Keeping my ground and adding to opened positions paid off in all fronts. The Turkish crisis seems contained, US equities are once again above 2822 level -in fact the level has been a nice opportunity to go long S&P500, US index fell, going long AUD/USD at 0.7284 and short USD/CAD at 1.3150 plays well, going long EUR/USD at the 200MA Weekly level (1.1357) is 81pips green, GBP/USD rebounded but unfortunately the 1.2660 level was not triggered. No view has been offered for EUR/JPY.

Major last week’s events:

- Tariffs front: no news under my radar, other than the tariffs between Turkey and USA

- NAFTA: no news

- Turkey: Despite the fact that no hike of the 17.75% rate has been made and no concession to US demands has been announced -in fact Turkey will impose new tariffs on US goods as a response to the doubling of aluminum and steel US tariffs-, TRY got stronger as Erdogan (Turkish President) released two Greeks militants, declared that he is staying inside the rules of free market economy and showed that he cares about the European support. Worth noted Qatar’s announcement to invest 15B$ in Turkey and the relatively small Turkeys debt denominated in hard currencies (16B$ in total, 3B$ to be repaid in October 18)

- Iran, Syria, North Korea: A third summit between North and South Korea scheduled within August. Merkel (German PM) to meet Putin (Russia).

- US Transformation: On Thursday, 350 publications, mainly local media outlets, published editorials against Trump’s attacks on press

- Cryptos: Total market cap at 219$, +5% w/w. The SEC’s decision on Bitcoin ETF, expected on 21st of September will be decisive.

Major next week events:

- The cost of debt financing is increasing in Greece as the country exits bailout programs and faces the higher market rates without ECB’s waiver. 10Y government bonds yield 4.34% in EUR. The low utilization rate, a new record of tourist’s arrivals and the pro-growth agenda of the opposition party (new elections to happen within the next 12 months) are the positive side of the coin.

- Thursday to Saturday, three-day, Jackson Hole Symposium of Central Bankers that I expect to strengthen EUR, AUD, CAD and weaken JPY and USD

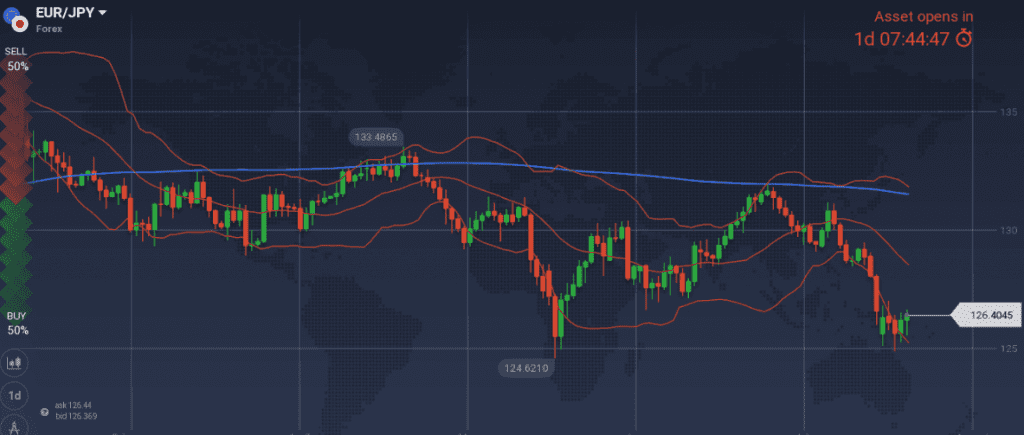

JPY

I would go long EUR/JPY at 125.10

Snapshot unchanged:

- Core CPI (=BOJ’s compass) at 0.8% (vs 2.0% target and BOJ’s members expectation of 1.2~1.3% within 2018), BOJ rate at -0.1%

- GDP at 1.00% annual, 0.5% q/q, 10Y Government bonds yield at 0.10% (+0bps w/w) vs BOJ’s target of 0.00±20% level

- Unemployment at 2.4%

Strengths of JPY:

- QQE will stay, up until core CPI reads 2.0% in a stable manner. The scheduled VAT hike on Oct19, rules out any possible monetary policy change, earlier than 2020.

- increasing inflation, retail sales, improved GDP reading, trade balance, increased Manufacturing PMI

- TRY crisis and CNY devaluation seem contained

Weaknesses of JPY:

- equities are doing well and are not expected to trigger a risk-off scenario that strengthens JPY

- decreased readings of Services PMI, monetary base, household spending, bank lending, machine orders and Trade balance

Watch:

- Thursday’s PMI and Friday’s National core CPI readings. Both readings are expected stronger and would offer a reason to exit a long EUR/JPY trade. Now I do not expect that they will influence it.

