Major last week’s events:

- Korea: On Monday N. Korea announced that will destroy Punggye-ri nuclear site and on Wednesday threatened to cancel the 12th of June planned meeting with USA

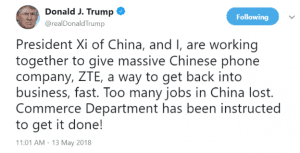

- Tariffs front: Trump lifted the ban of US companies selling to ZTE (ZTE is a Chinese tech company that was illegally selling to embargoed countries like Iran, N. Korea, Syria) giving ZTE a lifebelt.

Initially the move was interpreted as an exchange of China abandoning some tariffs on food products, then we learned that China corporations were providing 500M$ debt capital to Trump’s Son in law developments in Indonesia. On Thursday we learned that there is a Chinese offering package for 200B $ reduction of trade deficit, only to find out later that Foreign Minister of China denies such offering. On Friday, progress was reported at the meeting of Chinese and American officials, as China is set to remove tariffs and barriers for US products, allowing more US goods and services to be sold in China.

Initially the move was interpreted as an exchange of China abandoning some tariffs on food products, then we learned that China corporations were providing 500M$ debt capital to Trump’s Son in law developments in Indonesia. On Thursday we learned that there is a Chinese offering package for 200B $ reduction of trade deficit, only to find out later that Foreign Minister of China denies such offering. On Friday, progress was reported at the meeting of Chinese and American officials, as China is set to remove tariffs and barriers for US products, allowing more US goods and services to be sold in China. - NAFTA Talks: Deadline was missed. “Countries are nowhere near close to a deal” as Lighthizer said on Thursday

- Iran Deal: Iran Foreign Minister visited Beijing, Moscow and Brussels to save the deal. Merkel met Putin for the same reason. EU is working to shield European companies from US sanctions.

- Jerusalem: 62 Palestinians killed while US embassy moved to Jerusalem. US Ambassador in UN praised Israel and then exited the room as Palestinians begun talking.

- Italy: Week started with a deal between the anti-establishment party (5 Stars) and the anti-immigrant party (League) to form a government sending EUR tumbling.

- Cryptos: Total market cap at 375B$, same level as previous week.

My Forecasts:

Advising in favor of closing USD long positions in a week when Nafta deal did not happen, North Korea is back pedaling, Italy is set to have Populists Pagliacci for government, was a failure.

The good thing is that no argued position was on the red. The bad thing is that no profits could be made. Except for AUD/USD where one could make some returns when the 0.7485 level was re-tested, I completely missed the big move of EUR/USD, I missed the big move of GBP/JPY for 25pips, I have not offered a view for USD/CAD and completely missed to note the 131.20~131.30 range as a potential bounce range for EUR/JPY.

Major next week events:

- OPEC’s meeting on Monday

- Eurogroup on Thursday. JCPOA Joint Comprehensive Plan of Action with Iran and Greek debt will be discussed.

JPY

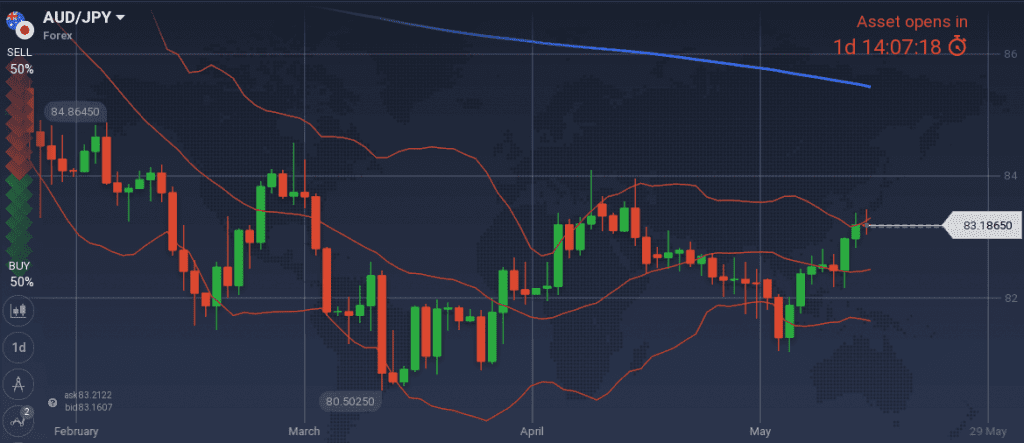

The EUR/JPY pair was dictated by the weakness of EUR rather than the strength of JPY. Adding short positions in the event the 132.39 level is triggered, is still valid, but this week I am shifting my attention to go long AUD/JPY at 82.75~82.65 range.

