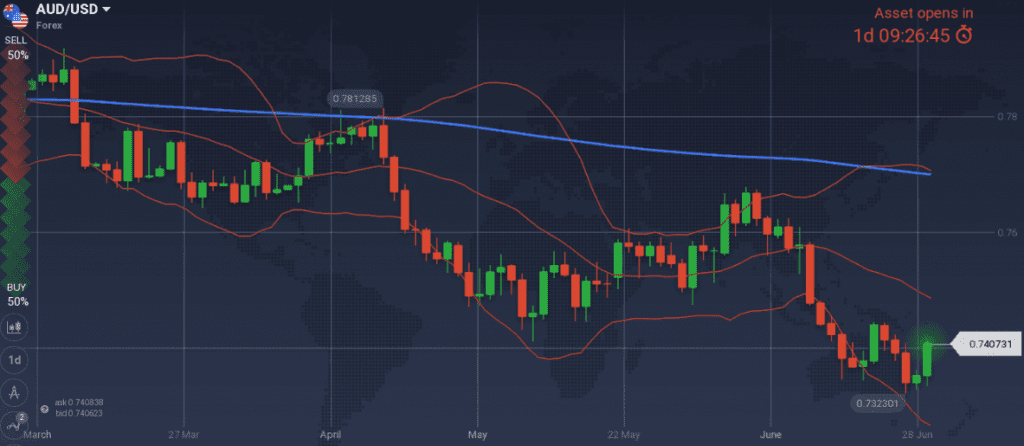

Last week, I enjoyed the downtrend gap of USD/TRY following Sunday’s Turkeys elections (a trade I had noted since the 11th of June report), the GBP getting stronger following the Friday’s 9.30GMT readings and the eventual downtrend move of USD/CAD. On the other hand, I missed the opportunity to rebuild EUR/USD short positions (the 1.1750 level was not triggered for 30pips) and the long AUD/USD trade needs to move further north to turn my old positions green.

Major last week’s events:

- EU: The two-day summit, fueled fears for European unity, but eventually common ground has been found, despite the contradicting agenda of member states on migration. United reaction towards USA’s tariffs, budget strengthening and a road-map towards common deposit insurance across EU, Brexit and a road-map for Albania and North Macedonia entering were included in the agenda.

- Korea, Iran: US ambassador is set to move to North Korea, while North Korea is updating its arsenal.

- Tariffs front-Trade Tactics: China is set to revise for the 8th time since 1995, the industries and rules under which it accepts foreign investments

- US transformation: Supreme Court acknowledged Trump’s power to set travel bans and Anthony Kennedy’s retirement potentially cements court’s bias to conservatism. Meanwhile, Bernie Sanders viewpoint is gaining traction at the Democrats camp, as a 28years old bartender wins New York Democrats primaries.

- Cryptos: Total market cap at 256B$, +0% w/w, -28% in the last three weeks and set to rebound

Major next week events:

- look for next episodes of Tariffs Drama-Trade Tactics.

- Starting from Thursday, Chinese commercial banks are allowed by the Central Bank to hold 0.5% less capital

JPY

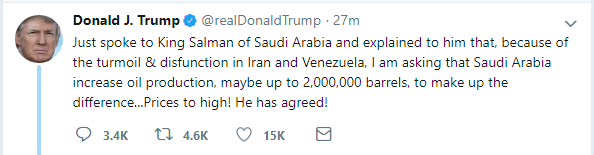

Last weeks advised 129.10 level to go short, offered a short-lived bounce of 50 pips on Friday, but eventually was not the best entry level.

