Weaker than expected data in the EU and Britain indicate slowing growth and undermine market expectations. In the EU manufacturing and composite PMI both came in positive, showing expansion within the economy, but both were weaker than expected and down from the previous month in evidence of slowing growth and cooling economic activity. The data was underpinned by similar readings from Germany and France, core economies within the EU, that show slowing growth and rising unemployment.

In Great Britain CPI was weaker than expected at 0.4% although it did rise from the previous months 0.1%. The problem is that YOY CPI and core CPI are both also weaker than expected but also down from the previous month in evidence of cooling inflationary pressure within that economy. In both cases, the EU and GBP, the data confirms a lack of impetus for central bankers to act in response to rising inflation. This means less chance of BOE rate hikes and less chance of ECB tightening.

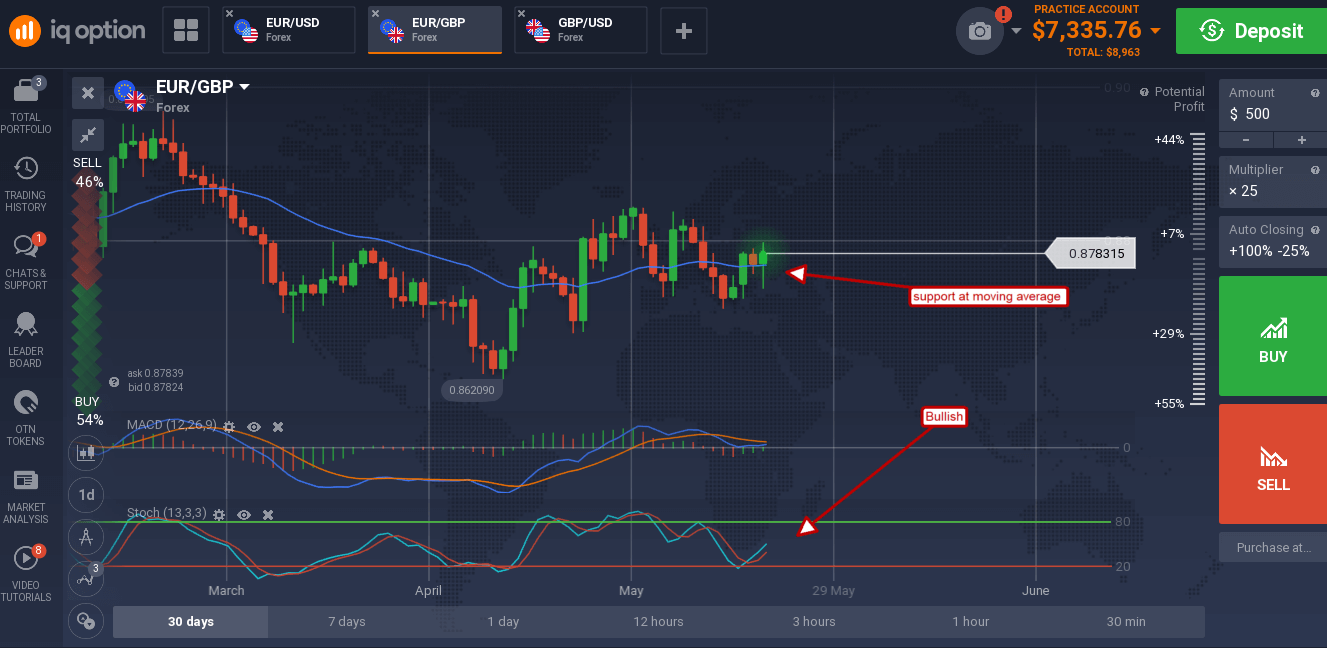

The euro was able to gain versus the pound as weakness in one economic zone offset weakness in the other. The pair remains range bound although it is heading higher within that range and that is confirmed by the indicators. Both stochastic and MACD are pointing higher and forming bullish crossovers indicative of rising prices. Support for the pair is at the moving average, near 0.8769, with targets near 0.8850.

