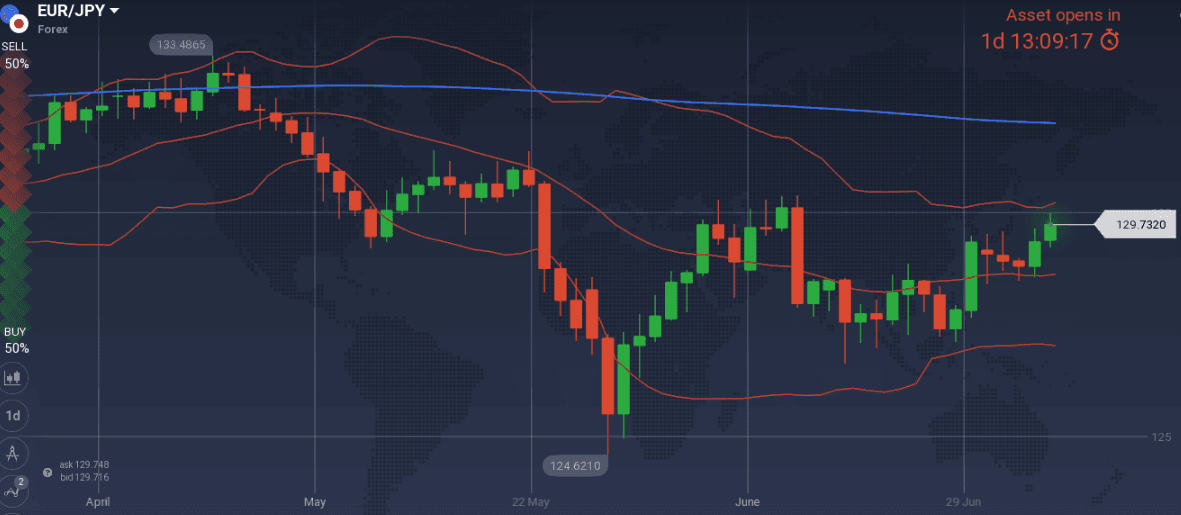

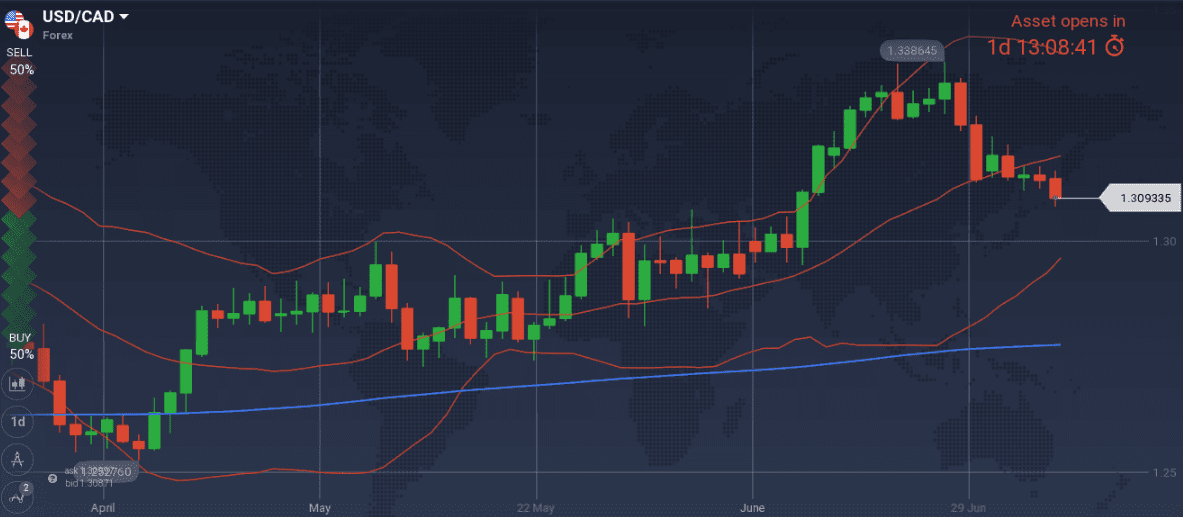

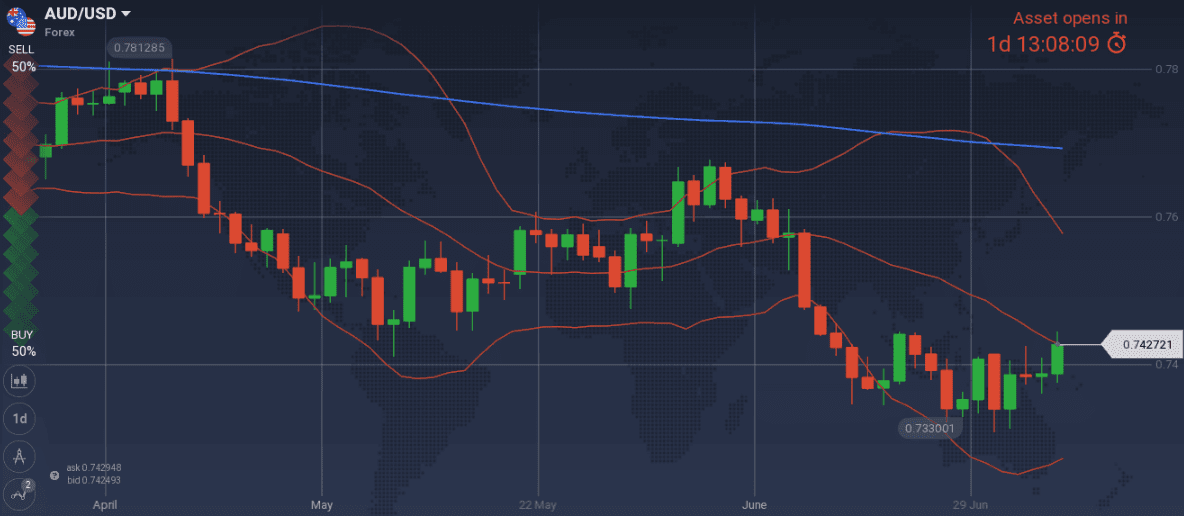

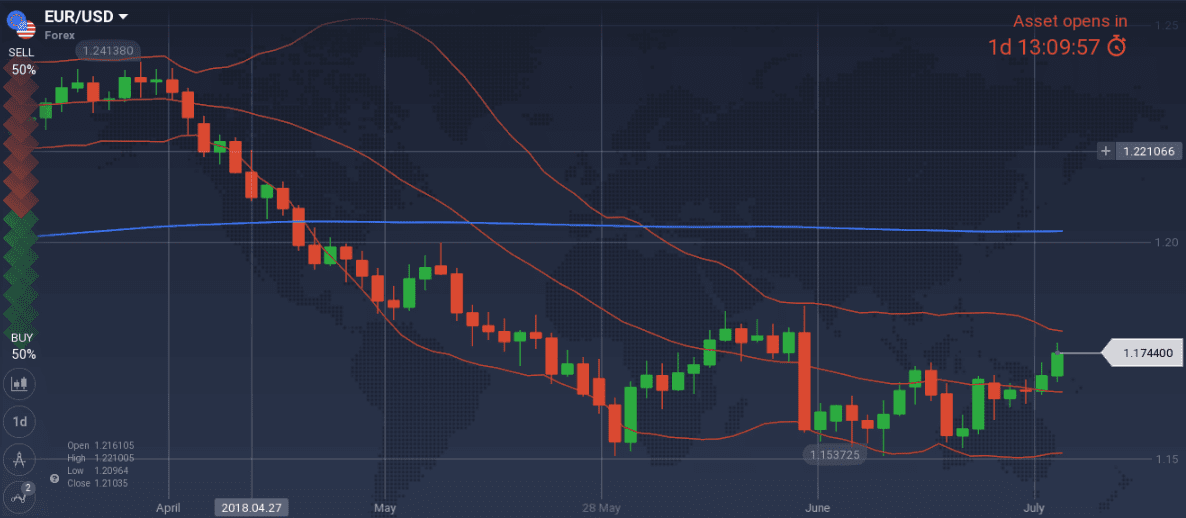

Last week’s forecasts can be archived in the green box. Short USD/CAD at 1.3208 played well, keeping long AUD/USD positions is looking good, avoiding the long USD bias was totally correct, long GBP/USD at 1.3090 was missed by 4 pips, and shorting EUR/JPY at 129.70 (1pip red) and EUR/USD (18pips green) at 1.1761 is too early to be judged.

