My last week’s stance and forecasts played well. The defining trades to short USD, keep open my long EUR/USD position at 1.1510, and go long AUD/USD at 0.7281 are paying off. The intentions to go long EUR/JPY at 125.10, short USD/CAD at 1.3150 and long GBP/USD at 1.2550 were not triggered but the direction of all three trades was correct.

Major last week’s events:

- Tariffs front: Second wave of 25% tariffs on 16B$ worth of Chinese and US goods materialized from both countries began on Wednesday. A third wave on 200B$ worth of goods has been threatened. Note that the latest trade talks between the countries officials took place on the same day and have been described as constructive by the Chinese, but were downplayed by the Americans

- NAFTA: negotiations between USA and Mexico have not yet concluded.

- Turkey: no news hit the headlines

- Iran, Syria, North Korea: Two new summits between Moon (S. Korea) and Kim (N. Korea) and between Trump and Kim are being planned. The meeting of Merkel (Germany) and Putin (Russia) on Ukraine, Syria and North Stream2 had no concrete outcome.

- US Transformation: As three men of Trump’s human shield pleaded guilty, found guilty or just turned over him (Cohen, Manafort, Pecker), an impeachment cannot be ruled out.

- Cryptos: Total market cap at 215B$, -2% w/w, -74% from the 800B$ peak. The week included a negative decision of SEC on a Bitcoin ETF that was well expected.

Major next week events:

- Nothing to note

JPY

I am closing my long EUR/JPY trades and search to short the pair at 129.94 level

Snapshot unchanged:

- Core CPI (=BOJ’s compass) at 0.8% (vs 2.0% target and BOJ’s members expectation of 1.2~1.3% within 2018), BOJ rate at -0.1%

- GDP at 1.00% annual, 0.5% q/q, 10Y Government bonds yield at 0.10% (+0bps w/w) vs BOJ’s target of 0.00±20% level

- Unemployment at 2.4%

Strengths of JPY:

- I expect US equities rebounding from current highs and pushing JPY higher

- QQE will stay, up until core CPI reads 2.0% in a stable manner. The scheduled VAT hike on Oct19, rules out any possible monetary policy change, earlier than 2020.

- increasing retail sales, improved GDP reading, trade balance, increased Manufacturing PMI

Weaknesses of JPY:

- decreased readings of Services PMI, monetary base, household spending, bank lending, machine orders and Trade balance

Watch:

- Tuesday’s inflation reading

- Friday’s Unemployment rate, m/m Industrial Production and y/y Housing starts

- Next Monetary Meeting on 19 September

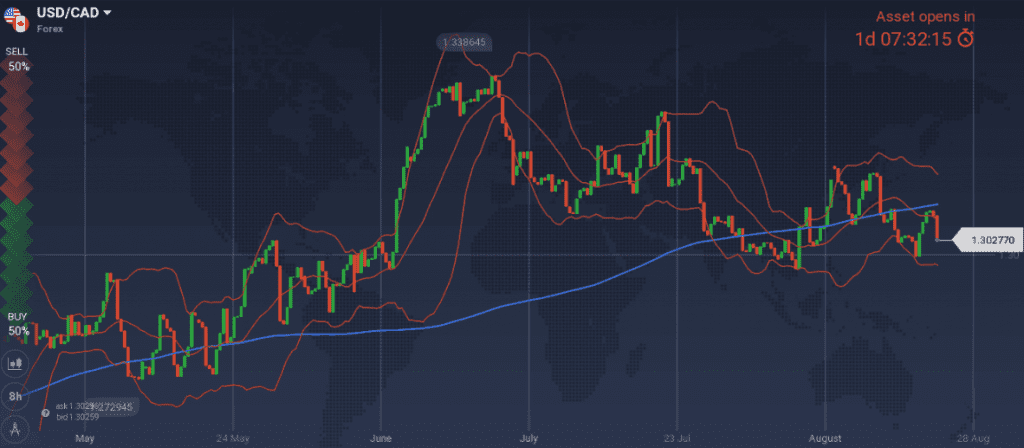

CAD

I will short USD/CAD in the event 1.3132 level is triggered

Snapshot unchanged:

- Inflation at 3.0% (vs 2.5% target), BOC rate at 1.50% (4 hikes so far, neutral rate according to BOC within 2.5%~3.5% range).

