We mentioned yesterday that some of the trends in the forex market will be tested, and in a trading day with light economic calendar we had only 2 significant new trends, one for the British Pound and one for the Canadian Dollar.

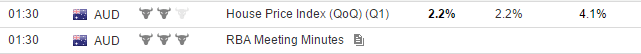

Australian Dollar

The Australian House Price Index reading for 1st quarter of the year was exactly as the forecast on a quarterly basis, but higher than expected on yearly basis, with a reading of 10.2% versus the estimate of 8.9%, a sign of inflationary pressures, which should be supportive for the Australian Dollar if these inflationary pressures persist, as the market will start anticipating an interest rate hike. AUD/USD trended down -0.32% from 0.7623 to 0.7571.

The Australian House Price Index reading for 1st quarter of the year was exactly as the forecast on a quarterly basis, but higher than expected on yearly basis, with a reading of 10.2% versus the estimate of 8.9%, a sign of inflationary pressures, which should be supportive for the Australian Dollar if these inflationary pressures persist, as the market will start anticipating an interest rate hike. AUD/USD trended down -0.32% from 0.7623 to 0.7571.

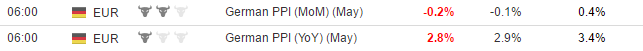

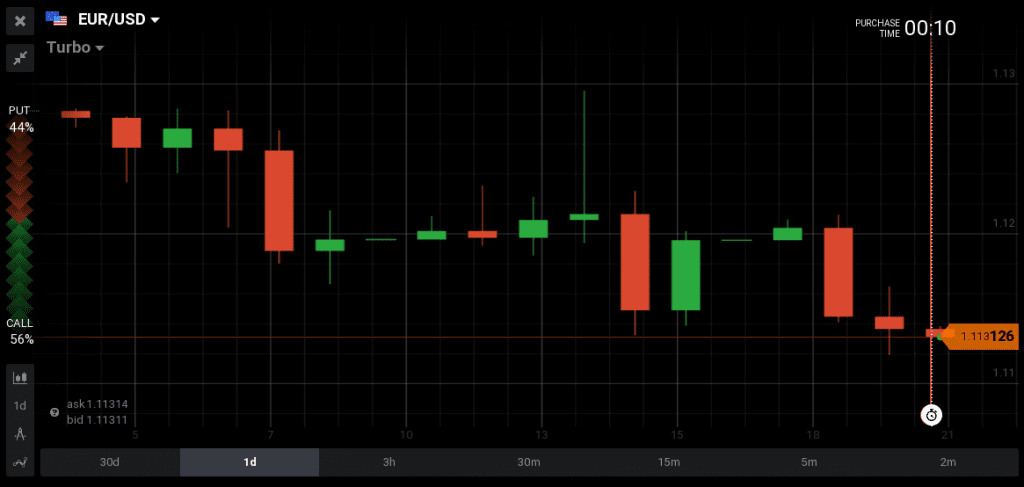

Euro

The German Producer Prices for the month of May showed falling prices both on monthly and yearly basis, with a yearly reading of 2.8% versus the forecast of 2.9%. As there is not any significant increase in retail prices and in the German inflation, this acts as neutral and maybe negative for the Euro, as the probability of an interest rate hike soon is diminishing. A lower Euro-Zone Current Account reading for the month of April compared to its previous reading was also neutral to negative for the Euro showing less capital flowing in the Euro-Zone. EUR/USD trended a bit lower from 1.1165 to 1.1119.

The German Producer Prices for the month of May showed falling prices both on monthly and yearly basis, with a yearly reading of 2.8% versus the forecast of 2.9%. As there is not any significant increase in retail prices and in the German inflation, this acts as neutral and maybe negative for the Euro, as the probability of an interest rate hike soon is diminishing. A lower Euro-Zone Current Account reading for the month of April compared to its previous reading was also neutral to negative for the Euro showing less capital flowing in the Euro-Zone. EUR/USD trended a bit lower from 1.1165 to 1.1119.

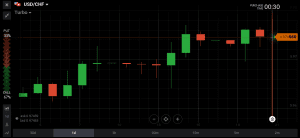

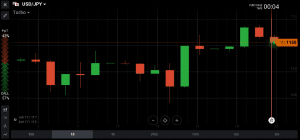

US Dollar

Only a better than expected, but still negative surplus reading for Current Account Balance in the US, which in theory is negative for the US Dollar was ignored by the forex market.

Oil prices continued sliding significantly down -1.63% which helped USD/CAD trending up, and gold prices were almost flat.

Economic calendar for Wednesday 21st June 2017

A day with a light economic calendar. All Industry Activity Index for Japan, US Existing Home Sales and US Crude Oil Inventories are some of the economic readings to watch today.