Snapshot is getting worse:

- Inflation (excluding food-National core CPI) at 0.7% (vs 2.0% target and BOJ’s members expectation of 1.2~1.3% within 2018), BOJ rate at -0.1%

- GDP at 0.90% annual, -0.2% q/q, 10Y Government bonds yield at 0.06% (+1bps w/w) vs BOJ’s target of 0.00% level

- Unemployment at 2.5% (lowest levels since 1993)

Strengths of JPY:

- QQE could stay in place up until 2020 or beyond.

- Increased Current Account

Weaknesses of JPY:

- equities seem to have found their support, following the high volatile February

- last week’s negative GDP reading and decreased inflation.

Watch:

- Monday’s 0.50GMT Trade Balance and Wednesday’s 1:50GMT Flash Manufacturing PMI to see if there is any room for an improved macro view for Japan that could support further short positions on EUR/JPY.

- Next Monetary Meeting on 15th of June

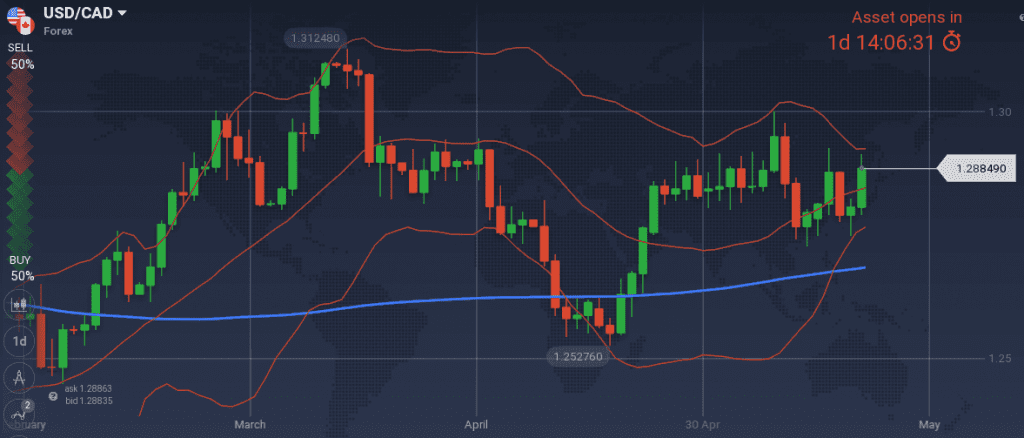

CAD

Unfortunately, I will keep avoiding offering any trading idea for CAD, as economy is growing at full potential and the only thing I want to see is increased lending in order to speculate on next rate hike.

Snapshot almost unchanged:

- Inflation at 2.2% (vs 1.0%~3.0% target range), BOC rate at 1.25% (3 hikes so far). Note BOC’s confidence on neutral rate within 2.5%~3.5% range.

- GDP at 2.9% annual (near potential GDP), 0.4% qoq, 10Y Government bonds yield at 2.49% (+11bps w/w)

- Unemployment at 5.8% and expected to decrease further.

Strengths of USD/CAD, weakness of CAD:

- Terms of trade (latest reading -4.1B CAD) favors USD

Weaknesses of USD/CAD, strengths of CAD:

- high oil prices. Note that the correlation between CAD and oil, used to be positive and strong in the past (i.e. both moved with the same direction). However, during the last weeks the relation is broken. Now stands at -0.25 (i.e. insignificant)

Watch:

- No market moving announcement is expected. Remember that Monday is a bank holiday.

- Next Monetary Meeting on 30th of May

AUD

0.7485 was a nice level to re-take long positions on AUD/USD. I keep my long bias and could re-enter at 0.7428 level.

Snapshot almost unchanged:

- Inflation at 1.9% (vs 2.0~3.0% target), RBA ‘s rate at 1.50% (no hike so far)

- GDP at 2.4% growth (3.0% could be achieved within 2018 and 2019 according to RBA), 10y Bond yields at 2.90% (+12 bps w/w)

- Unemployment increased slightly to 5.6% but is expected to decline.