- GDP at 2.3% (vs BOC expectations of 2.0% in 2018 and long-term potential of 1.8%), 10Y Government bonds yield at 2.26% (-1bps w/w)

- Unemployment at 5.8%

Strengths of USD/CAD, weakness of CAD:

- latest disappointing housing market, wholesale sales and retail sales readings

Weaknesses of USD/CAD, strengths of CAD:

- OPEC’s latest report showed that oil market is balanced, and oil prices should head north. Eventually oil price strengthening began during the last week

- Increased inflation gives enough reasons for a rate hike in two weeks

- strong GDP, trade balance, retail sales and unemployment readings

- Nafta negotiations are proceeding

Watch:

- Wednesday’s current account and Thursday’s GDP reading

- Next Monetary Meeting on 5th of September.

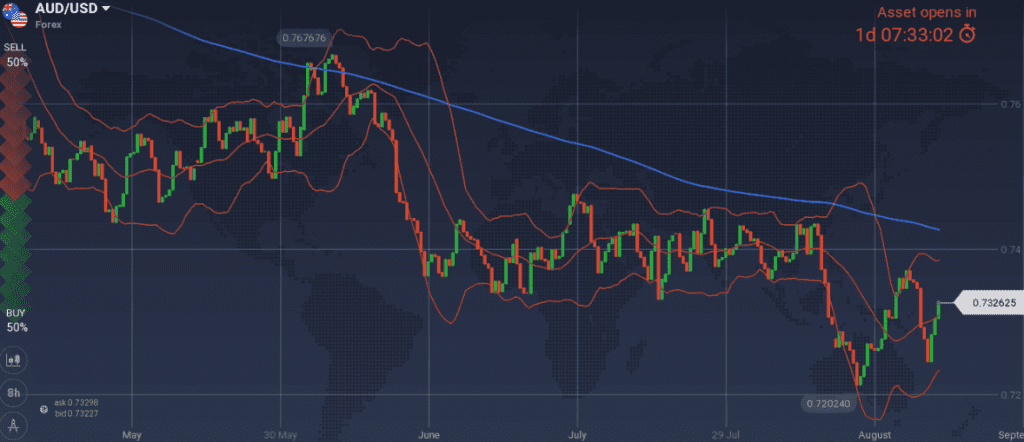

AUD

From the 6th of August report I was noting that the political landscape in Australia has changed. I was not expecting last week’s drama when the Prime Minister was changed.

In the fewest possible words: Current government is supported by 60 Liberals and 16 Nationals (total 76) in a 150-seat parliament (i.e.1 seat majority). Based on the political pressure of Nationals, a right-wing Liberal (Dutton) was trying to become PM accusing former PM (Turnbull) of being too leftish. At the end, another moderate (Morrison) became PM and everyone is now calling for stability.

I am entering long at 0.7300 AUD/USD targeting 0.7460

Snapshot unchanged:

- Inflation at 2.1% (vs 2.0~3.0% target, and expected to decline during 3Q18), RBA ‘s rate at 1.50% (no hike so far)

- GDP at 3.1% (RBA expects more than 3.0% within 2018 and 2019), 10y Bond yields at 2.55% (+0 bps w/w)

- Unemployment at 5.3% (expected to reach 5.0% by 2020)

Strengths:

- significant increase of GDP, inflation expectations and wage price index

- improved business confidence & profits, private capital expenditure, building approvals, new home sales (new releases expected this week) and latest impressive increase of consumer sentiment

- in my book, latest political drama is over. PM change was asked by people opposing tax cuts and National Energy Guarantee policies. At the end the new PM and Deputy were the architects of both.

Weaknesses:

- Market participants expect the rates to remain unchanged for a considerable period of time

- increased trade balanced is not expected in the near future

Watch:

- Apologies to my readers for failing to understand the importance of the noted political landscape change, and for only including it at the weaknesses section and not at the watch list section.

