Investing is the art of making accurate analogies. The less the analogy affects you personally, the easier it gets to be logical and practical. But the world is dependable, and to intellectually position yourself given an escalating war rhetoric and actual missiles, one needs to be cynical.

Major last week’s events:

- Syria: On Monday Trump named Putin for backing up the “Assad animal” as UN talks were underway on last week’s use of chemical weapons on civilians. Syrian TV was reporting US missile attacks. On Friday UN investigators came to Damascus and at 4.00 GMT Saturday USA, UK and France launched a one-hour missile attack on 3 selected sites in Homs and Damascus. Around 120 Tomahawk cruise missiles and Tornado jets were used. Russia had not been warned for the attacks. Syria reported that has managed to down 13 missiles.

- No news on the North Korean front.

- Tariffs front: Xi (China) announced that is thinking of lowering taxes on imported cars and willing to safeguard the intellectual property of foreign investments, increasing the odds of tariffs never happening. Trump is even thinking of re-entering TPP agreement

- Sanctions on Russia increased. Americans were banned to buy from RUSAL, Russia’s biggest producer of aluminum, sending aluminum price to their biggest one week increase in 30 years (+15%) and USD/RUB at +7% (On Wednesday the pair was counting a 12% move from Friday’s close)

- Cryptos managed to collect 70B USD in a matter of a week. Total market cap reached 330B$ on Friday from 258B$ at the beginning of the week. Within an hour (Thursday 13.45~14.45GMT) market cap increased by 30B$.

My last’s week’s forecasts did not help:

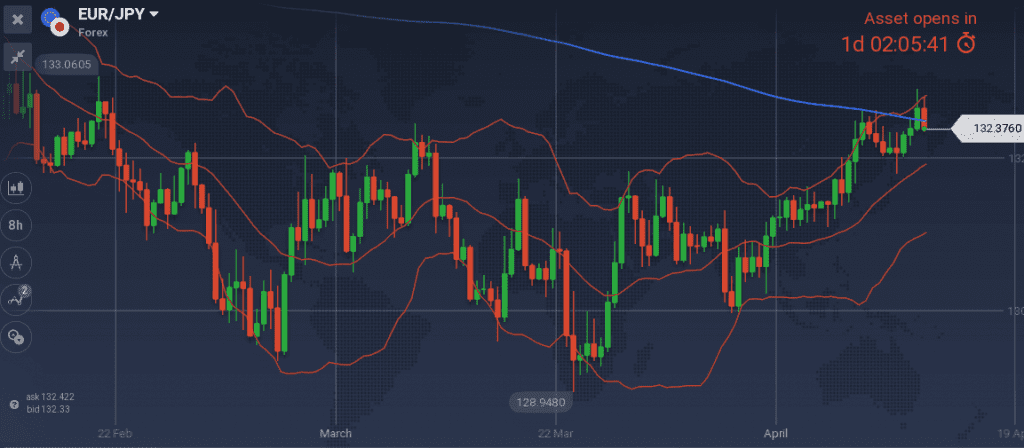

- Short 131.88~132.00 EUR/JPY positions on the red

- I correctly refused to offer entry points to go long USD/CAD

- I correctly advised to search for long positions on AUD/USD

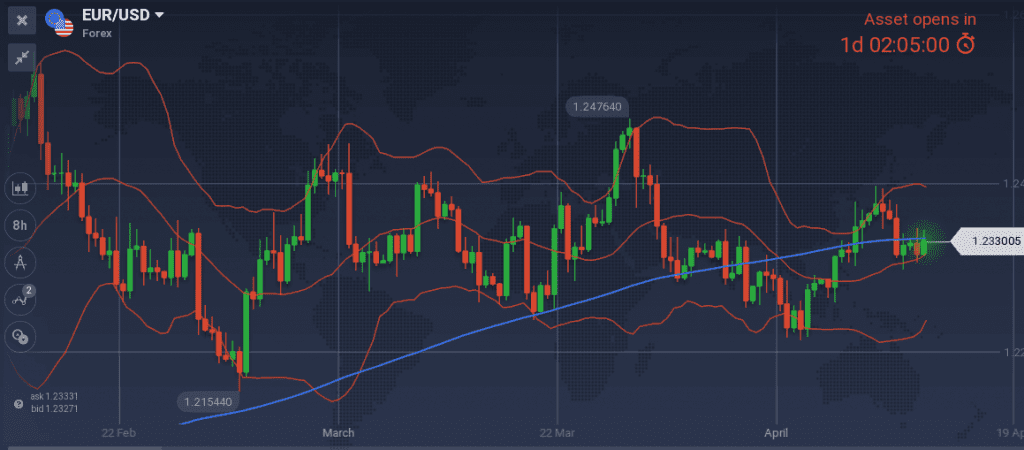

- I missed EUR/USD downtrend for 15 pips, as the pair has not triggered the 1.2410~1.2420 noted zone.

