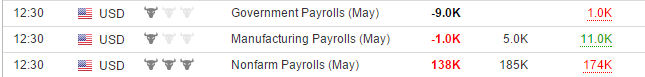

Past Friday 2nd June 2017 was a day full of US economic data, and the main news were the less than expected US non-farm payrolls, which once released sent the US Dollar lower against its major counterparts. But will this data prevent the Fed from increasing the key interest rate on June 14th?

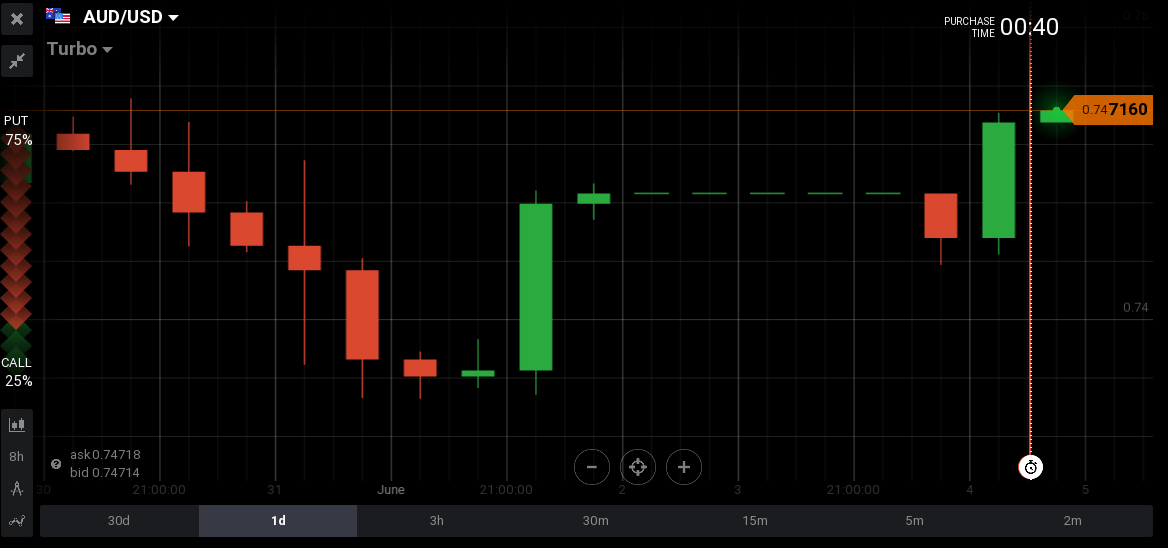

Australian Dollar

![]()

The Australian economy showed an increase in Home Sales of 0.8% in April compared to the decrease of -1.1% the previous month. Typically a growing housing market is supportive for the local currency, reflecting a stronger economy and so the AUD/USD moved higher from 0.7373 to 0.7476.

The Australian economy showed an increase in Home Sales of 0.8% in April compared to the decrease of -1.1% the previous month. Typically a growing housing market is supportive for the local currency, reflecting a stronger economy and so the AUD/USD moved higher from 0.7373 to 0.7476.