- Wednesday’s New Home sales m/m and Thursday’s Building approvals

- Next Monetary Meeting on 4th of September

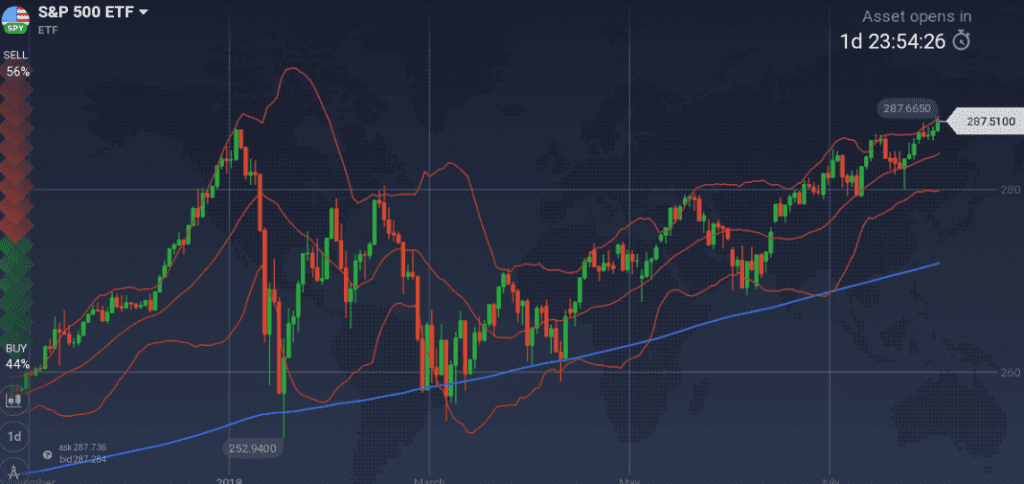

USD

FED’s minutes of latest meeting included 3+1 worth noted points. (a)EU-US deal helped equities (b)GDP is expected to slow (c) downward revision of energy prices (d) the decreased unit labor cost data (-0.9% q/q from +2.9% previous reading) were not available during the 1st of August meeting and that was only mentioned in a parenthesis.

As SP500 closed the week at 2873, the same level as the highest point reached before February’s downtrend, I am puzzled to find what would fuel a crossing of this level

I change my bias and I would go long USD-short US equities

Snapshot unchanged:

- Core PCE (=FED’s inflation compass) at 1.90%, FED ‘s rate at 1.95% (IOER) and expected to reach 3.1% within the cycle. FED’s view of long run rate at 2.9%

- GDP at 2.8%y/y (OPEC expects 2.9% for 2018), 4.1% q/q, 10y Bond yields at 2.83% (+3 bps w/w)

- Unemployment at 3.9% (vs natural rate of unemployment of 4.5%), FED expects 3.6% unemployment in 4Q18 and 3.5% for 2019 and 2020.

Strengths of USD:

- a possible equity downtrend from current highs would help USD

- a rate hike in September is almost certain. No one is paying attention to the decreased unit labor costs.

- strong macros: GDP reading, Manufacturing and services PMI are all expected to decrease but keep on being high

Weaknesses of USD:

- 10y Government Bond yields remain below 3.0% yield

- low industrial production reading and durable goods orders

Watch:

- Tuesday’s wholesale inventories. An increasing number is favoring equities downtrend

- Wednesday’s GDP q/q reading. I expect a lower than 3.9% reading that favors my short equities-long USD scenario

- Thursday’s inflation readings

- Next Monetary Meeting on 26 September, when a new hike is expected.

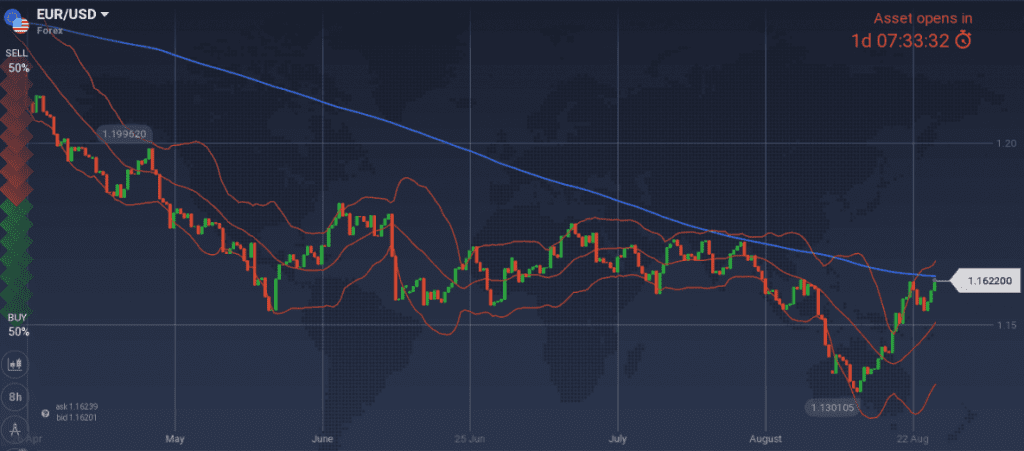

EUR

I am exiting my long trades at 1.1640.