- Proposed entry levels for GBP/USD, EUR/GBP and GBP/AUD where unfortunately never triggered but the 1.7810 proposed level to go long GBP/CAD hit bull’s-eye.

Cynically, I keep betting on the high tension, high volatility, increasing inflation, increasing bond yields, decreasing equities scenario that favors haven currencies.

Major next week events:

- Wednesday’s Monetary Meeting of Bank of Canada

- Friday’s OPEC and non-OPEC monitoring committee in Jeddah

- Scheduled IMF meeting on 20-22

JPY

EUR/JPY was proving me correct for only 6 hours. When the 131.88~132.00 range was triggered, pair moved south for 40pips (reached 131.40 level). Nevertheless, following Monday’s US close, the pair started an uptrend, crossed 200DayMovingAverage and the short positions are now in red.

I keep my short EUR/JPY bias and would re-enter at 133.46 and 134.35 level. Remember that JPY is enjoying a safe-haven status and we are entering in a week when actual missiles were launched.

Snapshot:

- 0% GDP growth, all time low unemployment at 2.5%

- Inflation (excluding food-National core CPI) at 1.0% (vs 2.0% target)

- 04% 10y Bond yields vs BOJ’s target of 0.00% level

Strengths of JPY:

- decisiveness communicated by the Central Bank. Next meeting is scheduled within 26 April

- geopolitical tensions

Weaknesses of JPY:

- last Monday’s disappointing Current Account reading of 1.02TJPY (last month was 2.02TJPY)

Watch:

- Tuesday’s 23:50GMT Trade Balance. Last reading was -0.20T JPY, market expects 0.10TJPY reading and I want to see anything more than that to keep confident with my scenario.

- Thursday’s 23:50GMT National Core CPI reading. Anything below 1.0% is within my scenario

- Next Monetary meeting on 26 April (2 weeks’ time)

CAD

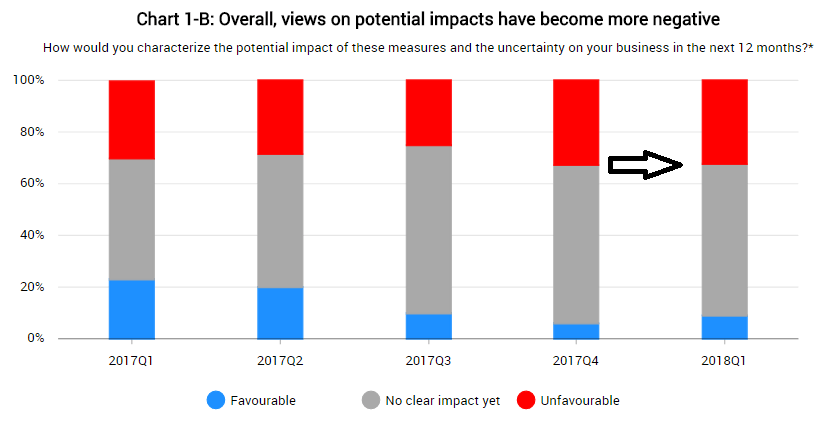

Monday’s well anticipated Business Outlook Survey has adequately cleared things out, but I am not able to offer a forecast. Canadian Businesses do not expect any significant -positive or negative- effect from Trump’s administration decisions, like NAFTA talks or tariffs, so the Bank of Canada was correctly not pricing in any bad scenario. The evolving aggregate of opinions is presented bellow and the only thing worth noted is that expectations for increase of sales growth towards USA is at record high levels.

Snapshot:

- Inflation at 2.2% (vs 1.0%~3.0% target range), BOC rate at 1.25% (3 hikes so far)

- GDP at 2.9% annual, 0.4% QOQ, 10Y Government bonds yield (+9bps w/w) at 2.24%

- Unemployment at 5.8% and expected to decrease further.

Strengths of USD/CAD, weakness of CAD:

- the latest GDP m/m low reading, and trade balance reading

Weaknesses of USD/CAD, strengths of CAD:

- Oil prices increase and the correlation with CAD is getting stronger (0.78 latest reading).

- Increasing probability of NAFTA deal within the first week of May

Watch:

- Wednesday’s 14:00 GMT Monetary decision of Bank of Canada. No hike is expected but I want to see the reasoning and language regarding the outlook for growth, the fiscal budget and expected wage growth.

AUD

AUD/USD moved upwards and within the 0.76~0.78 range but I cannot claim any credit for calling to buy the pair. Firstly, because the proposed 0.7550 level was not triggered and secondly because I believe that the upward move was mostly attributed to the decision to ban Americans from buying aluminum from the Russian RUSAL.

Both last week’s consumer sentiment and inflation expectations confirmed Central Bank’s worries of decreased future consumption.

I can offer no advice for the pair other than buying the gap in case we see a gap at the Wellington opening.