I keep my short bias on EUR/JPY and want to enter at 129.70 and 130.09

Snapshot improved:

- Inflation (excluding food-National core CPI) at 0.7% (vs 2.0% target and BOJ’s members expectation of 1.2~1.3% within 2018), BOJ rate at -0.1%

- GDP at 1.10% annual, -0.2% q/q, 10Y Government bonds yield at 0.04% (+0bps w/w) vs BOJ’s target of 0.00% level

- Unemployment decreased further to 2.2% (lowest levels since 1993)

Strengths of JPY:

- QQE will stay, up until core CPI reads 2.0% in a stable manner

- increasing Manufacturing PMI and decreasing unemployment

- latest equity sells off favored JPY. Remains to be seen if equities will continue to slide as both Dow30 and Dax are below their 200DayMovingAverage

Weaknesses of JPY:

- latest negative GDP reading and Trade Balance reading at -0.30T ¥

Watch:

- Tuesday’s 0.50GMT monetary base reading and the yield auctioned for the 10y Government bonds

- Next Monetary Policy meeting on 31 July.

CAD

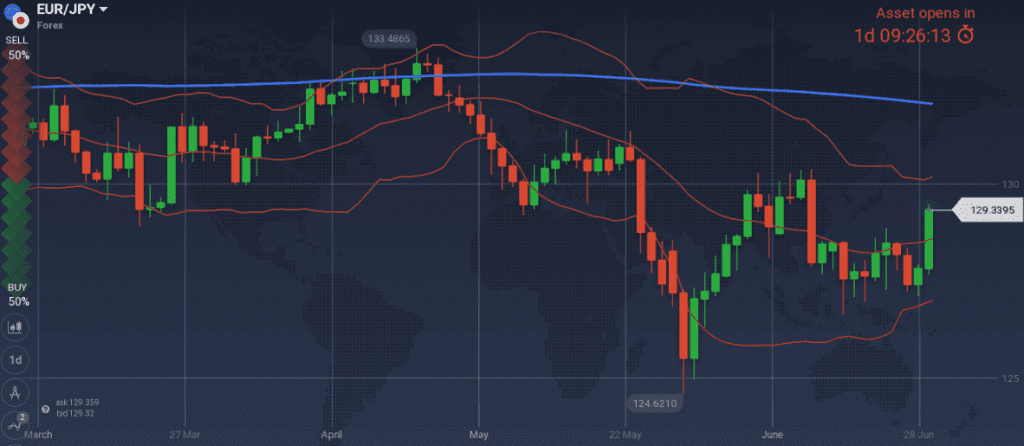

Following the last two days, long awaited, steep, south move and the crossing of 1.3150 level, it is hard to add more short trades at current levels.

I keep my short USD/CAD bias and could re-enter at 1.3208, as I believe in a possible rate hike on the next monetary meeting.

Snapshot unchanged:

- Inflation at 2.2% (vs 1.0%~3.0% target range, expected to increase again in 2018), BOC rate at 1.25% (3 hikes so far). Neutral rate within 2.5%~3.5% range according to BOC.

- GDP at 2.3% (vs BOC expectations of 2.0% in 2018 and long-term potential of 1.8%), 10Y Government bonds yield at 2.17% (+4bps w/w)

- Unemployment at 5.8% and expected to decrease further.

Strengths of USD/CAD, weakness of CAD:

- latest decreased m/m inflation and GDP readings

- deteriorating housing market, decreased manufacturing sales

Weaknesses of USD/CAD, strengths of CAD:

- OPEC’s latest decisions coupled with the decreasing US crude oil inventories are pushing oil price higher. Nevertheless, I re-quote that correlation between oil and USD/CAD is not constantly high. Now stands at -0.30.

- upcoming monetary meeting of Bank of Canada

Watch:

- Monday’s Bank Holiday

- Friday’s 13.30GMT Trade Balance

- Next Monetary Meeting on 11th of July.