- Next Monetary Meeting on 19 September

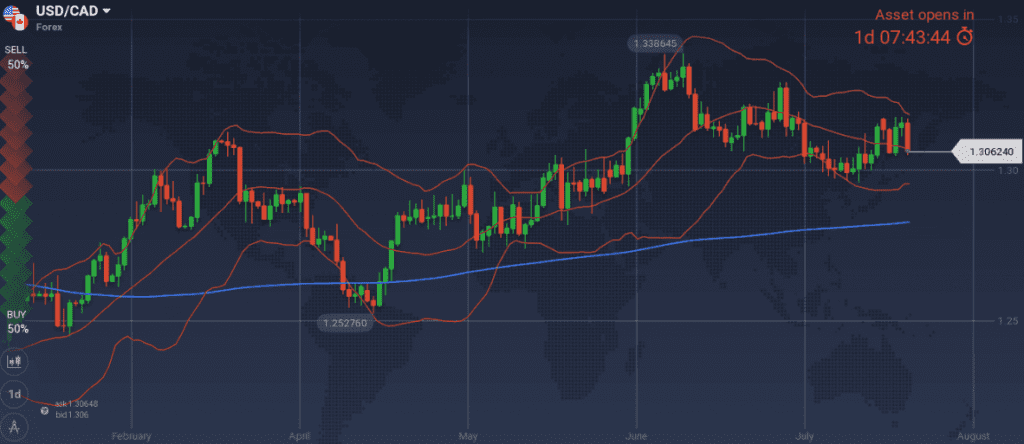

CAD

Shorting USD/CAD at 1.3150 played well and I could add to this position starting from 1.3132 level.

Snapshot improved:

- Inflation raised to 3.0% (vs 2.5% target), BOC rate at 1.50% (4 hikes so far, neutral rate according to BOC within 2.5%~3.5% range).

- GDP at 2.3% (vs BOC expectations of 2.0% in 2018 and long-term potential of 1.8%), 10Y Government bonds yield at 2.27% (-3bps w/w)

- Unemployment decreased to 5.8%

Strengths of USD/CAD, weakness of CAD:

- latest disappointing housing market readings

- oil strengthening has not yet materialized

Weaknesses of USD/CAD, strengths of CAD:

- OPEC’s latest report showed that oil market is balanced, and oil prices should head north. The increased US oil inventory reading of Wednesday, did not change the picture.

- Increased inflation gives enough reasons for a rate hike on September

- strong GDP, trade balance, retail sales and unemployment readings

- Nafta negotiations are proceeding

Watch:

- Tuesday’s Wholesale sales and Wednesday’s Retail sales. Increasing readings favor the short USD/CAD trade

- Next Monetary Meeting on 5th of September.

AUD

I keep considering 0.7281 AUD/USD as a level to go long

Snapshot improved further:

- Inflation at 2.1% (vs 2.0~3.0% target, and expected to decline during 3Q18), RBA ‘s rate at 1.50% (no hike so far)

- GDP at 3.1% (RBA expects more than 3.0% within 2018 and 2019), 10y Bond yields at 2.55% (-4 bps w/w)

- Unemployment decreased to 5.3% (expected to reach 5.0% by 2020)

Strengths:

- significant increase of GDP, inflation expectations and wage price index

- improved business confidence & profits, private capital expenditure, building approvals, new home sales and latest impressive increase of consumer sentiment

Weaknesses:

- Market participants expect the rates to remain unchanged for a considerable period of time

- Political landscape in Australia is changing following elections in Tasmania and Queensland

- increased trade balanced is not expected in the near future

Watch:

- Wednesday’s Melbourne Institute index and Construction reading will be my compass

- Next Monetary Meeting on 4th of September

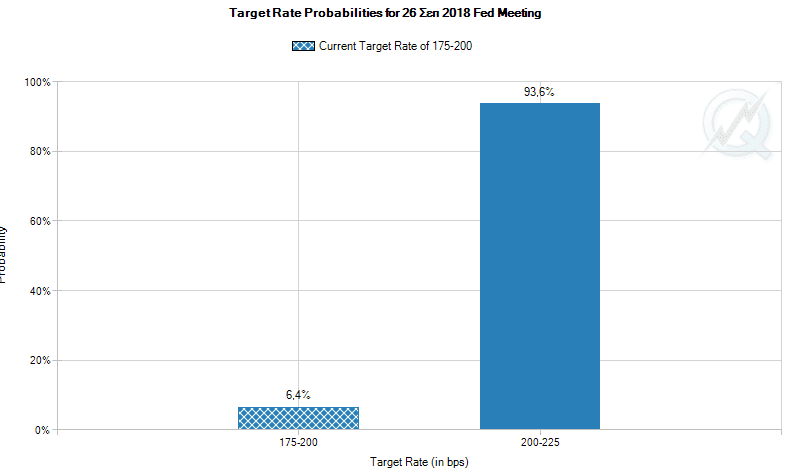

USD

Reasons that sent USD higher for the last couple of weeks, do not seem to persist.

I keep being biased to short USD.