Snapshot:

- Inflation at 1.9% (vs 2.0~3.0% target), RBA ‘s rate at 1.50% (no hike so far)

- GDP at 2.4% growth (2.8% was 2017 reading), 10y Bond yields at 2.74% (+7bps w/w)

- Unemployment at 5.6% and expected to decline

Strengths:

- AUD showed some strength despite the equity sell-off

Weaknesses:

- Latest declined GDP reading, declining terms of trade

Watch:

- Thursday’s 1:30GMT Unemployment reading that is expected back at 5.5%

- Next Monetary meeting on 4th of May. Note that markets are expecting the first rate hike no earlier than the first half of 2019.

USD

I am keeping my long bias on USD especially in a week that follows the strike in Syria.

Snapshot:

- Inflation (PCE) at 1.7% (vs 2.0 target and 1.9% FED’s expectations), FED ‘s rate at 1.75%. 6 hikes so far and another 6 hikes expected by the end of 2019 to reach 3.25%. FED’s view of long run rate remains at 2.75%~3.00%

- GDP at 2.9% growth (FED expects 2.7% in 2018), 10y Bond yields at 2.83% (+3bps w/w)

- Unemployment at 4.1% and expected to fall to 3.8% in 2018

Strengths of USD:

- strong macroeconomic announcements and yields of Government bonds (now at 2.83%. Worth noted that 3.00% seems to be the ceiling for 2018)

- weakening of US equities

- rising geopolitical risk in Syria

- hawkish tone at the released minutes of meeting of the 20~21 March meeting. You may mark the following two lines “the path of appropriate fund rates could be steeper” and “at some point in time communication should be revised to say that policy will become neutral or even restraining”

Weaknesses of USD:

- rising protectionism. Should be noted that last week’s episode of tariffs serial decreased the probability of the implementation of tariffs, as Xi (China) was willing to decrease taxes on imported vehicles and take measures to safeguard US intellectual property.

Watch:

- Monday’s 20:00GMT Treasury International Capital long term purchases. I want to see a number greater than 62.1B$ (=latest reading)

- Tuesday’s 13:15GMT Capacity utilization rate. I want to see a number above 77.9% (=current market consensus)

- Thursday’s 12:30GMT Manufacturing Index. I want to see a number above 21.2 (=current market consensus)

- Next Monetary Meeting on 2nd of May. Market is pricing in the next rate hike on 13 June meeting

EUR

I am keeping my short bias towards EUR/USD and search to enter at 1.2432~1.2465 levels

Snapshot:

- Core CPI Inflation at 1.0% (vs 2.0% target), ECB ‘s rate at 0.00%

- GDP at 2.7% growth, 10y Bond yields of EFSF at -0.41% (+1bps w/w)

- Unemployment decreased at 8.5%

Strengths of EUR/USD:

- tariff drama strengthens the pair. Yet, there is a great probability, especially following the last remarks of Xi (China) regarding taxes on vehicles and intellectual property, that all the tariff talking will remain verbal and will not materialize.

Weaknesses of EUR/USD:

- divergence of EU’s and USA’s economy that is evident at the 10y Government yields

- core CPI (inflation index watches by ECB) unchanged at 1.0% (next release on 3 May)

- latest PMI readings slightly decreased

- geopolitical risk favors USD

Watch:

- Tuesday’s 9:00GMT Economic Sentiment. I want to see decreasing numbers

- German’s 10y Bond auction on Wednesday and Spanish 10y Bond auction on Thursday. I want to see decreasing yields

- Thursday’s 8:00GMT current account. I need a decreasing number

- Friday’s 14:00GMT Consumer Confidence

- Next ECB’s Monetary meeting scheduled for 14 June.

GBP

I keep my long bias on GBP, but I want it to lose some value before it makes sense to enter the market. Entry levels for GΒP are:

- long GBP/USD at 1.4050

- long GBP/CAD at 1.7810 (same proposed level as previous week)

- long GBP/AUD at 1.8169 and 1.7955

- short EUR/GBP at 0.8830 and 0.8801 (same proposed levels as previous week)

Snapshot:

- Inflation at 2.70% (vs 2.0% target), BOE ‘s rate at 0.50% (a second hike on 10th of May is turning very probable

- GDP at 1.4% growth, 10y Bond yields at 1.44% (+1bps w/w)

- Record low unemployment at 4.3%

Strengths:

- Macro announcements are proving the strength of UK’ s economy (the improved Current Account and Good’s trade balance, the increased investments)

Weaknesses:

- decreased reading of M4 Money Supply m/m at -0,3%

- decreased construction and service PMI

- Tuesday’s 8:30GMT average earnings and unemployment reading. Increased earnings are helping my scenario

- Wednesday’s 8:30GMT inflation release. Any number above 2.70% favors my scenario

- Thursday’s 10y Bond auction. Latest auction yielded 1.58%. I want to see a greater than 1.44% yield to strengthen my scenario

- Next Monetary meeting on 10th of May