Major last week’s events:

- EU: German Government coalition managed to stay strong following the migration issue -both the Bavarian CSM and Social Democrats SPD are on board. On the other hand, Poland is playing with EU rules as it tries to undermine the independence of Poland’s Supreme Court.

- Korea, Iran: Pompeo (USA) visited North Korea on Friday. Rouhani (Iran) visited Switzerland and Austria.

- Tariffs front-Trade Tactics: On Monday, Canada responded with 25% tariffs on US steel and 10% tariffs on orange juice, whiskey and ketchup. The first US tariffs on 35B$ worth of Chinese imports took effect on Friday and a second wave of another 16B$ is expected soon. China has not yet responded, although there are analysts claiming that the Chinese response has already been made via it’s FX rate and the last 4 week’s long devaluation. Russia imposed 25%~40% tax on US products. Note that besides rhetoric exchanges, we count the steel and aluminum tariffs that took effect in full mode (=without exceptions) on 1st of June, the latest 35B$ tariffs and the fact that ZTE enjoys a 30day’s long permission to operate.

- US ambassador in Berlin met with German car makers.

- US transformation: On Tuesday we learned that Trump ordered his staff to find ways for US leaving WTO. US FART (=Fair and Reciprocal Tariff) Act is the name of the project and I really do not know whether to laugh or cry.

- Cryptos: Total market cap at 269 256B$, +5% w/w as expected from last report, -23% in the last four weeks.

Major next week events:

- Wednesday’s monthly report of OPEC. Measurable decrease of crude oil deliveries is expected during July according to Tanker-Tracker.

- Wednesday’s Monetary meeting of Bank of Canada and NATO summit in Brussels

- Friday’s Trump visit to London. Giant Balloon depicting a crying, Trump like, baby is approved to fly over Parliament Square Garden during the visit. The mayor’s approval followed a petition and a crowd-funding campaign that raised over 16K £

- Any new episode on tariffs front.

- Sunday’s World Cup Final. Even the Swedish team, has a chance in my book.

JPY

I was expecting JPY to strengthen decisively as the first set of tariffs towards China took effect last Friday. Since that was not the case, the prudent thing to do is avoid any further loading of the short EUR/JPY trade.

Snapshot unchanged:

- Inflation (excluding food-National core CPI) at 0.7% (vs 2.0% target and BOJ’s members expectation of 1.2~1.3% within 2018), BOJ rate at -0.1%

- GDP at 1.10% annual, -0.2% q/q, 10Y Government bonds yield at 0.03% (-1bps w/w) vs BOJ’s target of 0.00% level

- Unemployment at 2.2% (lowest levels since 1993)

Strengths of JPY:

- QQE will stay, up until core CPI reads 2.0% in a stable manner

- increasing Manufacturing PMI and decreasing unemployment

- an equity sells off would favor JPY. Yet the opposite thing happened last Friday.

Weaknesses of JPY:

- latest negative GDP reading and Trade Balance reading at -0.30T ¥

- last week’s decreased readings of monetary base and household spending

Watch:

- Monday’s Bank Lending and Current Account. Increased Bank Lending and a Current Account above 1.3T¥ favors my short EUR/JPY scenario

- Tuesday’s M2. I want to see a number above 3.2%

- Tuesday’s 7.00GMT Machine Tool Orders

- Next Monetary Policy meeting on 31 July.

CAD

Although I favor CAD, I believe that the 1.3220 level will soon be retested for me to short the pair one more time.

Snapshot deteriorated:

- Inflation at 2.2% (vs 1.0%~3.0% target range, expected to increase again in 2018), BOC rate at 1.25% (3 hikes so far). Neutral rate within 2.5%~3.5% range according to BOC.