Strengths:

- improved trade balance and increased building approvals

- improved business confidence

Weaknesses:

- household consumption is a source of uncertainty. Anything that quantifies household consumption (credit growth, wage growth, private capital expenditure) should be noted in the coming months. Latest reading of wages growth does not support AUD strengthening

Watch:

- No market moving announcement expected during the week

- Next Monetary Meeting on 5th of June

USD

The week was full of news in all fronts. Trade talks with China, Nafta negotiations, North Korea. All serials offered new headlines and USD strengthened further. Consequently, my last week’s advice to exit long USD trades did not played well.

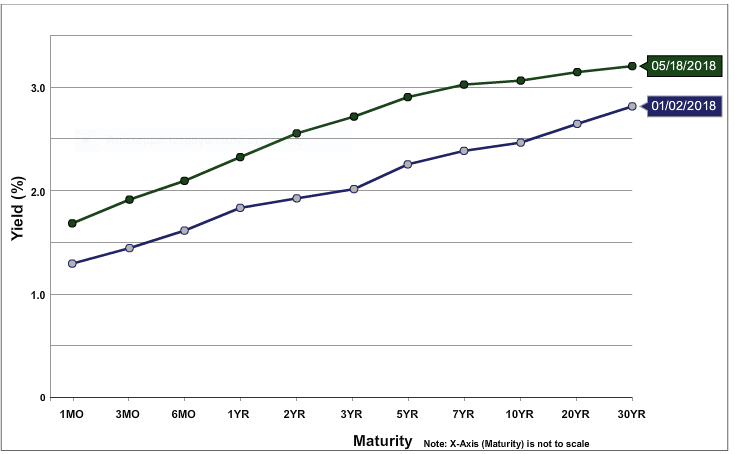

Meanwhile the week’s macro announcements did not change the view of a healthy economy growing at full speed and the 10Y Government bond closed the week yielding higher than 3.0%.

Snapshot almost unchanged:

- Inflation (Core PCE) at 1.9% (vs 2.0 target and 1.9% FED’s expectations), FED ‘s rate at 1.75%. 6 hikes so far in the business cycle and another 6 hikes expected by the end of 2019, to reach 3.25%. FED’s view of long run rate remains at 2.75%~3.00%

- GDP at 2.9% growth (FED expects 2.7% in 2018), 10y Bond yields at 3.06% (+9bps w/w)

- Unemployment at 3.9% and expected to fall to 3.8% in 2018

Strengths of USD:

- strong macros, increasing bond yields

- geopolitical risk

Weaknesses of USD:

- protectionism

- increasing oil prices

Watch:

- OPEC meeting on Monday and the new episodes of Trade talks with China, Summit with North Korea, Nafta talks

- Wednesday’s 14:45GMT Manufacturing PMI (latest reading 56.5) and Services PMI (54.6) and Friday’ s Consumer’s Sentiment. Latest readings are on the ceiling, but US economy may be growing even faster.

- Next Monetary Meeting on 13th of June.

Source: www.treasury.com

EUR

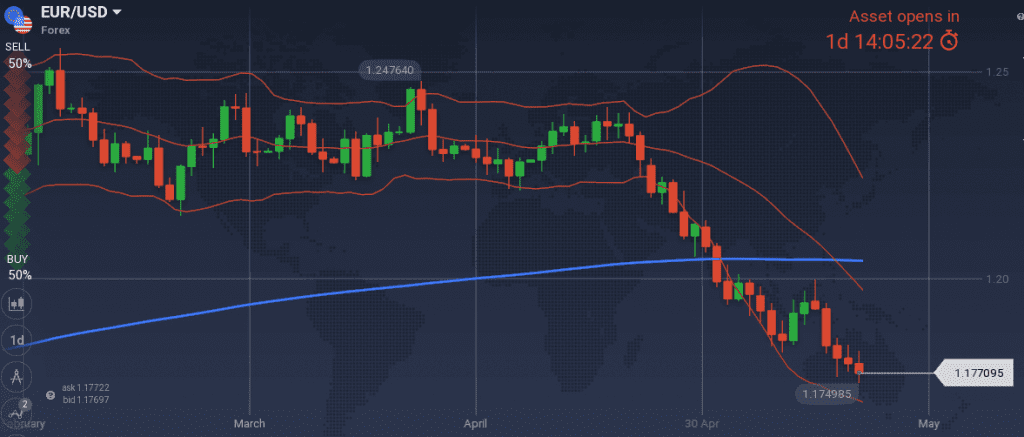

Exiting the short EUR/USD positions was a complete mistake, as the pair moved lower and we could have earned more. Political developments in Italy brought fear in the markets and increased the yields of all Government Bonds (except the EFSF’s ones). The Italian Populist’s coalition agenda reminded the unrealistic communication of the Greek government of 2015, when the contemporaneous (with the EUR backed by ECB) issuance of certificates backed by future tax transactions was considered a solid alternative.