Snapshot unchanged:

- Annual CPI at 2.1%, core CPI (=ECB’s compass) at 1.1%, ECB ‘s rate at 0.00%

- GDP increased to 2.2% growth (OPEC reduced expectations to 2.0%), 10y Bond yields of EFSF at -0.40% (-2bps w/w), 10y German Bond yields at 0.34% (+3bps w/w), 10y Italian Bond yield at 3.15% (+3bps w/w), 10y Greek Bonds yields at 4.60 (-12bpd w/w, at the first week following bailout protection)

- Unemployment at 8.3%

Strengths of EUR/USD:

- increased GDP, inflation, decreasing unemployment

- M3 growth (new reading on Tuesday), service and manufacturing PMI levels are still above the 50 thresholds, but decreasing

Weaknesses of EUR/USD:

- the pair is in the middle of 1.1514~1.1829 range and I expect that the uptrend will lose steam as new data are released

- divergence of monetary policy between EU and US, that can only be simulated with two expected down facing waves of the pair, on late September and mid-December

- a possible retrace of US equities

- Italy

Watch:

- Monday’s German Business Climate

- Tuesday’s M3 and Private loans. Decreasing number do not favor EUR.

- Friday’s inflation and unemployment readings. Neither of the above readings are expected higher, fueling the further increase of EUR.

- Next Monetary Meeting of ECB on 13th of September.

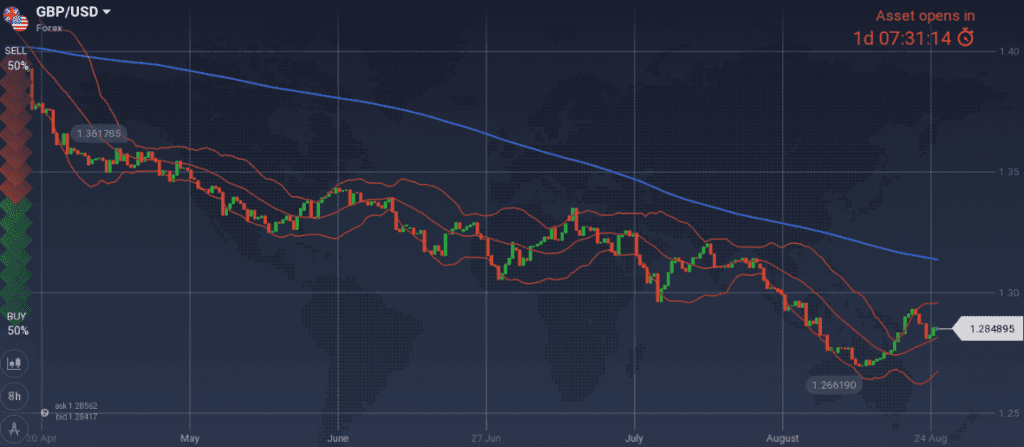

GBP

I stand my ground that UK will find a productive way to finalize its relations with EU. Nevertheless, I would avoid offering any weekly forecasts for GBP as we are approaching to November’s deadline and any comment from UK or EU politicians is able to move the market.

A compromise between having a competitive regulatory framework against the EU’s regulations and being able to contain the lower tax revenue from UK’s financial institutions losing their EU pass, is what is at stakes.

Snapshot unchanged:

- Inflation at 2.5% (vs 2.0% target), BOE ‘s rate at 0.75%

- GDP at 1.3% growth (vs 1.75% BOE’s expectations and 1.3% decreased OPEC’s expectations), 10y Bond yields at 1.27% (+3bps w/w)

- Unemployment at 4.0%

Strengths:

- the bad weather narrative for Q1 still makes sense.

- Macro picture is improving (GDP, unemployment, construction activity and housing market). On top, inflation increased proving that BOE was correct to hike.

Weaknesses:

- decreased average earnings and industrial order expectations

- latest Manufacturing and Services PMI that were decreasing

- the 23rd of August release of 80 technical notices by UK Government for the Medicines industry and Intellectual property procedures, in the event of a no Brexit deal. The move reveals that a no deal is possible, but the content of the notices reveal that any transition will be smooth.

Watch:

- UK politics

- Monday is a holiday

- Thursday’s M4 reading is expected to increase and would favor long GBP positions

- Friday’s consumer confidence that is expected low and does not favor GBP

- Next Monetary Meeting on 13th of September