AUD

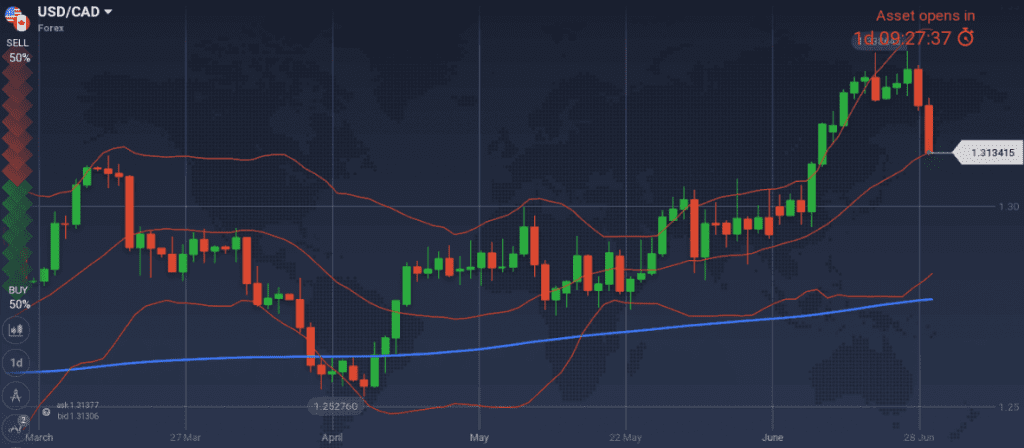

As we are heading to the Monetary Meeting, I keep my last week’s stance that economy is strong, long AUD/USD positions will pay off and 0.7680 level will eventually be reached within summer.

Snapshot unchanged:

- Inflation at 1.9% (vs 2.0~3.0% target), RBA ‘s rate at 1.50% (no hike so far)

- GDP at 3.1% (RBA expects 3.0% within 2018 and 2019), 10y Bond yields at 2.63% (-2 bps w/w)

- Unemployment at 5.4%

Strengths:

- significant increase of GDP reading and inflation expectations

- improved business confidence & consumer confidence, business profits, private capital expenditure, home loans to Australians

- falling Chinese Yuan, and expected July’s improved readings of Chinese economy

- reversal pattern

Weaknesses:

- latest reading of wages growth (next release on August), building approvals and new home sales do not support AUD strengthening.

Watch:

- Monday’s AIG Manufacturing Index. Any number above 56 is within my scenario.

- Tuesday’s Monetary Meeting

- Wednesday’s 2.30GMT Trade Balance. An increasing number strengthens my long AUD/USD bias

USD

I would avoid following my long USD bias, which has been my main theme for 2018.

Snapshot deteriorated:

- Inflation (Core PCE) hit FED’s target at 2.0%, FED ‘s rate at 1.95% (IOER) expected to reach 3.1% within the cycle. FED’s view of long run rate at 2.9%

- GDP revised downwards at 2.0%, 10y Bond yields at 2.86% (-3 bps w/w)

- Unemployment at 3.8% (vs natural rate of unemployment of 5.1% in 2015, 4.7% in 2017, 4.5% in 2018, could decrease further) FED expects 3.6% unemployment in 4Q18 and 3.5% for 2019 and 2020.

Strengths of USD:

- strong macros: Durable Goods orders, unemployment, retail sales, housing market

- Central Bank is keep on raising the natural rate of unemployment as participation increases

Weaknesses of USD:

- the 3.00% threshold seems high for 10y Government Bond yields and is not expected to be crossed any time soon

- last week’s rising Wholesale Inventories reading, coupled with the downward revision of GDP for 1Q2018

- PMI Manufacturing, PMI Services and sentiment decreasing from the highs

Watch:

- Monday’s 15.00GMT Manufacturing PMI. An expected decreasing number does not help long USD positions

- Wednesday’s bank holiday

- Friday’s 13.30GMT employment readings and trade balance

- Next Monetary Meeting on 1st of August

EUR

While the ongoing EU summit on migration was creating some headlines, the European macro picture continues to be mixed, with increasing hard readings on the one hand and decreasing sentiment on the other.

I keep my short EUR/USD bias and could enter at 1.1761 level.