- GDP at 2.3% (vs BOC expectations of 2.0% in 2018 and long-term potential of 1.8%), 10Y Government bonds yield at 2.13% (-4bps w/w)

- Unemployment increased at 6.0%

Strengths of USD/CAD, weakness of CAD:

- latest decreased inflation, GDP readings and increase unemployment

- decreased manufacturing sales, and decreased trade balance

Weaknesses of USD/CAD, strengths of CAD:

- oil is supposed to head North. Worth-noted that correlation of oil with USDCAD is only -0.31

- last Friday’s impressive move that strengthened CAD despite the bad unemployment and trade balance readings

- upcoming monetary meeting of Bank of Canada when rates are expected to rise

Watch:

- Tuesday’s readings on Housing, as it is one of the main sources of uncertainty in Canadian economy (the other is the investments that are postponed due to US trade policies)

- Wednesday’s 15.00GMT Monetary Meeting decision.

AUD

I remain confident with my long AUD/USD bias and would add long trades at 0.7380 levels.

Latest Monetary Meeting confirmed the strong foundations of Australian economy without adding anything new.

Snapshot unchanged:

- Inflation at 1.9% (vs 2.0~3.0% target), RBA ‘s rate at 1.50% (no hike so far)

- GDP at 3.1% (RBA expects more than 3.0% within 2018 and 2019), 10y Bond yields at 2.62% (-1 bps w/w)

- Unemployment at 5.4%

Strengths:

- significant increase of GDP reading, inflation expectations and trade balance

- improved business confidence & consumer confidence, business profits, private capital expenditure, home loans to Australians

- impressive uptrend of Australian Equities

Weaknesses:

- latest reading of wages growth (next release on August), building approvals and new home sales do not support AUD strengthening.

Watch:

- Wednesday’s 1.30GMT Consumer Sentiment. Besides US trade policies, the main source of uncertainty for Australian Economy is household consumption. A reading above 0.3% would reduce fears and help the long AUD scenario.

- Next Monetary Meeting on 7th of August

USD

I would avoid following my long USD bias, my main theme for 2018, at least until Wednesday. I would first want to hear some news from the NATO summit and the level of Wednesday’s 10y Government Bond auction, before committing to buy USD.

Snapshot mixed:

- Inflation (Core PCE) at FED’s target of 2.0%, FED ‘s rate at 1.95% (IOER) expected to reach 3.1% within the cycle. FED’s view of long run rate at 2.9%

- GDP at 2.0%, 10y Bond yields at 2.82% (-4 bps w/w)

- Unemployment increased to 4.0% (vs natural rate of unemployment of 5.1% in 2015, 4.7% in 2017, 4.5% in 2018, could decrease further) FED expects 3.6% unemployment in 4Q18 and 3.5% for 2019 and 2020.

Strengths of USD:

- strong macros: Durable Goods orders, retail sales, housing market. Manufacturing and Non-Manufacturing PMI hit the roof.

Weaknesses of USD:

- the 3.00% threshold seems high for 10y Government Bond yields

- downward revision of GDP for 1Q2018, first increase of unemployment since a long time

- the official beginning of trade war with China -in my view- pushes USD lower, despite the opposite expressed opinion of many analysts

- Monday’s 10.00GMT Consumer Credit. An increasing number is expected that is generally helping the long USD trade

- Wednesday’s OPEC, NATO meeting and 10y Government Bond Auction. I want to see a yield higher than 2.95% before committing to buy USD

- Thursday’s 13.30GMT inflation readings

- Next Monetary Meeting on 1st of August

EUR

I would close my short EUR/USD position the soonest possible.

EU’s political problems, that escalated during the latest EU summit on migration and almost caused new elections in Germany, now seem contained. Meanwhile, I do not expect USD to strengthen during the first week of the official beginning of Tariffs on Chinese goods.