I cannot enter short in current levels and note that 1.1765, 1.1660 and 1.1600 levels may stop the downtrend, so that EUR/USD begins consolidating.

Snapshot:

- Annual Core CPI Inflation at 0.7% (vs 2.0% target), ECB ‘s rate at 0.00%

- GDP at 2.5% growth (OPEC expects a 2.2% reading), 10y Bond yields of EFSF at -0.43% (-3bps w/w)

- Unemployment at 8.5%

Strengths of EUR/USD:

- the pair has already approached technically significant levels and additional bad news would need to come so that the downtrend is fueled.

Weaknesses of EUR/USD:

- political situation in Italy.

- the different point in the cycle between US and EU economy

Watch:

- Week begins with Monday’s Bank Holiday

- Wednesday’s 9:00GMT PMI readings. Unchanged or higher numbers of 56.2 Manufacturing PMI and 54.7 Services PMI will signal that EU economy is doing well and that the steepness of EUR/USD downtrend is not supported by fundamentals.

- Watch Tuesday’s GDP and Economic Sentiment, Wednesday’s yield of 10y German Bond, Friday’s Current Account and Trade Balance. I am expecting to see readings in favor of EUR, so all short EUR/USD positions are off for the week.

- Next Monetary Meeting on 14th of June

GBP

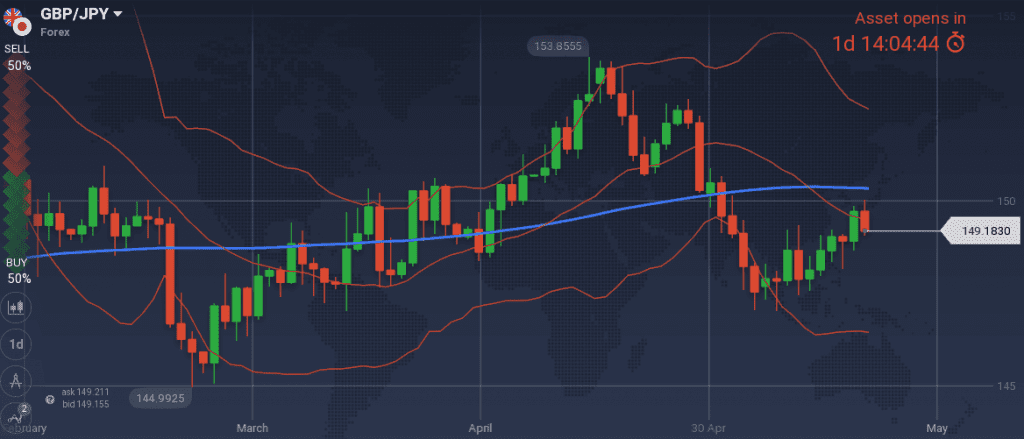

UK’s average earnings index was not favoring GBP. Yet Japan’s GDP reading was even more disappointing, and the long GBP/JPY trade was doing well during the week.

Unfortunately, we missed it for 25 pips, as the noted levels where not triggered.

I maintain my long GBP/JPY bias and will possibly enter at 148.35 level.

Snapshot almost unchanged:

- Inflation at 2.5% (vs 2.0% target), BOE ‘s rate at 0.50% (no hike expected in 2018)

- GDP at 1.2% growth (vs 1.4% previously vs 1.5% OPEC’s estimates), 10y Bond yields at 1.50% (+6bps w/w)

- Record low unemployment at 4.2% (BOE expects to fall further in Q2)

Strengths:

- the bad weather narrative regarding UK’s economy in 1Q18 may prove to be true.

Weaknesses:

- disappointing macroeconomic announcements

Watch:

- Wednesday’s 9:30GMT inflation readings. My long GBP/JPY scenario is helped with CPI above 2.5% and core CPI above 2.3%

- Thursday’s 9:30GMT retail sales. A higher than -1.2% reading favors my scenario

- Next Monetary Decision on 21 June.