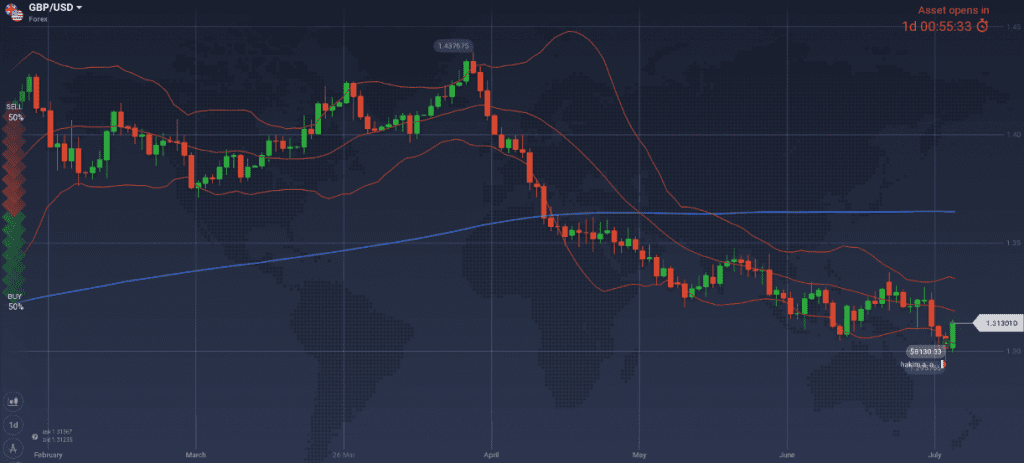

Expecting an increased inflation reading that would push GBP higher has not materialized. Inflation was unchanged at 2.40% offering no reason to refocus on improving macro conditions and out of the disruptive UK politics.

As the first concrete document from UK government is out, describing the EU-UK relationships after Brexit, the main opposition -voiced by the newly resigned Boris Johnson-is that UK is giving away regulatory innovation capabilities and narrows the scope of future trade agreements between UK and the rest of the world.

There is no concrete reason to be long GBP under these circumstances, other than the current exchange rate that looks cheap from a technical point of view. I could go long GBP/USD at 1.3042.

Snapshot unchanged:

- Inflation at 2.4% (vs 2.0% target), BOE ‘s rate at 0.50%

- GDP at 1.2% growth (1.4% OPEC’s estimates vs 1.75% BOE’s expectations), 10y Bond yields at 1.23% (-4bps w/w)

- Unemployment at 4.2% (BOE expects to fall further in Q2)

Strengths:

- the bad weather narrative for Q1 could be valid

- increased GDP qoq, M4, Current account, Manufacturing PMI, Construction PMI and Services PMI. Latest

- growing number of BOE’s members voting for a rate hike (3 members out of 9 instead of 2)

Weaknesses:

- latest retail sales, average earnings were disappointing.

- the expected re-rise of inflation has not yet materialized

- politics

Watch:

- Wednesday’s mortgages reading (High Street Lending). A number above 39.2K£ favors the long GBP/USD scenario

- Next Monetary Meeting on 2nd of August