Snapshot almost unchanged:

- Annual Core CPI decreased to 1.0% (vs 2.0% target), ECB ‘s rate at 0.00%

- GDP at 2.5% growth (OPEC expects a 2.2% reading), 10y Bond yields of EFSF at -0.37% (+0bps w/w), 10y German Bond yields at 0.3% (-4bps w/w), 10y Italian Bond yield at 2.68% (-1bps w/w, almost +23bps in 4 weeks since the political crisis)

- Unemployment at 8.5%

Strengths of EUR/USD:

- increased M3(latest reading at 4%), retail PMI above the 50 threshold, Manufacturing PMI and Service PMI at high and growing levels

- increasing oil prices. Note though, that the correlation between oil and EUR/USD (0.39) is not significant

Weaknesses of EUR/USD:

- investor’s confidence and economic sentiment decreasing

- current account decreased by 15% mom (from 32.8B€ to4B€)

- the different point in the cycle between US and EU economy

Watch:

- Monday’s and Wednesday’s 09.00GMT Manufacturing PMI and Services PMI reading

- Next Monetary Meeting on 26 July. Nothing significant is expected

GBP

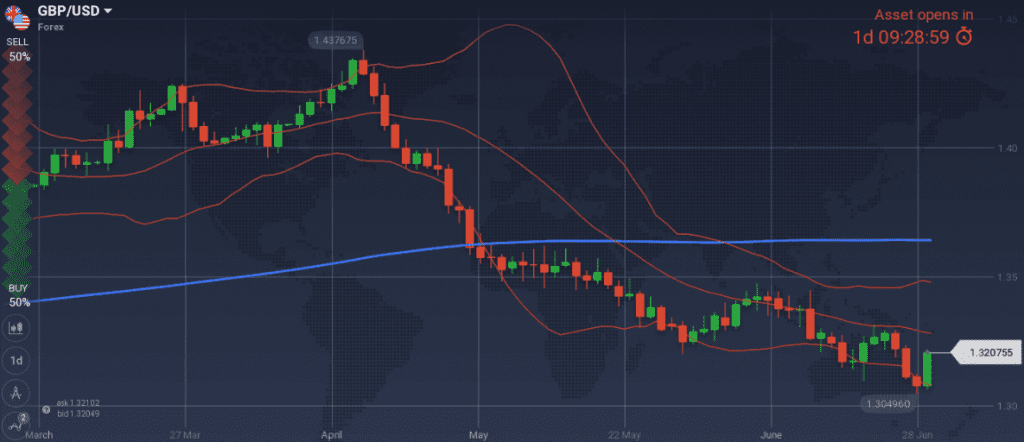

Friday’s Current Account, GDP, M4 readings coupled with the euphoria from EU-summit reaching a consensus on migration where enough to send GBP higher.

I could enter long GBP/USD at 1.3090 level.

Snapshot unchanged:

- Inflation at 2.4% (vs 2.0% target), BOE ‘s rate at 0.50% (no hike expected in 2018)

- GDP at 1.2% growth (1.5% OPEC’s estimates vs 1.75% BOE’s expectations), 10y Bond yields at 1.28% (-4bps w/w)

- Unemployment at 4.2% (BOE expects to fall further in Q2)

Strengths:

- the bad weather narrative for Q1 could be valid

- increased GDP qoq, M4 and Current account readings

- growing number of BOE’s members voting for a rate hike (3 members out of 9 instead of 2 members at past meetings)

Weaknesses:

- latest retail sales, average earnings, manufacturing production, construction was disappointing.

- Inflation at 2.4% expected to pick up again. Yet this has not materialized

- When the Brexit deadline was extended (3 months ago) away from March 2019 to December 2020, it was a relief. Yet, pressure will be back as progress is slow

Watch:

- Monday’s, Tuesday’s and Wednesday’s 9.30GMT Manufacturing PMI, Construction PMI and Services PMI. A -0.2 decrease from previous numbers would not change my long bias

- Tuesday’s auction of 10y Government Bond. Latest auctioned yield (1.61%) was way higher than current yields.

- Next Monetary Meeting on 2nd of August