Snapshot improved:

- Annual Core CPI at 1.0% (vs 2.0% target), ECB ‘s rate at 0.00%

- GDP at 2.5% growth (OPEC expects a 2.2% reading), 10y Bond yields of EFSF at -0.41% (+0bps w/w), 10y German Bond yields at 0.29% (-1bps w/w), 10y Italian Bond yield at 2.72% (+4bps w/w)

- Unemployment decreased to 8.4%

Strengths of EUR/USD:

- increased M3(latest reading at 4%), retail PMI above the 50 threshold, Manufacturing PMI and Service PMI at high levels. Unexpectedly high German Industrial production

- trade war between USA and China

Weaknesses of EUR/USD:

- investor’s confidence and economic sentiment decreasing

- latest current account decrease

Watch:

- Monday’s 9.30GMT and Tuesday’s 10.00GMT sentiment readings

- Wednesday’s NATO meeting and Friday’s Eurogroup

- Next Monetary Meeting on 26 July. Nothing significant is expected

GBP

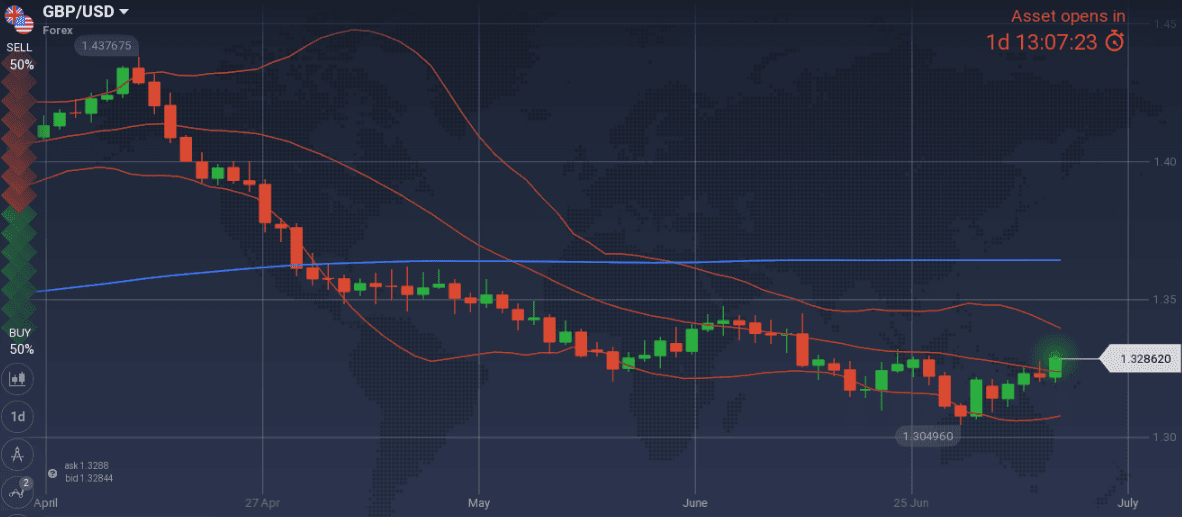

Unfortunately, I missed the big GBP/USD uptrend for 4 pips. Now the 1.3170 is the reasonable level to enter long with the intention to exit at 1.3381.

Snapshot unchanged:

- Inflation at 2.4% (vs 2.0% target), BOE ‘s rate at 0.50%

- GDP at 1.2% growth (1.4% OPEC’s estimates vs 1.75% BOE’s expectations), 10y Bond yields at 1.27% (-1bps w/w)

- Unemployment at 4.2% (BOE expects to fall further in Q2)

Strengths:

- the bad weather narrative for Q1 could be valid

- increased GDP QoQ, M4, Current account, Manufacturing PMI, Construction PMI and Services PMI

- growing number of BOE’s members voting for a rate hike (3 members out of 9 instead of 2)

- May (UK’s Prime Minister) managed to reach a consensus with her Cabinet on soft Brexit negotiations with EU. Remember that Brexit deadline has been extended to December 2020.

Weaknesses:

- latest retail sales, average earnings, manufacturing production, construction was disappointing.

- Inflation at 2.4% expected to pick up again. Yet this has not materialized

- Tuesday’s 9.30GMT GDP m/m and manufacturing production releases. Strong numbers are expected.

- Next Monetary Meeting on 2nd of August