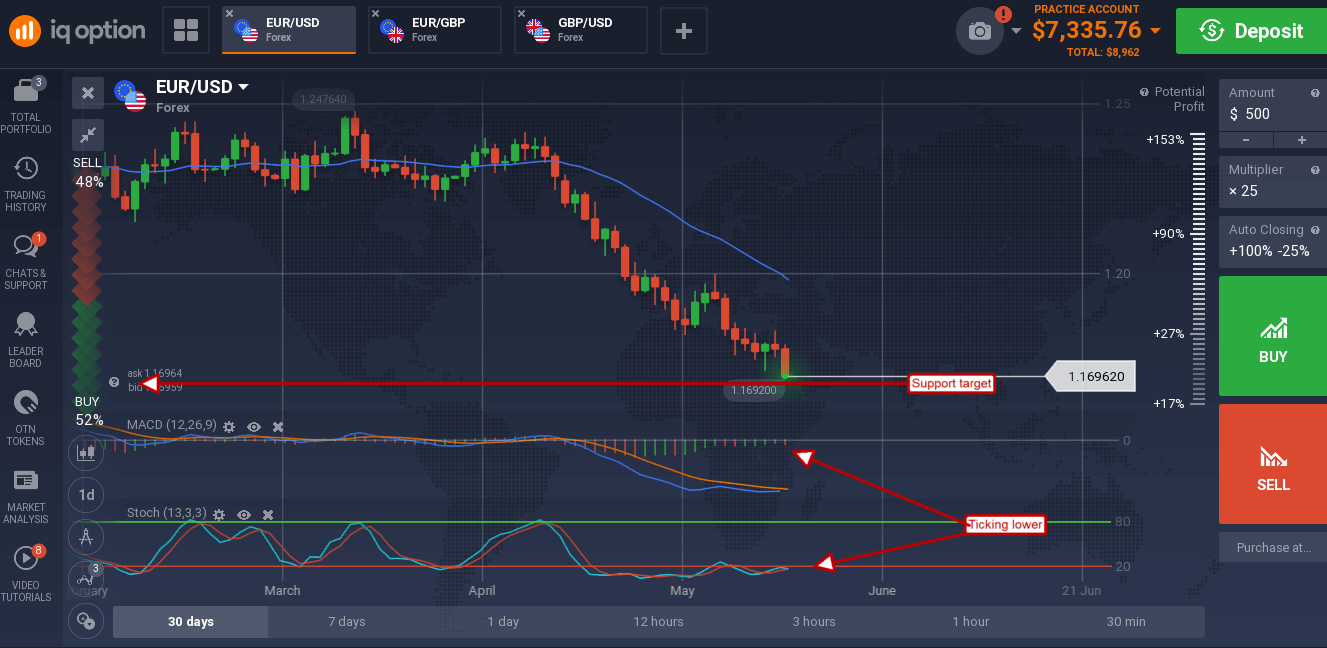

The euro was not able to gain versus the dollar. The single currency moved down to a new low on the weak data and expectation of hawkish comments from the FOMC within the soon to be released May meeting minutes. The pair is approaching a long-term support target near 1.6650 and looks like it will be reached in the near term. Both indicators are ticking lower within bearish formations suggesting lower prices are at hand. A break below support would be bearish for the pair and may lead to a long-term decline in the EUR/USD.

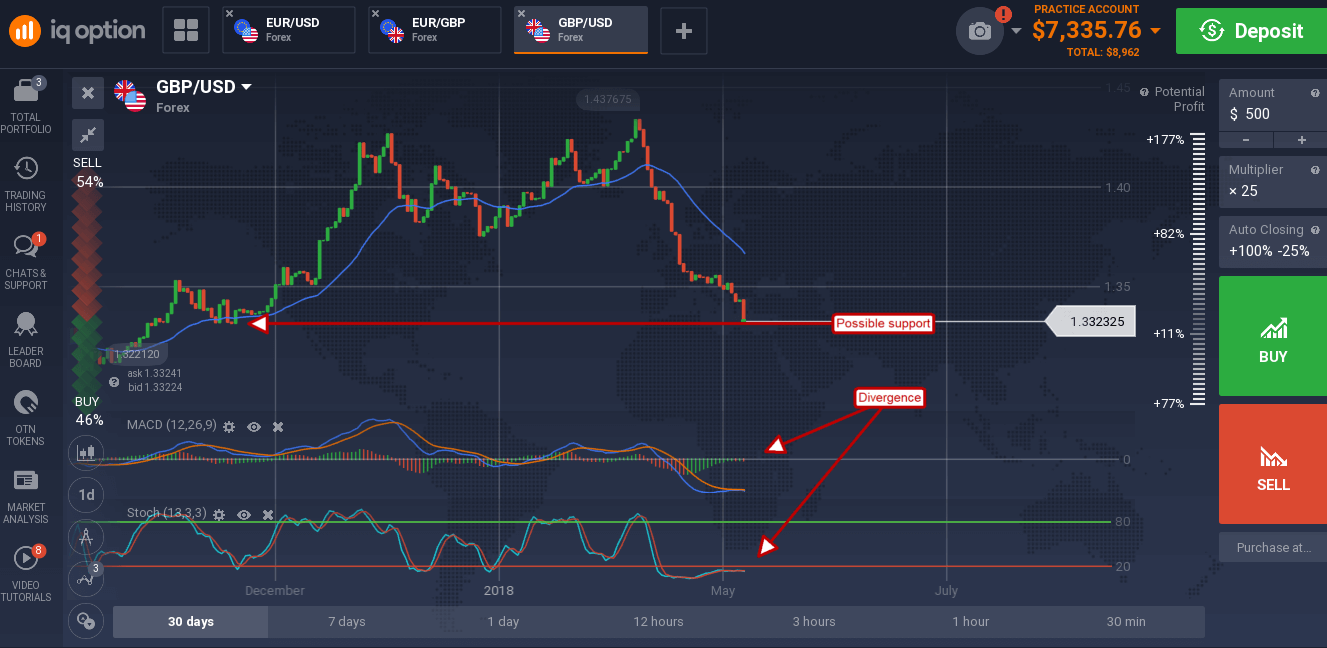

The pound sank on weak data from the UK, aided by strength in the USD, that has brought the GBP/USD pair down to long term lows. The low, near 1.3304, is also a potential support zone that is confirmed by the indicators. Both MACD and stochastic are showing significant divergence from the new low, consistent with support and weakening down trend.

If support is confirmed prices may bounce but a move sideways is more likely. A break below support would be bearish.