Snapshot unchanged:

- Core PCE (=FED’s inflation compass) at 1.90%, FED ‘s rate at 1.95% (IOER) and expected to reach 3.1% within the cycle. FED’s view of long run rate at 2.9%

- GDP at 2.8%y/y, 4.1% q/q, 10y Bond yields at 2.80% (-7 bps w/w)

- Unemployment at 3.9% (vs natural rate of unemployment of 4.5%), FED expects 3.6% unemployment in 4Q18 and 3.5% for 2019 and 2020.

Strengths of USD:

- strong macros: GDP reading, Factory orders increasing, Manufacturing and services PMI continue to be above 55 for an extended period, healthy housing market

Weaknesses of USD:

- S&P500 continues to be above the technically significant level of 2822. Latest business inventories reading coupled with the increased retail sales do not point to a business cycle that is at its peak.

- 10y Government Bond yields remain below 3.0% yield

- although markets are still pricing in a 90% probability of a rate hike in September and a 63% probability of a fourth hike in December, unit labor cost has decreased

- unexpectedly low industrial production reading

Watch:

- Wednesday’s FED’s minutes of the 1st of August meeting. I want to see the weight they put on unit labor cost dynamics and I want to check on Thursday how markets are pricing the probabilities for future rate hikes.

- Next Monetary Meeting on 26 September, when a new hike is expected.

EUR

I keep my long EUR/USD position, opened at 1.1510.

Snapshot improved:

- Annual CPI at 2.1%, core CPI (=ECB’s compass) at 1.1%, ECB ‘s rate at 0.00%

- GDP increased to 2.2% growth (OPEC reduced expectations to 2.0%), 10y Bond yields of EFSF at -0.42% (-7bps w/w), 10y German Bond yields at 0.31% (-1bps w/w), 10y Italian Bond yield at 3.12% (+13bps w/w)

- Unemployment at 8.3%

Strengths of EUR/USD:

- increased GDP, inflation, decreasing unemployment and increasing economic Sentiment

- M3 growth, service and manufacturing PMI levels (new readings are expected this week)

- Turkish crisis being overcome

Weaknesses of EUR/USD:

- divergence of monetary policy between EU and US, that can only be simulated with two expected down facing waves of the pair, on September and December

Watch:

- Thursday’s Manufacturing PMI, Services PMI and Consumer Confidence. Increasing numbers favor my long EUR/USD scenario

- Next Monetary Meeting of ECB on 13th of September.

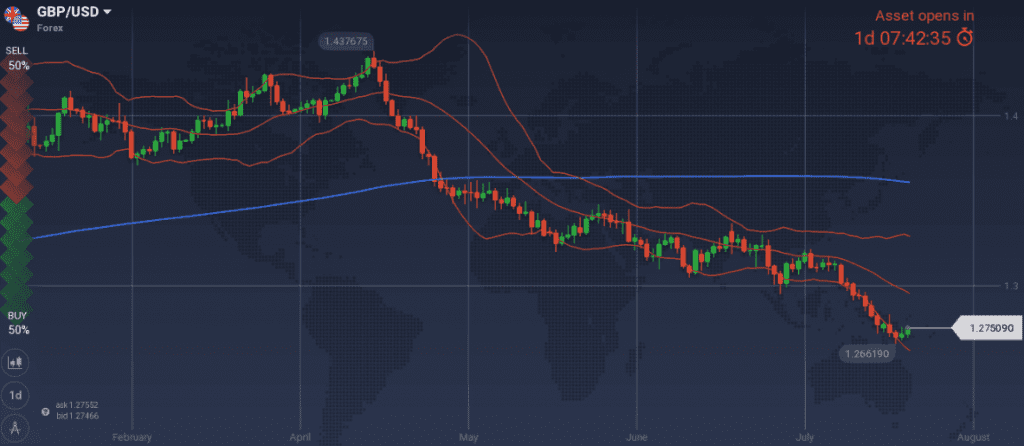

GBP

I stand my ground that UK will find a productive way to finalize its relations with EU and that current GBP levels will prove low. Latest macro readings were pointing to a stronger GBP.

I am re-entering long GBP/USD at 1.2550 level, targeting 1.3800 as the previous week

Snapshot improved further:

- Inflation increased to 2.5% (vs 2.0% target), BOE ‘s rate at 0.75%

- GDP increased to 1.3% growth (vs 1.75% BOE’s expectations and 1.3% decreased OPEC’s expectations), 10y Bond yields at 1.24% (+0bps w/w)

- Unemployment decreased to 4.0%

Strengths:

- the bad weather narrative for Q1 still makes sense.

- Macro picture is improving (GDP, unemployment, construction activity and housing market). On top, inflation increased proving that BOE was correct to hike.

Weaknesses:

- latest M4 and average earnings

- latest Manufacturing and Services PMI that were decreasing

Watch:

- UK politics, as no market moving announcement is expected during the week.

- Next Monetary Meeting on 13th of September.