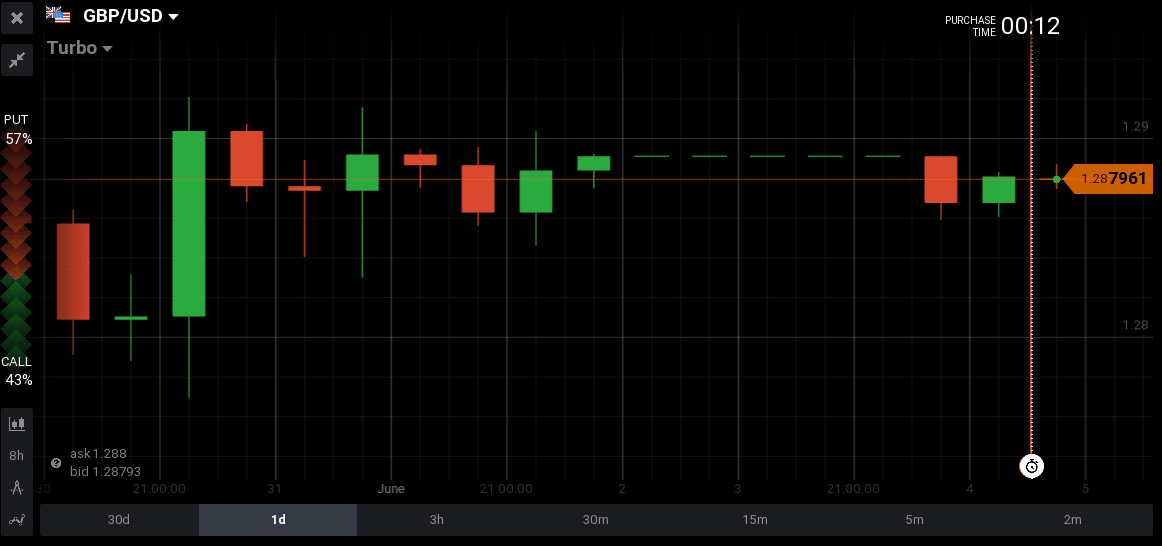

British Pound

GBP Markit/CIPS UK Construction PMI reading for the month of May was better than expected at 56.0 vs estimate of 52.6, another month showing strong expansion for the construction industry, a positive effect for the British Pound which moved higher from 1.2847 to 1.2904.

GBP Markit/CIPS UK Construction PMI reading for the month of May was better than expected at 56.0 vs estimate of 52.6, another month showing strong expansion for the construction industry, a positive effect for the British Pound which moved higher from 1.2847 to 1.2904.

Euro

Euro-Zone Producer Price Index for the month of April readings were softer than expected both on monthly and yearly basis, as on monthly basis the reading was 0.0% vs 0.2% and the yearly basis was 4.3% vs 4.5%. This shows no inflationary pressures for the moment for the consumers and in fact declining prices, which are good news for the consumers but neutral and perhaps negative for the Euro. Both these readings will not urge the ECB this week to increase its interest rate to fight inflation.

Euro-Zone Producer Price Index for the month of April readings were softer than expected both on monthly and yearly basis, as on monthly basis the reading was 0.0% vs 0.2% and the yearly basis was 4.3% vs 4.5%. This shows no inflationary pressures for the moment for the consumers and in fact declining prices, which are good news for the consumers but neutral and perhaps negative for the Euro. Both these readings will not urge the ECB this week to increase its interest rate to fight inflation.

The EUR/USD moved higher from 1.1205 to 1.1285 mainly because of news related to US economic data.

US Dollar

The most important economic news for Friday 2nd June 2017 were the US non-farm payrolls which were positive but came with a disappointing reading of 138K versus the expectation of 182k. The US economy created new jobs on a monthly basis but as the actual reading was less than expected, it triggered an immediate sell-off for the US Dollar. Also the US Trade Balance deficit for the month of April widened to -$47.6 billion versus the estimate of -$46.1 billion again showing more imports thane exports, which often leads to a depreciation of the US Dollar.

USD Average Hourly Earnings readings also disappointed the forex market showing no growth on a monthly basis and a decline on yearly basis as their readings were 0.2% vs 0.2% and 2.5% vs 2.6% respectively.

The much important news about the US unemployment rate whose reading came at 4.3% vs 4.4%, a new low for a period of 16 years, in theory should be very positive and supportive for the US Dollar. But it did not, at least for past Friday.

The US Dollar depreciated after the release of the non-farm payrolls and:

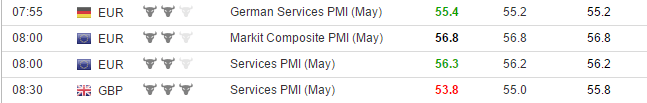

Key economic data for Monday 5th June 2017

Today we have several financial news and the economic calendar is full of data related to the Eurozone and multiple PMI readings for the expansion of its economy, there is also data related to the UK economy such as the Services PMI, and plenty of US economic data with most important the ISM Services/Non-Manufacturing Composite which will show us if there is strength for the services sector for the US economy.

It is important to mention that this week there will be plenty of opportunities to focus on existing and possibly new trends in the forex market. We have three major events, the Reserve Bank of Australia Rate decision tomorrow, the ECB rate decision on Thursday 8th June and the UK elections also on Thursday June 8th. All these economic news will have significant impact for the Australian Dollar, the Euro and the British Pound.